The Latest in Sustainability Communications Tactics Revealed

For those working in corporate responsibility, knowing when and how to announce news is critical. To that end, we talked to Bob Langert, who retired in 2016 following more than 30 years with McDonald’s, a tenure that included a role as the company's VP of CSR and sustainability.

In the spirit of CES in Las Vegas, the Detroit auto show and New York Fashion Week, sustainability communicators love to harness the energy of live events to announce big news.

For example, last fall at our 3BL Forum: Brands Taking Stands event, Smithfield Foods launched an ambitious manure-to-energy project to lower its emissions. The initiative scored strong pickup across the trade press and business media.

And last week during GreenBiz (held at Arizona State University, pictured above), sustainability communicators were hard at work, launching no fewer than four products, projects and partnerships:

- 3Degrees and Etsy unveiled a plan for the e-commerce company to offset 100 percent of its shipping emissions.

- SC Johnson revealed the company will produce the containers for its Windex Vinegar cleaning product with ocean plastics from Haiti, Indonesia and the Philippines.

- General Motors heralded a partnership with DTE Energy to source enough wind energy to power 100 percent of the electricity needs of GM’s global technical center in Warren, Michigan, and its Detroit-based operations at the Renaissance Center.

- Iron Mountain introduced a green data center program that allows colocation customers to report on their use of solar, wind and other renewable energy sources.

For those working in corporate responsibility and sustainability, knowing when and how to announce news is critical. Those who do the work, but don’t share their successes, may be squandering the goodwill the comes from employees, customers, investors and other key stakeholders receiving status updates.

One veteran practitioner, Bob Langert, retired in 2016 following more than 30 years with McDonald’s, where he was vice president of CSR and sustainability.

“No company’s really figured out the formula to do this. Everyone’s still afraid to toot their own horn,” Langert told TriplePundit in a recent video interview. “No company’s perfect. I think that the legal people run this thing too much because they want to minimize risk.”

“I do think the marketers and communicators have a great opportunity to leverage this (sustainability) part as part of the brand and reputation,” Langert continued. “If I had to start my career over, that might be an area that I’d spend more time on.”

In a new book, The Battle To Do Good: Inside McDonald’s Sustainability Journey, Langert details his communications strategies and offers an insider’s perspective on when to partner with foes rather than going to war. Watch the full interview here.

With partnerships under his belt including World Wildlife Fund for more responsible beef, Conservation International for sustainable fish and livestock behavior expert Temple Grandin for animal welfare, Langert’s perspective is valuable not only when it comes to how companies can accelerate corporate sustainability efforts, but nimbly communicate them as well.

Image credit: Arizona State University

ESG Engagement Wins More Boards' Buy-In, But Lags in U.S.

Boards are facing increasing pressure from stakeholders to engage on ESG challenges, but in the U.S., many corporate boards are still not getting the memo.

Boards are facing increasing pressure from stakeholders to engage on ESG (environmental, social and governance) challenges as a matter of long-term viability. But despite all this renewed focus, a new report finds that while 46 percent of boards globally discuss sustainability issues annually, North American boards of directors lag behind their counterparts in Europe and other regions in how often these issues land on the board agenda.

The Environmental Sustainability Governance Survey from the think tank Diligent Institute surveyed 447 respondents from directors, non-executive directions, executive directors and other c-suite executives across the globe. Diligent, which works with boards across 14,000 organizations in 90 countries, found that conversations and deliberations on sustainability in the boardroom will only increase: 43 percent of boards expect this discussion to occur quarterly, or even during every meeting.

Societal impact is also becoming more important than investor pressure and profit margins – 40 percent of corporate directors said societal impact was the top reason for prioritizing environmental sustainability. Only 9 percent of the directors who took the survey found that investor pressure was a key motivator.

This is surprising, given rising investor demand for companies to focus on ESG issues, as frequently reported on 3p. The number rises slightly (12 percent) for public company directors, but even then, it pales in comparison to all of the other priorities that drive board action on this topic, Diligent found. It is possible, according to Diligent, that investors are not applying as much real pressure in this area as much as the commentary would suggest.

Profit and societal impact: win-win

For Brian Stafford, CEO of Diligent, this is actually an encouraging sign.

“It doesn’t have to be profit or societal impact; it can actually be both. It was refreshing to see that more than 40 percent of board members see societal impact as the top reason to prioritize these issues,” Stafford told TriplePundit. “What investors focus on might differ one year to the next. I think there’s comfort to be had in the number of board members who will make decisions based on what is good for society.”

Certainly, some investors are applying real pressure to companies on sustainability issues, as 3p reported last week with Arjuna Capital’s move to pressure top tech companies and banks to reveal their gender pay gaps.

Shareholders raise a big stick

Leslie Hosking, who spent fifteen years as a director and seven years as the chair of Australia’s largest cement manufacturing company, Adelaide Brighton, and ten years as an independent director at AGL Energy Limited, an Australian public electric and gas company, said in the survey that he has noticed investors “using a big stick to force environmental change” in Australia.

He noted “proxy advisory focus on environmental issues has been heightened in Australia, and our superannuation fund managers are very much focusing on ESG to the extent that they’re contemplating voting against reappointment or remuneration at the AGM if the company doesn’t perform well in ESG.”

U.S. boards are lagging behind

Pressure on boards, from investors or other stakeholders, or simply the board’s own recognition of the importance of environmental sustainability, isn’t evenly distributed across regions. The survey concluded that boards in North America lag behind those in Australia and New Zealand and Europe. For example, only 29 percent of U.S. boards formally oversee environmental and sustainability issues, compared to 55 percent globally, and 65 percent of U.S. boards had no established policies or practices around those issues, compared to 39 percent globally. Only one in four boards globally has a formal mandate for these issues (and that ratio drops to 11 percent in the U.S.).

“Europe in general could be viewed as slightly further ahead the U.S. in governance generally and in ESG specifically,” Stafford told TriplePundit. “In Europe, we see, for instance, more quotas on the representation of women at board level, and larger pension funds, as in Norway or Sweden, which are huge proponents of sustainability.”

Stafford believes that U.S. boards will catch up “as long as they think about being stewards of their business for the next fifteen to twenty years.”

Movement towards long-termism

He noted a movement away from quarterly guidance towards the long-termism that sustainability requires. Here again, Europe, has been ahead, with one example being Unilever’s former CEO Paul Polman abandoning quarterly reporting in 2009, as 3p reported. In 2017, close to 40 percent of FTSE 100 companies in the United Kingdom reported no longer issuing quarterly reports to shareholders.

While he noted room for improvement, Stafford said, “We’re excited that forty percent of boards are focused on sustainability and ESG and not just because investors are asking about it but because they think it is essential for a company to have a positive societal impact. My takeaway is that there is good momentum in the boardroom, better than I might have thought, to push some of the ESG issues that investors are interested in.”

Power to influence change

Certainly, boards hold a lot of power to influence the winds of change. Fortune 500 boards oversee companies that together account for two-thirds of the U.S. GDP, with $12.8 trillion in revenues, $1.0 trillion in profits, $21.6 trillion in market value and 28.2 million employees worldwide.

And while Diligent’s survey might not have found boards acknowledging the investor pressure, it’s there. BlackRock Inc., the world’s largest asset manager overseeing $5.1 trillion, told portfolio companies in the energy and real estate sectors in 2017 that it expects a company's "board to have demonstrable fluency in how climate risk affects the business" if these organizations want to count on BlackRock’s continued investment.

Image credit: Pixabay

ConocoPhillips Seeks Natural Gas Lifeline for ‘Energy Transition’

This global energy giant earned itself a unique distinction when it released a new report on climate risk management, but a closer reading suggests that despite all the mentions of "climate," it's just business as usual.

ConocoPhillips earned itself a unique distinction last week when it released a new report on climate risk management. It is the first such report for the company. More importantly, the new report sets ConocoPhillips apart from other major U.S. players in the fossil oil and natural gas industry, for its specificity and high level of detail.

The new report marks a significant step forward in terms of corporate transparency about the specific, physical risks of extreme weather and other climate-related impacts. In that regard, it is a significant document that provides a clear, unambiguous counterbalance to lobbying organizations that continue to muddy the waters on climate science.

However, taken as a whole the new report does not suggest a significant behavior change on the part of ConocoPhllips. If anything, it appears that the company is digging in its heels.

ConocoPhllips and natural gas

The new report is titled, “Managing Climate-Related Risks: Building a resilient strategy for the energy transition.”

That sounds like a bold endorsement of renewable energy, but that depends on what ConocoPhillips means by “energy transition.” The phrase as commonly understood means the transition out of fossil fuels and into renewable resources. A quick read between the lines, though, suggests that the plan is to focus on cutting costs and innovating in the natural gas area while letting others manage the transition to renewables.

The focus on natural gas comes through at the beginning of the report, where ConocoPhillips explains that the International Energy Agency has developed several scenarios outlining mixed results for oil. Depending on which scenario you pick, oil demand could grow relative to 2016, or it could shrink.

Natural gas is a different story. ConocoPhillips draws a contrast with the EIA oil scenarios, stating that “natural gas demand increases by year 2040 across all the IEA scenarios.”

That natural gas growth opportunity doesn’t leave much wiggle room for diversifying into renewable energy.

What ‘transition’?

The company’s website reinforces its singular focus on fossil oil and natural gas resources. The “About Us” page, for example, leads off with this definitive summary:

“ConocoPhillips is committed to the efficient and effective exploration and production of oil and natural gas.”

The company’s recent acquisitions also indicate a focus on managing natural gas assets to force costs down.

Last April, for example, ConocoPhillips touched off some head-scratching when it sold some of its natural gas and oil assets in the legendary Permian Basin in Texas.

However, Forbes was among those recognizing the method behind the madness:

"Far from leaving the Permian, the company is actually high-grading its asset base there, and using the proceeds from the sales to acquire acreage in other producing areas.”

Specifically, according to Forbes the new acquisitions included a “liquids-rich natural gas play in Alberta and British Columbia called the Montney Field,” adding a significant new area of 35,000 acres to its existing leasehold of 105,000 acres.

ConocoPhillips also gobbled up 245,000 new acres at bargain-basement prices in another liquids-rich formation, the Austin Chalk formation in Louisiana.

The limits of climate risk reporting

Virtually no oil and natural gas companies have announced specific greenhouse gas targets, so it’s no surprise that the new ConocoPhillis report leaves that part out in the new risk report.

That’s consistent with the company’s annual Financial Report, released on February 19 under along with its annual 10-K report submitted to the U.S. Securities and Exchange Commission.

The Union of Concerned Scientists picked apart the 10-K and gave credit to Conoco Phillips for acknowledging the “growing number of climate damages lawsuits” filed over the past two years. However, UCS also noted that the report mentions “climate” almost 30 times without describing how the company plans to reduce its climate-changing emissions.

The company’s new Managing Climate Risks report received similar treatment from UCS. In an email statement last week, the organization provided this mixed review:

“…it described specific climate-related risks to its business and outlined short-, medium- and long-term tactics to address those risks. However, like other major fossil fuel companies, ConocoPhillips has not demonstrated a level of ambition sufficient to prevent the worst effects of climate change.”

Natural gas and behavior change

Shareholder pressure is gradually forcing oil and natural gas stakeholders like ConocoPhillips to acknowledge the science behind climate change and modify their behavior according to facts.

In that light, it may seem counterproductive for ConocoPhillips to stick so closely to its fossil fuel guns while other oil and natural gas producers stake their claims on a low carbon future that includes wind energy, solar energy, and related technology including electric vehicles and distributed energy.

Even ExxonMobil — a company notorious for its central role in sowing doubt about climate science — is dabbling in renewable energy.

Another interesting example is BP, the company behind the 2010 Deepwater Horizon offshore oil disaster. The company launched its ambitious “Beyond Petroleum” energy transition initiative in 2000, only to see it wither away in a few years. Last year the company dived back into the renewable energy market with a $200 million acquisition of solar leader LightSource.

Another factor working against ConocoPhillips is the falling cost of renewables. Here in the U.S., wind and solar are beginning to compete for power generation with natural gas. In addition, the building electrification trend is picking up steam and cutting into the market for natural gas used in heating, cooling and other building-related applications.

A global movement to reduce dependency on plastic could also eat into the natural gas market.

On the other hand, if the ConocoPhillips can deliver on its low-cost strategy, it has little incentive to diversify.

In fact, that strategy puts the company in a good position to grab a larger share of a shrinking natural gas market. Add a dose of carbon capture to the mix, and ConocoPhillips could ride its natural gas business for many years to come.

Unless, of course, shareholder pressure begins to account for risk factors other than climate change, including natural gas pipeline risks, local opposition to new pipelines, and the growing body of evidence demonstrating that natural gas operations pose significant risks to public health.

Image credit: Jerry Huddleston/Flickr

Sustainability Branding Can Help with the Shift to a Low-Carbon Economy

Evidence is growing that knowledge of a company's broader brand sustainability strategy can have a measurable impact on consumer choice.

The jury is still out on whether or not consumers choose products based on those little eco-labels on the package. Nevertheless, a new report from CDP suggests that businesses can get a jump on the competition by highlighting greenhouse gas reductions as part of their broader sustainable supply chain strategy.

Consumers and supply chain sustainability

Some studies suggest that sustainability package labeling is not registering with consumers.

However, evidence is growing that a broader brand sustainability strategy can have a measurable impact on consumer choice.

In an interview with Forbes last year, Michael Mapes, CEO of the leading aluminum can manufacturer EXAL Corporation, provided some evidence that at least one important consumer demographic is in fact paying attention to sustainability labeling:

“Sustainability really, really matters to consumers. 51% of millennial consumers state that they check product labels for sustainability claims before buying a product.”

Mapes also outlined the broader trend:

“Furthermore, the data supports that not only are consumers looking for sustainability claims, they are also voting with their wallets. Sustainable products grew at four times the rate of products without a commitment to sustainability.”

And, he underscored studies showing that brands can attract savvy consumers even when their sustainability strategy leads to higher costs:

“55% of consumers are willing to pay 15% more for sustainable packaging, and Nielsen reports that 66% of all consumers are willing to pay more for sustainable brands.”

His conclusion was definitive: “Consumers are inspecting product labels for sustainability claims and supporting the brands that are sustainability focused–even if it costs them more.”

The power of supply chain sustainability

CDP is a global leader in environmental disclosure and reporting for companies, cities, states and regions. Its network of investors and purchasers accounts for more than $100 trillion.

The organization advocates for supply chain transparency by recognizing companies that push their suppliers to adopt more sustainable practices.

Over the past ten years CDP has included more than 120 “Supplier Engagement” leaders on its roster, including Alphabet, Honda and Samsung.

The new CDP report is titled Cascading Commitments: Driving upstream action through supply chain engagement. It charts the organization’s progress over the past 10 years, and it outlines how brands and other organizations create an impact by emphasizing sustainability in their supply chains.

One measure of progress is the number of leading companies and organizations requesting environmental reporting from their suppliers. When CDP began its supplier engagement effort 10 years ago, only 14 organizations were on its list. As of last year, there were 115.

Together, these 115 companies engaged more than 5,500 of their leading suppliers in environmental reporting.

The new CDP report is based on data culled from this group of suppliers.

Overall, CDP found that leading purchasers now consider sustainability to be a “major factor” in purchasing.

Ten years ago, only 4 percent of the purchasers CDP surveyed were settling on suppliers based on environmental performance. As of last year, that number climbed to 73 percent.

In a press statement, Sonya Bhonsle, Global Head of Supply Chain at CDP, explained:

“We have seen a fundamental shift in expectations around business action on sustainability. Leading purchasers are using disclosure to push positive change down the supply chain, with data playing an increasingly important role in their decision-making.”

Supply chain sustainability and the energy transition

The CDP report makes a clear connection between supply chain engagement and greenhouse gas emissions.

As of last year, suppliers among the companies surveyed reported that they reduced their annual emissions by a total of 633 metric tons of carbon dioxide and achieved an estimated cost savings of $19.3 billion.

Bhonsle notes, however, that that there is plenty of room for improvement:

“With only 57% of suppliers reporting emissions reductions activities, and less than half (47%) with emissions reduction targets in place, the transformation in their customers’ expectations means that those suppliers failing to act sustainably may increasingly see it impact their bottom line.”

The water-energy nexus and plastic, too

Awareness of the connection between energy consumption and water resources has been building, and the CDP report provides some interesting insights in that regard.

According to the report, less than 50 percent of companies in the survey reported “board-level” oversight on water issues, compared to 69% for climate issues.

That finding is concerning, and it suggests that brands are missing opportunities to reduce greenhouse gas emissions through water resource management.

When brands to begin to pay more attention to water resources and the water-energy nexus, the repercussions for fossil fuel stakeholders could be considerable.

In particular, major oil and gas companies are already facing enormous shareholder pressure to report their greenhouse gas emissions and set targets for reduction.

The water-energy nexus adds more fuel to the fire. Here in the U.S., for example, a recent study links oil and gas fracking to unsustainable water use.

As the supply chain engagement movement grows to focus more attention on water resources, oil and gas companies will face more pressure from major purchasers as well as shareholders.

Finally, major purchasers are already on a collision course with oil and gas companies now that renewable energy is competitive.

ExxonMobil and other companies have been betting on petrochemicals as a growth area, but the CDP report suggests that any relief there will be temporary at best, as leading purchasers reduce their use of plastics.

Image credit: Joshua Rawson-Harris/Unsplash

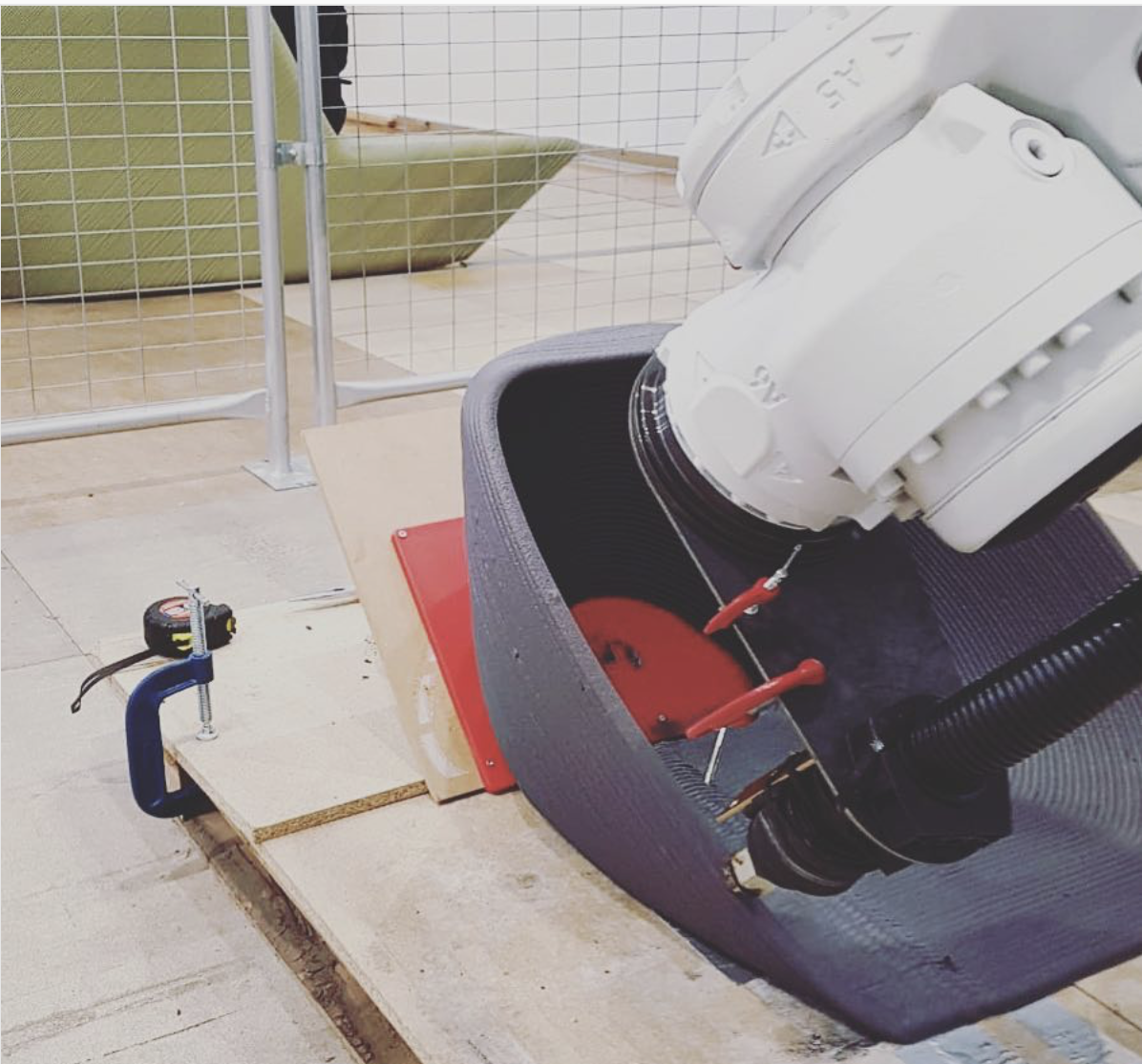

Zero Waste Lab Set Up by Coca-Cola and New Raw Studio

Coca-Cola, the world’s biggest soft drinks group, has partnered with a small environmental business to establish a plastic waste recycling hub.

Architects Panos Sakkas and Foteini Setaki began the New Raw studio in Rotterdam in the Netherlands to salvage and make use of discarded plastic.

The company’s Print Your City enterprise ground up plastic waste and converted it into functional street furniture with a large-scale 3D printer.

The New Raw founders said: “Plastic has a design failure. It is designed to last for ever, but often we use it once and then throw it away. With Print Your City we endeavor to show a better way of using plastic in long-lasting and high-value applications.”

New Raw and Coca-Cola set up the Zero Waste Lab in the Greek port city of Thessaloniki as an education center. Local people are able to learn about plastic recycling, deliver waste plastic and design furniture for their neighbourhoods.

When the center was opened New Raw announced: “Citizens can shape the designs and uses of each unique object according to their needs.

“They can choose which public space will house their piece, as well as the shape, color and specific integrated functions that will promote a healthy and environment-friendly lifestyle in the city. Each object can feature a bike rack or a vaulting horse, a tree pot or even a dog feeding bowl or a bookcase.

“What’s more, the geometries are based on ergonomic curvatures that accommodate a relaxed body posture.”

To date more than 3,000 designs have been submitted by locals and the first pieces of furniture are about to be installed in Hanth Park in Thessaloniki.

The Zero Waste Lab will run until May, by which time New Raw hopes to have recycled four tons of plastic waste.

The Swiss-based multinational Nestlé is phasing out plastic straws and hard plastics as part of its objective to use only recyclable and reusable materials by 2025.

In February Nestlé, the world’s second largest food and drinks group, will replace plastic straws with alternatives, including paper items, and will shortly introduce new packaging designs to reduce littering. Products including Nesquik and Smarties will become plastic-free in 2019 and the Milo powdered drink will be in paper-based pouches by 2020.

Some of the innovations result from the Institute of Packaging Sciences that Nestlé founded in 2018. Future ventures include a campaign to prevent plastic leaking into the oceans in south-east Asia, in which Nestlé will join forces with Project STOP, a €4m ($4.52m, £3.64m) initiative from the Austrian polyethylene and polypropylene manufacturer to promote sustainable and low-cost waste systems.

Big Money Joins the Fight Against Food Waste

Companies dedicated to solving food waste secured $125 million in venture capital in 2018. We take a closer look at some of the companies attracting investor attention right now—and break down what their ideas could mean for the future.

Venture capitalists and large-scale investors are warming up to the business opportunities in reducing food waste. Throwing out food is similar to flushing money, and food waste adds up to a $1 trillion annual drain on the global economy, according to the U.N. Food and Agriculture Organization. The losses from food waste extend beyond the costs of production when considering the 800 million people who go hungry every day around the world.

Viable solutions that simultaneously solve these financial and socioeconomic issues have perked the interest of big-money investors. Companies dedicated to solving food waste secured $125 million in venture capital in 2018, according to a recent report from ReFED, a nonprofit that leverages data to reduce global food waste. Let’s take a closer look at some of the companies attracting investor attention right now—and break down what their ideas could mean for the future.

Companies tap tech to tackle food waste in the home

Food waste occurs at all levels of the value chain, but most of it happens in household trash cans. Households contribute 43 percent to total food waste in the U.S., and the average four-person family spends $1,500 on wasted food each year. This is an open door for businesses looking to help individuals reduce their food waste.

Smart fridges provide several solutions: Models from the likes of Samsung and LG have the capability to send expiration date notifications, create grocery lists, and provide views of their contents on mobile phones. Some of the newest models can even create recipes based around food that is about to expire.

While smart fridges may help to reduce waste, their high price tags restrict who can buy them. Prices exceed $2,000, at least double the price of a conventional refrigerator. Families confronted with this purchase decision likely consider whether waste savings will offset the price difference—and for many, smart fridges are out of budget.

An alternative exists in FridgeCam, a product sold by the U.K.-based company Smarter. It is far less expensive at about $196 and can be easily installed on any refrigerator. It has mixed reviews, though, drawing many complaints on its finicky camera. Users must individually tag the contents of their fridge and strategically place items to be recognized by the camera. The technology is simply not smart enough yet to make FridgeCam a convenient solution for most users.

Are last year’s venture capital investments a harbinger of future tech improvements? The jury is still out, but there are plenty of players in the game vying to make tech-driven solutions to food waste a reality at scale.

A big opportunity in grocery stores

Other businesses are focused on reducing waste further up the supply chain. Grocery stores likely present the greatest opportunity to cut waste. Food waste in grocery stores is associated with multiple costs, including lost sales and disposal fees—creating a bottom-line incentive for companies to take action, infers Deena Shanker of Bloomberg.

Walmart, the world’s largest retailer, has taken the approach of reducing prices on produce with upcoming expiration dates. Anything that is left unsold is donated to food banks. The company is also prolonging product freshness by cutting the time it takes for produce like strawberries to travel from suppliers to its stores, Bloomberg reported.

Walmart’s size gives the company high bargaining power with its suppliers, a strategy that may not be an option for smaller grocery stores. Still, the Internet of things may help other large grocery stores mimic Walmart’s model. Installing sensors on product pallets can help suppliers predict freshness and make necessary adjustments. For example, a sensor can detect unfavorable temperature changes and alert the supplier before quality has been affected. Additionally, large suppliers can coordinate product expiration dates with their destinations. If a pallet of berries has been detected to expire soon, for example, the supplier can reroute the shipment to a closer destination.

The bottom line

The influx of capital into these business opportunities shines optimism on food waste issues, but it still remains to be seen if tech businesses can keep up with the challenge. If 2018 venture capital investments foreshadow future cash flows, we can expect to see significant growth in this industry coming soon.

Image credits: Artur Rutkowski and Annie Spratt via Unsplash

Why Are Americans Skeptical of Genetic Modification?

Americans are probably more familiar with genetically modified crops and foods than they realize, yet biotech companies have a long road ahead to overcome consumers' skepticism of this technology.

Americans are probably more familiar with genetically modified (GM) crops and foods than most realize. In fact, 60-70 percent of processed grocery store products contain some GM (also referred to as GMO or "GMOs") ingredients. Concerns about the safety of GM crops and foods have been festering for more than two decades. All the while scientific testing has been occurring and more supply chains in food production have begun to include GM crops.

Yield10 Bioscience, an agricultural technology company, is looking to introduce gene edited corn into the GM mix with claims that the crop is safe and good for the environment. Corn is the highest value commercial row crop grown in the United States. Optimizing crop yield is beneficial as this can reduce water and chemical use and produce hardier crops.

A crop is classified as genetically modified when its genetic makeup or genome has been tweaked using biotechnology. A lot of testing takes place to determine if a GM organism is safe for the environment and consumption. There are many ways crops and foods can be genetically modified, too.

The many sustainable approaches for altering the genome

Conventional breeding practices result in a wide range of crop varieties available today for purchase in grocery stores. Apples, including varietals such as Fuji, Honeycrisp and Red Delicious, are one example where particular seeds are bred together to create differences in taste, texture, size and color. The different varieties are the result of significant changes to the original genetic makeup of the fruit. This style of conventional breeding is called selective breeding, and it involves genetic mutation.

There’s also mutagenesis, a process by which the genetic information of an organism is changed, resulting in a mutation. This may occur naturally and spontaneously, or as a result of exposure to mutagens. Ruby Red grapefruits can be sold in the organic foods section, yet have also been called “frankenfruit” because this variety of grapefruit is the result of mutagenesis where scientists spent years testing blasting grapefruit with gamma radiation. Despite the extent of change caused by a mutation, mutagenesis is not classified as genetic engineering.

The most controversial approach for altering the genome is transgenic alteration. A GMO is transgenic when it contains a gene from a different species. In the article, “Are GMOs Safe?” by Michigan State University’s AgBioResearch department, professor Felicia Wu explains:

“Anytime you introduce a novel gene into an organism, you allow it to encode for a new protein. Proteins are rarely toxic and they are rarely carcinogenic, but they can be allergenic. Everything to which we’re allergic in our food or our environment is a protein. So a real concern when these GMOs first came out was that we were introducing new potential allergens into the food supply.”

Under Yield10’s corn development program, novel traits discovered by the company will be deployed in corn by a third-party agriculture company with proven biotechnology expertise. This portion of the development activity is expected to be completed in early 2020. Yield10 also has plans to engage another third-party company to conduct field testing of the corn to evaluate seed yield impact.

The yield traits included in the corn development program are C3003, C3004 and C3011, as well as the transcription factors C4001, C4002 and C4003. C3003, a gene found in algae, has produced encouraging improvements in seed yield in oilseed crops. The trait C3004 will also be evaluated in corn, based on encouraging seed yield results obtained in Camelina. C3011 is a new trait developed in Yield10’s GRAIN gene discovery platform. Yield10 has reported that the C4000 series of traits, which include global regulatory genes, or global transcription factors (“GTFs”), can significantly increase photosynthesis and biomass yield in studies utilizing switchgrass as a model crop.

How To Lessen Consumer Anxieties Surrounding Transgenic Crops

Roundup-Ready crops are involved transgenic alteration; and, in the sustainability sector and for many consumers, this does not bring forth feelings of comfort. Roundup-Ready “terminator genes” were developed to help farmers control weeds. The active ingredient in Roundup is glyphosate. Glyphosate is a non-selective herbicide, which means it will likely kill most plants. It prevents plants from making certain proteins needed for growth. Roundup-Ready crops are resistant to Roundup. As controversy over Roundup causing cancer heightens, it is no wonder why biotechnology is highly scrutinized.

Biotechnology has rapidly evolved over the two decades. Altering genes creates a lot of controversy and anxiety. However, it should be emphasized that GM crops are produced under rigorous regulatory frameworks and extensively safety tested prior to commercialization. As with Yield10’s development program for its transgenic corn, companies that make transparent the biotechnology techniques in use are far more likely to gain the trust of consumers.

Image credit: Unsplash/Kimmy Williams

The Sustainability Solution for the Travel Industry: Self-Cleaning Hotel Rooms!

The global travel industry, notably the hotel and hospitality sector, has long struggled with sustainability. A Danish company says its coating technology could help reduce hotels' consumption of water and cleaners.

The global travel industry, notably the hotel and hospitality sector, has long been struggling with sustainability.

This is not necessarily the industry’s fault. Hotels, resorts and conference centers face this fundamental challenge: whether we travel for business or pleasure, we often choose to act differently on the road than we do at home.

Sure, there have been ideas, and a cottage industry of advisors that has emerged over the years. We know about that card asking you not to have your towels or sheets changed (we know how well that works). Waterless or almost-waterless washing machines to get those linens clean deserve mention. Of course, some chains have pushed investments in renewables. Tackling the bottled water question also makes the list. The blue recycling bin in the room appears from time to time. There’s progress being made – but there is still a long road ahead as hotels sort out how to mitigate all that consumption of water, solvents and energy.

But what if hotels had self-cleaning rooms?

No, this isn’t a scenario inspired by The Hangover trilogy (nothing could have helped that sad hotel room the morning after). The Danish manufacturer ACT.Global says it has developed a proprietary coating technology that at first glance, seems almost too good to be true. This coating’s benefits come across as assuring even the most strident germaphobe: the company says it protects against microbes, cigarette smoke, allergens, and stains. The results that ACT.Global tout include better indoor air quality; reduced use of water, chemicals and detergents; and improved hygiene.

But before you cup your ear and ask, “tell me more!” let’s return back to earth. The cost, for now, is not cheap: a company representative recently told Bloomberg that using this “CleanCoat” technology costs about $2,500 per room. It may be a while until your favorite Fairfield Inn or Holiday Inn Express locations showcase this feature.

Of course, the argument goes this technology can generate long-term savings. For hotel managers, this means no cleaning products accidentally spilling and ruining carpets, reduced utility bills and even lower labor costs. Now your room’s cleaning crew can concentrate on sweeping up those airplane pretzel crumbs you saved from your flight, replacing the toiletries you hoovered two minutes after walking in the room or finding the TV remote you mistakenly left in the shower. Economies of scale could eventually kick in as more companies see the value in ACT.Global's innovation.

For now, you can find, or should we say, experience this coating wonder at the Hotel Herman K in Copenhagen. Visitors, however, may be less excited about CleanCoat than what this hotel's “industrial luxury” rooms offer – a fabulous all-inclusive minibar!

No wonder why management thought it was a good idea to have this coating applied anywhere possible.

Image credit: Hotel Herman K

Older Workers, America’s Most Undervalued Asset

Older workers should be a valued resource that too often fall under the radar; yet they also comprise a large part of our entrepreneurial culture.

There’s constant talk about millennials and the value they offer companies – as well as chatter about the risks these same businesses could face in the U.S. if they do not effectively recruit and retain this rapidly growing demographic of workers. Plenty of this discussion has occurred here on TriplePundit, as our writers and guest commentators have been reminding readers about how this generation of workers generally seeks work-life balance, a job with purpose and a working environment in which they are assured their employers are giving back.

As corporations step over each other in the stampede to show they are millennial-friendly, while conference stages are packed with speakers declaring that millennials are the future (last I checked, every current generation in history eventually became the future), there’s a demographic that is overlooked, under-appreciated and too quickly dismissed.

Older workers are also a valued resource that too often are falling under the radar.

The definition of “older” runs the gamut. Plenty of workers in their late-30s have felt shunned as our culture glamorizes youth at the expense of wisdom; we’ve all seen those corny “Over the Hill” napkins at a 40th birthday party; and then there are gasps when the 100-year-old works on his or her birthday, as Millie Feasel of Columbus Ohio did recently at a hardware store at which she has been an employee for almost 60 years.

Bias, discrimination and dismissal directed at mature workers has much to do with how older people are portrayed in popular culture and in our everyday vernacular. But our assumptions about older generations often overlook what a vibrant part of the economy these people hold – and if valued, will contribute even more to the business community and society.

For example, we often associate entrepreneurs with youth – images of Mark Zuckerberg in a hoodie or Elizabeth Holmes (ahem) in a Steve Jobs-ish black turtleneck, not someone with silver hair in pinstripes (or vintage OP shorts), can account for part of this bias. But again, that snapshot of entrepreneurship in our brains obfuscates a simple fact: one-quarter of entrepreneurs are in that 55-64 age bracket, according to ongoing research by the Ewing Marion Kauffman Foundation.

What can account for these numbers? To start, look at the economic fluctuations these workers have endured.

When millennials insist on gaining work-life balance the way in which they perceive older workers have already achieved, that wish is a misfire for a very important reason: many within the over-50 crowd have not yet reached that point, either. The boom and bust cycle of the past 40 years has forced many Americans to create their own payrolls rather than count on being part of one.

Older workers, many of whom are still working when we are quick to assume they have neared retirement age, still remember the recession of the early 1980s, as plenty of them witnessed their young careers derailed while unemployment reached double digits. The good times eventually rolled on through the 1980s, but then recession hit a decade later as the U.S. tackled its mounting national debt. Leapfrog another decade, and we had the double whammy of portfolios hit by the circa 2000 dot-com crash and then the economic hit after 9/11. And we all remember the fiscal crisis of a 2008-2009.

Therein lies another trigger for this rise in entrepreneurship for older Gen X and younger baby boomers; many had to forge their own career path as companies were increasingly reticent to hire them. Being laid off at age 30 is a temporary setback. At 40, it presents a massive challenge. When we hit 50, such an event means it is time to think out new ideas, as knocks on company doors will go largely unanswered. A pink slip at 60 can be catastrophic, as that worker is too young for Medicare or Social Security and a resume won’t even cross a human resources manager’s desk.

I’ll add another reason why older entrepreneurs are coming into their own.

As a former colleague recently reminded me, “Quite frankly, there’s no substitute for experience.”

If America’s companies truly want to show that they are leading on diversity and employee engagement, they would be more than wise to instruct their HR departments to remember those words and view those pre-2000 dates on a resume as not liabilities, but as valuable assets.

As Chris Farrell recently shared on Fast Company, “America has passed a significant inflection point when it comes to experienced workers and mature entrepreneurs creating a more welcoming economy and labor market. Experienced workers are no longer obsolete.”

Image credit: Pixabay/Rawpixel

Costco, the E-Commerce CSR Leader?

Costco is emerging as a CSR leader in the e-commerce sector; the fact its employees are treated well and as a result, feel happier, is part of the reason why.

An annual survey just released by the American Customer Satisfaction Index made some waves in the e-commerce world. Despite jumping relatively late into the online e-commerce circus ring, Costco narrowly edged out Amazon to take the crown as the “most satisfying online retailer.” The warehouse retailer made quite a debut indeed, as this is the first time Costco has ever been included in these rankings.

Retail experts could attribute this to countless factors: Costco’s Kirkland-branded products, from dress shirts to coconut oil, have established themselves with their low cost and high quality; the company has launched what is generally a well-regarded online grocery delivery service; and as anyone who has come across a harried delivery worker can testify, occasionally that Amazon package has endured quite the rough journey.

But there could also be another factor at play: maybe those Costco employees are just treated well and as a result, feel happier.

The debate over Amazon’s treatment of its warehouse and delivery workers has long festered online: some of this conversation has appeared here on TriplePundit. The counter argument, naturally, is that Amazon is creating jobs in areas where finding gainful employment can be a painful slog, from California’s Central Valley to southwestern Ohio.

Several years ago, I wrote an article that described Costco as a corporate social responsibility (CSR) leader in the retail sector. From my point of view, if one wants to start “sustainable,” we should start with people. As I wrote in 2012:

“Employees working on the floor can make a salary that reaches the mid-$40,000 range; not bad for someone who starts working for the company out of high school. And while the vast majority of Costco’s employees are not unionized (most of those are legacy employees from Price Club that the Teamsters represent), over 80 percent have competitively priced health insurance plans. The outcome includes more productive workers, lower turnover and for what it’s worth, relatively high job satisfaction.”

Almost seven years later, the general assessment of the benefits of working at a Costco warehouse have not changed much: competitive healthcare benefits, a 401K plan, paid lunch and rest breaks and perhaps most importantly to employees, growth potential, according to a 2018 Business Insider article.

Apply those same perks to someone driving a delivery truck for Costco, and the deal is relatively sweet as well. According to Glassdoor, average pay working as a Costco driver is in the low $60K range – compare that to the average salary for all truck drivers, which is approximately $43,500. Even for pay promised at $80,000, nowadays this truck driving of any distance involves a job few want to do. In fairness, Costco delivery drivers are not driving the lonely, long-haul routes that make this job physically exhausting and one constantly isolating. Nevertheless, the fact Costco has long has a reputation for low employee turnover speaks volumes.

Meanwhile, treating employees well does not mean Costco’s financial performance is lagging. While its stock price tumbled along with the rest of the market in late 2019, this year it has been on the rebound. Costco wins plaudits time and again for treating both floor workers and shareholders more than decently. If you believe in social sustainability and insist all workers should have the chance to earn a decent wage and be rewarded for hard work, face it: shopping at Costco is a compelling choice for some consumers to make.

Image credit: Tony Webster/Flickr