5 Key Sustainability Developments in 2018

As someone who has developed sustainability targets, adopted ESG (environmental, social and governance) best practices and evaluates various corporate responsibility programs day to day, week to week, I have seen a lot of positive change over the past year – and am aware of the numerous challenges all of us in this function face. With that said, based on what I’ve observed over the past year, here are five key sustainability developments I have seen as defining 2018.

Businesses, states, cities and municipalities take up the mantle for climate change.

While President Trump’s decision to have the U.S. leave the Paris Agreement received a great deal of attention, far more important – in the long run – is the fact that many businesses, cities and municipalities took the opportunity to reaffirm, and in some cases, strengthen, their commitments to reducing climate change.

It will be further testament to a “sea change” if the same thing happens when it comes to other clean air and water regulations that are being rolled back, recognizing that clean air and water are things that make communities healthy places where people will want to live and therefore add more value than the cost of enforcing these regulations. And in any event, plenty of data suggests the economic costs of pollution justify clean air and water.

Science-based targets.

We’re seeing more emphasis on science rather than regulatory compliance. By accepting that the scientific consensus is not a political position but is based on conclusions reached through decades of scientific inquiry by thousands of independent, committed and dedicated professionals, we are seeing key players working to prevent major negative impacts associated with changing the chemical composition of our atmosphere.

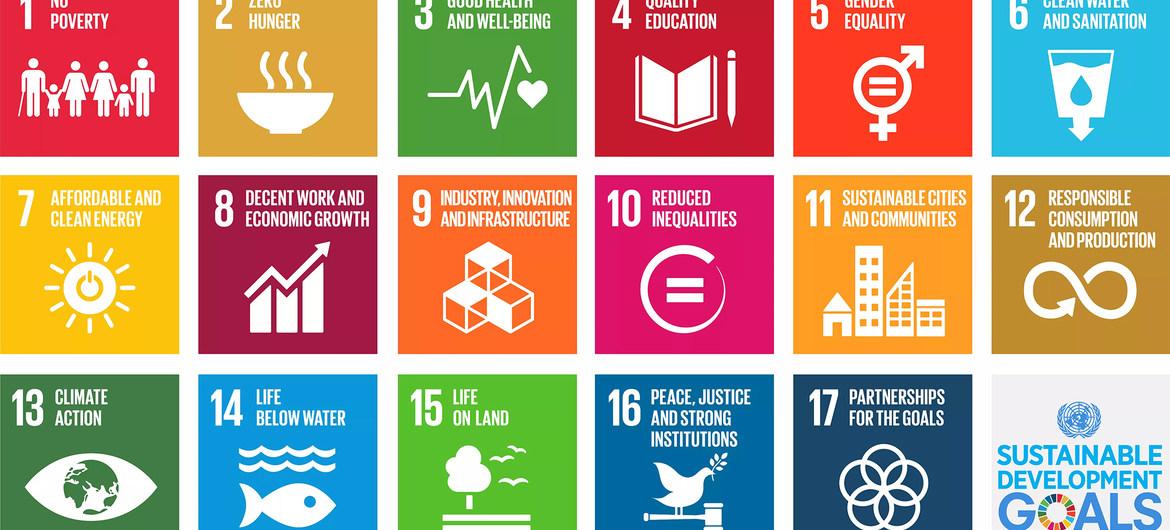

Sustainable Development Goals (SDGs) continue to gain traction.

In addition to climate change, we are seeing many more organizations adopting and aligning with the SDGs. While some continue to make the mistake of claiming “everything we do helps one of the goals and we do things to help each of them,” many organizations are looking at the targets and initiatives within specific goals where they have the most impact. Companies, NGOs and governments are making more tangible contributions by going beyond the language as framing their efforts and looking at specific actions within the goals.

I am seeing particular emphasis where it belongs: on key drivers. For example, worldwide we are seeing more focus on affordable, reliable and sustainable energy, which the United Nations points out is integral to many of the other goals. One example includes the efforts to reduce or eliminate hunger and solving food waste (which is also a major source of GHG emissions) by repurposing foods that might not be as visually appealing but contain the same nutritional value as their most aesthetic counterparts. And the challenge of equal opportunity is finally gaining traction, with more businesses and countries addressing the issue of equal pay for equal work. After all, if people “are our most valuable asset” – why are some of the most productive and talented valued less? After all, I have never heard of anyone being offered to pay less for something based on the gender of the person that created, prepared or built it.

Transportation undergoing seminal changes.

Volvo is going all electric. Ford is eliminating poorly-selling sedans and looking at other mobility solutions. GM has announced plans for e-bikes. Along with the fact that individual auto ownership appears to be falling in urban areas of the developed world, all of these shifts are just the start of what will be seismic shifts in the global transportation and mobility sectors.The push toward electrification.

The focus on the electrification of just about everything will require continued and massive updates of electrical power generation and distribution systems worldwide. While solar, wind, hydropower and geothermal offer tremendous growth, renewables still generate only a fraction of the world’s total power production — much less than will be needed if other sectors make a swift shift. Efforts to source and use biologically-generated natural gas are ramping up, particularly in Europe where it is used both for generating electricity as well as thermal applications like heating and cooking.

And a word of thanks

2018 was also the year that two CEO vanguards of the sustainability movement, Paul Polman of Unilever and Indra Nooyi of PepsiCo, announced their departures. I wish to thank them because each has left a legacy of action and advocacy - and in a way, akin to the U.S. leaving the Paris Agreement, this not only represents new opportunities for both of them and their companies but for new – and more – business leaders to assume the responsibility for being those we look to for inspiration and ideas in 2019 and beyond.

Image credit: Paula Prekopova/Unsplash

Teaching New Skills & Embracing Talent from Everywhere Fuels Growth in a Rapidly Changing Digital Economy

Today, more than ever, we hear about issues related to the workforce and the age of a digital economy: from talent shortages and immigration to skills gaps and economic inequality to job creation and inclusion. On their own, these are big issues to solve for, but together they represent both opportunities and challenges for Cisco, our customers, and our partners.

But as I think about these issues and how they impact our increasingly digital economy, one thing is clear: people are the heart of it all. And there are three key areas where we can help people that I believe will continue to drive economic opportunity and growth.

Enabling New Skills Development

How do we ensure we align the right people with the right skills focused on the right work and in the right locations to capitalize on the changing workforce of today and tomorrow? It starts with creating consistent definitions across industries around job roles, skills, and capabilities that are indicative of future abilities rather than past achievements. This sounds basic, but the shared lexicon between industries and countries when it comes to the workforce hardly exists today which slows hiring, allows for unfairness in practices, and in turn, lost economic opportunity.

We also need to think how we can create career talent opportunities that better prepares students, either from a standard university approach or targeted technical paths. In particular, a much more robust apprenticeship-like approach that gives student earlier visibility into the workforce and career pathways. We are testing this approach with a three-year program in engineering which recruits from Duke’s Fuqua School of Business; Berkeley Haas; Kellogg School of Management; USC Marshall School of Business; and MIT Management Sloan School.

Embracing Talent from Everywhere

Today, our CEO Chuck Robbins and the Business Roundtable released a study on the impact a reduction in visas for high-skilled international students who graduate from U.S. universities would have on the U.S. economy. The findings alone make clear the importance of embracing talent from home and abroad to continuing economic growth:

- A decrease in real U.S. gross domestic product by about a quarter of a percentage point by 2028. The slowdown in economic growth is caused by a decline in immigrant consumers and workers who would otherwise reduce hiring shortages and fill skills gaps.

- A loss of 443,000 jobs over the next decade — including 255,000 jobs held by native-born workers. This result reinforces the findings of prior studies that show that foreign-born workers actually create jobs for native-born workers on aggregate, rather than displace them.

Protecting & Advocating for People

In the face of economic and social uncertainty it’s our responsibility to protect and advocate for people. How is this related to economic growth? Because people make up the workforces and economies that are often looked at in an abstract manner. If we want to see continued economic growth, encourage hiring, and create highly-skilled workforces, we must create an environment where people feel they are supported and can thrive despite the uncertainty that is out there. It’s no coincidence that you see so many companies and NGOs publicly taking stands around discriminatory policies, practices, and laws. They simply create barriers that impede economic growth.

The economic and workforce shifts we face today are no doubt daunting, but I believe that viewing them through the lens of people-first rather than individual economic, job creation, or education challenges will open up a world of opportunity. I look forward to sharing more about our progress as we continue on our journey to address what people need in these times.

Previously posted on the Cisco Blog and 3BL Media news.

Image credit: Venveo/Unsplash

3 Inspirational Examples of Sustainability Leadership From 2018

A lot happened this year. The U.S. made some notable progress with the first Muslim and Native American women elected to Congress, and SpaceX launched the world’s most powerful rocket. We also experienced some major lows, with hundreds of innocent lives lost to multiple mass shootings and families torn apart due to the current administration’s troubling immigration policies. Now, with 2018 coming to a close, attention is being redirected to the year ahead.

Before we begin anticipating what’s to come in 2019, let's step back and celebrate a few of this year's most encouraging corporate sustainability accomplishments.

1. Hundreds of companies committed to Science-Based Targets (SBT)

As of today, 505 companies have joined the Science-Based Target Initiative (SBTi), a collaborative effort that champions science-based target setting as a powerful way of boosting companies’ competitive advantage in the transition to the low-carbon economy. More than 200 set or committed to setting targets this year alone. This momentum is establishing a precedent for companies to embrace ambitious climate action, with or without leadership from government. And it’s fueling innovation by encouraging companies to think creatively about what it will take to meet these targets.

In April of 2018, Best Buy committed to the SBTi and is now in the process of setting targets. This past summer, the company hired EDF Climate Corps fellow Daniel Katzenberger to design Science-Based Targets that include emissions from the company’s entire value chain (Scope 1, 2 and 3). Katzenberger focused on the company’s largest source of emissions, the Scope 3 category: use of sold products. These are the emissions derived from customers using the products they purchase from Best Buy. By working with manufacturers, vendors and merchants, Katzenberger proposed ways for Best Buy to improve the energy efficiency of the products the company sells, thereby lowering the carbon footprint of its customers.

2. Shell set industry-first carbon targets

Royal Dutch Shell recently announced it would be the first major oil and gas company to set carbon emissions targets that are linked to executive pay. The short-term targets will be set every three to five years to reduce the company’s carbon footprint on an annual basis. The announcement comes on top of the company’s earlier goal of cutting carbon emissions in half by 2050.

Tyler Van Leeuwen, group carbon opportunities manager at Shell and an EDF Climate Corps alumni, leads a team in charge of identifying and implementing innovative ways for Shell to reduce its own CO2 emissions, as well as those of its customers. Van Leeuwen identifies and incubates opportunities for reducing CO2 emissions and delivering low-carbon energy to customers, all while delivering business value. This includes promoting investments in natural carbon storage solutions and scaling financing models that enable profitable use of renewables across Shell’s portfolio.

3. Lyft now delivers carbon-neutral rides

Earlier this year, Lyft announced that all of its rides would be carbon neutral. This was later extended to the rest of the ride-sharing company's operations. Lyft plans to reach carbon neutrality by offsetting all emissions from the business—including rides—and sourcing all of its electricity from renewables. But, before offsetting could happen, Lyft had to determine exactly how much it had to offset and what options were available to do so.

This past summer, Matt Panopio, an EDF Climate Corps fellow, was hired to calculate Lyft’s carbon footprint. He collected activity data and identified critical sources of emissions across the company’s value chain, providing the company with its first-ever GHG emissions inventory. This data inventory lays the foundation for future sustainability initiatives and carbon emissions reporting at Lyft. It also arms the company with the information needed to determine the strategies best suited for meeting its GHG goals—whether that be investing in renewable energy or deploying electric vehicles.

As head of the EDF Climate Corps program, I am in the unique position of having exposure to hundreds of first-hand stories about how individuals like Daniel, Tyler and Matt are helping companies, utilities and cities pave the way for a low-carbon future. I’m excited for what’s to come in 2019, and eager to learn about—and share—more inspiring sustainability leadership stories like these.

Previously published on 3BL Media news.

Image credit: Pixabay

New Reporting Standards Pave the Way for More Transparency Around Corporate Tax Practices

Tax and payments to governments play a vital role in enabling the achievement of the Sustainable Development Goals (SDGs). Alongside other voluntary initiatives, it is through tax and payments to governments that companies—big and small—contribute to society.

Recent tax-related scandals, such as the release of the Panama and Paradise Papers, have led to a public debate around the world and a growing demand from investors, civil society, media and governments for more information on how companies approach taxes. To address this information need, the Global Sustainability Standards Board (GSSB), the independent standard-setting body of the Global Reporting Initiative (GRI), launched a project to consider creating a new reporting standard aimed at promoting greater transparency around a company’s approach to taxes. Last week, it published the draft standard for public comment.

“Stakeholders need and expect consistent, quality information about tax and payments to government in order to have an informed public debate around questions of equity, fairness and acceptability of tax approaches,” says Judy Kuszewski, chair of the Global Sustainability Standards Board. “Tax revenues and their application are essential to society’s ability to deliver on the Sustainable Development Goals. Likewise, tax transparency promotes trust and credibility in the taxation system and in the tax practices of companies. It enables stakeholders to make informed judgments about whether a company’s position on tax and payments to governments reflects society’s priorities and creates a reliable basis for decision-making.”

The current state of public tax reporting leaves much to be desired. A recent study by RobecoSAM indicated that only 17 percent of 830 companies surveyed were reporting publicly on tax payments at a country level, and most of these were only operating in a single country.

This number is anticipated to increase significantly. Eighty percent of respondents in a recent OECD Base Erosion and Profit Shifting (BEPS) survey by Deloitte, targeting tax and finance managers and executives from multinational companies in 38 countries, said they expect public country-by-country reporting to be adopted globally in the next few years. GRI’s proposed tax standard aims to take a major step towards enabling such reporting by setting out common, well defined disclosures related to tax strategy, governance, control, risk, and stakeholder engagement, as well as country-by-country reporting of income, tax, and business activities.

“As the global standard-setter for ESG reporting, GRI is uniquely positioned for this pioneering work," Kuszewski adds. "The multi-stakeholder approach led by GRI’s independent Global Sustainability Standards Board allows a consensus position on transparency to be developed through the collaboration of all relevant stakeholder groups, exclusively in the public interest. This approach guarantees a globally acceptable standard that enables vital societal dialogue to address global sustainability challenges. We invite all interested stakeholders to engage during the upcoming public comment."

Previously published on 3BL Media News.

Image credit: Pixabay

6 NGOs Making the Holidays Brighter

This is the time of year to get together with family and friends, and for those of us with means, to celebrate and indulge. But for too many people living and working around us, celebrating and being merry are far from their thoughts. Add the ongoing political and economic uncertainty, this time of year can be a harsh reminder of what it feels like to lose everything – or struggle to get by day-to-day in the first place. For some of us, the holiday season can be triggering, period.

There are countless nonprofits, however, that are doing what they can to make the holidays a time of hope and relief from what is often the ugly reality of the world. We cannot name them all, obviously, but these are just a few that have been on our radar – and note that these groups span a wide range of issues, from supporting families to environmental stewardship to supporting the formerly incarcerated. Side note: these organizations can always benefit from individual and corporate support.

Launched by José Andrés after the 2010 earthquake in Haiti, this global group of chefs have time and time again responded quickly to natural (or should we say, climate change-induced) disasters, from Puerto Rico to California. World Central Kitchen (WCK) and Andrés have been relentless ensuring citizens under duress could at least have one hot meal a day, even under the most trying circumstances. WCK also runs a wide range of public health, educational and social enterprise programs. Andrés' latest focus: offering federal workers affected by the U.S. government’s shutdown a free sandwich at any of his D.C. restaurants.

Dave Thomas Foundation for Adoption

There are countless ways in which foster children fall through the cracks in the U.S. social welfare system – and are often vulnerable in ways that don’t even cross our minds. On that point, The Dave Thomas Foundation for Adoption stands out as the only public nonprofit charity in the United States that is focused exclusively on foster care adoption. This organization distributes funds and provides training to adoption agencies in the U.S. and Canada. Learn about the organization’s most recent work and awareness campaigns here.

The discrepancies rampant in the U.S. criminal justice system are well documented, and despite the hype over the recent passage of a criminal justice reform bill, it’s important to remember that this legislation is a steppingstone – not a complete overhaul. Mission: Launch is one nonprofit that helps reintegrate those who have been rehabilitated back into society, while advocating for families who have been affected by mass incarceration. To learn more, read this profile of Mission Launch and other organizations that carry on similar missions.

Yes, there are countless organizations that do a fantastic job advocating for the environment. The Conservation Fund, however, has a compelling market-based approach to preserving land. From reforesting areas in Kansas to partnering with Apple in order to expand forest acreage in Maine, The Conservation Fund says it has helped preserve almost 8 million acres of land in all 50 U.S. states. There’s a chance the holiday season hike or cross-country ski excursion you’ve taken was made possible due to this group’s work.

National Alliance to End Homelessness

Evidence often suggests we are spending more money here in the U.S. to target homelessness here in the U.S., but the problem seems to be getting worse, not better. This challenge appears to be intractable in part because the solutions needed vary by region – a program that may shine in one community may not work in another. To that end, one organization striving to make a difference is the National Alliance to End Homeless. By working at the federal level, conducting ongoing research and partnering with communities to turn innovative ideas into successful programs, The Alliance has proven to be an effective conduit to finding the best possible answers for America’s homelessness crisis.

Delta Blues Museum, Clarksdale, MS.

Everyone has their pain and struggles, and no matter how severe or impossible it may seem, music can always soothe the soul. Of course, there are many cultural organizations, museums and historical societies that could use support, so yes, full disclosure: one of us here at TriplePundit is on the Delta Blues Museum’s board (and will not know about this article until it's live). If you love blues music, well . . . Clarksdale, MS and the surrounding Delta region are known as “the land where the blues began.” In addition to the museum itself, this organization runs events that bring the world’s foremost blues musicians together.

Image credit: World Central Kitchen

The Top 10 TriplePundit Stories During 2018

We’ve had quite the year here at TriplePundit, as there was no shortage of news stories, from brands taking stands to more advancements in clean energy technologies to more companies jumping on the circular economy bandwagon. Over the weekend, we crunched the numbers along with taking a look at the talk we generated on social media - and came up what we conclude are the ten most popular stories for 2019. The articles' authors are mentioned at the end of each summary.

Danone North America Is Now the Largest B Corp on Earth (1)

In 2017, Danone’s U.S. subsidiary announced it had completed the steps in order to become the largest public benefit corporation in the U.S. – and by last spring the company that owns brands such as Silk and Horizon Organic could verify that it had become the largest B Corp on the planet. Danone’s commitment to social responsibility is not relegated to the U.S. Additional subsidiaries have been granted B Corp or similar certification, including business units in Argentina, France, Indonesia, Spain and the United Kingdom. This work is among many reasons why Mariano Lozano, Danone North America’s president and CEO, was a winner at this fall’s Responsible CEO Awards at 3BL Forum. (Leon Kaye)

The Ultimate Green Car: Built-In Solar Panels to Power Electric Vehicles (2)

The next few years could be a breakout time for solar panels on electric vehicles, and what once seemed like something out of a Jetsons episode could be reality sooner than we think. Readers clearly are anticipating such cars that can drive us into this future, so this story about a German startup that plans to launch production in 2019 ended up ranking high on this list. (Tina Casey)

Electric Aviation May Slash Emissions by Early 2020s (3)

With uncertainty whether the world can truly come together and follow through on the Paris Agreement, yet alone on the Sustainable Development Goals (SDGs), readers were smitten with this story about how the electric aviation industry believes solar technology is ready to meet the challenge of reducing emissions while helping the world meet global climate goals. (Amy Brown)

Companies Worth $1.3 Trillion Pledge a Boost for the Circular Economy (4)

The circular economy has been a topic we’ve covered extensively this year. In January, an announcement that 30 companies across 16 industries would participate in a long-term project could have prompted more businesses to take action. All year long, we’ve seen a push for companies to adopt systems in which more waste is eliminated – or prevent the generation of garbage in the first place. (Leon Kaye)

More Trouble in Coal Country (5)

Make Coal Great Again was one of President 45’s promises that helped him pull that inside straight ushering him into the White House two years ago. But all year long, our lead clean tech reporter has been documenting how economics, state and local policy, as well as the continued scaling up of renewables, together have made that campaign promise a nearly impossible one to deliver. (Tina Casey)

Corona Fights Ocean Pollution by Thinking Outside the Ring (6)

All year long, we’ve been witnessing that the little things matter for big reasons – and that includes plastic straws and how we clump together six-packs of beverages. At this rate, it won’t be long till “Joe Six-Pack” is renamed “Jose Biodegradable Six-Pack” or “Joe Snap Pack.” Hence the popularity of this news item covering Corona’s replacement for the plastic six-pack ring. (Tina Casey)

Only Two Fortune 500 CEOs Are Women of Color. What’s Up with That? (7)

Longtime PepsiCo CEO Indra Nooyi stepped down this fall, which at the time left only 24 women at the helm of America’s 500 largest publicly-traded companies – down from 32 the previous year. Despite all the talk about diversity and inclusion, plenty of questions remain about how penetrable the “glass ceiling” really is – especially for women of color. (Mary Mazzoni)

New Evidence That Rewarding Executives for Corporate Social Responsibility Really Does Work (8)

Are executives being compensated for genuine achievements, or are they simply collecting a bonus for successful greenwashing campaigns? That’s a fair question to ask, but a research team concluded that managers who foresee potential trouble spots and strategically target investments in corporate social responsibility (CSR) to address them are more likely to protect their firms from the effects of adverse events, while improving their companies’ overall reputation – and be rewarded in kind. (Tina Casey)

Small Businesses Can (and Should) Do More to Align with the SDGs

Earlier this year, four in 10 of the world’s largest firms referenced the SDGs in their corporate reporting, according to a study by KPMG, but many smaller companies remain unsure of how they can do their part. Case studies of how two small companies made alignment with the SDGs work for them resonated with readers, many of whom are looking here on 3p for direction. Trust us, we’ll cover this topic more in 2019. (Mary Mazzoni)

Transportation Now Largest Source of U.S. Emissions, While Renewables Surge

Why does this story matter? First the good news: renewables have helped the global power generation sector become more efficient and decrease emissions. But the fact that worldwide, transportation is generating more emissions than power generation for the first time in 40 years shows that the pressure is on automakers, logistic companies and the aviation industry to do their part to accelerate climate action. (Leon Kaye)

Image credit: United Nations News

Global Gender Gap Narrows, But Workforce Disparities Remain

The global gender gap narrowed slightly in 2018, but the World Economic Forum (WEF) estimates it will take more than 100 years to close. Economic parity is even further out of reach, with the wait time for equal pay and workforce participation pegged at a disheartening 202 years, according to the WEF’s annual Gender Equality Index.

Closing the workforce gender gap could add $28 trillion to the global GDP, according to the nonpartisan Council on Foreign Relations. Yet proportionately fewer women than men participate in the global workforce, and women around the world continue to earn less than their male counterparts, data from the WEF Index suggests.

“What we’re seeing globally is that we don’t have any country that’s achieved gender equality, regardless of level of development, region or type of economy,” Anna-Karin Jatfors, regional director for U.N. Women, told Bloomberg. “Gender inequality is the reality around the world, and we’re seeing that in all aspects of women’s lives.”

If we know gender parity will help the global economy, what the heck is taking so long? We took a look inside the Index to find out more.

A marginal improvement

This year’s report benchmarks 149 countries on their progress toward gender parity. Overall, gender disparity decreased by less than 0.1 percent in 2018 based on economic, educational, political and health metrics, Bloomberg reported. It’s a marginal improvement, but it’s a step in the right direction compared to last year, when equality metrics worsened for the first time since the Index launched in 2006.

Still, some disparities are harder to address than others. “Income gaps have been ‘particularly persistent,’ with 63 percent of the global wage gap having closed so far,” Krystal Chia of Bloomberg reported, citing the Index. And although the economic opportunity gap shrunk slightly this year, the proportion of women participating in the global labor force actually declined, according to the WEF.

Fewer women in the workforce: What’s up with that?

"We have been producing this report for 13 years. And in the last couple of years, we started to see this tapering-off of progress that hasn't been happening before," Saadia Zahidi, head of the WEF’s Centre for the New Economy and Society and member of its managing board, told the China News Service.

The WEF cites a few reasons why gaps in workforce participation, career advancement and pay remain so prevalent worldwide. One, which was highlighted in most national media coverage of the Index and confirms prior research, centers around the gender imbalance in STEM (science, technology, engineering and math) careers.

Indeed, the numbers are hard to ignore. Less than 30 percent of the world’s researchers are women, according to the U.N. Educational, Scientific and Cultural Organization (UNESCO), and women represent less than 25 percent of the U.S. STEM workforce. Globally, only 22 percent of artificial intelligence (AI) professionals are female, according to research from the WEF and LinkedIn.

Compounding their lack of representation in this increasingly crucial and lucrative segment, the jobs women tend to take are more vulnerable to automation—leaving women at greater risk of being left behind.

Zahidi called on companies to step up to ensure recent gains in gender equality are not reversed as technologies advance. “Industries must proactively hardwire gender parity in the future of work through effective training, reskilling and upskilling interventions and tangible job transition pathways, which will be key to narrowing these emerging gender gaps and reversing the trends we are seeing today,” she said in a statement. “It’s in their long-term interest because diverse businesses perform better.”

That last assertion aligns with a 2018 study from the Boston Consulting Group, which found that companies with gender diverse leadership produced 19 percent more revenue.

But however consequential the STEM gap may be, it doesn’t fully account for observed workforce disparities. In most countries around the world, the infrastructure needed to help women enter or re-enter the workforce—such as childcare and eldercare—is under-developed, according to the WEF, and unpaid work remains primarily the responsibility of women.

“For most economies, we actually haven't found the way for parents to be able to combine work and family,” Zahidi told the China News Service. “And most of the burdens of unpaid care work, whether childcare or eldercare, tends to fall upon women."

Women spend more of their time working for free

Among the 29 countries for which data are available, women spend, on average, twice as much time on housework, childcare and other unpaid activities than men, according to the Index. This finding mirrors prior research, including a 2018 study from the U.N. that estimates women do 2.6 times more unpaid care and domestic work than men.

“Women, even full-time working women, spend fewer hours on average doing paid work than their husbands or partners do,” Kim Parker, the director of social trends research at the Pew Research Center, told MarketWatch earlier this year. “That may be due in part to the fact that there’s this expectation or default arrangement where they are doing more of the child care or housework.”

This calls to mind the prevailing sentiment that the need for schedule flexibility often prevents women from advancing in the workplace. It also illuminates why women need all that flexibility in the first place—because they spend so much time on unpaid tasks that allow the global economy to function but aren’t factored into the global GDP. "If women stopped doing a lot of the work they do unpaid, then the whole economy would collapse," Shahra Razavi, chief of the research and data section at U.N. Women, told CNN Money.

For most, these conclusions are likely not surprising. But they point to potential pathways that companies and governments can pursue—alongside policies that enhance STEM equality—in order to close the workforce gender gap faster. For example, economies that provide public or subsidized childcare have more than twice the percentage of women wage earners, according to a 2017 report from the World Bank.

Image credit: Rawpixel via Unsplash

Brands Drop Ads from TV Show That Disses Immigrants

Originally published as The Big Story in the Brands Taking Stands weekly newsletter; click here to sign up.

Free speech, boycott threats, company and consumer values, the immigration debate—big issues have risen to the top of the corporate agenda once again. The occasion: Advertisers have withdrawn their support from a TV program after a pundit voiced strident opinions that they say run counter to their values. Once again, the major players are a Fox News television program and its sponsors.

“We will not be advertising on Mr. Carlson’s show in the coming weeks, as we reevaluate our relationship with his program.” That’s the punch line to a tweet by Pacific Life, the insurance company whose ubiquitous whales-breaching ads seem to blanket the TV landscape, including Fox News host Tucker Carlson's show.

The impetus for the announcement was Carlson’s characteristically incendiary comments on immigration— specifically, those Central American groups now gathering at the Mexican-U.S. border. In his opening monologue, Carlson claimed “an endless chain of migrant caravans” is mounting an “invasion” that he said “makes our own country poorer and dirtier and more divided.” The segment ended with a Pacific Life ad.

Flagged by activists in the Twittersphere as a racist statement by activists, comments protesting Carlson’s opinions and pointing out Pacific Life’s advertising support went viral, prompting the company’s decision.

Pacific Life’s reply to the pundit’s anti-immigrant rant was a flat pushback: “As a company, we strongly disagree with Mr. Carlson’s statements.” The company’s tweet went on to state its position, one rooted in its brand identity: “Our customer base and our workforce reflect the diversity of our great nation, something we take great pride in.”

This is no small move. In the past 30 days, Pacific Life has aired 69 spots from its 23 nationally broadcast TV ad campaigns, with a spend ranking of #466 compared to all other advertisers, according to iSpot.TV. The company is ranked #313 on the Fortune 500 list; counts more than half of the 100 largest U.S. companies as clients; recorded $9.4 billion in revenue in 2017; and has assets of $158 billion.

In other words, there are big ad dollars on the line here, as a 150-year-old brand measures its reputation against a media outlet’s ideological position to which it objects.

Pacific Life has been joined by the job site Indeed, which said, “Our site is for everyone, regardless of background or beliefs,” and confirmed that it is “not currently advertising on Tucker Carlson Tonight and has no plans to advertise on this program in the future.”

Other companies are adding to the ad dropout list. Bowflex, the fitness training company, announced its withdrawal of support: “We have requested that Fox News remove our ads from Tucker Carlson Tonight in the future,” announced parent company Nautilus.

And SmileDirectClub has issued a policy that would prevent its ads from continuing to run on Carlson’s program. In a statement, it said that it is “actively working with our media buyers to confirm that SmileDirectClub is no longer running our ads around any political opinion shows.” That stance sidesteps questions of taking a position in favor of withdrawing from any controversy over socio-political issues.

A Fox Network spokesperson described the events as a social media assault by “left-wing advocacy groups” on companies “in an effort to stifle free speech.”

Of course, no company is abridging Carlson’s right to speak on Fox News—just questioning whether it should be expected to pay to support his opinions. As more brands take stands on public policy issues, look for them to take positions that align with their interests. In this case, those who favor a robust anti-immigrant stance are running head on into one of the strongest movements in business today: The effort to expand, not restrict, diversity and inclusion in workforces, and to reflect the diverse consumer market to which companies must appeal to be viable.

Be sure to stay informed about the latest in corporate responsibility and corporate activism with the Brands Taking Stands newsletter. And follow us on Twitter @BrandsTkgStands.

Image: AdobeStock/JP Photography

Millennials’ Food Choices Means Canned Tuna Stays on Shelves

Millennials have been blamed for killing dozens of industries, from banks to beer to real estate (even cereals and napkins). Now they’re accused of killing canned tuna because they can’t be bothered to open a can, and according to an executive for tuna company Starkist in The Wall Street Journal, don’t even own can openers.

That was the last straw (paper, not plastic, please) for Jolie Peters, senior editor at Plan 3000, a socially conscious storytelling platform by and for Millennials and Generation Z. Peters, 26, thinks people are completely missing the story about Millennials and food - and are clueless in a few other areas as well. After all, they are shaking up the finance world with their focus on socially responsible investing.

“The article [in the WSJ] was striking to me because it framed the death of canned tuna in a negative way but there’s definitely some truth to it. Millennials and Gen Z’s are seeking out fresher options,” Peters told TriplePundit.

As the daughter of restaurateurs who grew up eating freshly prepared food, Peters says she has never eaten canned tuna—but not for lack of a can opener.

Leading a food revolution

The real story about Millennials and Gen Z’s and food is a much more positive one, she says. “We’re moving away from canned fish and canned vegetables to fresher farm-to-table ingredients. There are environmental reasons, too, why we are moving away from things that used to be pantry staples.”

Millennials, who represent nearly one-quarter of the population, are increasingly shifting away from meat and fish in general, with 10 percent of consumers between ages 18 to 29 either vegetarian or vegan.

As for canned tuna’s carbon footprint, there’s some debate. While the Environmental Working Group claims not eating canned tuna saves 6.1 kilograms of CO2 per kilo of canned tuna, a study commissioned by the WWF estimated the carbon footprint of canned tuna to be far lower.

You are what you eat

“Millennials are activists at our core, and food and the environment often overlap,” Peters says. “We want to know where our food is coming from, that it is sourced sustainably. We’re asking questions about the source of our food that people haven’t asked for a very long time.”

Millennials are some of the healthiest eaters of any generation. According to the Organic Trade Association, 52 percent of organic consumers are Millennials and they eat 52 percent more vegetables than their older counterparts. And they’re shifting their diets dramatically, with some 40 percent embracing plant-based diets.

The food industry needs to pay attention to how this important demographic is making food choices. – and many are doing so. For example, Peters says Trader Joe’s is one retailer beloved by Millennials that is “spot on” when it comes to understanding what they want (although Greenpeace ranks Trader Joe’s as just “okay” on its seafood sustainability practices). Others, like the canned tuna companies, may not be getting it.

Appealing to Millennial tastes

“Large corporations and large food companies have a challenge in that they are older and so large. Our demographic is shifting to small food businesses and smaller farms and markets and local chefs and it’s really hard for those corporations that our parents supported so wholeheartedly to reach us,” Peters says.

Genuine, thoughtful efforts to listen to the voices of Millennials and Gen Z’s and their food preferences will be heard, Peters said. “Companies need to find a way to care about issues that really make sense to our generation.”

However, large processed food companies will still struggle in appealing to her age group, Peters says. She is not alone in this attitude—one study says Millennials are twice as likely to distrust large food companies than older generations.

“I’m not sure that any big corporation will really be able to satisfy what we’re looking for as you can’t make up for that demand from our generation for locally grown and produced food,” she says.

Are big food companies listening?

Many of the world’s largest food companies would reply that they are aware of Millennials’ concerns and are responding in kind. Many global food and beverage companies have grown largely in recent years by acquiring smaller, socially-conscious brands and letting them carry on business as usual.

Witness Unilever’s purchase of Ben and Jerry’s almost 20 years ago; Honest Tea has been part of Coca-Cola; Hormel has done the same with Justin’s and Applegate Farms. PepsiCo, meanwhile, has dabbled in projects such as working with smallholder farmers in Ethiopia; three years ago the company said its sustainability efforts reined in $375 million in savings. But as Peters’ concerns suggest, the world’s largest companies have a lot more convincing to do in order to court this enormous, and lucrative, demographic.

Image credit: NeONBRAND/Unsplash

Low Carbon Strategy May Fix Coca-Cola's Supply Chain Problem

Judging from the latest news humming around the Intertubes, the Coca-Cola Company seems to have gazed into a crystal ball and discerned an interesting supply chain problem looming in the low carbon economy of the future. Let's call it the carbon dioxide dilemma. Carbon dioxide is a greenhouse gas responsible for global warming, but for Coca-Cola and other soft drink makers, the problem could be not enough of it, rather than too much.

Or not, as the case may be. Coca-Cola has hit upon a high tech solution that could prove, once again, that the low carbon economy of the future is one in which bottom line and sustainability goals intertwine.

What puts the pop in soda pop?

Carbon dioxide has a wide number of commercial uses as a liquid, solid, and gas. As a gas it is common in food processing, especially in the preservation of fresh meats and salads, in making packaged foods and of course, in the beverage sector. Carbon dioxide gas has unique properties and an acidic taste, which adds flavor and interest to drinks that would otherwise be flat and bland-tasting.

It's no accident that carbonated drinks became popular on the heels of the industrial revolution. Almost all commercially available CO2 is captured from large scale breweries and biogas operations, or from industrial processes with a high carbon content, such as lime (used in cement) or ammonia manufacturing.

The future of the carbon dioxide supply chain

The supply chain pressure is already closing in on Coca-Cola and other beverage companies as the overall global demand for soft drinks and processed foods rises. Beverage manufacturers are also facing supply chain competition from sales of bottled CO2 for home use. New systems for creating chemicals, fuel and plastic products from industrial waste gas are contributing to the squeeze, too.

Supply chain cracks are already beginning to show. Just last summer, for example, The Grocer attributed a "CO2 crisis" in the United Kingdom and Europe to a seasonal problem. Summer is the season when ammonia and bio-ethanol plants often shut down for maintenance, and across Europe more plants than usual went offline.

The U.K. was especially hard hit. It also experienced a shortfall in CO2 purifying capacity last summer, which exacerbated the problem. Several purifying plants shut down for routine maintenance while others experienced technical difficulties, leaving just one plant in operation for a time.

A transportation bottleneck also came into play. There was a shortfall in specialized delivery trucks, which The Grocer attributed to the gas industry's failure to plan ahead "develop the logistical capacity needed to keep pace with growing demand," partly due to skyrocketing growth in the brewery sector.

Coca-Cola and the low carbon economy of the future

This is where the Coca-Cola solution comes in. Carbon dioxide is, of course, ubiquitous in the atmosphere. So, the potential is there for bottling plants and other facilities to simply acquire their own supply from the ambient air, using equipment located in or near the facility.

As a corporate social responsibility bonus, an ambient air carbon capture system would also help companies like Coca-Cola offset their carbon footprint in a very simple and direct way.

The main stumbling block to ambient air capture has been cost, but global warming has provided the financial motivation for startups to tinker around with the technology and come up with commercially viable systems.

The latest news from Coca-Cola could have broad implications for the decarbonization. As reported by Gasworld earlier this week, Coca-Cola has partnered with the startup carbon capture company Climeworks to draw CO2 from ambient air, and use it in a bottling plant.

Climeworks has developed a modular, automated system it calls Direct Air Capture, in collaboration with the leading CO2 supplier Pentair Union Engineering (Denmark-based Union Engineering was acquired by the global water solutions company Pentair last year).

The company is a spinoff based on research from the renewable energy program at Switzerland's ETH Zurich. The basic steps of its carbon capture process are relatively straightforward.

Air is drawn into the system where it encounters a filter. Once the filter is saturated with CO2 it is exposed to heat, at a temperature equal to the boiling point of water or 212 °F. This relatively low level of heat enables the system to operate on a diverse energy platform, including geothermal as well as other renewables.

Once heated, the filter releases the CO2 and it is collected as a concentrated gas. According to the company, the filter can be used for several thousand cycles.

The first to try the new technology will be Coca-Cola HBC Switzerland's sparkling water brand Valsa. Though it's a pilot project aimed at helping Climeworks scale up the technology, Coca-Cola is already thinking big: the Swiss subsidiary is its second-largest anchor bottler.

Beyond beverages

Like Coca-Cola, Climeworks is also thinking ahead. Greenhouses are another source of demand for commercial carbon dioxide, which they use to create a rich environment for growing plants. Climeworks is looking into that sector for additional business.

Other areas of interest include fresh meat and vegetable packing, dry ice manufacturing, and the bulk gas used for carbonation by bars and restaurants as well as synthesizing fuels, plastics and other materials.

Photo: via Coca-Cola.