Renewables Aggregation Model Scores First Big Test

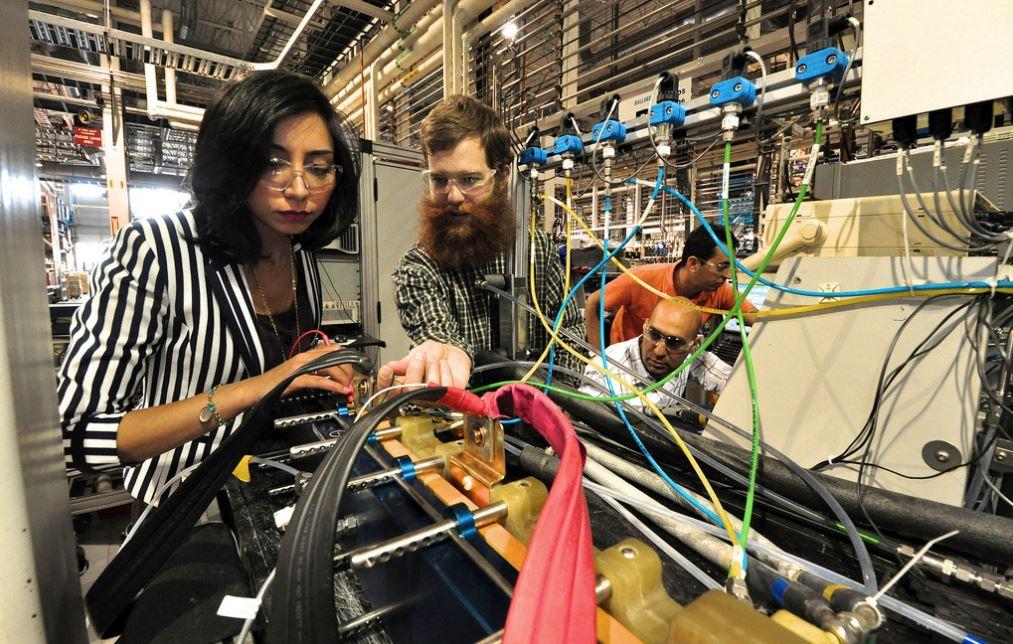

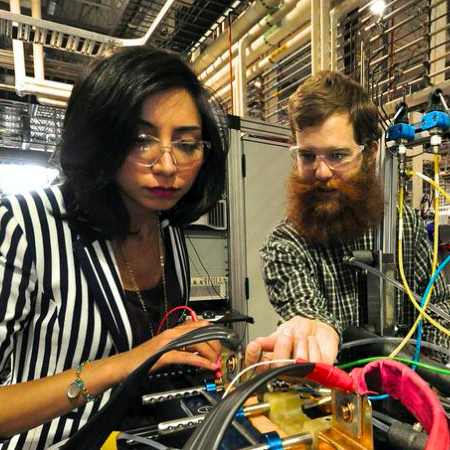

Wind power is just one technology that could scale up if this renewables aggregation model gains traction.

Major U.S. companies have been snapping up solar and wind power projects at a rapid clip. The pace could pick up even more if a unique renewable energy aggregation deal between Bloomberg, Cox Enterprises, Gap Inc., Salesforce and Workday carries out as planned. The first-of-its-kind arrangement enables multiple companies to piggyback on the same deal for utility-scale wind and solar.

Five is better than one

If you’re wondering why all the big fuss over yet another renewable energy deal by leading companies, that’s a good question.

Utility-scale wind and solar deals are no longer big news when an individual company is doing the wheeling and dealing. It has become commonplace for companies with high energy requirements to claim large amounts of clean electricity from major new clean power projects. In particular, high-demand companies in the data and communications fields — AT&T, Facebook and Google, for example — have been turning to renewable energy for reliability and price stability in addition to the environmental benefits.

The problem is how to incentivize renewable energy for businesses that have a relatively low demand profile and lack the deal-making leverage and resources commanded by high-demand stakeholders.

One alternative is to install rooftop solar panels and other onsite renewables, but many companies don’t have that opportunity. In any case, businesses with onsite wind or solar often need to supplement their onsite output with offsite energy purchases.

Collectively, then, these low-demand businesses represent an important opportunity to grow the demand for utility-scale renewable energy projects.

That’s where the new renewable energy aggregation partnership comes in.

Under the name “Corporate Renewable Energy Aggregation Group,” five global companies — Bloomberg, Cox, Gap, Salesforce and Workday — have joined together to claim 42.5 megawatts from a 100-megawatt solar farm in North Carolina.

Bloomberg explains the motive:

“…This group of companies, coming together as the is the first example of companies aggregating similar, relatively small amounts of renewable energy demand to collaboratively enter into a virtual power purchase agreement (VPPA), collectively acting as the anchor tenant for a large offsite renewable energy project.”

The arrangement is a win-win for the developer, too. With an anchor tenant in hand, the developer can make a stronger case for other prospective purchasers to jump on board.

Think globally, act locally

The involvement of five U.S. companies with a global reach is a key aspect of the new partnership.

The participating companies expect the aggregation model to provide a gateway for smaller-demand companies to push the market for large offsite clean energy projects.

If the model proves transferrable, that would save other companies a considerable amount of time and effort, including legal expenses related to negotiations.

According to Bloomberg, the five companies began collaborating on the aggregation concept in 2017, with support from the Business Council on Climate Change and Rocky Mountain Institute’s Business Renewables Center.

The company LevelTen Energy was also involved. LevelTen specializes in renewable energy aggregation, deploying its proprietary “Dynamic Matching Engine” platform to tailor deals for buyers and sellers. The company says it currently has almost 1,600 projects within its portfolio.

Renewable energy development: you ain’t seen nothing yet

The solar project developer is BayWa r.e. Solar Projects, LLC, and it also foresees the aggregation model sparking a new wave of large-scale renewable energy projects.

BayWa r.e. CEO Jam Attari explains:

“For BayWa r.e. this novel deal is, not only, the right new model for corporate energy procurement, but an example of our commitment to a significant, strategic investment in key markets to support the growing demand for renewable energy by corporations in the Americas.”

BayWa r.e. is not waiting around to see who else picks up on the aggregation idea. The company already announced a total of 350 megawatts in solar projects for North Carolina and Virginia, with the first coming online in 2017 and 2018.

In another interesting twist on the collaboration angle, BayWa r.e. has partnered on the 350-megawatt solar development plan with the North Carolina company Geenex, which specializes in streamlining the development of utility-scale solar projects.

Through BayWa r.e., the impact of the new arrangement could also extend beyond solar and into other renewable energy projects. The company also specializes in wind power and bioenergy.

It’s also worth noting that BayWa r.e. is a global company with an impact that reaches far beyond the U.S. It comes under the umbrella of the trading and logistics company BayWa, which is headquartered in Germany.

All this is by way of saying that the renewable energy field is poised for even more rapid acceleration, as leading stakeholders develop sophisticated new models for partnerships.

Image credit: Beyond Coal & Gas/Flickr

4 Ways Collaboration Can Get Companies on CDP’s "A List"

We should certainly celebrate the companies that made it to CDP's A list. But if we neglect the B’s, C’s and D’s, we all lose.

Last week, CDP recognized companies for leading on climate change. Around 127 brands received an “A” grade – 2% of reporting companies – while the others were stamped with B’s, C’s and D’s.

We should certainly celebrate the companies that made it to the A List. These companies have proven leadership in corporate climate action and should be recognized.

But if we neglect the B’s, C’s and D’s, we all lose.

True cohesive climate action requires elevating the environmental performance of all companies – not just one-by-one. And the best way to do that is through collaboration.

The purpose behind CDP’s list and what it’s missing

CDP asks companies to report their environmental impact, how they’re managing it and what opportunities exist for reducing it.

These grades are published to give a holistic view at how the world’s companies are tackling climate change – and to light a fire under their feet to do more.

But CDP is only one reporting framework.

If a company doesn’t make the A List, it doesn’t necessarily mean that they are not taking action to reduce their footprint.

Take Hershey, who just announced a suite of environmental plans, including committing to set Science-Based Targets. Or Comcast, which is working towards zero waste by reducing the amount of waste and recyclables it sends to landfills. Or NRG Energy, which developed an asset analysis and enterprise risk assessment tool that can be used to improve the sustainability of its supply chain.

Other companies might receive a B, C, or D because their reporting capabilities aren’t in line with CDP’s standards. And others, quite possibly, might just need help turning their ambition into action.

Turn the B, C, and D’s to A’s through collaboration

One of the best ways to give these non-A List companies the support they need is through collaboration. Because in reality, the biggest environmental challenges can’t be conquered by 127 companies. There needs to be impact across entire industries.

Here are four ways collaboration can be used to help elevate all companies.

- Work with peers. Collaboration and transparency must exist within the industry itself. True business leadership isn’t about improving individual performance – it’s about helping others do the same by sharing best practices. Set the bar, then help others get there.

- Partner with NGOs. Partnerships can help tackle the middle miles – the time when the real hard work kicks in. NGOs provide hands-on help to execute against climate-related goals – like EDF Climate Corps has been doing for over a decade.

- Join initiatives. Since the decision to pull the U.S. from the Paris Climate Agreement, companies have stepped up on climate leadership by announcing commitments of their own, like joining the Science-Based Target initiative or RE100. Setting ambitious, measurable GHG emission targets through these groups also keeps companies honest by holding them publicly accountable.

- Engage with policy makers. The most important thing companies and investors can do is use their influence to accelerate the transition to a low carbon economy by supporting smart policies. Because while voluntary corporate actions to cut emissions are important, they’re simply not enough. Only public policy can deliver the pace and scale of reductions needed to move entire industries – not isolated corporate commitments.

Collaborating can help the remaining 98% of companies get closer to next year’s “A List.”

Previously posted on 3BL Media News and the EDF+Business blog.

The First Climate Change Bankruptcy Is a Wake Up Call

The announcement that PG&E, the giant California utility, intends to file for bankruptcy is a wakeup call for companies to move the economic impact of climate change to the top of corporate agendas.

The announcement that PG&E, the giant California utility, intends to file for bankruptcy is a wakeup call for companies to move the economic impact of climate change to the top of corporate agendas. With a $3.75 billion market cap, PG&E is facing an estimated $30+ billion in lawsuits for damages from the wildfires. That $27 billion gap between valuation and potential liabilities—combined with a drop in share price from a high of $49 to its current $5—should give any C-suite and board the existential shivers. No company wants to be next in line for the Wall Street Journal feature that would follow last week’s “PG&E: The First Climate-Change Bankruptcy, Probably Not the Last.”

There are signs that business is stepping up its scrutiny of the link between climate change’s effects and its economic impact. The concern is now moving the issue from the environmental column to the bottom line, as calculations of risks, costs and profits are increasingly weighed together with the moral imperative. Brands taking stands on climate change are going to be increasingly judged by how well they execute their fiduciary duty re: the issue as well as how responsible they are being in their sustainability practices and strategies.

Exhibit A: Last week, economists called for a tax on carbon emissions in the U.S. in a public letter signed by the last four people to lead the Federal Reserve, 15 former leaders of the White House Council of Economic Advisors and 27 Nobel laureates. The collective statement called for “immediate national action” and described a gradually rising tax whose proceeds would be distributed to consumers as “carbon dividends.”

Exhibit B: “Many of the central economic questions of the decades ahead are, at their core, going to be climate questions,” writes Neil Irwin, a senior economics correspondent for the New York Times. Irwin goes on to describe the myriad details of the daunting challenges of climate change’s “giant impact on the economy” in four key issues.

Exhibit C: Michael Bloomberg has announced six financial sector leaders as the founding members of the new Climate Finance Leadership Initiative. Its goal is to help facilitate the private financing objectives included in the Paris Agreement. Bloomberg, the UN’s Special Envoy for Climate Action, previously co-founded America’s Pledge, launched the American Cities Climate Challenge, and participates in We Are Still In—all efforts focused on climate change from a policy point of view. The CFLI is aimed at the same target through a financial lens.

In this initiative, it’s all about the money, says Bloomberg. “The faster we can accelerate investment in projects that both reduce emissions and create jobs, the more progress we can make reducing the health and economic risks that come with climate change. This initiative will help us do that, by bringing more capital to the fight against climate change.” That call to financial action is echoed by the group’s other founding members, which include the CEOs of AXA, HSBC, Goldman Sachs, Enel, and Macquarie, as well as the Executive Managing Director and CIO of the Government Pension Investment Fund (Japan).

Exhibit D: Finance firms must adopt a “natural capital” strategy to manage risk, warns PwC, in a new report. “In the face of climate challenges, most financial service providers are still failing to assess the extent to which environmental degradation could pose financial risks to their firms.” Adopting a “natural capital approach that integrates ecosystem-oriented management with economic decision-making and development by placing a financial value on natural resources” is the holistic solution to environmental risks, concludes the advisory.

Exhibit E: Refinitiv, the financial data provider (formerly part of Thomson Reuters) that reports on ESG investment, has announced a commitment to its own environmental practices. “Addressing the world’s biggest sustainability issues requires collective leadership that exemplifies the behaviors that will bring about change and empower others to do the same,” said David Craig, Refinitiv CEO, in a statement. “As well as driving changes in investment behavior through our data and insights, this also means caring about our own operational footprint.” Refinitiv’s mission “is to lead the way as a sustainable, responsible business and use the power of its data and insights to help the global investment community shift towards sustainable investments,”added Luke Manning, head of Sustainability and Strategic Initiatives for Refinitiv.“We are increasingly harnessing our core capabilities to drive positive social impact, being smarter with our resources and footprint, and balancing short-term considerations with long-term progress.”

Exhibit F: The World Bank Group is hosting a conference of the Climate Finance Funds at the end of this month. “The Power of 10: Shaping the Future of Climate Action” is convening world leaders to discuss systemic change, including climate finance. This kind of global initiative has tended to be peripheral to U.S. business interests in the past but is taking on a renewed urgency today. This is yet another way to look at climate change through its impact on world economies.

I rest the case—for the moment. Here’s the deal: These and other actions by brands taking stands on climate change signal renewed focus on a bottom line that is both profitable as well as responsible.

IMAGE CREDIT: U.S. Forest Service/Flickr

Be sure to subscribe to the weekly Brands Taking Stands newsletter.

The What, Why and How of Community-Scale Composting

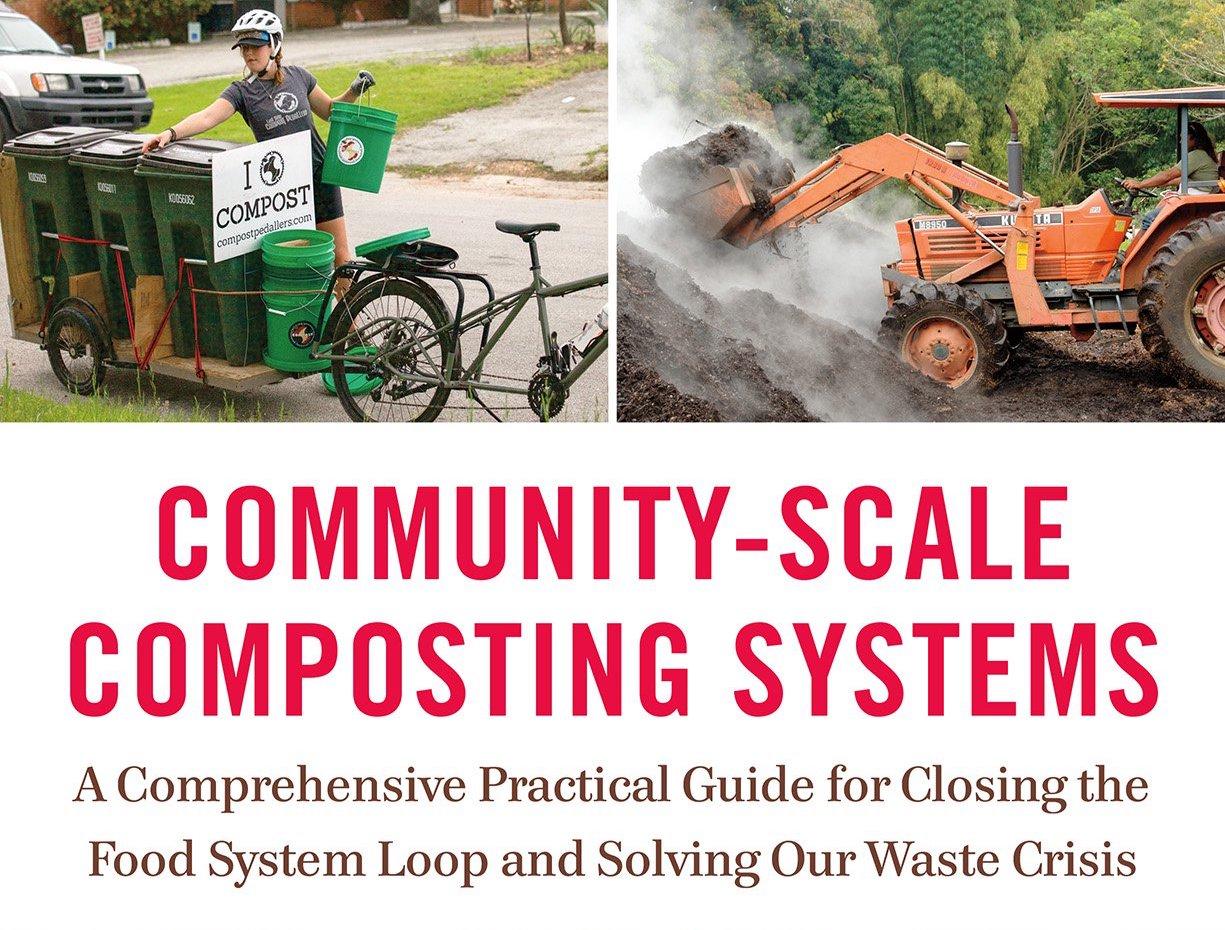

The following excerpt is adapted from James McSweeney’s book Community-Scale Composting Systems: A Comprehensive Practical Guide for Closing the Food System Loop and Solving Our Waste Crisis (Chelsea Green Publishing, February 2019) and is reprinted with permission from the publisher.

Everyone on the planet generates organic wastes, just as we all eat and breathe. More than 38 million tons of food scraps were generated in the United States in 2014, with only 5.1 percent being recovered or recycled, according to the U.S. Environmental Protection Agency. Naturally, an enormous diversity of systems to capture, transport and recycle organics has developed from this resource niche.

The fundamental building blocks of all composting systems are the same regardless of scale. In every system, organic refuse is generated, collected and composted. These three basic components are necessary whether the source is a single residence or a city. But composting wouldn’t exist without the fourth fundamental component of these systems, the end uses. These include a wide range of applications and markets, as well as other forms of soil fertility, animal feed and energy.

My new book covers recycling systems that handle organics at volumes above the scale of a single home and below the scale of a large city—in other words, community-scale composting. When planned appropriately, community-scale composting systems can handle the organics generated by a specific population, neighborhood or region. Across the United States, composters operating at this scale are emerging at a growing pace, as is an awareness of the benefits and services that composting provides.

In my experience, this sector of composters is typically focused on producing a very high-grade end product. Small-batch, horticultural, boutique, organic, bicycle-powered, artisan, community-based: There is no end to the ways in which these producers can be classified. What is increasingly apparent from this boom is that (1) there remains an abundance of waste; (2) awareness of the problem is growing; and (3) people are actively intervening to build the systems to collect, recycle and reuse available organic resources in their communities.

The rapid growth and maturation of composting has led to a healthy discussion about how a functional and efficient organics recycling infrastructure can and should look. One result of this discussion is the solidification of a self-identifying segment of composters referring to themselves as “community composters.” Appropriately, the concept of community composting seems to have developed organically and with no single particular origin. Rather, organizations, projects and even news articles appear to have taken on the term for its succinctness, though with their own slightly varying definitions. I first started using the term while working at the Highfields Center for Composting, to describe the services we provided. At first, I found it hard to define exactly what we were doing, but clearly it involved composting, community, education and infrastructure. Over time, I learned to describe what we did as “supporting the development of community composting programs,” and eventually our motto became “your partner in community composting.” It wasn’t until the 2012 U.S. Composting Council Conference in Orlando, Florida, that the presence of a plethora of similarly-minded practitioners around the United States helped the concept truly come into focus.

I wasn’t the only one whose eyes were opened at that conference. Within the year, conference calls and planning for the first national convergence of community composters were ongoing. In the fall of 2013, the composting industry’s leading publication, BioCycle, and the Institute for Local Self Reliance (ILSR) hosted the first Cultivating Community Composting Forum in Columbus, Ohio, a convergence that has continued annually.

In 2014, the Highfields Center for Composting (HCC) and ILSR wrote a report on community-scale organics solutions, called Growing Local Fertility: A Guide to Community Composting, from which my new book is built. We faced the question of defining community composting for both ourselves and our audience, which took a great deal of time and thought. We decided that it was critical to involve other community composting practitioners and advocates in the process, and we reached out to several of the players that were involved in the development of the national community composting forum for their input. The team also agreed that the development of defining principles, rather than a set of exclusive criteria, would have the greatest long-term impact on the culture of composting as a whole. We wanted the vision for community composting to feel inclusive to the wide array of practitioners who identify with the term, and ideally to act as a standard of social and environmental ethics toward which anyone in the organics recycling sector could strive.

The team arrived at the following set of Core Community Composting Principles:

1. Resources recovered. Waste is reduced; food scraps and other organic materials are diverted from disposal and composted.

2. Locally based and closed loop. Organic materials are a community asset and are generated and recycled into compost within the same neighborhood or community.

3. Organic materials returned to soils. Compost is used to enhance local soils, support local food production, and conserve natural ecology by improving soil structure and maintaining nutrients, carbon and soil microorganisms.

4. Community-scaled and diverse. Composting infrastructure is diverse, distributed and sustainable; systems are scaled to meet the needs of a self-defined community.

5. Community-engaged, -empowered and -educated. Compost programming engages and educates the community in food systems thinking, resource stewardship, or community sustainability while providing solutions that empower individuals, businesses, and institutions to capture organic waste and retain it as a community resource.

6. Community-supported. Programming aligns with community goals, such as healthy soils and healthy people, and is supported by the community it serves. The reverse is true, too. A community composting program supports a community's social, economic and environmental well-being.

Making waste management compatible with our food system

To many people, it may be a given that the composts you produce at home are intended for use in food production, but I can assure you, this is commonly not the case. Much as you see with foods in organic agriculture, the scale, localness, distribution, processing and quality of the composts that are available to the end consumer can vary hugely from producer to producer and product to product. In fact, today’s organics recycling is as much a waste management business as it is an agricultural practice. There is sometimes tension between these two sectors, despite the common goal of minimizing waste and conserving resources. In unique cases, operations from the waste industry display an awareness of the needs of agricultural producers, but this is by no means a given, which many in the waste management sector openly admit.

While managing food scraps as a high-quality agricultural input holds enormous value, that potential frequently goes unrealized. Instead composts on the market are often immature, contain significant plastic nanoparticles or are commingled with sewage, reducing the options for end use. The use of such composts must be better understood and targeted appropriately. One 2009 study, for example, found a correlation between facility scale and the presence of fecal indicators (bad bugs in human and animal feces), with levels of E. coli and salmonella increasing with facility scale.

Another undesirable trend is utilizing water resource recovery facilities or WRRFs (formerly known as wastewater treatment plants or WTPs) for organics recycling. Combining food scraps with sewage reduces the food scraps’ potential end uses, creating an end product that is less marketable and contains traces of everything that went into the sewage system including heavy metals and industrial wastes. While this approach keeps organic resources out of landfills, the yields can be highly variable when it comes to their quality as an agricultural input, offsets of greenhouse gas (GHG) emissions and renewable energy status, and overall net benefit to the environment and society. In cases where the solids fraction coming out of the WRRF are not separated and composted, many people are rightly calling this practice out as “composting” in name only.

Until quite recently, depending upon where you live, small-scale producers of high-quality composts have been either the norm or nonexistent. The tremendous growth in composting has led to an explosion of composting at all scales, hence a stratification of distinct sectors of organics recyclers. In many places small-scale high-quality producers are nonexistent or just now starting to appear. In other places community-scale composting forged the path, and now laws and other factors have initiated larger operations that potentially threaten smaller producers.

All of that said, the community-scale composting movement is not about condemning any one sector of organics recyclers. Organics recycling is nuanced, and there is a need for infrastructure that meets the scale of our population, as well as a need for diverse grades of composts for a variety of applications, including non-food-producing lands. Instead, community-scale composting’s role is to make great, local-food-system-grade composts and to be a growing model of local, closed-loop ecological principles.

Triple A Scores Became Tougher in Latest CDP Rankings

Of the 6,800 companies CDP recently scored from an A to a D-, only the top 2 percent made the organization's most recent A List. We highlight a few of the companies who performed well and how they stand out.

For companies vying for the highly prized CDP recognition, “triple A” scores became much tougher to attain in 2018. While 140 companies were named to the 2018 list, only two, Firmenich and L’Oreal, received triple A scores in performance against all three areas surveyed: climate change, water security and forests.

CDP, formerly the Carbon Disclosure Project, is widely recognized as one of the world’s leading sustainability reporting frameworks. It represents the interests of over 650 investors with assets of $87 trillion.

In 2018, it changed its methodology to add emphasis to water security, given the urgency of the issue, investor pressure and to align with the data being requested by the Task Force on Climate-related Financial Disclosures.

Of the 6,800 companies CDP scored from A to D-, only the top 2 percent made the A List. In addition to the triple A hitters, noted companies within this ranking include Johnson & Johnson, Mitsubishi Electric, Nestle, Best Buy, UPS, Unilever and Apple (which was once publicly shamed for not reporting to CDP).

The weight of water

“If climate change is the shark, water risk is the teeth, the area where the effects of climate change will be felt most acutely,” Dexter Galvin, global director of corporates and supply chains at CDP, said in an interview with Ethical Corporation. “Last year the number of companies receiving A’s [in water risk] didn’t reflect the level of preparedness in the marketplace. . . . This year we’ve been more probing in our questions on water and looked more deeply into the water impacts in supply chains.”

Firmenich, the world’s largest privately owned flavor and fragrance business, scored in the top 2 percent, based in part on its commitment to renewable energy. Today 100 percent of its European manufacturing sites rely solely on renewable electricity; it is aiming to have all of its plants powered by renewable energy by 2020.

CDP also took notice of Firmenich’s state-of-the-art wastewater treatment plant in China, which allows it to operate a manufacturing plant that provides almost double the company’s previous manufacturing capacity.

L’Oreal commits to zero deforestation

On the climate front, L’Oreal said it has reduced the emissions of its industrial sites by 73 percent compared to 2005 by lowering the greenhouse gas emissions of its plants and distribution centers, using renewable energy and improving its energy efficiency. As evidence that it can grow its business while minimizing its carbon footprint, in the same period, L’Oreal’s says its production volume increased by 33 percent.

The company has also committed to zero deforestation by 2020 and already sources 100 percent of its palm oil derivatives from sources certified by the Roundtable on Sustainable Palm Oil, according to its CDP report.

Top marks for innovation

Other examples of leadership and innovation in the CDP ranking include

ACCIONA, Gap, Ford and KAO Corporation, which are among the more than 25 companies on the A List for their water security action.

Seven companies received an A for their efforts to address deforestation, including Beiersdorf, Tetra Pak and UPM-Kymmene.

Other companies received kudos for a range of initiatives that earned them A rankings:

Best Buy US: By promoting ENERGY STAR certified products, the retailer helped American customers save more than US$45 million in utility bills in FY18, an energy saving which equates to removing nearly 55,000 cars from the road for a year.

Lego Group: The Danish toymaker launched the first LEGO elements made from plant-based plastic sourced from sugar cane and has committed to making all LEGO products from sustainable materials by 2030.

LG Display: From 2013 to 2017, the Korean electronics company developed and invested in 156 water-related reduction (water reuse) technologies, to save about KRW 4.61 billion (US$4 million).

Even if it is more difficult than ever to earn that elusive triple A, CDP is likely to continue to be one of the most anticipated recognitions of top sustainability performance. Since 2013, the number of organizations reporting to CDP has risen 55 percent.

Outperforming the index

And the investors who value so highly the CDP scores for evaluating companies’ ESG risks are being rewarded. The STOXX Global Climate Change Leaders Index – which is based on the CDP A List – outperformed the STOXX Global 1800 by 5.4 percent per annum from December 2011 to July 2018, according to CDP.

“This demonstrates that the leadership on environmental issues shown by the A List goes hand in hand with being a successful and profitable business,” Galvin noted in CDP’s announcement.

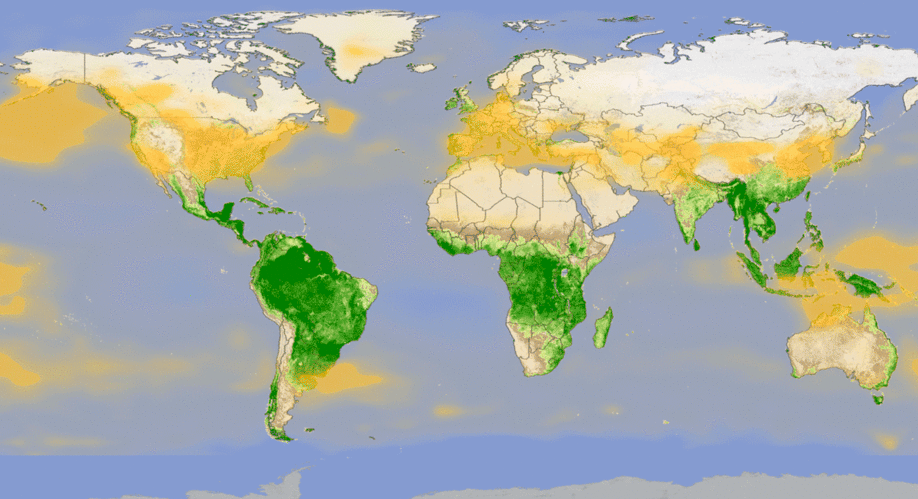

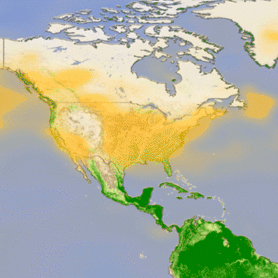

Image credit: NASA

When Boycotts Work: Howard Schultz Could Do to Starbucks What No One Else Could

Howard Schultz's talk of running as an independent in the 2020 presidential election could spark a boycott against Starbucks that in the end could actually succeed.

Starbucks has achieved near-legendary status for its ability to weather a seemingly endless parade of boycotts, and now it looks like the company is in for another test. Former CEO Howard Schultz set off a firestorm of protest earlier this week when he let word slip that he may make a run for the White House as an independent in 2020.

How could this boycott work?

There are many angles to the latest Starbucks boycott, not the least of which is that Schultz just launched a three-month tour to promote his new book.

Generating free publicity on a national basis all but guarantees healthy numbers on the sales ledger, whether or not Schultz follows through to pursue the role of Commander-in-Chief. Reportedly he intends to make an announcement when the book tour concludes.

Another angle involves Schultz’s status as the former — not the current — CEO of Starbucks. Schultz grew the company from a small beanery into a global colossus, but last June he announced that he was stepping down from his position. That raises the question of whether or not a Starbucks boycott would have any impact on him.

That’s a good question. The answer is yes, probably.

Schultz may have an ongoing financial interest in in the company’s ability to thrive. Aside from that, Starbucks is the core of his reputation and they key to his legitimacy as an influencer, both politically and in the private sector.

Why are people so upset at Starbucks this time?

Under Schultz’s tenure, Starbucks amassed a considerable record in the corporate social responsibility CSR area, so it’s no surprise that its boycotters typically come from the right side of the political spectrum.

Helping to fuel the right-win fire is the Fox News organization, which routinely targets Starbucks for the design of its holiday cups.

Nevertheless, the company has also endured boycotts (or at least the threat of a boycott) from the left. Just last spring, for example, Starbucks took a considerable amount of heat when a store manager called 911 on two African-American customers, over use of the store’s public bathroom.

Then-CEO Howard Schultz took immediate action to quell the backlash, partly by requiring all employees to undergo training. He also announced that anyone, customer or not, can use the bathrooms at Starbucks.

Actually, not all Starbucks stores have public bathrooms. However, that’s a moot point. Schultz’s quick action drew an overwhelming wave of favorable publicity, and the crisis subsided.

Schultz’s potential bid for president set off another surge of protest from the left, but there may be no quick solution this time.

Democrats are already rallying the troops to defeat President Trump’s re-election bid in 2020. The primary season is off to a rough-and-tumble start, but the aim is to propel a single, strong candidate into the General Election.

However, instead of piling into the Democratic primary, Schultz has made it clear that he intends to run as an independent.

Without digging too deeply into the political weeds, it’s a fair guess that third-party candidate with a left-leaning reputation would in effect hand the election over to President Trump for another four years.

That’s why people are upset.

When boycotts work, part 1.

TriplePundit has been following boycotts since the runup to the 2016 presidential election.

The pattern that emerges is that consumer boycotts rarely work, though they can be effective against brands that are already suffering reputation issues.

That doesn’t bode well for Starbucks boycotters, considering the brand’s strong record on CSR issues.

On the other hand, Schultz’s short-lived and rocky tenure as owner of the Seattle SuperSonics could give the boycotters a point of leverage.

The argument in favor of Schultz as a presidential candidate from the left rests on the idea that he would run the country like he ran Starbucks, CSR and all.

The SuperSonics venture presents almost the polar opposite of that picture, with serious missteps all along the way from employee relations to public relations and civic responsibility.

As news of that debacle circulates, it may also revive bitter memories of local coffee houses going out of business as Starbucks expanded, nailing down key locations.

In other words, Starbucks’s carefully cultivated brand seems strong now, but there are areas in which it is exposed to risk.

When boycotts work, part 2.

By throwing a monkey wrench into the 2020 election cycle, Schultz also risks alienating his customer base — including journalists, reporters, activists and students.

Talking Points Memo editor and publisher Josh Marshall provides a representative sample of the view from the left:

“Myself, considering what we’ve seen over the last 72 hours, I’d be hard pressed to go into a Starbucks. I just think he’s [Schultz is] too big of a jerk, courting too much potential damage for the country for reasons that don’t seem to go beyond ego.”

Marshall also notes that Starbucks is essentially an urban brand, putting it precisely in the place where coffee drinkers have many other options among the rising crop of boutique coffee houses.

Competition from Dunkin’ Donuts and MacDonald’s is another factor to consider.

Yet another element is the emergence of two grassroots boycott platforms, Grab Your Wallet and Sleeping Giants.

These platforms have been effective because they focus on getting businesses to boycott bad actors — in other words, a business-to-business boycott. Grab Your Wallet’s initial aim was to stop retailers from carrying Trump-branded products, and Sleeping Giants targeted advertisers on the Breitbart media website.

Both campaigns have since grown into powerful organizing forces. It would take just one step to transfer their business-to-business model into a conventional consumer boycott, one with a decent chance of success.

The bottom line: If Howard Schultz throws his hat into the ring as an Independent candidate for president, look for Fox News to celebrate, not excoriate, next year’s iteration of the Starbucks holiday cup.

Image credit: U.S. Department of Housing and Urban Development/Flickr

China’s Largest Retailer Commits to Inclusive Business

JD.com's recent sustainability report showcases efforts to stand out on social and environmental sustainability in China.

At 1.42 billion people, China constitutes nearly 20 percent of the world’s population. Hence, we can make the argument that when China truly embraces sustainability, the impact can scale up and become global. One company says it stands out among Chinese enterprises when it comes to integrating environmental and social sustainability across its entire business operations.

Could more Chinese companies issue more sustainability-related disclosures? Possibly, depending on the response to one of the country’s largest retailers, which recently issued such a report.

JD.com recently published its corporate social responsibility (CSR) report, which highlights what the company says is a focus on achieving sustainability while contributing added value to society. JD is launching large-scale projects that the company claims will reduce emissions and waste, while at the same time, could help promote the idea of sustainable consumption among the Chinese consumers.

Reducing the company’s environmental footprint

Becoming more energy efficient is an important part of JD’s long-term sustainability plan. The company has built and installed a solar photovoltaic (PV) power generation system on the roof of its Shanghai Asia No. 1 logistics center. The system became operational in June 2018 and is one component of the company’s drive to reduce carbon emissions.

JD claims it has ambitious plans to scale up its reliance on solar power. By 2030, the company says it will create the world’s largest ecosystem of rooftop photovoltaic power by teaming up with global players. The goal is to create a photovoltaic power generation area of more than 200 million square meters (over 77 square miles).

On the transportation front, JD discloses what it says is the ongoing deployment of more than 5,000 “new energy” vehicles in several cities across China. This nationwide fleet refers to any vehicle that uses some form of renewable fuel or alternative power train, including all-electric, hybrid and hydrogen-powered vehicles. Examples run the gamut from electric vans, solar-powered tricycles and hydrogen-powered delivery trucks that emit only water. Within two years, the company’s entire nationwide fleet of direct-sale delivery trucks will be upgraded to these next-gen vehicles.

In June 2017, JD Logistics says it brought together industry peers to launch the Green Stream Initiative, a joint green supply chain campaign to improve resource utilization and reduce emissions. The company has launched a 1 billion RMB ($147 million) JD Logistics Green Fund to drive environmental innovation and promote more sustainable consumption.

As part of the initiative, JD used 100,000 recyclable “green boxes” to deliver goods in 2017. These boxes are reusable packing containers made from what JD describes as strong but lightweight thermoplastic resin. A company representative explained that this material allows the boxes to be re-used with greater frequency and efficiency, reducing overall paper usage as well as the company’s carbon footprint.

Empowering rural communities and youth

JD claims it has recruited 25,000 employees from the poorest counties, in addition to nearly 60,000 “village promoters” in rural areas. The company also stakes the claim on being the first e-commerce company to set up a platform selling products from rural regions across China. Over three million products sourced from rural areas are now offered online and have achieved sales volume of 20 billion RMB ($3 million), benefiting more than 300,000 people from 832 of China’s poorest counties. The company has also launched a program in tandem with L'Oréal that recruits prospective employees who have disabilities.

As explained by JD in an email exchange with TriplePundit, JD employees traveled around the country to numerous villages specifically and actively to recruit local workers using tactics such as job fairs. “By providing jobs in these rural areas, where opportunities are few and often revolve around subsistence agriculture, we have helped improve the lives of many and helped lift thousands of families out of poverty,” said a company spokesperson.

Across these rural areas, JD offers jobs in functions such as delivery distribution, warehousing and customer service. Broadly speaking, employees in these areas can earn an average of over 6,000 RMB ($900) monthly, or more than double their previous income, according to local statistics cited by JD. Furthermore, the company says these workers no longer need to migrate to urban areas to seek jobs, which generates more local economic growth in these areas and improves the quality of life for families who no longer need to be separated from each other for much of the year.

Meanwhile, online, JD has launched 188 local specialty malls on its platform, which the company insists benefit 90 percent of the poorest counties in China. These online shops source unique local items from poor areas and make them available for purchase to all of JD’s more than 300 million customers across the country, vastly expanding the market for these suppliers. The company cites that it has conducted more than 630 e-commerce training sessions, benefiting more than 100,000 people across China. To promote the startup culture for youth, JD has established 103 e-commerce incubators for young entrepreneurs.

JD Giving Platform

JD has built a user-friendly online donation platform to provide integrated support to various charities. Charities are able to use the platform not just to raise funds, but also to leverage the company’s extensive supply and distribution network, customer service and technical support to ensure the money reaches the intended recipients.

“Success is unsustainable if a company offers no additional value to the society,” said Richard Liu, founder and CEO of JD.com in his message to the stakeholders. “JD does this by creating an ecosystem in which every part of our footprint, from the creation of a product, to its packaging, sale and delivery, is executed with the expectation that our impact on society and the environment will always be positive,” he said.

Image credit: JD.com

Ben & Jerry’s Steps Up, Resists Single Use Plastics

Time to resist single use plastics, says Ben & Jerry's

Ben & Jerry’s has been a brand taking a stand long before corporate activism became a growing movement within the business community. Although the brand has been part of the Unilever family since the beginning of this century, activism is still part and parcel of the company’s mission – as in speaking out against various Trump White House’s policies and even naming a flavor “Resist” that helps fund four nonprofits. From having a supply chain that includes giving workers a second chance to going fair trade, Ben & Jerrys has long been a step ahead the rest of the competition.

Now the venerable ice cream brand is swimming against the single-use plastic tide. This week, the Vermont-based company announced that it is moving (or according to a press release, “mooooving”) away from single-use plastic at its retail locations.

This will be a difficult but impressive move for Ben & Jerry’s if it works out. The company says its shops pass out around 2.5 million plastic straws and a whopping 30 million plastic spoons a year. Line them up end to end, and all those single-use spoons would form a trail from Lake Champlain to Northern Florida.

Having a tidy recycling bin in each and every shop isn’t the solution, according to the company. “We’re not going to recycle our way of this problem,” said Jenna Evans, the company’s global sustainability manager in a public statement.

So how will Ben & Jerry’s scoop itself out of its mound of plastic waste? The company will include these three steps:

- Since last August, the company has made plastic straws available only by customers’ request, and Ben & Jerry’s says many of its stores have already shifted to alternatives such as paper straws. Paper straws will be available by request starting in early April.

- By April 9 (which by the way, is Ben & Jerry’s Free Cone Day), all spoons will be made out of wood. No word on what exactly that wood will be, and whether it will be from responsible or certified sources.

- By the end of next year, the company says it will settle on alternatives to its plastic-lined cups and plastic lids.

For those who indulge by purchasing Ben & Jerry’s pints at the supermarket, the company is also looking for a new packing solution. Ben & Jerry’s has been sourcing Forest Stewardship Council (FSC) certified paper for a decade, but those containers are difficult to keep out of landfill or the incinerator – a coating applied to the paper makes them difficult to either recycle or compost. Could a plant-based solution be on the horizon? The company says it is looking at alternatives for now.

Ben & Jerry’s announcement itself is not groundbreaking; the company acknowledges these steps are not enough to stop the flow of plastic into the globe’s oceans. Nevertheless, these changes send a signal to food companies: prove that you’re several paces ahead of consumer trends, or pretty soon, you’ll be left behind.

Image credit: Ben & Jerry’s

Loop Is Ready for Zero Waste: Are You?

Major consumer brands are banking that this new program can circle the "Loop."

The newswires have been buzzing about Loop, a startup that will introduce zero waste, reusable packaging into households in the U.S. and France, beginning this spring. The business model has the makings of success. The big question is whether or not individual consumers are ready to get with the program.

Zero waste? We can’t even manage tote bags!

The problem of consumer engagement with zero waste is especially acute in the U.S., which has long been hooked on single-use packaging. The plastic bag problem is a good example. Walk into any supermarket in the U.S., and it’s clear that Loop has its work cut out for it.

Almost nobody brings their own reusable shopping bags to pack their groceries. The checkout counters may be festooned with reusable bags for sale at a modest cost, yet almost nobody takes the opportunity to buy one.

Aside from customers who frequent Whole Foods and similar stores, many U.S. consumers can’t grasp the concept of voluntarily reusing a simple shopping bag, let alone anything else.

Nevertheless, the zero waste moment has arrived

All right, that’s enough of the bad news. The good news is that Loop may just have the right service at the right time.

China set the stage for Loop last year, by clamping down on its role as a global recycling center, leaving U.S. municipalities with tons of cans, bottles and plastic containers on their hands.

China’s action exposed an inconvenient truth about recycling. Recycling is an important part of a sustainable future, but it is only part of the solution.

Major global brands are already beginning to go to the next level. They are promoting reduced and reusable package, and that’s where one factor in Loop’s potential success comes in.

Loop already has two dozen major household brands in its partnership roster, including Tide, Crest, Dove, and of course, Gillette, along with several lesser known brands including Seventh Generation.

Another key is to success the adoption of online shopping by the general public. Consumers are primed for the convenience of home delivery.

The fact that delivery trucks are ubiquitous is also important, because it enables Loop to piggyback on UPS trucks to pick up empties as well as drop off deliveries.

The thin line between recycling to zero waste

A generation or two ago, children did not learn about recycling in school and many communities did not have recycling policies. Now recycling is mainstream, and that could be another key to Loop’s potential success.

In a video introducing itself, Loop demonstrates how zero waste fits conveniently — and attractively — into households that already recycle.

Look closely and you’ll spot a hybrid electric UPS truck in the background, too. As a partner in the zero waste endeavor, UPS designed the company’s compartmentalized, reusable delivery boxes.

Recycling is also where experience comes in. Loop is the brainchild of TerraCycle founder and CEO Tom Szaky. In an interview last year with Greener Package, Szaky explained that “TerraCycle’s business is all about figuring out how to eliminate the concept of waste.”

TerraCycle got its start recycling things that were not being recycled, from ball point pens to dirty diapers. That model has been a “phenomenal” success for the company. The next logical step was upcycling, including an ocean plastic category with Procter & Gamble that has already scaled into 30 countries.

Szaky sums up the main message:

“Knowing that people care about this sort of thing really motivates the team to keep doing the really challenging work.”

That may seem overly optimistic, considering the aforementioned issue of plastic bags.

Then again, cities in the USA are beginning to pass plastic bag ordinances, and the entire state of New Jersey is considering legislation that would ban single-use bags.

Zero waste really could be ready for its closeup.

Image credit: Lhttps://loopstore.com/oop

DOE Banks on Hydrogen Economy for Rust Belt Revival, Again

The DOE is banking that fuel cells can revive Michigan's economy for the long run

Where have we heard this before? Back in 2004 the U.S. Department of Energy (DOE) partnered with Detroit-based DTE Energy to create a $3 million R&D park aimed at making Michigan the epicenter of the sparkling renewable hydrogen economy of the future. Fourteen years later, that still hasn’t materialized. Nevertheless, earlier this month DOE announced a new iteration of the hydrogen effort, this time in partnership with the Michigan Economic Development Corporation.

So, could the second time be the charm?

When at first you don’t succeed . . .

The Michigan Economic Development Corporation expressed significant interest in fuel cell manufacturing as early as 2001, when it commissioned a report under the title, “Positioning the State of Michigan as a Leading Candidate for Fuel Cell and Alternative Powertrain Manufacturing.”

According to the report, the end of the internal combustion engine was in sight, and Michigan would have to replace thousands of manufacturing jobs with, well, something else.

The 2004 venture was actually quite ambitious for its day. Part of a $1.7 billion, five-year plan for hydrogen development under the George W. Bush administration, the project focused on renewable hydrogen.

The hydrogen would be produced by “splitting” plain tap water with an electrical current, a process called electrolysis. The electricity was to be provided by solar or wind power, and therein lies part of the problem: the wind and solar technology of 2004 was more expensive and less efficient than today’s next-generation wind turbines and photovoltaic cells.

Another problem was the electrolysis system. The water-splitting technology of 2004 was not ready for prime time, at least not in terms of commercial viability. Low cost, high-efficiency electrolyzers are only just now emerging within the commercial market.

In 2006 the University of Michigan analyzed the project and found that the facility was already in need of an upgrade. They reported that “the Park, with its current demonstration-stage technologies and costs, is not cost competitive in commercial hydrogen, utility-scale energy storage, or hydrogen vehicle markets.”

DTE was still pitching the R&D effort as a “working prototype” in 2010, but the facility was capable only of producing enough hydrogen for a “small office complex” and a handful of fuel cell vehicles.

DTE’s current website reflects the reality of the situation. While noting the benefits of fuel cells over internal combustion engines, DTE summarizes the technology as follows:

“ . . . fuel cells can power a variety of things, but are still being tested and have not been introduced to market in a large capacity . . . “

Try more and better hydrogen . . .

As disappointing as the Hydrogen Technology Park may be, it does illustrate the importance of maintaining foundational research programs over the long run.

Other public and private sector R&D efforts in the U.S. are beginning to bear fruit. In 2017, for example, GM and Honda announced a partnership to manufacture fuel cells for electric vehicles in Michigan, and other major auto manufacturers are including fuel cell electric vehicles in their lineups.

Fuel cell cars have yet to crack the mainstream U.S. market, but the demand for fuel cell forklifts and delivery trucks is surging.

With all this in mind, the new partnership with the Michigan Economic Development Corporation takes on new significance.

The agreement consists of a memorandum of understanding between MEDC and DOE’s Office of Fuel Cell Technologies Office, aimed at “collaboration on hydrogen and fuel cell research and development (R&D) with the state of Michigan to promote private investment and domestic job creation.”

The MOU provides Michigan stakeholders with access to DOE’s sprawling network of laboratories, with a focus on data collection and analysis.

The idea is to steer R&D efforts into more effective pathways for developing the nation’s hydrogen infrastructure and increasing the amount of hydrogen production.

Or should we say, make that renewable hydrogen!

Ramping up hydrogen production will be a tough nut to crack, without also ramping up greenhouse gas emissions. Currently, 95% of U.S. hydrogen is sourced from natural gas.

Nevertheless, the DOE has set a long-term goal of transitioning out of natural gas and into low or zero emission sources including biogas and solar power. Using waste heat from nuclear power plants is another zero-emission option.

In the solar field, one leading technology currently under consideration for large scale hydrogen production is thermochemical water splitting. The process involves exposing chemically altered water to high temperatures of up to 2,000°C. The heat drives reactions that produce hydrogen. The process is attractive because it can be scaled up by using concentrated solar systems to produce heat with zero emissions. The process also involves no emissions or byproducts, as the chemicals can be re-used in each cycle.

Image credit: DTE Energy