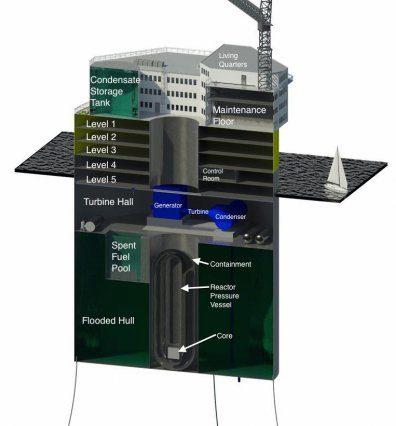

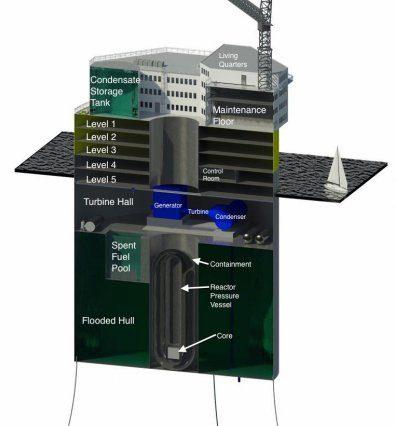

Offshore Floating Nuclear Power Plant Concept Under Development

MIT scientists are exploring what they say could revolutionize the nuclear power plant, both in terms of safety and cost. The floating offshore nuclear power plant could be constructed in a centralized shipyard, towed five to nine miles offshore, and then anchored in place.

This power plant would utilize existing oil and gas rig technology and contain living corridors, a helipad, and an underwater transmission line to carry the power to population centers. Contributing to its success, the offshore floating nuclear power plant would utilize both lightwater nuclear reactor technology and offshore platforms used for oil and gas exploration and extraction -- which helps reduce risk by using mature technology.

Allegedly, tsunami waves and earthquakes wouldn't be concerning in deeper water, unlike the vulnerability of the Fukushima power plant. In addition, the ocean can be used as a nearly infinite heat sink, making it virtually impossible for a meltdown to occur, unlike onshore plants where there is no ensured long-term heat sink.

If an accident did occur offshore, it would ensure greater safety and radioactive gases could be vented underwater, thus population center onshore would remain safe. The reactor would be located deep underwater, allowing for passive cooling by seawater, even during a potential accident.

It is getting increasingly difficult to site nuclear power plants, because of both safety concerns and the required proximity to a water source for cooling. Waterfront property is typically more expensive, augmenting the project development costs of a nuclear power plant. Proximity to population centers is ideal.

“The ocean is inexpensive real estate,” says professor Jacopo Buongiorno, from MIT. His team believes this fact will help boost the economic performance of the plant. It is likely that coastal communities, however, will be opposed to a nuclear power plant floating a few miles offshore; public concern for nuclear power plants has increased since an earthquake and tsunami in 2011 caused an accident at the Fukushima Daiichi nuclear plant complex.

The concept of an offshore nuclear power plant is not new. The idea was first raised by power utility companies in the early 1970s. The Russians are constructing a 70 MW nuclear reactor aboard a ship, the Akademik Lomonosov, which could aid in Arctic offshore oil and gas exploration. This project however has been plagued by financing problems and delays.

In the end, it is important to question if nuclear is the answer to our low-carbon energy needs. If it is, then exploring ways to potentially make it safer are essential, and perhaps looking offshore is a smart next step. It does seem like unintended consequences are likely however. Even if this offshore floating nuclear power plant utilizes two mature technologies, the exact impact on the oceans are yet to be determined. If nothing else, the heat from the plant would have an impact on wildlife. Although professor Jacopo Buongiorno states that the plant would be economical, it seems the operating costs of an offshore platform would be greater and the threat of a terrorist attack concerning.

Although the "not in my backyard" sentiment is strong with nuclear power plants, thus it is doubtful that coastal communities will view a floating plant much differently. Even if this concept is a good idea, it seems unlikely to manifest anytime soon.

For more information on the project, check out the video below.

https://www.youtube.com/watch?v=8Xi-NPDEWKc

Illustration courtesy of Jake Jurewicz of MIT's Department of Nuclear Science and Engineering

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.

Grassroots 'Solarize' Campaigns Spread Across the U.S.

Coupling the benefits of clean, affordable renewable energy more closely with social and economic development, U.S. solar power market participants, including manufacturers such as SolarWorld Industries America, are joining with NGOs and community development organizations to launch "Solarize" community solar energy programs.

On April 22, SolarWorld USA highlighted its participation in the launch of two such programs on opposite sides of the country: one in Charlotte, N.C. and another in Salt Lake City, Utah.

The latest in a growing trend, these grassroots solar energy programs make exclusive use of high-performance SolarWorld photovoltaic (PV) panels -- which are made in the U.S., installed by local contractors, and purchased by the groups at volume-discount pricing, the Hillsboro, Ore.-based PV manufacturer highlights in a news release.

Grassroots community solar

SolarWorld's involvement in the development of local community solar energy projects stretches back to 2009. Since then, it has partnered with so-called “Solarize” campaigns in 26 communities in four states to install solar panels with a rated electricity generation capacity of around 3 megawatts (MW).

“SolarWorld has supplied solar panels for community solar programs since the 'Solarize' concept was conceived by residents of a Southeast Portland neighborhood in 2009,” the company highlights in its news release. In partnership with Solar Oregon, the nonprofit Energy Trust of Oregon, city governments, solar installers, and the U.S. Department of Energy (DOE), SolarWorld has supplied more than 2.6 MW of solar PV panels in Oregon alone.

SolarWorld has also supplied PV panels to Solarize campaigns in neighboring Washington state. Run by the Northwest SEED nonprofit and electric utilities Seattle City Light and Snohomish County Public Utility District, SolarWorld has supplied its PV panels to five communities in and around Seattle since 2012.

Commenting on its involvement in the latest Solarize community-led solar energy campaigns in Charlotte and Salt Lake City, president of SolarWorld Industries America's U.S. operations Mukesh Dulani commented:

“In this exciting period of the solar industry’s development, when crowd-sourcing is emerging as a viable community financing instrument, the Solarize approach has established a proven track record and model to spark further innovation.”

Solarize Charlotte and Salt Lake City

The latest community solar energy campaigns in Charlotte and Salt Lake City “mark two important evolutions of the community solar concept,” SolarWorld USA goes on to note.

Supported by more than 20 community, faith and other grassroots groups, Charlotte's Cleaner is Cheaper coalition on April 22 launched its “Solarize Charlotte" program. The focus, as SolarWorld USA explains, is “on bringing clean, safe power to low-income communities and working families.”

Following the lead of the DOE's Solarize programs in states such as California that were early adopters of solar energy, grassroots coalitions such as Cleaner is Cheaper are now spreading the triple bottom line-based business development model to states where solar power is just beginning to emerge as a mainstream energy alternative.

The Solarize campaign in Utah adds another wrinkle to the community solar development program model: It's the first in the country to be sponsored by a university.

Dubbed “U Community Solar,” the University of Utah's campaign is offering university faculty, students, staff, alumni and campus guests discounts on the purchase and installation of solar panels. In addition, U Community Solar participants can give renewable energy credits stemming from their solar energy installations to the university, helping the University of Utah achieve its carbon emissions-reduction goals.

Images courtesy of SolarWorld Industries America

The New Energy Landscape Part II: Growth Areas for Impact and Sustainable Energy Investment

Editor's Note: This is the second post in a two-part series on the new energy landscape. In case you missed it, you can read the first post here.

By Marta Maretich

Energy is set to be a key global concern for the foreseeable future—and to continue to be an important focus for impact and sustainable investors. In this post, the second in a two-part series on the new energy landscape, Marta Maretich highlights further growth areas for energy investment.

In a recent report, the U.N. Intergovernmental Panel on Climate Change (IPCC) weighed into the debate about energy by offering its top picks for alternative energy sources to lead climate change mitigation measures. Their list of top technologies is controversial (even deeply flawed, according to some critics), yet the IPCC’s recommendations may turn out to be influential and so could be significant for impact and sustainable investors operating in the energy sector.

Nuclear power

In a post-Fukushima world, nuclear power is more controversial than ever. Germany, a global leader in greening its energy sector, is set to phase out nuclear power entirely by 2030.

Nonetheless nuclear power is central to the IPCC’s plans for climate change mitigation. Though certainly not a “renewable,” as the report claims, nuclear is a zero-carbon source of power. Despite its drawbacks, it appeals to countries worried about energy security as well as those trying to wean themselves away from using polluting coal. For these reasons, worldwide nuclear capacity is increasing, with countries such as Spain and the USA stepping up production. New reactors are going up in many counties including Taiwan, China, South Korea and Russia.

This activity may hold opportunities for impact and sustainable investors who believe that nuclear may offer the best hope for a carbon-neutral future—as well as those who are willing to back an unpopular industry as it develops better, safer technologies. Molten salt reactors—which so far exist only on paper—could produce 20 times more power per plant, cost half the price of existing reactors and consume, rather than produce, nuclear waste. It's worth noting that China has pledged to build one before 2050.

Energy efficiency

The drive toward greater efficiency is already underway as rising fuel costs push consumers to find ways to get more out of their energy spending. The quest will create business opportunities in a number of industries including construction, where energy-saving design is becoming the norm, and transportation, where more efficient vehicles are cutting fuel bills for individual consumers, companies and municipalities.

Manufacturing will be an important growth area. Energy use is becoming an issue for top managers who now see it as key to bottom-line success. This will create opportunities for growing businesses in consultancy and service delivery as companies seek expert advice on how to optimize their specific processes.

Biofuels

Biofuels have come in for a lot of criticism in recent years and now the United Nations has released a report officially warning that growing crops to make “green” biofuel harms the environment and drives up food prices. Still, biofuels are central to the mitigation pathways proposed by the IPCC, a fact that some critics, like environmental groups Biofuel Watch and the Global Forest Coalition, have attacked.This may not be sufficient reason to exclude biofuels from a green energy future, however. Promising new technologies, particularly those that convert waste into biofuel, may put this sector back on the map for impact and sustainable investors. A recent study found that biofuels derived from paper, wood and food waste could provide 16 percent of fuel needed for road transportation in Europe by 2030.

BECCS

Bioenergy with carbon capture and storage (BECCS or Bio-CCS) is another controversial technology central to the IPCC’s mitigation measures report. The process involves power plants burning biomass to generate electricity with the carbon created being extracted and stored underground for “geological timescales." BECCS could provide large amounts of carbon-zero electricity, yet there are doubts about how viable it would prove in practice and so far no plants are up and running. It may be years before BECCS can prove its worth—but watch this space as the idea of carbon capture as a necessary measure for achieving carbon neutrality gains ground.

And more…

The IPCC recommendations are notable for the many technologies they leave out. A quick scan of the alternative energy sector reveals a wealth of new approaches and processes the report ignores: micro-generation, hydrogen fuel cells and smart grids -- to name only a few. There’s evidence, too, that large public utility companies are starting to change the way they provide energy, making them justifiable investments for impact and sustainable investors. Lifestyle changes leading to reduced energy consumption will also create attractive business opportunities, for example in the areas of smart metering, transportation and green building.

The list of possible investments for impact and sustainable investors is long — and, happily, getting longer. But there is much to do if the world is going to meet increasing global energy demands while at the same time cutting emissions—and the need to accelerate change is urgent if we want to avoid the worst-case scenarios described in the latest IPCC reports.

Image credit: lightwise / 123RF Stock Photo

About the author: Marta Maretich writes about impact, sustainable and social investing for Maximpact.com, a deal listing portal and information hub for the new finance sector. She is Chief Editor of the Maximpact blog.@maximpactdotcom

About Maximpact: Maximpact is a free global portal for the social, impact and sustainability sectors. It operates as a secure web-based listing service that allows sustainability, philanthropy and CSR professionals, as well as entrepreneurs, intermediaries, and funds to share information about initiatives and impact investment deals, online. For more information on the platform or to review latest impact projects visit: www.maximpact.com. This article first appeared on Maximpact’s blog.

SolarCoin: Accelerating Solar Investment

Editor’s Note: This is the fourth post in a series on electricity-backed currency. In case you missed it, you can read the introduction to SolarCoin here, the second installment here and third post here.

By Sam Bliss

To review: SolarCoin is a digital currency designed to reward producers of solar power. One SolarCoin is granted for each megawatt-hour (MWh) of solar electricity generation.

SolarCoin is valuable because, like any computer-based currency with a block chain public ledger, it provides a trustworthy way to transact money online without an intermediary charging fees and exposing your information to vulnerability. Moreover, unlike other digital forms of money, SolarCoin represents the physical production of clean, useful energy.

Information on how to get SolarCoin is included in my introductory post, the second piece of the series describes the currency's inherent value, and the most recent post contains more details about how SolarCoin can become popular and gain exchange value.

Granting this new currency to people with solar panels at their residences and owners of large solar installations shows that SolarCoin users agree that renewable electricity from the sun is a good thing, but how does using SolarCoin actually contribute to prosperity for people and ecosystems?

More solar

In short, SolarCoin will drive the implementation of solar electricity projects. All else equal, more solar power equals less global warming, less air pollution, less freshwater consumption, slower depletion of natural resources and greater energy freedom.

As more people and business recognize SolarCoin as useful money, its value will rise and stabilize. Therefore, as the quantity and variety of goods and services that SolarCoins can buy expand, the incentive to generate solar power grows in tandem.

Adding SolarCoin as an extra reward for solar electricity producers will increase solar power production in two ways.

Increased benefits

First, SolarCoin offers added benefits to solar electricity projects, which means more solar investment.

With SolarCoin, solar electricity production can earn standard money (dollars) and digital money (SolarCoin), adding to the benefit side of of any potential installation's cost-benefit comparison. As a consequence, some ‘on-the-margin’ prospective installations whose costs would outweigh the future revenue in strict dollar terms may become good investments thanks to the value of the SolarCoins that they will earn.

Put another way, SolarCoin is another cash flow for solar power producers. This extra benefit above and beyond the money earned from selling power to electric utilities or using it to offset energy bills will increase the number of potential solar projects that make economic sense.

Decreased costs

Second, by increasing the number of projects undertaken, SolarCoin will speed the price decrease for new solar installations.

Solar projects get cheaper as we become better at making efficient panels, putting them up, and using them to capture the sun’s energy. Economists call this price drop 'experience curve effects'; as we gain more experience with solar power, it becomes more cost-competitive with -- and ultimately less expensive than -- fossil-fueled electricity.

Remember, SolarCoin makes more potential solar installations worthwhile investments because it offers additional benefits to the producers of solar electricity. The extra reward for solar power increases the rate of solar proliferation, which speeds up the ‘learning-by-doing’ process that brings down costs.

Positive feedback

By way of summary, SolarCoin offers an added reward that can increase the number of solar electricity systems built. As solar expands as a source of electricity, the price of a solar system in dollar terms goes down, further accelerating investment.

This positive feedback loop may strengthen the boom in solar installations that is already underway. In 2013, total installed capacity of photovoltaic systems in the U.S. increased by 41 percent. According to Solar Energy Industries Association President and CEO Rhone Resch, more solar generation capacity has come on-line in the U.S. over the last 18 months than the previous 30 years combined.

More good

As more electricity is generated from the sun, less is needed from fossil fuels. Hence, increasing the rate of new solar investment also speeds up the decarbonization of the electric grid and protects communities from the harmful effects of burning coal and natural gas, in terms of both local air quality and global climate stability.

Researcher Carol Olsen of the Netherlands' Energy Research Center offered some concrete numbers in a New York Times article: “Compared with electricity from coal, PV electricity over its lifetime uses 86 to 89 percent less water, occupies or transforms over 80 percent less land, presents approximately 95 percent lower toxicity to humans, contributes 92 to 97 percent less to acid rain, and 97 to 98 percent less to marine eutrophication," which is the excess release of nutrients that harms freshwater ecosystems.

We can agree that solar panels make electricity with a much smaller environmental trade-off than burning fossil fuels, which still accounted for 68 percent of world electricity generation in 2011, according to the International Energy Administration. Since SolarCoin has the potential to accelerate the shift toward solar, it seems clear that the digital currency will contribute to human and ecological well-being as it scales up.

Yet as we examine the way that SolarCoin drives the uptake of solar technology, an equity issue emerges. The currency is granted to the residents of a dwelling with a solar system and owners of large solar installations, which implicitly penalizes everyone who doesn't have a roof or yard for panels nor enough money to invest in a solar project.

The next post in the series will explore SolarCoin's implications on inequality and wealth distribution. Stay tuned!<

Photograph by Gary Chamberlain, courtesy of Wikimedia Commons

Figure courtesy of GTM Research/SEIA U.S. Solar Market Insight: 2013 Year-in-Review

Pie Chart from International Energy Administration, 2013 Key World Energy Statistics

Sam is an aspiring economist and writer. You can read his work at theblisspoint.org. Sam’s digital wallet does not yet hold any SolarCoin thanks to his technological incompetence, but you can help change that — simply send SolarCoins to: 8Rs7YHL4z5jeNenpMD3X4BnaMZstx7QwEk

Recap: Twitter Chat with Heineken: What Does It Mean to Brew a Better Future?

Last week we had a great live twitter chat featuring HEINEKEN in conjunction with the release of the company's latest sustainability report.

Heineken proclaims that sustainability has been an integral part of business operations throughout its 150-year history. Now, in 2014, the beer giant's commitments are coming to life through its Brewing a Better Future (BaBF) Program and its long-term approach to creating shared, sustainable value in four areas that it can impact directly: protecting water resources, reducing carbon emissions, sourcing sustainably and advocating responsible consumption.

Heineken recently published its 2013 Sustainability Report, which outlines the company's progress on the way to meet its 2020 sustainability commitments. The full 2013 report can be viewed at sustainabilityreport.heineken.com.

If you weren't able to join us live, I've put together a Storify including all the questions we asked and all the reader questions we had time to get to. Take a look after the jump...

Michigan Cities Building a Sustainable Energy Platform: Holland, Ann Arbor and Beyond

Editor's Note: This is the second post in a two-part series examining how Michigan cities are adopting sustainable energy efficiency platforms to recover from the economic downturn. In case you missed it, you can read the first post here.

By Dr. Haris Alibašić

The Holland Board of Public Works is a municipal utility in the city of Holland, Mich. Having a municipal utility presents a significant opportunity for advancement of the energy goals for the organization and community. In 2011, Holland developed a comprehensive community energy efficiency and conservation strategy establishing a baseline and long-term energy scenarios. The action items included in the strategy include a district heating program, Industrial Services – the “Holland Full Utility Service Bundle," a building energy labeling program, and community education and outreach -- among others.

All the elements of community-wide and organizational outreach are recognized in these plans, as well as laser-like focus on energy efficiency and support for renewable energy. One of the principle writers of Holland’s energy plans and the city’s planner, Mark VanderPloeg, commented that having a “municipal utility is a benefit to the community.” As Mark described it, the city of Holland has also completed many what could be considered “the low hanging fruit” energy efficiency projects , including lighting upgrades and innovative downtown pedestrian lighting retrofits.

Now, the city is taking things a step further. According to a recent press release, the Holland City Council and the Holland Board of Public Works approved the pricing and sale of $158.84 million in municipal revenue bonds to help fund building a combined cycle natural gas power generating facility. While Holland does not have a set renewable energy goal for its operations, its Board of Public Works will invest in renewables and significant energy efficiency projects, including downtown heating and cooling. Its commitment to renewable energy through Holland BPW was demonstrated through a 20-year contract with the Michigan Public Power Agency (MPPA). The BPW is looking to build a new natural gas facility, which will have excess thermal heat that could enable expansion of the existing snowmelt system. This provides an opportunity to start the district energy system and heating and cooling system.

A look at the city of Ann Arbor

Officials in the city of Ann Arbor have also deployed similar strategies to those used in Grand Rapids and Holland. Ann Arbor has a strong reputation of environmental planning, concentrating on climate change and sustainable energy, both in the areas of energy efficiency and renewable energy. Sustainability is institutionalized and is included in the city’s planning process, where communication of the progress in sustainability-related areas is very important. The city’s Sustainable Action Plan includes both quantified and qualified targets, and Ann Arbor factors it into its Master Plan in order to integrate sustainability and to encourage accountability and transparency.

Ann Arbor has deployed various sustainable energy strategies as part of the plan. When compared to other cities in Michigan, Ann Arbor has a strong interest in financing energy efficiency improvements in commercial buildings using “Property Assessed Clean Energy (PACE) districts to finance efficiency improvements and renewable energy systems to commercial and industrial properties through voluntary special assessments bonds.” In additional energy efficiency efforts, using existing data and “forecasting future scenarios” the city set a 30 percent renewable energy goal for municipal operations by 2015. Additionally, Ann Arbor through its a2energy outreach and education effort is reaching out and promoting energy efficiency and renewable energy to residents and businesses.

Other cities in Michigan

Other cities in Michigan have also explored and implemented sustainable energy in their operations, from Dearborn with their energy efficiency improvements, solar, and energy performance contracting for lighting in their fire houses; to an innovative performance contracting project in Farmington Hills for efficiency upgrades and conservation measures; to city-wide geothermal in Wyandotte.

Positive outcomes related to successful deployment of sustainable energy platforms in Michigan cities has a ripple effect on communities and organizations, and there are many other program and project opportunities to be explored that could benefit cities both inside and outside the state.

Image credit: Flickr/michigancommunities

Haris Alibašić directs the City of Grand Rapids’ Office of Energy and Sustainability and teaches courses and workshops in the Graduate Certificate in Sustainability program at Grand Valley State University. Haris holds a Ph.D. in Public Policy and Administration. He may be reached at halibasi at grcity.us

3p Weekend: 10 Companies Thriving in American Downtowns

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

The migration of major companies from urban downtowns to surrounding suburbs has spanned decades. Across the U.S., commuters sit idly in traffic jams while cities become blighted by decreased business activity and population loss. But as more Americans move back to once-forgotten urban centers, top companies are doing the same -- bolstering their bottom lines and revitalizing downtowns in the process.

1. Zappo's CEO is turning Las Vegas into startup paradise

In 2011, Zappo's CEO Tony Hsieh announced he was starting a $350 million fund to transform a blighted stretch of downtown Las Vegas into a hotspot for young entrepreneurs. Hsieh has big dreams with his Downtown Project -- from "empowering people to follow their passions" to creating a "vibrant, connected urban core" and the "co-working capital of the world" -- but with $200 million allocated to real estate development alone, he has a solid shot at making it happen.

Sara Corbett of Wired.com caught up with Hsieh in downtown Vegas earlier this year. (If you're craving a bit of inspiration, do yourself a favor at check the post out here. It's really worth a read in full.) Less than three years after the initial announcement, the Downtown Project team is snapping up old motel complexes and commercial buildings that haven’t flourished in decades. They've also set up a $50 million TechFund to endow promising startups, Wired reported.

2. After 40 years in the 'burbs, Panasonic moves to Newark

After the contract on its suburban office park expired, Panasonic North America relocated its headquarters to downtown Newark, N.J. Employee retention played a part in the company's decision to choose Newark over flashier urban centers like San Francisco and Washington, D.C. But as TriplePundit founder Nick Aster discovered in an exclusive interview at Fortune Brainstorm Green 2013, so did social responsibility.

Although CEO Joe Taylor told TriplePundit that Newark wasn't the most "financially lucrative" choice in the short-term, it happened to be smack dab in the middle of one of the best mass transit hubs in the U.S. -- allowing the company to retain its top talent in an environmentally and socially responsible way. The 12-story headquarters was the first new office building for Newark in more than 20 years.

3. Target test-drives downsized stores to bolster city presence

Target has been headquartered in downtown Minneapolis for more than 50 years. The retail giant expanded its operations in the city in 2012, buying up additional office space across the street from its 250,000-square-foot headquarters -- a move that buoyed the spirits of downtown property owners and investors.

Earlier this year, the company began test-driving miniature versions of its stores that will fit in urban downtowns. The first downsized TargetExpress store, near the University of Minnesota, will be even smaller than the CityTarget stores the retailer began introducing more than two years ago.

4. Dan Gilbert gives a boost to downtown Detroit

Dan Gilbert recently moved thousands of employees from his company Quicken Loans’ former headquarters in the suburbs to downtown Detroit. The conscious businessman has also purchased more than a dozen downtown properties in recent years and speaks openly about his commitment to revitalize the district.

5. New Belgium toasts to life in Fort Collins, Colo.

Since 1991, New Belgium Brewery has grown from a few bottles in a basement to the nation's eighth largest brewery -- and it's done it all in Fort Collins, Colo. While the brewery only employs 350 people in the city, its reach and influence is unparalleled.

As Trevor Hughes of the Coloradoan.com put it: "The brewery is something of a cultural touchstone for Fort Collins: The decisions New Belgium makes not only shape the beers we drink, but affect the kinds of bikes we ride, the racks we lock those bikes to and the trails we pedal along."

Over the past two decades, the company has attracted tourist dollars, driven the use of solar panels and electric cars, and even helped change state law. Now, CEO Kim Jordan is taking her change-making business prowess to the East Coast -- with the construction of a $175 million facility in downtown Ashville, N.C.

6. Futuristic hotel promises to revitalize downtown Houston

Hotel Alessandra will not only be the flashiest new hotel in downtown Houston, but it will also be the key to the district's rebirth, the hotel's architect told the Houston Business Journal in March.

“This and other projects are going to rejuvenate downtown Houston, bringing a lot of excitement and activity to the area, where people will live, work and play,” Kap Malik, design principal for the project, told the paper. “It will be a landmark building.” The 25-story luxury hotel is expected in the third quarter of 2016, just in time for the Super Bowl.

7. Little Caesars founder spurs big change in the Motor City

Dan Gilbert isn't the only one that's striving to rebuild troubled downtown Detroit. Little Caesars Pizza founder and current Detroit Red Wings owner Mike Ilitch and his family have provided a steady stream of investment to the city for the past 25 years. Projects such as Comerica Park, the MotorCity Casino Hotel, Hockeytown Cafe and the renovation of the Fox Theatre have brought millions in revenue to the city. The latest will be a $650-million arena district for the Red Wings -- planned for the city's Cass Corridor.

8. Coca-Cola expands operations in downtown Atlanta

Last year, Coca-Cola Co. announced it would open a 2,000-person information-technology office near its headquarters in downtown Atlanta, relocating some tech staff that had been based in the suburbs. With this most recent move, the company will employ more than 6,500 people downtown, reports the Atlanta Business Chronicle.

9. Northwestern Mutual doubles down in downtown Milwaukee

Although the company already maintains a hefty presence in downtown Milwaukee, Northwestern Mutual is doubling down with the construction of a massive, 1.1 million-square-foot office building in the heart of the city center. The project will create 1,000 construction-related jobs through 2017, as well as 1,900 permanent jobs for the city and millions of dollars in new tax base.

10. Companies steadily return to downtown Chicago

In recent years, at least 10 companies have relocated some or all of their business from the suburbs back to downtown Chicago, including United Airlines, BP, Gogo.com and Motorola. The district's days as an urban ghost town are long gone -- as both big businesses and young, talented employees ditch the suburbs for the city life.

Treehouse image courtesy of Downtown Containerpark

New Belgium headquarters image courtesy of New Belgium Brewery

Coca-Cola headquarters image: Flickr/psyberartist

Based in Philadelphia, Mary Mazzoni is an editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared on the Huffington Post, Sustainable Brands, Earth911 and The Daily Meal. You can follow her on Twitter @mary_mazzoni.

Is H&M Serious About Making Fashion Sustainable?

A couple of weeks ago, H&M released its 2013 sustainability report. At the beginning of the report, CEO Karl-Johan Persson wrote the following:

“At H&M, we have set ourselves the challenge of ultimately making fashion sustainable and sustainability fashionable. We want to help people express their personality and feel proud of what they wear. I’m very excited to see the progress we’ve made so far and how this will help us to make you an even better offer – and create a more sustainable fashion future.”

You can take this statement with a grain of salt, especially after the tragedy in Bangladesh last year and given that it comes from the CEO of one of the world’s largest fast fashion retailers. Still, I think it’s also important to read what H&M does to make fashion sustainable. But before diving into the report, I was curious to see what Persson wrote last year, in H&M’s 2012 report, which was published shortly before the Rana Plaza Factory collapse in Bangladesh. Here’s what I found there:

“At H&M, we think of sustainability as a word of action. It’s an ongoing journey full of heart, drive and passion with sincere direction, constantly pushing the boundaries. We take a long-term view of our business. Looking beyond short-term profits and investing in sustainability makes good business sense – and is quite simply the right thing to do.” - Karl-Johan Persson, CEO

Shortly after, 1,129 garment workers were killed in the Rana Plaza factory in Bangladesh -- putting this statement in perspective. Apparently though, the theme in these statements hasn’t changed – H&M is on a journey derived by a clear mission of making fashion more sustainable. Now it’s time to dive into the report and see if this vision has merits.

The report itself outlines H&M’s progress in 2013 and focuses on the company’s most important Conscious Actions (“Conscious is the name for everything we do for a more sustainable fashion future,” H&M explains in the report). These actions are presented through the company’s seven commitments: Provide fashion for conscious customers; choose and reward responsible partners; be ethical; be climate smart; reduce, reuse and recycle; use natural resources responsibly; and strengthen communities.

As expected the report is filled with figures showing progress. Some of them are very clear -- for example, 15.8 percent of the company's cotton now comes from more sustainable sources (2012: 11.4 percent). Some of them not so much -- 3,047 tons of no longer wanted garments collected. Is it a lot or not? While the company provides a reference point – “that’s as much textile fabric as in about 15 million T-shirts,” it’s still not clear if this figure represents an impressive achievement or just a little progress.

You might wonder why we should ask for more clarity with such numbers – isn’t it enough to know that H&M collected from its customers the equivalent of 15 million T-shirts last year? Well, I believe the answer is no, and the reason is that this recycling program is at the heart of H&M’s efforts to build a closed-loop system, making thus its business sustainable – “It’s the quickest and easiest way for our industry to dramatically reduce how many resources we use,” H&M explains on its website.

So given that H&M sells more than 550 million garments annually (2011 figures) it would be helpful if the company would give a clearer perspective on what 3,047 tons actually mean in terms of its short-term goal “to prove it is possible to 'close the loop' on textile production by eliminating waste and decreasing the environmental impact of the fashion industry.” So is it possible or not?

The lack of clear reference points is a recurring theme throughout the report. In other words, it’s really difficult to know if the progress the company has made in 2013 is good enough. Take for example the following achievements outlined on the second commitment – “Choose and reward responsible partners”:

- Fair living wage roadmap launched, enabling suppliers to pay higher wages to their workers.

- 894,975 workers in Bangladesh and India have been educated about their rights since 2008.

- First brand to sign the Accord for Building and Fire Safety in Bangladesh.

These steps sound great, but I really don’t know what the value of the education H&M provides to workers is and to what degree it improves their working conditions, and I’m also not sure whether the company’s planned fair living wage is really fair. What I’m missing here is another voice -- of a stakeholder group maybe -- that would provide a more objective perspective on these steps, telling us for example that H&M indeed deserves kudos for the leadership role it played in signing the accord. But also, as the New York Times reported, H&M was, at first, reluctant about the accord and did it apparently only after it was pressured to do so.

The bottom line is that H&M seems to be genuinely interested in sustainability, but it’s still not clear from this report if the company’s efforts so far are substantial or incremental. In other words, you won’t find in this report an answer to the question of whether or not fast fashion can really be sustainable.

Oh, and one more thing – dear H&M friends, do you really need to include in your report statements like “It breaks our hearts to see fashion end up in landfill”? You’re H&M after all, not Patagonia.

Image credit: SimonQ, Flickr Creative Commons

Raz Godelnik is an Assistant Professor of Strategic Design and Management at Parsons The New School of Design. You can follow Raz on Twitter.

The New Energy Landscape Part I: Impact and Sustainable Energy Investing

By Marta Maretich

Energy is set to be a key global concern for the foreseeable future—and to continue to be an important focus for impact and sustainable investors. In this, the first in a two-part series on the new energy landscape, Marta Maretich explores the factors shaping the landscape and highlights some promising sectors for investment in energy.

Investment in the energy sector is set to boom over the coming years. The reasons behind this are well known, especially to environmentally conscious investors: Fossil fuels are becoming scarcer, energy costs are rising, levels of industrialization are increasing, as is global prosperity -- bringing increased demand for energy as well as unwanted side effects from its use, like pollution.

Recent findings about climate change are also driving a renewed interest in energy. A series of reports from the IPCC are shining a light on the urgent need to change the way we use energy as well as the types of energy we use. According its recent report, energy is responsible for 47 percent of the increase in anthropogenic (man-made) CO2 emissions—fossil fuel byproducts linked to climate change. High carbon-intensity energy, related to economic growth in developing countries, is an important contributor.

A changing climate for investment

These statistics mean that energy use is set to become an important front in the battle against runaway climate change. The U.N. is currently using them to inform its process of forging a new international convention on climate change. When this framework emerges in 2015, this in turn will have implications for investors as governments react by establishing new policies, setting regulation and, probably, funneling more public money into mitigation measures. Whether or not you accept the idea of man-made climate change, there’s little doubt that the IPCC’s reports will affect the outlook for investing in the energy sector.

All these factors—plus the fact that new technologies and approaches are proliferating—are making energy a focus for investors of all kinds, despite the fact that some alternative energy markets have proven volatile in the past. Today there are more ways to invest in energy than ever before and everyone seems to be looking for the technologies that will replace fossil fuels in our investment portfolios as well as our economies. Fortunately, there’s increased scope for investing as the clean and green energy market continues its path of growth and diversification.

Developments in recent years seem to indicate that there won’t be a single solution to the energy question. It’s more probable that there will be a wide array of approaches that form a patchwork of solutions for different applications. Many of these will be local, rooted in culture and geography, and investors who know how to spot an opportunity at the local level will reap the benefits, as will those who know how to support energy businesses as they scale up and roll out products and services on a wider basis.

Sticking with renewables

Solar power, wind power and hydroelectric generation businesses have long been staples in impact and sustainable investment portfolios. Global growth in the uptake of these technologies has been significant and the demand for renewable power continues to skyrocket. Impact capital has played a role in bringing clean technologies forward and introducing them into new markets. As a result, renewables now represent an evolved market and continue to have strong returns.

Against this background, investors like Triodos with its renewable energy fund, have already garnered considerable experience in investing in diverse energy solutions including hydroelectric, wind and solar. Others, like the Global Environment Facility (GEF) have been instrumental in financing specific energy technologies to fit local needs in countries as diverse as China, Mexico and Egypt.

With future outlooks positive, especially in light of advances such as new approaches to managing existing grids and new technologies coming online to improve energy storage thus making wind power more viable, these sectors remain good bets as we move into 2014.

Read more about high potential energy investments for impact and sustainable investors in The New Energy Landscape Part II: Growth Areas for Impact and Sustainable Energy Investment.

Image credit: lightwise / 123RF Stock Photo

About the author: Marta Maretich writes about impact, sustainable and social investing for Maximpact.com, a deal listing portal and information hub for the new finance sector. She is Chief Editor of the Maximpact blog. @maximpactdotcom

About Maximpact: Maximpact is a free global portal for the social, impact and sustainability sectors. It operates as a secure web-based listing service that allows sustainability, philanthropy and CSR professionals, as well as entrepreneurs, intermediaries, and funds to share information about initiatives and impact investment deals, online. For more information on the platform or to review latest impact projects visit: www.maximpact.com. This article first appeared on Maximpact’s blog.

Heads Up: We'll Be At the 'Abu Dhabi Ascent' U.N. Climate Conference May 4-5

May 4-5, a special two-day, high-level United Nations meeting -- "Abu Dhabi Ascent" -- will convene in Abu Dhabi, United Arab Emirates, with the aim "to reinvigorate government and private sector actions needed to seriously address global climate change."

The conference was formally announced in February by United Nations Secretary General Ban Ki-moon and United Arab Emirates Minister of State and Special Envoy for Energy and Climate Change Dr. Sultan Al Jaber, and it will gather global leaders from government, the private sector and civil society. The meeting is in advance of the U.N. Secretary General's Climate Summit 2014, being held on September 23 in New York, "in an effort to bolster and catalyze climate action proposals."

Abu Dhabi Ascent will focus on nine high-impact areas including energy efficiency, land use and forests, finance, renewable energy, agriculture, resilience, transportation, short-lived climate pollutants, and cities. The meeting will also explore international and multi-stakeholder efforts that support ambitious on-the-ground actions.

Both Abu Dhabi Ascent and Climate Summit 2014 are precursors to the 2015 U.N. FCCC Climate Change Conference in Paris where a global, binding climate agreement will be negotiated, and as such, aim to drive political will and action in advance of the 2015 conference.

TriplePundit will be at Abu Dhabi Ascent as a guest of Masdar, a subsidiary of Mubadala, Abu Dhabi's strategic investment company. Masdar is currently delivering nearly 1 gigawatt of renewable energy to international grids, meaning that, "Today the UAE is the only OPEC nation supplying both hydrocarbons and renewable energy to the international market" according to Dr. Al Jaber. In addition, Masdar has also embarked on a journey to build the world's most sustainable city, just outside Abu Dhabi, forming a "greenprint" for how cities can accommodate for rapid urbanization, while also dramatically reducing energy, water and waste. (For a look inside Masdar City, check out this video tour and photo essay.)

The conference comes at a time when, according to a report in the San Francisco Chronicle, for the entire month of April 2014, levels of CO2 exceeded 400 parts per million for the first time. In the report, a Stanford atmospheric scientist and environmental engineer, Mark Z. Jacobson, is quoted as saying, "The rise of carbon dioxide levels above 400 parts per million is an indicator that the problem of global warming is getting worse not better," adding, " we need to focus on solutions to this problem, namely converting to wind, water and solar power for all purposes."

Please follow along with us as we report from the conference May 4-5.

Follow me on Twitter: @PhilCovBlog