Global Philanthropy Forum Convenes in Redwood City, Calif.

By Lina Constantinovici

The Global Philanthropy Forum (GPF) convened in Redwood City, Calif. April 23-25, with participation from foundations, NGOs, and international development and aid agencies. In its fourteenth year, the forum is produced by the World Affairs Council.

The event launched in 2001 with a regional Silicon Valley focus, then evolved to a focus on American philanthropists and more recently a focus on global philanthropists, according to Jane Wales, CEO of Global Philanthropy Forum and World Affairs Council, and vice president of the Aspen Institute. In the past couple of years, GPF has launched three regional events: Brazilian Philanthropy Forum and Philanthropy Asia Summit in 2012, and the African Philanthropy Forum in February of this year. “GPF is expanding its reach through the creation of the regional affiliates and partnerships in emerging economies where strategic philanthropy is on the rise.” according to Cory Porter, communications director. The Global Philanthropy Forum currently numbers 1,800 members that span every continent.

This year’s theme is “Global Goals, Citizen Solutions,” with three main areas of focus: Planet (Earth’s Changing Physiology), People (Demographic Change) and Philanthropy (Redefining Philanthropy). Foundation collaboration, leadership, women and girls, and venture philanthropy/impact investing were reoccurring trends in the panel discussions, keynotes and breakout sessions over the three days. MacArthur Foundation and MasterCard Foundation shared insights from their two-year, $24 million partnership focused on secondary education, while the president of the World Bank Group called for a broader spectrum of funding options and models for international sustainable development.

Speakers included foundations like Skoll, Packard, Hilton, Aga Khan, Rockefeller Brothers, Heron, JPMorgan Chase, Citi, Ford, international organizations such as the World Bank, Inter-American Development Bank, UNDP, Global Fund for Women, the International Finance Corporation, Institute for the Future, Transparency International, BSR, Center for Global Development, Conservation International and NEXUS. The forum also attracted NGOs like Teach for All, Lybian Women’s Platform for Peace, Shining Hope for Communities, Helpage International, Sanergy, Groundwork and buy42.com -- China’s first online charity shop -- with corporate presence from UBS, Monitor Deloitte and PayPal.

Gro Brundtland, former Prime Minister of Norway, a member of the Elders, and chair of the Brundtland Commission that defined sustainable development as meeting the needs of the present without compromising the ability of future generations to meet their needs, closed the event with the assertion: “Health systems and basic education are crucial to the success of any viable government”.

Lina Constantinovici, MBA, is building an economy that creates conditions conducive to life as the Founder and CEO of StartupNectar, an incubator for early-stage breakthrough solutions in the water, energy, and material science space. Lina's work is focused on innovation in early-stage funding and support for for-profit and non-profit solutions that have the potential to address key global challenges with an eco-system approach, as well as on contributing to evolving our macro-economic structures towards more sustainable ones. Lina has also been designing education programs and curricula that build capacity to navigate an increasingly complex world.

Goldsmith backs NAVS Air France protest

Sustainable investor Ben Goldsmith has said ‘Non!’ to Air France monkey shipments as part of a week of action organised by the National Anti-Vivisection Society (NAVS) during its annual Lab Animal Week, now in its 35th year.

Lab Animal Week runs from 21st-27th April and was founded by the NAVS to highlight the suffering of animals used for unreliable and unnecessary tests. Air France became the last remaining passenger airline shipping monkeys to laboratories when China Southern Airlines updated its policy earlier this year.

NAVS chief executive, Jan Creamer commented: “We are very glad of Ben’s support to raise awareness of the cruel lab monkey trade. Our investigations show that lab monkeys endure brutal lives on breeding farms. When the day comes, they are placed into tiny boxes and flown to laboratories; many have died en route.”

In 2012, the number of monkeys experimented on in the UK rose by nearly 50% to over 2,000. In the same year, 1,500 monkeys were imported into the UK for experiments; two out of three came from Mauritius.

NAVS highlights the fact that there are a growing number of alternatives to using monkeys in experiments. These provide data based on likely effects in humans, rather than in monkeys, therefore avoiding the misleading results and past disasters when results from monkeys have been applied to humans.

Read more about NAVS' campaign here.

Apple faces protests over worker welfare in China

Apple's New York flagship store was a scene of protest at the weekend. Protesters gathered to participate in a demonstration calling on the smartphone giant to stop the poisoning of workers who make iPhones and other Apple products.

The protest stemmed from the “Bad Apple Campaign,” launched jointly by Green America and China Labor Watch, earlier this year. To date, the campaign has collected nearly seventeen thousand signatures urging Apple’s ceo Tim Cook to remove dangerous chemicals in an effort to protect the young Chinese workers who manufacture Apple’s products. Additionally, more than 750,000 have watched the campaign’s associated film Who Pays the Price? The Human Cost of Electronics.

“Apple is seen as the smartphone pioneer and has led within its industry by using more renewable energy and reducing conflict minerals, however, to truly be the leader, Apple needs to ensure that none of the workers who make its products are put at risk”, said Elizabeth O’Connell, Green America's campaigns director . “Apple is a highly profitable company who can afford to ensure that the lives of the Chinese workers who assemble its products are protected just as much as workers in the US.”

Smartphones and other electronics are made with thousands of chemicals, many of which are known to be harmful to human health such as benzene or n-hexane. Occupational exposure to benzene can lead to leukemia, say campaigners.

The protests’ location at Apple’s “Cube” store, near Central Park, is significant in that the store is one of Apple’s most profitable retail locations, grossing more than $350m per year. Industry experts estimate that Apple could remove benzene and other dangerous chemicals from production for as little as $1 dollar per device.

Unilever steps up sustainability plans

Anglo-Dutch fmcg giant Unilever is stepping up several of its sustainability commitments in the areas of deforestation, food security and public health.

Commenting on progress it has made so far, ceo, Paul Polman (pictured above) said: “In the three years since we launched the Unilever Sustainable Living Plan we have learned that sustainability drives business growth and a much deeper connection with our employees and consumers. In 2013, we’ve seen good progress, particularly on targets within our direct control. Our Plan is helping us to save money, reduce risk and drive innovation, and brands that have done the most to embrace sustainable living, like Dove, Lifebuoy, Pureit and Domestos, are enjoying some of our fastest growth.”

In the area of social compliance, Unilever also confirmed that the Sustainable Living Plan has been expanded with a more substantive Enhancing Livelihoods programme focusing on fairness in the workplace, opportunities for women and developing inclusive business.

Forum for the Future has worked with Unilever on its sustainable business strategy for several years. In relation to the revised Unilever Sustainable Living Plan (USLP), Forum used its ‘Futures’ expertise to help Unilever identify the external mega trends and major issues and use them to map the areas where Unilever can drive the most change.

Ben Kellard, head of sustainable business at Forum for the Future, said: “Learning and adapting is important in any business strategy, but it’s even more impressive when companies, like Unilever, revise an already innovative plan with the intention of bringing about broader change on a global scale.

“Unilever is rightly taking a systems based approach to sustainable business thinking – this means influencing the nature of the systems in which it operates to create a context in which they can innovate for long-term success. Such progressive approaches not only bring about positive social and environmental impacts but also financial success – just last week Unilever announced results that beat the City forecasts. Other businesses should now look to see what Unilever is doing and consider ways they can adopt more progressive practices into their own approaches, to safeguard their future success and viability.”

3p Weekend: 7 Eco Apps That Are Actually Worth Downloading

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

Whether you're on iOS or Android, your app store is likely crowded with "green" applications, each claiming to be next big thing. Sounds great and all, but on closer examination most of these apps receive dismal reviews and often aren't worth the download space. To save you some time scouring the app store, this week 3p rounded up seven apps that are actually useful for reducing environmental impact and spending your dollar where it counts.

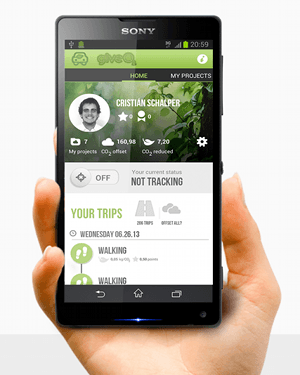

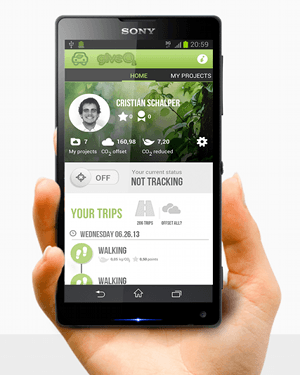

1. GiveO2

In a crowd of carbon footprint trackers, GiveO2 stands out. Debuted at SXSW 2013, this bilingual app for iOs and Android allows users to easily monitor the carbon footprint of their daily commutes -- whether it's by car, bike, public transit or a combination of the three. The app works with your GPS so you don't have to worry about typing in miles manually, and, miraculously, it also promises not to drain your battery life.

Users can also snag rewards and discounts at participating retailers for shrinking their footprints, or select from a pool of sustainable projects around the world to offset transportation-related emissions -- putting sustainable purchasing power in the palm of their hands.

2. Leafully

Grand prize winner of the DOE's Apps for Energy challenge in 2012, Leafully goes beyond most energy trackers by connecting directly a user's local utility, automatically monitoring energy consumption, and notifying the user when they consume more energy than normal. Energy efficiency is the nation's cheapest energy source, proven once again by an April report from the American Council for an Energy-Efficient Economy (ACEEE), and helping users cut back will not only reduce peak-hour burdens for local utility companies but also ensure lower carbon emissions for all.

3. GoodGuide

GoodGuide makes it easy to find safe, ethical and environmentally-friendly products while on-the-go. Powered by the GoodGuide.com database, the app provides health, environmental and social performance ratings for more than 120,000 food, personal care and household products.Users can also customize the app by selecting issues they care about most, such as the environment, animal welfare or organic certification, and see how products perform on their preferences -- a win not only for consumers but for any company trying to draw attention to its latest sustainable offering. The app has been so successful that the GoodGuide team hooked up with Target last fall to rate thousands of products on the retail giant’s shelves and develop an industry standard that allows consumers to make informed purchasing decisions.

4. PaperKarma

This top-rated app is bad news for pamphlet pushers but good news for socially responsible businesses that moved away from junk mail torture ages ago. The app not only helps save trees, but also puts control back in the hands of the consumer -- further underscoring the need for companies to adopt new, clever advertising tactics that actually resonate with the conscious consumer.

5. Seafood Watch

The ocean covers 71 percent of the Earth’s surface and contains 97 percent of its water, yet a growing number of factors continue to threaten the health of our oceans and, by extension, the sustainable future of our planet. Overfishing is one key concern, and it can be difficult for consumers to engage in this area and determine how best to take action.

Enter Seafood Watch, a top-rated app from Monterey Bay Aquarium that allows consumers to choose ocean-friendly seafood at their favorite restaurants and stores -- and helps sustainable brands, eateries and distributors stand out.

6. Waze

Hate gridlock? So do we. It pollutes the air, diminishes productivity and, in some cases, can even bring entire cities to a screeching halt. So, if you haven't heard about Waze -- the crowdsourced solution to spending two hours on I-95 -- it's time to get with the program.

Originally developed in Israel and acquired by Google for an astonishing $1.1 billion last June, Waze is the world's largest community-based traffic app that lets users share real-time traffic and road information with other drivers in their area, saving everyone time, gas money and carbon emissions on their daily commute.

7. Carma Carpooling

Carma Carpooling from Avego is the No. 1 carpooling verification app in the U.S. and eight other countries around the world. By making it easy to connect with neighbors looking for a ride, Carma Carpooling helps commuters reduce both carbon emissions and urban gridlock.

Image courtesy of GiveO2

Based in Philadelphia, Mary Mazzoni is an editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared on the Huffington Post, Sustainable Brands, Earth911 and The Daily Meal. You can follow her on Twitter @mary_mazzoni.

Biomass: The Cure for Smokey Lake Tahoe

Last week Placer County, in north-central California, took a big step in its efforts to improve air quality in the Lake Tahoe region. After more than seven years of research -- exhaustive studies by the county, the U.S. Forest Service, and the Placer County Air Pollution Control District, as well as input from residents and other stakeholders on both sides of the California-Nevada border -- Placer County agreed to become the location for a new biomass gasification plant. The plant, which would be run by a subsidiary of San Francisco-based Phoenix Energy, would be located outside of Truckee, Calif., on the north end of Lake Tahoe.

Air quality is a chronic issue in California’s scenic Lake Tahoe area, which sits some two hours above Sacramento in the Sierra Nevada Mountains. At 6,200 feet above sea level, the alpine-enclosed lake becomes a natural catch basin for drifting smoke from wood-burning and auto emissions. These emissions contribute to the degradation of the lake and surrounding forest, elevating the risk of wildfires -- a little-known side effect that is particularly concerning in light of prolonged draughts in the region and mounting concerns about climate change.

And it’s a problem that isn’t limited to the congested metropolitan area of South Lake Tahoe City, but also affects Placer County, on the north and west ends of the lake. Because of location and topography, air quality around the lake can often be elevated beyond what is considered reasonable by national standards. During fire season, air quality can reach dangerous levels.

“We actually have a pretty significant fire about every other year in Placer County, so it is always on our minds,” said Brett Storey, who serves as senior management analyst and biomass program manager for Placer County.

Storey explained that air pollution from recent fires, such as last year’s Rim Fire and American Fire, underscored the need for finding new ways to get rid of the brush and deadwood that was culled during fire abatement efforts. Traditional methods involve piling and burning biomass that for physical reasons wasn’t hauled out of the forest. Storey said the practice, while necessary, was actually contributing to the air pollution.

The answer that the county came up with would not only cut emissions by more than half, but once up and running, could contribute power to the local utility company, Liberty Utilities.

http://vimeo.com/89771199

According to Stangl, who has constructed two other biomass plants in California, the operation has ecological benefits as well. Biomass gasification uses extremely high temperatures to convert the organic carbon-based materials into gases and char. The gases are then separated and used to produce electricity that in this case, would be sold to the local power company. The remaining biochar would be sold as fertilizer, or used as a nontoxic filter media.

Unlike older biomass systems, Stangl explained, emissions are almost negligible with gasification. The carbon is, for the most part, retained in the biochar.

“Each day I can put the carbon we make on a scale and tell you precisely how much carbon did not get emitted because it is left in solid state,” Stangl said. “We sell to large farms, citrus owners in Fresno County, avocado growers in San Diego, grape growers in the Bay Area, leafy greens and strawberry growers in the Monterey area. And they put that in the soil.”

For the Air Pollution Control District of Placer County, the idea of a biomass gasification unit that can reduce the amount of pile-and-burning for fire mitigation is promising news as well. Bruce Springsteen (no relation to the singer), who is an engineer for the agency, explained that the plant would be required to apply for air permits from the agency before it could operate. He said that while his agency was not involved in spearheading the plans for the plant, he could see the direct benefits of not having to rely on pile-and-burn methods for the majority of hazardous fuel mitigation.

“Our agency is very supportive of the utilization of woody forest waste biomass that comes from fuel treatments and forest management practices,” said Springsteen. “We, and the land managers, feel [it] is critical for forest hazard reduction and returning the forest to a fire-resilient condition.” The burning, he said, was often a “necessary evil” in fire mitigation that he hoped would be reduced if and when the gasification plant went ahead.

“[We have] done a lot of work to determine the huge air quality benefits that come from using this material in energy facilities. Well-controlled, well-designed ways of burning it or gasifying it produces good, renewable electricity or energy.” He said the air emissions associated with such facilities are “much lower than the alternative, which is putting it in a big pile and lighting it on fire.”

According to Storey, emissions from gasification were estimated to be at least 75 percent less than from pile-and-burn methods.

“If we build this, we will have the ability to grab all of that wasted material. And no longer will it have to burn in open piles, but we will be able to convert it into energy that will all have good pollution air-control systems, so the emissions will be 75 to 99 percent less than [pile-and-burn methods].”

Storey admitted that the plant still has some hurdles to jump, which includes having it authorized for operation by the Air Pollution Control District. But he said the unique cost-sharing that has emerged from the project is what will likely make it a success.

Placer County has just finalized an agreement with the U.S. Forest Service's Lake Tahoe Basin Management Unit to transport biomass to the plant and is in the process of finalizing agreements with other agencies for the same work. The cost of the pick-up (within certain distances) would be split between the county and the Forest Service. Storey said that agreement alone speaks volumes about the potential of this project.

“Because now [agencies] see that we have a long-term supply solution of grabbing the material,” a point that may also help with securing any further funding for the construction, Storey said. “This is a joint problem for us, and we are trying to provide joint solutions.”

The cost of the project has been met from a variety of sources, including matching grants from the Department of Energy, in-kind work from both county and federal agencies, and funding from Stangl. Storey said the county has put about $1.5 million into the investment.

The capacity of the plant will be fairly small for a gasification plant, about 17,000 bone-dry tons of waste a year. Preconditions require that the fuel must be third-party certified to be waste that would have been designated for pile-and-burn disposal. Storey told us these conditions were set early on in the planning, but also address concerns from local residents that other parts of the forest remain protected. Both he and Stangl noted that while gasification can handle most of the waste product that would come from fire mitigation efforts, there may be some biomass that will not be accessible by vehicle due to location and will still have to be piled and burned.

Storey said that if all goes according to plan, the county hopes to begin construction by spring of next year -- and for the plant to be up and running by early 2016. With the likelihood of more fire seasons in the future, that’s good news for the Lake Tahoe region and its residents.

Image courtesy of Phoenix Energy

New IPCC Report: The World is On Track for a Hefty Temperature Increase

If the world continues down its current carbon-spewing course, global temperatures will hit a staggering 4.8 degrees Celsius above preindustrial levels by the end of the century, with potentially disastrous consequences for humanity, ecosystems and sustainable development, according to a new report by the U.N. Intergovernmental Panel on Climate Change (IPCC).

The report, "Climate Change 2014: Mitigation of Climate Change," is the third of three Working Group Reports, which make up the IPCC's fifth Assessment Report on climate change. Produced by 235 authors from 58 countries, the report analyzed close to 1,200 climate scenarios investigating the economic, technological and institutional requirements for meeting global climate goals.

Based on this analysis, the report found that stabilizing global temperature rise at 2 degrees Celsius over preindustrial temperatures—the limit considered by many scientists to be safe — will require lowering greenhouse gas emissions (GHG) by as much as 70 percent compared to 2010 numbers by mid-century and reaching near-zero emissions by 2100.

Between 2000 and 2010, global GHG emissions increased by the equivalent of 10 billion tons of carbon dioxide (CO2), the report says. Half of all human CO2 emissions between 1750 and 2010 have occurred in the last 40 years. Mashable recently reported that the amount of CO2 in Earth’s atmosphere has, for the first time, exceeded 402 parts per million (ppm) -- higher than at any time in at least the past 800,000 years. CO2 is one of the longest-lived GHGs, which means the emissions that have and continue to pump into the atmosphere will remain there for centuries.

Scenarios show that to have a likely chance of limiting the increase in global mean temperature to 2 degrees Celsius means lowering global greenhouse gas emissions by 40 to 70 percent compared with 2010 by mid-century -- and to near-zero by the end of this century. Ambitious mitigation may even require removing carbon dioxide from the atmosphere. IPCC says scientific literature confirms that even less ambitious temperature goals would still require similar emissions reductions.

“Climate policies in line with the 2 degrees Celsius goal need to aim for substantial emission reductions,” said Ottmar Edenhofer, one of the three co-chairs of IPCC Working Group III. “There is a clear message from science: To avoid dangerous interference with the climate system, we need to move away from business as usual.”

But don’t freak out just yet. Many fast actions for addressing climate change are proving to be more affordable than previously imagined, IPCC says. For example, actions to improve energy efficiency through new building codes and vehicle efficiency standards can significantly reduce emissions without harming people's quality of life. A recent report by the American Council for an Energy-Efficient Economy (ACEEE) found that energy efficiency programs aimed at reducing energy waste cost utilities only about 3 cents per kilowatt hour, while generating the same amount of electricity from sources such as fossil fuels can cost two to three times more.

Renewable energy technologies, such as wind and solar, are becoming cheaper to produce and deploy.

Estimates of the economic costs of mitigation vary widely, IPCC says. In business-as-usual scenarios, consumption grows by 1.6 to 3 percent per year. Ambitious mitigation would reduce this growth by around 0.06 percentage points a year. However, the underlying estimates do not take into account economic benefits of reduced climate change.

The IPCC report also emphasizes the importance of quickly addressing emissions sources, which can reduce warming while producing co-benefits for human health and ecosystem impacts. Several recent studies have shown that addressing short-lived climate pollutants (SLCPs), including black carbon soot, methane, tropospheric ozone and hydrofluorocarbons, can produce significant near-term climate benefits while also improving human health, food security and energy security.

"Cutting short-lived climate pollutants [SLCPs] could cut the current rate of climate change in half by 2050, while preventing more than 2.4 million air-pollution related deaths a year and avoiding around 35 million tons of crop losses annually," said Durwood Zaelke, president of the Institute for Governance and Sustainable Development. "Cutting SLCPs is one of the best ways to reduce impacts over the next 50 years and beyond."

Fast mitigation and co-benefits are particularly high where currently legislated and planned air pollution controls are weak, the IPCC report says.

"We have the technologies to cut the short-lived pollutants today," Zaelke added. "This includes phasing down HFCs under the Montreal Protocol and using other complementary initiatives such as the Climate and Clean Air Coalition to Reduce Short-Lived Climate Pollutants, the only global effort focusing on these pollutants."

In the United States, President Barack Obama’s Climate Action Plan has finally established some semblance of a comprehensive national climate change strategy. Some of the policies outlined in the plan, such as the Environmental Protection Agency’s impending carbon rules for existing power plants, could achieve even greater GHG reductions than previously thought — and at less cost. This is a good start, but much more needs to be done. Even if the U.S. one day achieves carbon neutrality, it will all be for naught if emerging economies such as India and China continue to spout CO2.

Global warming is, after all global warming.

Image Credit: Flickr Daryl Mulvihill

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

Court: Minnesota Coal Power Law Conflicts with Constitution

A federal judge’s ruling in Minnesota last week highlighted just how out of sync some federal laws may be with new climate change mitigation efforts.

Last Friday, U.S. District Judge Susan Richard Nelson struck down Minnesota’s landmark 2007 legislation that prohibited utility companies from purchasing energy from coal-fired power plants built after 2009 unless the carbon emissions were offset. The state law was designed to fit with Minnesota’s goal of reducing fossil fuel use by 15 percent by 2015.

The judge enjoined Minnesota from enforcing certain sections of the law, saying that it conflicted with the commerce clause of the U.S. Constitution. The ruling was in response to a lawsuit by North Dakota alleging that Minnesota’s law prohibited companies from selling its coal-based power to utilities in Minnesota. The judge agreed, saying that Minnesota’s New Generation Energy Act got in the way of federal regulation of commerce.

Ruling that the state law “overreaches” and is a “classic example of extraterritorial regulation,” she suggested that if all states could craft legislation like this, “the current marketplace for electricity would come to a grinding halt.”

North Dakota, which was joined in suit by power and coal companies, celebrated the ruling, which in effect lends financial support for the continuation of its coal-run power plants. An estimated 79 percent of the state's power generation comes from coal sources.

For its part, Minnesota pointed out that the state law doesn’t prohibit utility companies from purchasing coal-derived energy from plants built after 2009, but it does require the company to offset the carbon emissions -- a point that wasn’t supported with the federal ruling.

Minnesota Gov. Mark Dayton, who has said that the state will appeal the ruling, expressed dismay about the lack of requirements for North Dakota coal plant operators to address environmental concerns.

“Prevailing winds will carry those toxic emissions directly into Minnesota. That shameful practice should not be permitted by either the state or federal government,” he said.

Michael Noble, executive director of the Minnesota-based Fresh Energy advocacy group, offered a somewhat cheery insight to the ruling. He noted that with new federal rules from the Obama administration limiting emissions from coal-powered plants, the district court’s ruling, and in fact Minnesota’s tough battle for restricting coal-powered plants, may soon be a moot point.

“They won their litigation, but the world is moving on from coal,” Noble concluded.

Still, this recent ruling does make you wonder whether we’re set up for more jurisdictional battles that presuppose that a state’s efforts to curb carbon emissions (and address climate change) are treading on federal grounds established hundreds of years ago by the Constitution. Will climate change mitigation that strives to protect a state’s environment from greenhouse gases come down to requiring a constitutional change? Or will such laws need to be federally implemented? I shudder to think that each effort designed at curbing climate change would need to undergo Congressional scrutiny, given the last year’s legislative stumbling blocks on Capitol Hill.

The results of Minnesota’s appeal may answer those questions, and no doubt states and environmental advocates will be watching to see which way these winds will ultimately blow.

Image credit: Johnathunder (CC)

Water: The Latest Trend in Eco-Clean

Remember when people boycotted movie theatre popcorn because of the high saturated fat content of the coconut oil used to pop the kernels? Time marches on, and coconut oil becomes the latest health fad.

Trends come and go in the world of eco-cleanliness, too. Now that I'm out on maternity leave, my inbox and mailbox have become full of articles and resources on keeping my home and baby clean without caustic chemical agents. Or maybe they were always full of this sort of info, but now that I have a little one at home, I'm paying closer attention. But I digress. Water. I was surprised to learn in our baby care class that even organic, sensitive skin wipes are passe. All the cool kids are using a simple washcloth (disposable or reusable) and warm water to clean their baby's booty. It makes sense, really. The alcohol in wipes can dry delicate skin, and let's be honest, adults don't soap up after every BM, so why should the babies?

The world of home cleanliness has it's own player in the "water-clean" movement too: Steam cleaning is all the rage. Haan sent me their HAAN Multiforce Pro SS25 to test, and since I'm playing SAHM for the next couple of months, I figured I'd give it a whirl. This standup steam cleaner looks like a lean vacuum, but has attachments and settings to clean tile, hardwood, laminate, vinyl, and even steam your carpets. The concept of cleanliness here is that the steam sterilizes all your surfaces, and their "CR-Motion technology" scrubs away dirt and grease. I tried it in my bathroom where our laminate floor was covered with baby-related effluent. The steam cleaner worked like a champ to lift the stains while the baby was napping, and it was great to be off my hands and knees. Word to the wise: The unit needs to rest on a special mat when it's on but not in motion, lest you burn a hole in your floor. When I rested it as directed, the unit started smoking. After 30 seconds, I realized I had the mat upside down, but it wasn't obvious which way was up at first, at least for this sleep deprived lady.

Will this steam cleaner find a place in our cleaning arsenal?

Probably! It seems useful for major floor cleanings, although for quick pick-me-ups a spray bottle and a rag are surely easier.

However, I'm not a huge gadget person; I probably wouldn't buy a steam cleaner of my own volition. The unit sells for $239 a pop, which can buy a lot of eco all-purpose cleaner (and even more vinegar). I appear to be in the minority -- people love this thing.

Readers, what do you think? Is steam cleaned the wave of the future?

Image credit: Aaron Hockley, Flickr

Human Rights and Professional Wrongs

By Adam Carrel

A minimum threshold of rights for all human beings is one of the great unrealized ambitions of the post-War era. Despite the enormous efforts of multilateral and grassroots institutions to make the United Nations Declaration of Human Rights a basic unifier across all nations, huge disparities still remain between populations, ethnicities and genders around the world.

It is a little surprising, then, that for many companies, there has been no shortage of certifiers willing to confirm that their developing country-based assets and contractors meet a minimum standard of human rights almost regardless of where they’re situated. This is not to suggest that certifying agencies have been willingly misrepresenting the effectiveness of corporate human rights programs but rather that the criteria on which human rights (or ‘social compliance’) is based has been overly simplistic.

In no instance has this been more apparent than that of the tragic collapse of the Rana Plaza Garment Factory last year, which cost more than 1,000 lives with many more injured. One striking aspect of the Rana Plaza collapse was that despite the factory and its management being demonstrably unaligned to even the most unambitious social compliance program, the factory had somehow survived the scrutiny of some of the leading social compliance policies in the apparel sector.

The global supply chain is vast, and one factory collapse, however tragic, does not itself confirm a systemic flaw in the mainstream approach to social compliance. However, Rana Plaza was only the worst in an escalating frequency of factory-based tragedies that has prompted widespread introspection within industry regarding the meaningfulness of prevailing approaches to social compliance. The effect of Rana Plaza was to push into the public domain the question of whether social compliance programs are achieving their stated objectives and, maybe more importantly, driving substantive improvements.

The effectiveness of social compliance programs will become an important consideration for corporate legal counsels and other officers managing the liabilities of corporations in the years ahead. We are quickly reaching a point where the production of a factory certification will no longer be indicative of an adequate effort to protect workers in company supply chains or to manage brand risk on behalf of shareholders.

Evaluating this risk is particularly important for those companies whose approach to social compliance draws on the standard supplier-funded, out-sourced model of social compliance as opposed to those (and there are several) who have looked to develop more innovative, hands-on relationships with producing factories. Many leading brands went back to the drawing board years ago to begin to remedy what, within industry, have been broadly shared concerns regarding the effectiveness of the mainstream approach. These concerns may be summarized as:

- A checklist approach to social compliance auditing that is skewed towards the detection of clerical errors and health and safety questions with ‘yes/no’ answers. Such approaches often fail to assess the actual health and safety culture within an operation or the root causes that underpin non-compliances.

- Too many criteria to allow companies the opportunity to meet a minimum standard of compliance.

- A limited appetite of auditors to look beyond their audit protocols to pursue suspicions of fraudulent or inaccurate representations on the part of factories and factory agents. These commonly include doctored books, undisclosed out-sourcing and coaching employees in their responses to auditor questions.

- Limited stakeholder engagement beyond factory walls to obtain an independent picture of factory conditions.

- Tolerance of agents and intermediaries providing incomplete factory listings to downstream companies.

- Social compliance standards that have not been updated to reflect the changing demographics of labor forces, i.e. Bangladesh vs. China.

- Procurements processes that may make it possible for company personnel to circumvent the social compliance standard and raise purchase orders for factories that have not had their human rights status assessed.

In terms of building off these acknowledged flaws, the following attributes are likely to be increasingly common within leading companies and those looking to reduce their exposure to future legal and reputational controversy:

1. Companies need to use third party certifiers and auditors more strategically.

One of the reasons why the social compliance industry has become so commoditized is that the cost of assessing every factory for some companies can be enormous. If the average code of conduct audit provided surety of compliance then this might still be worth it, however the fact that the present approach to certification has been shown to hide a multitude of sins means companies need to re-consider if this is money well spent.

While it is still important that every factory is assessed against uniform criteria, if the value currently added by outsourcing this to a verification agency is limited, companies could consider training their own quality assurance personnel to perform these assessments themselves. Quality assurance personnel are typically required to visit many producing factory locations anyway and typically also have a strong sense of what poor performance looks like.

Naturally the credibility of any company’s social compliance program is still predicated on third party validation, and with the money saved in internalizing the ‘check box’ component of social compliance, third parties can be engaged to perform more meaningful risk-based assessments. Such assessments should cover a large and representative sample of a company’s factory base, be executed by more experienced practitioners and their scope should be expanded to cover the root causes behind the physical indicators of non-compliance.

2. Procurement systems need to be tightened to escalate the approval process to management before orders can be placed with factories that have not had their social compliance status assessed.

Many companies already possess systems that disallow the generation of a purchase order without someone signing-off on the social compliance status of factories and this practice, if implemented broadly, could become a new minimum standard across industry.

3. Agents and intermediaries need to be brought in line with the social compliance expectations of retailers.

The rise of major -- primarily South China-based -- agents and intermediaries has removed much of the knowledge retailers had of the factories producing their goods. The representations of these intermediaries regarding social compliance should not be taken at face value given the growing evidence of undisclosed suppliers and subcontracting within intermediaries supply bases.

4. Corrective Action Plans (‘CAPs’) need to pursue cultural as well as visual change.

Improving health and safety outcomes is as much about driving behavioral change on the part of management and employees as it is improving the quality of physical apparatus. All too often CAPS are cleared on the basis of photographic evidence of a physical improvement (i.e. an unblocked exit or an illuminated exit sign) without any evidence of the development or enhancement of the management systems that should be pursuing continuous improvement in health and safety outcomes. Accordingly such physical improvements often lapse into non-compliance once manufacturing has actually commenced at that facility.

In all the soul searching that has followed Rana Plaza, two more obvious truths are finally receiving the appropriate acknowledgement:

1. Corporate commitments to human rights and vast and opaque supply-chains are mutually exclusive.

Once the tide of public and regulatory opinion mandates tangible improvements in the conditions of developing country supply chains one thing this will have to entail is consolidated factory bases with which retailers maintain more direct relationships. Only in this context will factories possess a sufficient incentive to invest in more than just cosmetic improvements and will retailers be in a position to see corrective action plans through to a sustainable conclusion.

2. Retailers are going to have to start a conversation with consumers regarding the price of human rights.

The economic models, particularly in the realm of ‘fast fashion’, are predicated on consumers buying higher volumes of lower priced items, and the relative low price of the goods themselves are predicated, often in large part, on the cheapest labor from the poorest of countries. As such, financing sustained improvements in human rights and working conditions may ultimately have to be financed by consumers paying a higher price for a higher standard of ethics. Articulating the merits of this premium to a presently under-informed consumer base will be a major challenge for industry as it tries to improve human rights issues in the global supply chain.

Image credit: Flickr/ setca_bbtk

Adam Carrel is a Senior Manager with EY’s Climate Change and Sustainability Services practice specializing in environmental, social and governance (ESG) concerns, in particular as they relate to multinational corporations. Carrel has a breadth of experience consulting on ESG matters in his native Australia and internationally with a recent focus on South East Asia and the Americas. His work commonly involves working with major international corporations in optimizing their approach to environmental management, community and government relations and corporate communications. Additionally Carrel has extensive experience supporting the sustainability reporting of Ernst & Young’s clients, either through assisting with the development of sustainability reports or by auditing their disclosures.