The Next 100 Days Will Be Crucial for Securing Climate Resilience

This second article on climate resilience policies within the Biden administration was written with Laurie Schoeman.

Last week, we discussed how President Biden’s first 100 days in office has helped us as a country reset and ensure that the 2020s will be known as the resilience decade. So far, the very early scorecard on climate change risk disclosures and the financial markets is one that rates favorably. But the next 100 days will be crucial as we anticipate what the Biden White House can achieve to bolster climate resilience across the U.S.

The Biden administration’s American Jobs plan proposes to stimulate the U.S. economy by creating jobs; capitalizing infrastructure, housing and services; and investing in education and training of millions of Americans in dozens of industries.

It’s an ambitious range of policies: $213 billion in support of housing; $621 billion in transportation infrastructure; $50 billion to improve infrastructure resilience through additions to FEMA’s Building Resilient Infrastructure and Communities (BRIC) program and U.S. Department of Housing and Urban Development’s Community Development Block Grant (CDBG) program; $111 billion for water infrastructure improvements; and $100 billion to improve the nation’s electric grid and investment in clean energy.

Linking equity and climate resilience

A slate of executive orders from President Biden signal a vision and drive to build social equity. The executive order focused on tackling the climate crisis creates an environmental justice council and sets a goal to deliver 40 percent of climate investment benefits to disadvantaged communities, referred to as Justice40.

Another executive order on advancing racial equity and support for underserved communities prioritizes a “comprehensive approach to advancing equity for all, including people of color and others who have been historically underserved, marginalized, and adversely affected by persistent poverty and inequality” in federal government programs. These executive orders will need to be turned into active programs so that they have permanency and longevity moving forward.

The administration’s removal of "onerous restrictions" that have been preventing full deployment of more than $8 billion dollars in congressionally approved Hurricane Maria recovery funding to Puerto Rico unlocks funding dedicated almost four years ago to help Puerto Rico recover and build protection from future storms.

The president’s ”30 by 30” U.S. lands and oceans climate goal envisions teaming with various state, local, tribal, and territorial governments’ agricultural and forest landowners; the fishing industry; and other key stakeholders” to protect 30 percent of U.S. lands and ocean territories by 2030.

A focus on environmental justice is a must

The American Rescue Plan bill includes $100 million for environmental justice grants – a step in the right direction to address disproportionate climate risks to vulnerable populations and, hopefully, not too little, too late. The bill recognizes the nation’s strength depends on American households having access to fundamental services and on states and cities possessing funding to support critical functions and maintain a dynamic public transportation network.

Exemplifying an early impact of these executive orders is the Transportation Department’s Infrastructure for Rebuilding America program. For the first time, it will support projects aimed specifically at fighting the effects of climate change and environmental racism to ensure equity in infrastructure and clean energy investments. Further, the department has rebranded TIGER and BUILD as Rebuilding American Infrastructure with Sustainability and Equity (RAISE).

For America’s communities, look to leading initiative such as Resilience 21 (R21), a coalition of 50 leading U.S. practitioners, of which we are part of, that works with cities and communities of all sizes and types to build resilience to current and future shocks and stresses with an emphasis on the disproportionate risks faced by marginalized communities. A chief recommendation of the R21 includes the development of a “Future Visioning” Task Force to address communities threatened by climate and human-caused displacement, including sea level rise, wildfire, flooding, environmental degradation and pollution and civil unrest. This task force must support the free will and mobility of communities to determine their own futures and address funding for proactive action.

Samantha Medlock, senior counsel of the House Select Committee on the Climate Crisis told Resilience 21, “a lot of efficacy will come through implementation. We need to consider the needs of America’s communities.” She suggested setting a goal post that embeds resilience into infrastructure, housing and disaster response and recovery bills.

What does the next 100 days and beyond hold?

The hard work must continue, with as much urgency as the first 100 days, to make up for a lack of climate resilience effort in the last decade and to rebuild the nation’s economy and spirit. The new administration will need to build and train teams to implement policy and vision and ensure staff has subject matter expertise and a proven track record in climate resilience, adaptation and equity. Policies and programs created, designed and deployed need to be informed by practitioners to yield permanent structural changes that can resolve the deep systemic challenges that impact many low- and moderate-income communities and communities of color that are now in the direct path of natural hazards and risks.

Look for a draft executive order, focused on climate-related financial risk disclosures, that will insert climate risk into decision-making across the financial sector. Major industries such as housing, agriculture, lending and insurance will be asked to assess and disclose climate risks, identify solutions to manage those risks, and as necessary, fund the implementation of these strategies.

Avril Haines, director of national intelligence, recently told world leaders that climate change is a national security issue at late April’s virtual climate summit. “It needs to be fully integrated with every aspect of our analysis in order to allow us not only to monitor the threat but also, critically, to ensure that policymakers understand the importance of climate change on seemingly unrelated policies,” she said.

This is an admirable start to what promises to be an exciting and uncertain adventure in this resilience decade. We must continue to push to make decisions at all levels of government that strengthen our path forward for all and help us to acknowledge previous and historical inequities, plan for current and future risks, invest in affordable housing, transportation, water and other infrastructure and build capacity to create justice for all.

Co-author Laurie Schoeman is the co-founder of Resilience 21 and leads Enterprise Community Partners’ efforts to preserve and protect affordable housing across the nation from the risks and impacts of natural hazards and a changing climate.

Image credit: Nikola Majksner/Unsplash

Why It Matters: Barclays Withdraws from a Prison Financing Deal

Last month the American Sustainable Business Council (ASBC) and Social Venture Circle (SVC) announced that we terminated the membership of and were refunding dues paid by Barclays. This was first-of-its-kind decision for our organizations and one we did not take lightly. This resulted from Barclays’ decision to participate in a prison financing deal in Alabama, which violates our membership criteria by making investments that perpetuate systemic racism and inequity, instead of driving positive change.

Barclays may have viewed their role as underwriting the deal as separate from their direct investment in the prison construction or operations; nevertheless, for us, our membership, and the values on which we advocate, we did not distinguish the difference as meaningful. Regardless of any distinction, the outcome of the deal was to be more investment in an unjust incarceration system. Meanwhile, we advocate for investment and policies to support investment in a more healthy, just, and equitable society. We could not reconcile the two. Decisions of this sort are among the most difficult that any membership organization ever has to make, especially when it involves such a high-profile member.

As pro-business organizations representing tens of thousands of businesses, business organizations, and others, we focused on using the moment to encourage business leaders and investors to rally in their support encouraging Barclays to pull out of the deal. Leading a group of impact investors, coordinated by Christina Hollenback, Founder & Principal of Justice Capital, a loud chorus of social justice advocates called on investors to refuse to purchase the $630 million taxable municipal bond offering by the Alabama Department of Corrections through the Wisconsin Public Finance Authority.

Barclays then announced it was pulling out of the deal. “We have advised our client that we are no longer participating in the transaction intended to provide financing for correctional facilities in the State of Alabama,” Barclays said Monday through a spokesman in an emailed statement. “While our objective was to enable the State to improve its facilities, we recognize that this is a complex and important issue. In light of the feedback that we have heard, we will continue to review our policies.”

ASBC and SVC in turn released a statement in support of the Barclays decision, including many comments of support from members and coalition partners. Critical to the process was ASBC and SVC’s offer to Barclays senior management to discuss our decision and offer advice and support on developing processes that might help avoid such conflicts in the future. Our sincere hope is that if they chose to pursue rejoining, we will have a constructive dialogue moving forward. The finance industry has more to gain from investments in a just, equitable, and sustainable society and economy.

Our goal is to work collaboratively with all companies, including large financial institutions, to develop better leadership practices in the areas of responsible and sustainable business. Our role is to change the rules of business for a better societal outcome. We encourage changes in a positive and constructive manner that helps businesses channel their investment in a just and sustainable stakeholder economy that leaves nobody behind. No business is perfect and the goal of ASBC and SVC’s work is to lead the way for those committed to accelerate progress.

Image credit: Patrick Hendry/Unsplash

Small Landowners Are Untapped Heroes in the Fight Against Climate Change

Forests are fundamentally linked to climate change, both as a cause and a solution. Clearing and mismanagement of forests contribute about 12 percent of global carbon emissions. But forests also act as a carbon sink, absorbing carbon dioxide, as well as regulating water flows and protecting the rich biodiversity and communities that depend on them.

As such, forestry has long been central to climate change mitigation plans, including carbon offset programs, wherein an entity pays to remove or avoid equivalent emissions elsewhere that they would emit in their operations. Due to increased demand for these programs and a need for conservation finance tools, a new initiative called the Family Forest Carbon Program, created by the American Forest Foundation (AFF) and The Nature Conservancy, aims to maximize the climate mitigation potential of forests by engaging family forest owners to deliver meaningful conservation through active forest management.

“Globally, engaging and enrolling small private landowners in natural climate solutions programs is critical in the race to tackle climate change,” said Josh Parrish, director of the American Forest Carbon Initiative at the Nature Conservancy. “Through a partnership between The Nature Conservancy and the American Forest Foundation, the Family Forest Carbon Program is providing small family forest owners in the U.S. with knowledge, incentives and new market opportunities that have the ability to meaningfully reduce the impacts of climate change.”

Bringing family forest owners into the carbon market

About 10.7 million ownerships from individuals, families, trusts, and estates account for 36 percent of U.S. forests (approximately 290 million acres). Despite their essential role in the management and sustainability of forested land, these family forest owners are often left out of the majority of carbon reduction schemes.

Carbon offset-related projects are typically developed on forested properties of 5,000 acres or more. That means family forest owners are left out of chances to bring in additional income from their land that could help them implement sustainable forest practices that sequester and store more carbon. Significant opportunities exist to bring these family forest owners into the mix, to the benefits of both the forest owners and corporations. The Family Forest Carbon Program looks to close that gap.

The nature of these forests being owned and run by families means there may be a wide range of experience and expertise in sustainable practices or how to effectively participate in the carbon market. Many landowners lack up-to-date technical knowledge or have difficulty meeting the cost of sustainable management of their land. The Family Forest Carbon Program empowers those forest owners to participate in carbon markets in a way that is viable, at scale, and sustainable.

The program is unique compared to many traditional forestry carbon market projects, a sign the markets are opening to other stakeholders beyond the large, industrial forest tracts. “Our project is different in that it is geared specifically to landowners with small forest holdings (between 20 and 1,000 acres),” Christine Cadigan, senior director of the Family Forest Carbon Program at AFF, told TriplePundit. Enabling their participation not only increases the availability of carbon credits, but it also gives these smaller landowners a seat at the table and the revenue to pursue the most sustainable path for their forests.

A new accounting methodology ensures offsets tied to family forests are verifiable and real

Criticism lobbed at forestry in carbon markets caused a multi-year dip in adequate attention being paid to the sector. In the meantime, however, forestry experts have made significant strides in both the accounting and frameworks, setting up the potential for substantial contributions going forward.

As corporations set more ambitious carbon goals and countries buckle down to meet their Paris climate agreement commitments, they’ll undoubtedly need to look at a range of options to help achieve these. Carbon credits are designed to give companies the last step needed to address their outstanding or residual emissions, or the emissions from their supply chains. Recent numbers indicate that demand for offsets, a significant portion of which will come from forestry, will likely outstrip supply by 2025. More than ever, the carbon savings that come from the forestry sector will need to be reliable, verifiable, and additional (meaning reductions that are in excess of those that would have happened without a given project, i.e., the baseline).

To address this, the Family Forest Carbon Program has developed a new forest carbon accounting methodology that builds on existing forestry carbon sequestration methodologies. The new framework "advances the integrity of an environmental claim by being able to isolate our program as the single variable that contributed to the carbon that is generated,” Cadigan said.

Once the methodology completes the final approval stage through Verra’s Verified Carbon Standard, it will be able to meet the stringent criteria needed to ensure that when carbon reductions are promised, they are real.

How small landowners can help companies meet their carbon goals

Greenwashing has been a key criticism of corporate carbon reduction strategies over the years. Sensitive to that, some companies are taking a deeper dive into more substantial direct reductions, but ambitious goals will still likely require some level of offset. One of the ways the Family Forest Carbon Program aims to ensure that carbon credits through its program are part of a meaningful plan is by working with companies that take a comprehensive approach to their net-zero strategies.

“Companies [we work with] follow the carbon mitigation hierarchy,” Cadigan told us. “They first avoid and reduce or upgrade systems to reduce the emissions they are producing. As companies work to reduce their emissions, they will, given the current state of knowledge and technology, inevitably encounter emissions that are difficult or even impossible to eliminate at this time. The Family Forest Carbon Program can help take this last step. Companies can and should use nature-based carbon sequestration as a bridge to their long-term strategy.”

Helping families foster sustainable forests at scale

The Family Forest Carbon Program is now open to landowners in Pennsylvania, with plans to expand throughout central Appalachia later in 2021. Landowners in this part of the country have not typically been able to participate in carbon reduction programs, despite the region’s economic difficulty in recent decades and a significant forest cover with a lot to offer.

"Success means building a program that works for small landowners, provides inclusive opportunities for participation in forest carbon projects, infuses private climate finance and conservation activities into regions that would not have otherwise benefited, and importantly, meaningfully mitigates climate change by providing credible additional carbon storage and sequestration opportunities,” Cadigan said.

Forest carbon sequestration is an affordable and scalable climate solution. But few forests are adequately managed for sequestration, and many smaller landowners may not be aware of the opportunities a sustainably managed forest can bring. For example, a trio of sisters in Pennsylvania inherited their family’s chestnut farm with little to no knowledge of forestry. Recently, they found the Family Forest Carbon Program. Through the program, they have developed a 10-year plan to improve the health of their trees, in return the program compensates them as partners in a carbon sequestration project. The land that has been in their family for three generations can now provide measurable benefits for their families and the planet.

Small landowners like the Hartman sisters often have deep emotional ties to their land — and empowering them to preserve their forests’ longevity while being fairly compensated and helping companies to achieve net-zero climate emissions is a win-win-win.

This article series is sponsored by Procter & Gamble and produced by the TriplePundit editorial team.

Image credit: kazuend/Unsplash

Why the Shift from Measuring GDP to Green Growth Matters

Simon Kuznets, the illustrious economist and statistician often referred to as the “Father” of Gross Domestic Product (GDP), once warned, “The welfare of a nation can scarcely be inferred from a measurement of national income as defined by GDP.” Despite Kuznets’ warning, GDP has evolved as the primary measure of a nation’s prosperity, health and well-being. That may change, however, as proponents of newer metrics such as green growth are gaining traction.

GDP measurement is highly coveted in the world of business as it is a standard metric representative of production and growth. In fact, GDP has a high correlation with the Human Development Index, hence historically associated with a robust society. The grander the GDP, the lower the unemployment, the sturdier the infrastructure, the higher the rates of education, and so forth. Yet, Kuznets’s caveat is as relevant today as it was ninety years ago. Not only is the average global temperature rising at unprecedented rates, but over 97 percent of climate scientists around the globe have identified the same culprit: human activity. More specifically, the human activity responsible for those very same rises in productivity. Businesses, economists and climate scientists alike are now confronted with a startling question: can we continue to grow a robust society without cooking planet Earth? Is an emphasis on green growth the answer?

What exactly is green growth?

Two researchers at the forefront of science and human development, offer some insights to the prevailing question above. One of them, Johan Rockström, is the mind behind the internationally renowned “Planetary Boundary” framework that identifies nine processes that regulate the stability and resilience of the Earth System. The researchers first set out to explore the varied definitions of the term: green growth. The Organization for Economic Co-operation and Development (OECD), World Bank, European Commission (EC) and the United Nations Environmental Program (UNEP) have their own renditions of green growth. Unfortunately, none set measurable criteria for what passes as green growth. Lofty terms and concepts are encouraging, but not enough.

Achieving genuine green growth

Rockström and his research partner go on to define green growth. Importantly, they align their definition to Science Based Targets (targets based on the scientific communities best understanding of how to limit warming to less than 2°C by the end of the 21st century).

Yes, the skeptic is correct, as climate modeling comes with uncertainty. For this reason, the skeptic should consider embracing guidelines such as a planetary boundaries framework, as it serves as a warning sign that screams, “Unknown Territory!” Climate scientists understand the boundaries we have comfortably lived in for thousands of years. From there… all bets are off. Let us skeptics agree, steering clear of the hazy horizons, with the best known available science, is a pragmatic approach to exercise. Experts in the field of climatology are adamant about remaining below the 2°C threshold we are swiftly approaching. We don’t know what we don’t know, but we do know what we don’t want to know.

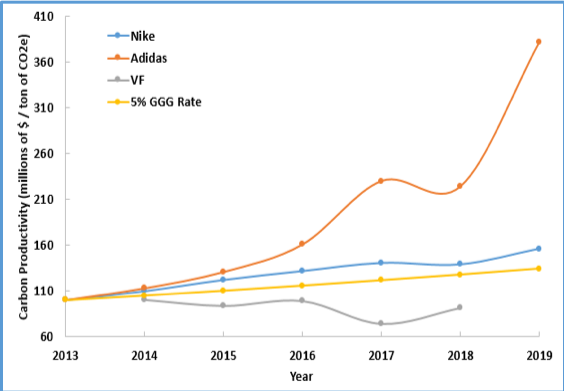

Carbon productivity (CAPRO)

Business and science communities alike have a new tool at their disposal. The authors define green growth as: economic output that lowers total environmental footprint. Economic output is measured as value added in an entity over time (GDP, revenue, etc.), while an environmental footprint can be measured in CO2e emissions in tons per year, or in any other form you should so choose. Carbon productivity (CAPRO), then, is the value generated per CO2e unit used. Based on extensive research, the authors discovered:

- CAPRO > 5 percent Genuine Green Growth (GGG) Rate pa* is a minimum threshold to keep in line with < 2 ° C warming by the end of the 21st century

- CAPRO > 10 percent GGG pa provides a more than 50% chance of < 1.5 ° C warming by the end of the 21st century

*Genuine Green Growth is defined as 5% CAPRO, per annum (pa), whereby most studies converge

Green growth critics debunked

As with any ratio, this does not cover all bases. The authors caution readers against "gray growth", and acknowledge the need for green growth indicators including biodiversity, land and water. However, carbon productivity is a wonderful start as the warming planet directly influences all of these natural systems. In addition, they debunk common critiques of green growth and conduct a case study using Nordic countries to highlight evidence of genuine green growth.

Sweden, Finland and Denmark all exceeded the 5 percent CAPRO pa threshold between 2003 and 2014. So, not only is green growth measurable, it is entirely obtainable.

A CAPRO case study

Genuine green growth, deftly defined by these authors, can be calculated by anyone. I took it upon myself to examine if the apparel giants Adidas, Nike and VF have decoupled emissions from revenue throughout the past seven years.

The findings? Adidas has torched the competition (note the chart above). Nike has done the bare minimum, something to note considering last year’s $37 billion in annual global revenue. Please, Nike, consider mimicking Adidas’s environmental approach. Take a look at the performance of its green fund, which acts as a source of capital for energy efficiency and green energy projects across all Adidas locations. The firm strategically leverages high-return projects to subsidize projects that may be less appealing financially but promise major reductions in carbon emissions. When you set smart goals, devise a plan and finance those plans, miraculous improvements happen. In other words, Nike should take its own advice, and just do it.

Implications for the future

Remember, prior to the industrial age, all renowned economists (Adam Smith and the likes) included land productivity in their manifestos for a strong human ecosystem. Carbon productivity is a metric that can be applied across all countries, industries and states. Thanks to these insights, we can continue to grow a robust society without cooking planet Earth. The question now begs, will we?

Image credit: Navneet Mahajan/Unsplash

Are Lab-Created Diamonds ‘Forever,’ or Only Second Best?

Pandora Jewelry announced this week that it will rely solely on lab-created diamonds (also called lab-grown diamonds) moving forward. Sustainability and affordability are the two factors the jewelry giant pointed to as most influential in its decision. CEO Alexander Lacik said in a statement, “Diamonds are not only forever, but for everyone.” Pandora’s not alone in its march away from mines. Even the world’s largest diamond retailer, Signet, is expanding its lab-created offerings.

What’s behind Pandora’s move to lab-created diamonds

Lab-created diamonds certainly avoid the environmental and human costs, including child labor, that mire mining. A 2020 Human Rights Watch (HRW) report finds that most jewelry companies cannot assure customers that their supply chain is free of human rights abuses. HRW also observed that mine workers have faced increased risk of exploitation and abuse during the pandemic.

While having a simpler supply chain, synthetic diamonds also claim identical physical, chemical and optical properties as natural diamonds.

The production of lab-created diamonds does, however, currently requires a lot of energy. The BBC reports that 50 to 60 percent of synthetic diamonds are made in China — where coal energy is predominant — using high pressure, high temperature (HPHT) technology. Despite this energy use, Saleem Ali, professor of energy and the environment at University of Delaware who occasionally advises diamond makers, reassured Vogue Business that synthetic processing wouldn’t be able to reach the carbon impacts of mining activities, which often includes exploration, explosives and heavy machinery.

Bain & Company’s 2020-2021 “Global Diamond Industry” analysis found double-digit growth in synthetic diamond production, with a 10-fold price differential between natural and lab-created diamonds in some cases. The report also indicates that young consumers in particular are considering sustainability when deciding whether to buy diamond jewelry. Companies are responding with increased attention to emissions, water consumption, traceability, diversity, as well as community support, the report notes.

A ‘climate-neutral’ diamond

The sustainability of lab-created diamonds gained new traction this year as WD Lab Grown Diamonds became the first “Certified Sustainable” and “Certified Climate Neutral” producer under the provisional Certification Standard for Sustainable Diamonds.

“This accomplishment reflects our wholehearted commitment to safeguarding the environment, protecting the human rights of workers and communities, and providing reassurance to the modern consumer with fully traceable, guaranteed conflict-free product,” CEO Sue Rechner said in a statement.

What “climate neutral” means for the certification, beyond carbon neutrality, is that greenhouse gases, climate pollutants and legacy emissions are all measured, mitigated and offset.

Don’t count out mined diamonds quite yet

While synthetic diamond makers are proving their transparency and environmental and social friendliness, diamond mines can make a case for their utility as well. If companies do their due diligence by identifying, preventing, addressing and remediating environmental and human rights abuses, mines can offer a healthy economic support to their communities.

Responsible mining expert Estelle Levin-Nally told Vogue Business, “To the person who cares about economic development, buy from the large-scale mine. To the person that cares about poverty, buy from a small-scale mine. […]”

Last year’s Human Rights Watch report, however, found none of the 15 major jewelry companies assessed ranking “excellent” in their due diligence. Tiffany & Co. and Pandora were alone in their “strong” efforts toward responsible sourcing.

Overcoming the ‘artificial’ association

At this point, synthetic diamonds only represent at most six percent of total diamond production, according to the Bain report, but they have great potential for growth and innovation. Their price-point reaches a segment of the population that may not have bought a diamond otherwise, at least not outside of a marriage engagement. They can also be adapted for unique market opportunities. Founder and CEO of Forever Companies jewelry brands Gary LaCourt wrote for Forbes that lab-created diamonds have the potential to be customized to a customer’s specifications, even containing an embedded picture or phrase.

Despite potential, the current perception of lab-created diamonds lingers in the negative realm, according to the Bain report, with labels such as “artificial” and “fake.” As companies embrace synthetic diamonds, they will likely brand and rebrand them, altering public perception in the process. After all, the success of diamonds over other gemstones has always been about marketing.

Image credit: Pixabay

For Farmers Surviving the Pandemic, Timely Federal Grants and CDFIs Made All the Difference

Last winter, farmers in Maine may have had little hope of still being in business in the spring of 2021, given how their businesses were rocked by the pandemic. But for many, their fortunes quickly changed when Coastal Enterprises Inc. (CEI), Maine’s longtime community development financial institution (CDFIs), stepped in to administer millions of dollars in 2020 CARES Act assistance to farmers across the state.

In just 25 days during December 2020, CEI administered $17.4 million in CARES Act funding to 437 farmers, producers and processors across the state. The grants ranged between $1,000 and $100,000 for pandemic-related infrastructure investments, making unplanned e-commerce investments, and more. For some, the grants literally saved their businesses. While CEI is a lender and not a grant-making agency, it is an example of how CDFIs can rise to the challenge of disbursing the funds gladly.

“This was one of those moments where grant money would have a profound effect on the farm and food community, and it was exactly what was needed at this time,” Gray Harris, a senior vice president at CEI, told TriplePundit.

As Harris explains, these were reimbursement grants—meaning that farmers and food producers did not know that this grant would even exist when they invested in their businesses in response to the pandemic. As 3p has reported, Maine farmers were not alone as producers across the country had to pivot quickly to survive during the height of the pandemic.

“People invested in their businesses at a time of extraordinary economic uncertainty, without perfect information, adjusting their plans and strategies, believing that to take that risk was better than doing nothing at all. I find that extraordinarily inspiring. How could we not step up to support them?” she said.

Community lending as support for the ‘unbankable’

CDFIs have a particular focus on so-called “unbankable” businesses – those entrepreneurs without the kind of balance sheets and histories that banks require. While this was not a criteria of the CARES-Act funded grant program, Harris says some of those who benefited may have fallen into this category.

“These are businesses that often have a hard time obtaining loan capital from conventional banks, due to any number of risk factors, perceived or real, the high-risk nature of an industry dependent on and at the mercy of the weather; start up or early stage of the business with little track record; establishing a brand and difficulty in breaking into new, emerging and unproven markets; limited business assets to offer as collateral; low margins with long trajectories to scale,” Harris explained.

Often, she adds, the limiting factor is simply domain expertise. “The importance of farm and food business lending expertise cannot be overstated enough - farming, but really any food business that relies on farming as a part of its supply chain, require lenders to have specialized knowledge to really finance them properly, and that takes time and commitment.”

CDFIs, she explains, “know their communities and the networks in which the businesses exist; and can use that relational data to support underwriting.”

CEI’s ability to support small businesses got a big lift last December with a $10 million gift from billionaire philanthropist MacKenzie Scott; It was among 384 nonprofits selected for their ability to provide immediate support to people suffering the economic effects of the pandemic. For CEI, Harris says, the gift was “an extraordinary recognition” of the organization’s 40-year track record and a validation of its work using community capital as a form of economic justice.

Innovative lending from CDFIs allowed farmers to pivot

Matt Griffeth, co-owner of Griffeth Farms in Limestone, Maine, which grows potatoes for producers like such as McCain Foods and Frito Lay, as well as feed barley for the beef industry, told 3p that the funds for CEI from the CARES Act “allowed us to stay ahead of the curve for the new food safety protocols that we have had to adopt since COVID 19 happened. The majority of our processors’ product is sold in restaurants, so we have really had to change our thought process on marketing potatoes and keeping employees and food safe.”

For Seth Kroeck, co-owner of Crystal Spring Farm in Brunswick, Maine, which has 187 acres of crops such as wild blueberries and hay, the funding from one of Maine's leading CDFIs also made a significant impact on the farm’s operations and bottom line.

“After the dust of last spring settled, we, like most farms and small business, started making plans on how to pivot both our operations and our marketing goals for the pandemic,” he told 3p. “Valuable cashflow was spent on safety equipment and PPE for staff in the field and making deliveries. More space in barns and new work surfaces in buildings where we wash and pack had to be setup and purchased. Having financial support to make these changes without hurting our bottom line allowed us to continue on growing and packing produce right through the year.”

Kroeck is all too familiar with the obstacles for obtaining capital for smaller agricultural businesses like his. “Lending is a huge obstacle for small- and medium-size farms. Commercial lenders don’t know what to do with us,” he said.

He thinks it is time this changed: “With all of the challenges we have seen to national supply chains over the past year I think the value of regional and local food systems should be clear to everyone.”

That would include investors, who, as 3p reported last week, may be missing the multi-billion dollar opportunity presented by transformative investment in climate-smart agriculture.

Kroeck would like to see state and federal support of smaller-scale farm lending systems that are not tied to commercial banking. He commends examples like CEI’s loan program Wicked Fast and the U.S. Department of Agriculture’s Farm Service Agency (FSA) Farm Storage Facility Loan (FSFL) that offer a quick turnaround, low interest and are geared toward loans of $50,000 or less.

“These types of lending programs could be a model going forward,” he added.

Harris agreed. “We move capital into places that are overlooked and underinvested, creating economic inclusion and resilience. It’s a model that is needed more than ever as we recover from a global pandemic and transform our economy with a focus on equity and environmental sustainability.”

Image credit: Mario Mendez/Unsplash

Regenerative Agriculture, Coming Soon to a Timberland Shoe Near You

Regenerative agriculture was once a backwater of experimental farming strategies. Now Timberland, and its parent company VF Corporation, have pushed it into the limelight by announcing the first regenerative rubber supply system in the apparel industry. The new initiative could help bring more clarity to the role of organic practices in regenerative agriculture, in addition to providing consumers with a new opportunity to contribute to a more sustainable supply chain.

The need for clarity on organic and regenerative agriculture

The U.S. Department of Agriculture credits the publisher, author, and organic farmer Robert Rodale with initially coining the term “regenerative” to mean purposeful farming practices that sustain renewable resources for future generations. Regenerative farming places a premium on building up soil health, conserving water and contributing to biodiversity.

Rodale passed away in 1990 but his influence continues through the Rodale Institute and Rodale Research Center. Over the years, the field of regenerative agriculture has developed into a holistic system that embraces community well-being in addition to sustaining essential resources.

Similarly, organic farming has come to signify practices that go beyond simply prohibiting the use of certain chemicals. Organic farming typically includes an emphasis on soil and water conservation as well as biodiversity.

Though organic and regenerative farming overlap in key areas, the organic label of the U.S. Department of Agriculture refers more specifically to the application of chemicals. Consumers who look for the organic label are not necessarily getting the full sustainability bang for their buck.

On the flip side, critics point out that regenerative farming does not necessarily preclude the use of synthetic chemicals.

Timberland shines a spotlight on rubber and regenerative farming

The new regenerative rubber initiative is just one part of Timberland’s goal of sourcing 100 percent of its natural materials from regenerative agriculture by 2030. That high-profile leadership role provides Timberland with significant leverage over the extent to which organic and regenerative farming could become one and the same.

So far, Timberland seems to be leaning on the side of both regenerative and organic practices. While not explicitly making an organic pledge in a press release announcing the new initiative, Timberland does include chemicals in a list of problems it hopes to resolve.

“Rubber is typically grown in a monoculture; it uses a single type of tree, degrades biodiversity and often uses chemicals or may involve exploitative labor practices,” the company explains. “Monoculture rubber plantations are also a significant contributor to rainforest deforestation across Southeast Asia.”

In addition, Timberland’s partner in the new rubber initiative is the regenerative agriculture firm Terra Genesis International, which emphasizes organic farming as part of its approach.

“Regenerative agriculture is a system of farming principles and practices that increases biodiversity, enriches soils, improves watersheds, and enhances ecosystem services,” Terra Genesis explains, adding that “The system draws from decades of scientific and applied research by the global communities of organic farming, agroecology, holistic grazing, and agroforestry.”

The Terra Genesis portfolio leans heavily on firms that support organic agriculture, including the beverage company Rebbl, the superfood company Imlak’esh Organics and the skin care company Badger Balm.

As further evidence of an emphasis on organic techniques, Timberland also underscores the role of indigenous practices in regenerative rubber farming.

“Based on local indigenous knowledge, regenerative rubber farming incorporates multiple tree species to mimic a natural forest ecosystem. This revitalizes biodiversity and enhances ecosystem services such as soil health, water cycling, carbon sequestration and the creation of favorable microclimates,” Timberland explains.

“By supporting ‘train the trainer’ programs, Timberland and VF will help to scale local indigenous knowledge and transition more plantations to regenerative systems,” Timberland adds.

Farming for the Earth

Timberland also underscores the community benefits of regenerative agriculture, pointing out that “this approach also provides a diversity of yields that farmers can rely on for multiple streams of income, leading to increased resiliency and long-lasting positive impacts for the community.”

That is a key issue for the natural rubber industry. For all the consolidation taking place in the agricultural sector, about 85 percent of natural rubber production is in the hands of thousands of small, family-run enterprises in Asia. That puts community well-being front and center in Timberland’s regenerative farming mission.

The concern for community sustainability dovetails with accelerating concern over the climate crisis. Part of the reason for the explosion of interest in regenerative farming is its potentially powerful role in carbon sequestration, as promoted by the Rodale Institute.

Other leading consumer brands, including Danone and Anhueser-Busch, are also staking out ground in the regenerative farming field. In addition, there is growing evidence that carefully designed arrays of solar panels can complement regenerative strategies.

As regenerative agriculture grows, efforts like the Timberland rubber initiative can help set a high bar for a holistic approach that highlights organic practices and community health, too.

Image credit: David Clode/Unsplash

Biden’s First 100 days: A Climate Resilience Appraisal

This article on the Biden administration’s plans and how they could affect climate resilience was written with Laurie Schoeman.

How has President Biden’s first 100 days in office helped us as we continue through this resilience decade? What’s the very early scorecard on climate change risk disclosures and the financial markets?

In a new CNN Poll, the president gets the highest rating for his performance during the first 100 days for his leadership on environmental policy, with a net positive rating of 54 percent. What is clear is his team has the social capital, vision, commitment and know-how to drive an agenda that builds an equitable, resilient and strong nation.

It’s encouraging that the new president’s climate action strategy includes important and valid emphasis on climate change mitigation. He has spoken favorably about decreasing greenhouse gas emissions primarily through increasing investments in renewable power, while increasing regulations to direct the private sector toward more efficient technologies and operations. Nevertheless, to connect this strategy to apply to all Americans, the White House must emphasize climate resilience. So far, the administration’s policies are trending in a positive direction.

Here is our top seven list of the administration’s most impactful efforts to build a climate-resilient nation.

Seven key steps the new administration has taken toward climate resilience

President Biden has reinstated America as a leader in domestic and international climate action by rejoining the Paris Agreement, committing to both decrease global greenhouse gas emissions and boost climate resilience in our communities.

The administration has so far positioned seasoned and respected leaders to champion the international and domestic climate agenda and put climate action into practice, including Cecilia Martinez, Senior Director of Environmental Justice at the White House Council on Environmental Quality; Deb Haaland, Secretary of the Department of the Interior; Michael Regan, Administrator of the Environmental Protection Agency; Gina McCarthy National Senior Climate Advisor; and John Kerry, International Climate Envoy.

Treasury Secretary Janet Yellen committed her department to examine the financial risks of climate change; to wield Treasury’s broad powers to tackle potential risks to the financial system posed climate change imposes; and to the appointment of a senior official to lead climate initiatives.

The Federal Reserve has launched a climate committee to assess the implications of climate change risks on the U.S. financial system, including banks, corporations and infrastructure.

The Federal Housing Finance Agency has issued a “Request for Input” on integrating climate risk management for its regulated entities that include Freddie Mac, Fannie Mae, and the Federal Home Loan Bank to investigate housing finance system climate risks disclosure and management.

The Securities and Exchange Commission has begun work on potential regulations that would require companies to disclose exposure to climate risk; it is evaluating climate disclosure guidelines, and it has prepared a detailed questionnaire seeking industry feedback until mid-June.

And finally, the Commodity Future Trading Commission has announced a new Climate Risk Unit that follows on its groundbreaking 2020 report, Managing Climate Risk in the U.S. Financial System.

So what's next?

These all are significant advances. But at a moment when the nation is emerging from the economic and community disruption of the century’s largest health crisis, every move the Biden Administration makes must be related to supporting both Main Street and Wall Street. Next week, we will discuss several initiatives on which the new administration can lead that we believe can bolster climate resilience along with the economic infrastructure of the nation.

Co-author Laurie Schoeman is the co-founder of Resilience 21 and leads Enterprise Community Partners’ efforts to preserve and protect affordable housing across the nation from the risks and impacts of natural hazards and a changing climate.

Image credit: Tabrez Syed/Unsplash

System Change is Key to Driving Social Impact Work That Matters

The level of system change required to tackle many of the world’s most pressing challenges can seem overwhelming. Sometimes, a simple and unlikely symbol changes our perspectives. For personal care company Kimberly-Clark, it was a photo of an abandoned toilet in the middle of a field. A donation to a rural community to drive sanitation, it had never been used because the physical, social and cultural infrastructure to support its role in better sanitation hadn’t been addressed.

Kimberly-Clark is no stranger to social impact work. The company has driven impact to improve sanitation and hygiene and empower women and girls through global initiatives that provide access to sanitation and menstrual hygiene education. But seeing the picture of that humble toilet prompted a much deeper conversation about the broader physical and social system challenges at play.

Kimberly-Clark did not donate the abandoned toilet in question, but the photo resonated with leadership to make sure any investment would result in true system change and how it would be measured: When a company invests in toilets or plumbing systems, it doesn’t just improve health and hygiene — it can change an entire community, opening up new income and educational opportunities, reducing mortality from preventable diseases, and giving people dignity and peace of mind. But it has to take the local realities into account for any of that to happen.

With a goal to impact 1 billion lives by 2030 in partnership with nonprofits and NGOs, the team at Kimberly-Clark realized they needed to overhaul the way the company measures impact in order to demonstrate value and hold themselves accountable. That meant taking a step back to understand why it was so important to adopt a system-change perspective in the first place, and why it was so challenging to measure results.

System change: Getting to the root cause of the problem

For answers to those big questions, Kimberly-Clark turned to Dr. Sally Uren, a member of its Sustainability Advisory Board who is also CEO of Forum for the Future, an international sustainability nonprofit that specializes in addressing global challenges by catalyzing change in key systems — from food to apparel, energy to shipping. It runs a School of System Change to help people bring the practice into their work.

Forum for the Future defines system change as “the emergence of a new pattern of organization or system structure. That pattern being the physical structure, the flows and relationships or the mindsets or paradigms of a system, it is also a pattern that results in the new goals of the system.”

In other words: System change is both an outcome and a process — and it’s key to driving the transformational change the world needs.

Uren cited two major reasons why it’s time for businesses to take account of system change: “The first reason is simply the scale and urgency of the challenges we face,” she told TriplePundit. “If we think about what needs to happen over the next few years, to secure a stable climate, to maintain biodiversity, the science is telling us that incremental change just won't be enough.”

“We have to think about wholesale, transformational change and about the systems we rely on and how they fundamentally operate. Because tweaking around the edge of those systems isn’t going to drive the radical change that will deliver on the U.N. Sustainable Development Goals,” she added.

System change also illuminates the root cause of a problem. “When we think about structural inequalities or structural racism, we tend to latch onto the surface-level events. But a system approach really prompts you to think about the root causes,” Uren continued. “What is driving this inequality that we see in our system? What is driving the structural racism? And we start to then understand that the drivers are much more around personal values, mindsets and history. The whole history of colonialization is a really fundamental root cause of some of the racism that we see today, and this prompts us to really reflect on how the global economy is wired.”

In the case of Kimberly-Clark, period poverty is a broader systemic challenge that has a direct influence on its social impact work. Period poverty, or a lack of access to menstrual hygiene products, knowledge and basic sanitation that enable women to manage their periods with dignity, could be caused by many factors: There may be social or cultural issues contributing to the problem, or the products may not be affordable.

Solutions therefore need to be seen through a systems lens, Uren explained. “A systems approach allows you to understand the broader issue that you need to address alongside a particular problem that you might be solving for.”

Four ways systems begin to change

Uren went on to outline four ways in which systems begin to change. The first is new activity — new innovations, pioneering practices or new flows of information. The second signal that a system is changing is when businesses find new ways to deliver goods and services to market — the shift from a linear consumption model to a circular economy is a good example. These shifts, in turn, often lead to new financial or legislative incentives. The number of organizations adopting new ways of doing things, or the numbers of new business models or new financial incentives working in the economy, are all indicators of a system changing.

Third, the goals and desired outcomes of the system will begin to shift. “That’s where you need collaborations,” Uren added. “At Forum for the Future, we create collaborations to really change the goals of a given system. One example is a project with the cotton industry to change the goals of the cotton system from a system designed to deliver conventional cotton to sustainable cotton – shifting the goals of the system in this way will drive mainstreaming measures to protect the environment and ways of dealing with deep-rooted inequalities. Another example is our collaboration, aimed at transforming the protein system to allow equitable access to sustainable protein for a growing population.”

The final signal that a system is changing centers on mindset. “Deep, structural, systemic change comes from a shift in mindset, a shift in the stories we tell ourselves and a shift in the beliefs that we hold,” Uren explained. "This is where you see new narratives emerging, and it's happening right now in our pandemic landscape: A narrative is emerging that safe planetary health equals human health. That has always been true, but that narrative wasn't really well understood before COVID-19.”

Recognize when a system is unsustainable — and take action

If she were to succinctly capture her advice to leaders on how to tackle the challenge of measuring their impact on system change, Uren said it comes down to four success factors.

Take the time to understand the concept of system change. “It’s not an easy concept sometimes, and it's also laden with jargon and it's quite academic. But taking the time to understand what a systems approach might mean to your operations is really important,” Uren advised. “Essentially it's about understanding the connections between things and understanding root causes.”

Get comfortable about blending qualitative and quantitative metrics. “For companies, there's a real desire for quantitative metrics, but when it comes to understanding system change, that's actually quite hard to do,” Uren told us. “While key stakeholders, particularly investors are keen to see metrics having a blend of qualitative and quantitative metrics is really important.”

Accept a bit of ambiguity. “We don't live in a linear world, but we keep on trying to solve for our big challenges as if it was linear,” Uren observed. “As humans, we quite like certainty, but systems don’t work like that. The systems we rely on are dynamic and complex."

Ask yourself the tough questions. “The fourth success factor is probably the most important, which is to really encourage every individual to ask themselves, ‘Is what I am doing locking in an existing unsustainable system? Am I unwittingly perpetuating the status quo? Or am I allowing the emergence of a new way of doing things?’” Uren concluded.

Achieving effective and measurable system change requires companies to understand the broader issue that you need to address alongside a particular problem that you might be solving for. And as Uren reminds us, “We need to be really hard and honest with ourselves. If we are, we will see systemic change deliver meaningful positive social impact sooner rather than later.”

This article series is sponsored by Kimberly-Clark and produced by the TriplePundit editorial team.

Image credit: Bill Wegener/Unsplash

Mother’s Day (and Father’s Day) Deserves a Thoughtful Gift. Here Are a Few Sustainable Ideas.

We might be a little late for Mother’s Day (especially since we're often shipping our gifts), but Father’s Day isn’t too far off, and in any event, these Mother’s Day gift ideas could really work for just about any occasion.

For those who want to send something on the thoughtful side but wish to be somewhat responsible with the environment and social impact in mind, we offer a few ideas. And yes, some out there may slap your wrists for the shipping involved (i.e., over the carbon footprint), but we think these companies present some happy exceptions. Read on, and Happy Mother's Day (and next month, Father's Day!)

Bouqs offers countless color pops of joy

We’ve long been a fan this Southern California company, which has been changing how flowers are sourced, sold and delivered for several years. Bouqs, based in Southern California, promises to deliver flowers directly from farms in regions such as South America. Customers can visit the company’s site and select a bouquet, and recipients will receive those arrangements relatively quickly. Less storage time means less waste - as much as 40 percent of all flowers marketed in the U.S. end up never sold. The company has claimed its flower farming partners can now gain access to benefits such as day care, health care and education for its employees - while practicing “sustainable, eco-friendly farming.” As far as flowers go, this is about as farm-to-table as you can get. Currently, one line of flowers will contribute funds to Campaign Zero to fight police brutality.

Orchids grown responsibly

California’s central coast (from Santa Barbara to Santa Cruz counties) is host to the perfect climate for growing many varieties of flowers. Westerlay Orchids, based in the small seaside town of Carpinteria, is a third-generation family business that excels in raising Orchidaceae. If you happen to live on the west coast, Westerlay’s orchids are available at some supermarkets, or you can arrange online to have mom or dad receive a box. The company has it down when it comes to shipping them skillfully without overdoing the packaging. Further, Westerlay has invested in a bevy of sustainable farming practices and technologies. FYI: Orchids have a small footprint when it comes to care - we’re talking a monthly rinse of the roots and a few ice cubes each week. Easy-peasy.

Greyston Bakery

Looking for an indulgence with a social mission? Greyston Bakery has for years been churning out brownies and blondies in Yonkers, New York, and the company includes Ben & Jerry’s amongst its customers. Greyston has gone above and beyond its mission of employing the last hired and first fired to bake its brownies. Three years ago, the company launched the eponymous Center for Open Hiring, a space where business leaders can learn more about the “open hiring” human resources model. You can send anyone a box, and there are vegan options, too. Be sure to get on Greyston’s email list – they do have sweet promos from time to time, including one as of press time for this year's Mother’s Day.

Make Mother’s Day a wild one with Wild Friends Foods

Is supporting women-owned businesses important to you, your parents, or considering the reality of this economy, just about anyone? Wild Friends Foods and its line of nut butters check many boxes: It’s a certified B-Corp, runs its own 1 percent give-back program and says it sources responsibly for its ingredients, whether they are nuts, coconut, cacao or honey. If love means getting a 6-pack of nut butters in the mail, then you’ll score points with a Wild Friends order: plus, spend $49 bucks or more and the shipping free. The chocolate coconut peanut butter is to die and slather for, not necessarily in that order.

Reef-friendly sunscreen

He or she, or them, may not be able to find a rental car this summer, so depending on how that industry shakes out, staycations could still be the norm this year for us and many of our parents But whether the summer plans call for Maui, Montserrat, Melbourne, Montevideo or Making Do in the Backyard, it’s about time to stock up on sunscreen. And with all the research suggesting many sunscreen ingredients are harmful to marine life such as coral (Hawaiʻi has already banned some ingredients), personal care and beauty product companies are rolling out more “reef-friendly” sunscreens. The retailer Ulta is only one example. Oh, and if your mom, dad or you are fearful as Alexis Rose of Schitt’s Creek has been of being or “moving to a place that doesn't have a Sephora for literally 2,700 miles,” that chain offers several options, too.

Whimsy adult coloring books that give a lift to talented artists

Speaking of Schitt’s Creek (we don’t indulge in pettifogging), if mom or dad is looking for something different and relaxing to do by the pool or during a Zoom meeting in which they fast lost interest, why not consider adult coloring books? We like the bundles of pencils and stencils from Pop Colors, including this Rosebud Motel-themed one in case you wanted to do your own kaleidoscopic version of Moira Rose’s Versace Pope outfit that Catherine O’Hara wore in the series finale. The “Fold in the Cheese Orange” and “Bébé Blue” are enough to inspire any fan of the show to whip out the credit card without any inner cogitations. The Oregon-based company is only one example of how we can support the creative community, which has been hit hard during the global pandemic. So in the event you lack any local access to an apothecary, check out Pop Colors' fun product lines. Other themes include bundles of pencils and books like "Game of Tones" and "Stranger Colors."

“Eko-friendly” yoga mats

There’s a reason or two why getting into a Lulu Lemon during the pandemic was about as easy as sneaking into Fort Knox. But soon, soon many of us will be able to resume our practices again. So, do you want mom or dad to once again launch into the downward dog without you risking a trip to the doghouse with the wrong gift? Well, Manduka has a line of yoga mats that the company says are manufactured responsibly – as in, rubber not harvested from the Amazon region and after manufacturing, the mats are softened with foaming agents that aren’t environmentally destructive. Options include a travel size if your parent(s) can indeed score a rental car later this summer. Again, Happy Mother's Day!

Image credit: Sai de Silva/Unsplash