Foster Farms Recalls Chicken, Sues Insurer for Rejecting Claim

Foster Farms has a problem, a big problem.

No, it isn’t its long-standing battle with Salmonella Heidelberg infections in the chicken in its processing centers, or the ongoing investigations by the U.S. Department of Agriculture, whose enforcement arm announced a recall of Foster Farm chicken the day before the Fourth of July holiday.

Its looming problem is with its insurance carrier, which is refusing to accept a claim for the $14.2 million that the manufacturer says it has lost from tainted chicken.

According to Lloyds of London, which insured the poultry manufacturer, Foster Farms' losses don’t fit the profile for a compensatable claim. But the interesting thing about this story is the wide spectrum of interpretations about just what has happened over the past 16 months and why Foster Farms is left holding the bag.

According to a letter from the USDA to Foster Farms dated Oct. 7, 2013, the agency advised the company that it planned to “withhold the marks of inspection and suspend the assignment of inspectors at the three facilities in California unless the firm submitted plans to prevent the persistent recurrence of salmonella contamination.” In the letter, the FSIS warned Foster Farms of its responsibility to ensure that its product was not “adulterated.” But it didn’t actually ever say that Foster Farms chicken was adulterated.

The U.S. Poultry Products Inspection Act, says the letter, “provides FSIS (Food Safety Inspection Service, the USDA’s enforcement arm) program personnel the authority to refuse to allow poultry or poultry food products and meat or meat food products to be labeled, marked, stamped, or the sanitary conditions of any such establishment are such that product is rendered adulterated, and provide definitions for the term 'adulterated.”

It continues with this warning by saying that the Livingston, Calif. plant “has been implicated as a producer and supplier of poultry products associated with this ongoing Salmonella Heidelberg illness outbreak. As a result, on Sept. 9, 2013, FSIS initiated intensified salmonella verification testing of various poultry products at this establishment, as well as three other Foster Farms establishments (Establishment 6137 in Livingston, Calif.; Establishment 7632 in Fresno, Calif.; and Establishment 6164A in Kelso, Washington).”

The “intensified testing” confirmed that salmonella was found both in one or more of the processing plants as well as in the products.

Yet four days later, Daniel Engeljohn, USDA’s assistant administrator for FSIS field operations, went on record saying that the FSIS found no evidence of adulterated product, and therefore did not ask for a voluntary recall.

“[The FSIS’] decision was that we did not believe the product being produced in the marketplace was adulterated, which would be what we would have to conclude to have it removed from the marketplace,” Engeljohn said in an interview with Meatingplace.com.

In the end, the USDA may not have done Foster Farms any favors by not ordering a recall, either when the salmonella was first detected, or in January 2014, when FSIS ordered the Livingston plant closed due to cockroaches. When the company attempted to file a claim with Lloyds, the insurance carrier rejected the claim because no recall had been initiated, even though the plant had been closed by FSIS due to infestation.

“We agree that ‘recall’ is not defined within our policy, however to attempt to expand the definition of this word beyond the common meaning is clearly misguided and we do not agree that any ambiguity exists,” said Jonathan Kelly, claims manager for Lloyds’ underwriter XL Group.

Foster Farms calls the decision an “exceedingly narrow definition of the word 'recall,” and has launched a suit against Lloyd’s underwriters for $12.5 million.

One of the issues at the heart of this debacle is the USDA method of determining that a recall is necessary. In its letter, it painstakingly lays out the steps it took to determine that the antibiotic-resistant form of salmonella was in the product that consumers had bought.

“The majority of case-patients reported chicken consumption prior to illness onset; among those with brand information, 80 percent reported consumption of Foster Farms chicken during case-patients' interviews,” notes the letter. “A high proportion of case-patients were hospitalized. Foster Farms has been implicated as the producer and supplier of poultry products associated with an ongoing Salmonella Heidelberg illness outbreak in several states.”

Yet determination that a recall was necessary did not come until the agency was able to definitively link the poisoning to the case of a 10-year-old child who had been hospitalized for food poisoning in June. The USDA then announced a Class I recall, which is done when the USDA feels “there is a reasonable probability that the use of the product will cause serious, adverse health consequences or death.”

Whether Foster Farms wins the suit against XL Group et al, it may still be in for more litigation. At least two different lawyers have announced that they are interested in speaking with consumers who were sickened from tainted Foster Farms meat.

For its part, the company says it has attempted to caution consumers of the importance of washing their hands and notes the apparent failure of many to do so when handling raw chicken. It sponsored a study by a UC Davis expert that shows that many consumers can potentially contaminate their food by not washing their hands often enough. Unfortunately, while the study reiterates some pretty important standards for safe handling of raw meats, its lessons may well fall on deaf ears. After 600 cases in 29 states and evidence of infection in more than one plant, consumers may be less worried about whether they should wash their hands than whether they can risk buying chicken from Foster Farms -- at all.

And with the news that the USDA's recall only extends to three days of production in March 2014, the agency may find that consumers' growing loss of faith extends well beyond the company label on their supermarket shelves.

Image credit: Public Domain/Dnor

Coming to a Store Near You: Ch-Ch-Ch Chia Seeds!

What? Ch-ch-ch Chia Seeds?

If you didn’t have a Chia Pet at some point growing up, then you were denied a normal childhood (unless you’re from the Bay Area, where owning a Chia Pet would have denied you the “hipster” label for life). These lovable terra-cotta figurines, which have spanned the animal kingdom from hippos and gnomes to Newt Gingrich and Barack Obama, brightened up many a room with their fast-growing chlorophyll afros.

After almost 40 years of selling these equally coveted and mocked figurines, Joseph Enterprises, the keeper of Chia Pets, has entered the health food business. The company has finally started to market chia seeds. And not just any chia seeds: Ch-Ch-Ch-Chia Seeds!

Naturally the question comes up of why Joseph Enterprises waited so long to market the seeds in addition to their iconic ceramic menagerie. After all, chia seeds have joined the lofty status on par with quinoa and goji berries, displacing the passé superfoods of yesterday such as flax seeds and tofu. But this is also a company that has made a mint selling other products including the Clapper, Pogo Whisk and Ove Glove. So while the adjacency appears a bit odd at first, the company’s track record bodes well for these tiny slick seeds.

As the testimonials show, chia seeds are a nutritional jackpot: rich Omega-3’s, calcium and fiber are among the nutrients these prized little seeds boast. And, unlike farmed salmon and fish oil capsules often processed from dubious sources, they are vegan. Their taste is pretty benign, too. Like those tapioca balls plunked in boba teas, they also have a slimy texture when wet, but are far more healthful and are easier to chug down.

So what Joseph Enterprises missed in timing will be compensated by the market they will corner. While chia seeds have long been in the corner health food store, and then of course scaled thanks to the likes of Whole Foods, Trader Joe’s and even Costco, the market for Joseph Enterprises’ new product has its crosshairs on a slightly different consumer base.

Just watch the television commercial and you will see: Ch-Ch-Ch-Chia Seeds are directed at the same folks who would pick up a Chia Pet at the neighborhood store. They are available at chains such as Walgreen’s and the big box stores Target and Walmart. Whether their sales will perform well at stores more known for Russell Stover candies and Red Vines remains to be seen, but in a country where obesity and related health problems are on the upswing, this is a trend much welcomed.

So what was once a niche product has become mainstream, and prices are increasing. Originating from South and Central America, entrepreneurs are trying to grow chia in North America — and, as the Wall Street Journal has recently profiled, chia is now growing in Kentucky’s Bluegrass Country. A new cash crop would certainly be welcome by farmers -- and could skirt controversies that have plagued popular foods like quinoa, which have boosted farmers’ incomes but have become priced out of range for many people whose families relied on them for centuries.

Image credit: Joseph Enterprises

Leon Kaye has lived in Abu Dhabi for the past year and is on his way back to California. Follow him on Instagram and Twitter.

Book Review: Sustainability Careers for MBAs

From finance to operations, there is a "dizzying landscape of options" for MBA careers in sustainability. Many MBA candidates who are entering the sustainability job market are on uncharted waters. Katie Kross provides clarity, tips and resources for navigating the diverse paths to sustainability careers for MBAs in the soon-to-be released second addition of her book, "Profession and Purpose: A Resource Guide for Careers in Sustainability."

Kross states that the path for sustainability careers can take numerous off-campus routes, diverging from a largely on-campus career search for many traditional MBA careers. Her book is bursting at the seams with job hunting tactics and inspirations, providing structure to a potentially daunting task. It is written both for people just beginning their careers or those wishing to switch careers after earning an MBA.

Part I: Something for everyone

Despite a variety of potential career paths -- from renewable energy to green marketing -- Kross identifies specific themes that are helpful across the board. She gives numerous examples of specific sustainability job titles, helping job seekers gain insight into potential career options. In addition, she mentions additional training and certifications specific to sustainability, such as LEED Green Associate and GRI Reporting Certification, helping career-seekers hone in on an expertise.

Some of her advice was broad enough to apply to most job-seekers, such as tips on using social media channels and networks, and others were specific to green careers, including specific websites and networking opportunities. Every paragraph, however, had some emphasis on business and sustainability -- setting it apart as a useful resource to job-seekers within this niche.

From job boards to informational interviews, the resource guide explores a variety of avenues for getting prepared and creating a career path, through both formal and informal approaches. Kross recommends throughout the book that career-seekers to do their homework by reading sustainability reports, relevant trade publications and blogs, and she says it's always a good idea to speak with people to gain insights into the market.

I found the section, "organizing our search" in Part I to be especially helpful. It even provides a general timeline for MBA candidates on specific activities and intentions, with many suggestions specific to sustainability, such as making the most of a Net Impact membership or attending U.S. Green Building Council and Sustainable Brands events.

Parts II and III: Choosing a career path

Part II of the book focuses on specific career paths, including corporate sustainability, green building and environmental conservation, with sections on trends in the field, skills needed, sample employers and key resources. It profiles people that acquired jobs in each field, with information on how they found their current position and job search tips. Each section is a goldmine for current, specific information on each career path, with insights from industry leaders.

The final section of the book is filled with job search resources, again specific to sustainability careers. It's also extremely thorough, with job posting websites, books, reports, and conferences. Even career seekers that have done a lot of previous research are likely to find some really valuable resources in this section, as it is up-to-date and very comprehensive.

"Profession and Purpose" is a must-have for MBA candidates wishing to enter sustainability careers and a very useful tool for anyone wishing to start a career in sustainability. Its 200 pages are densely packed with so much information that even the most aimless green business career-seekers will gain direction and insight for a new career path.

Image credit: "Profession and Purpose: A Resource Guide for Careers in Sustainability"

Case Study: How to Grow Without Compromising Your Mission

By Gary Groff

The organic and Fairtrade food company Alter Eco has boosted revenues by more than 40 percent annually, from $7 million in 2012 to a projected $14.5 million in 2014 — while actively advancing its mission. How did the company do it?

A key factor for any sustainable business is getting financing right. That means not only choosing the right mix of financing — equity, debt, nontraditional alternatives — but also choosing funders that understand opportunities in your sector and support your mission. The following examples show how three mission-driven companies that have used this strategy successfully.

Alter Eco: Mission-aligned investors enable impact to rise with revenue

When Alter Eco began vying for supermarket shelf space nine years ago, the company’s biggest asset was a passionate pitch. “We wanted to show that we could be a profitable business while having a positive impact on our ecosystem, our planet and the people who live on it,” said Edouard Rollet, Alter Eco’s co-founder and president.

For example, Alter Eco buys cocoa for its chocolates from the Acopagro Cooperative in the Peruvian Amazon, paying a Fairtrade price plus a premium directed to meeting community needs, such as medical coverage for farmers. Alter Eco also supports the co-op’s reforestation projects: Along with several other companies, it has helped finance the planting of 2 million trees and expects to help fund 8 million more in the next five years. As a result, Alter Eco can claim carbon-negative operations.

Alter Eco’s business model carries costs that other packaged food companies don’t face, and that added to its start-up challenges. For the first two years, Rollet and CEO and co-founder Mathieu Senard lived and worked in a one-room San Francisco apartment, with a couple of beds beside their desks. The company grew with investments from individuals and social enterprise funders Good Capital and Renewal Funds, which were as interested in Alter Eco’s mission as in its business prospects.

When the company broke even, it obtained asset-based debt financing from New Resource Bank, which has helped Alter Eco to pay quinoa farmers at the time of harvest and to buy raw materials for its innovative compostable packaging. Additional debt financing from New Island Capital, a values-based investor focused on community and environmental sustainability, is also funding increased quinoa purchases. Alter Eco expects to maintain its growth pace over the next few years.

Blue Bottle Coffee: Deliciousness, hospitality and sustainability rule

Since 2002, Blue Bottle Coffee grew from one man roasting coffee in a converted potting shed in Oakland and selling it at farmers markets, to seven Bay Area locations, six in New York and more cafes under development.

“It’s nice to have a plan, but I didn’t,” founder and CEO James Freeman told the audience at a New Resource re:think event last year. “I meet people who are so into their plan they lose their product. We just grew every year. We do a lot of things that spring out of my desire to have them.”

People organized around a clear purpose is one thing that allows spontaneous ideas to take off successfully. Challenged by his managers a few years ago to come up with a mission statement, Freeman boiled it down to three words: deliciousness, hospitality and sustainability. “Any question that comes up we can basically answer by appealing to those words,” he said.

Another key factor: “The investors and bankers I’ve chosen to work with haven’t said, ‘Well, James, you have to open 6.2 stores in the next year,’ and put me in a position where I had to do something that didn’t feel right.”

Veritable Vegetable: Organics pioneer bases all decisions on mission fit

Veritable Vegetable is a trailblazer in many ways. It was founded in 1974 as a worker collective — a part of the People’s Food System, a group organized to create an alternative food system. Over its 40 years as a dedicated distributor of high-quality organic produce, the company has helped drive demand for organics throughout California (and parts of Arizona, Colorado, Nevada, New Mexico and Hawaii), influenced organic certification standards, advocated for sustainable food and agriculture legislation, and advised other organic distributors on successful business models.

Veritable Vegetable’s revenues have grown from $45,000 in 1975 to close to $50 million in 2013, and it now serves a network of more than 600 farms, grocers, cooperative markets, restaurants and schools.

The company’s original credo, “food for people, not for profit,” is still core to its operation and translates into transparency in pricing, ethical business practices and wages, support for local food banks and wellness programs, policy-reform advocacy, and other sustainability initiatives. For example, a 2007 loan from New Resource allowed Veritable Vegetable to expand production capability while conserving energy with state-of-the-art cooler systems, heavy-duty doors and specialized lighting. A 2008 loan funded the solar panels that now supply 70 percent of its energy.

Veritable Vegetable also applies its mission standards to choosing financial and other business partners, said Daria Colner, director of marketing communications. “We make business decisions based on our values and take a long-term partnership approach to our business relationships.”

While each of these companies followed a different growth path, there is a common theme here: They’re all guided by a clear, powerful vision, and they all found funders who share their vision.

Images courtesy of Alter Eco, Blue Bottle Coffee and Veritable Vegetable

Gary Groff helps sustainability-oriented businesses obtain growth capital and make key connections. An avid surfer and environmentalist, he’s senior vice president of commercial banking at New Resource Bank and has worked with Alter Eco and Ritual Coffee, among others. Learn more about New Resource and its planet-smart banking at: www.newresourcebank.com.

3p Weekend: 5 Companies with Exemplary Customer Service

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

In a world where terms and conditions pages read like Russian novels, it's unfortunate that exemplary customer service is more the exception than the rule. But Friday isn't a day to focus on the negative.

With that in mind, this week we're tipping our hats to five companies that prove the stereotype wrong and are rewarded with happy customers and healthy bottom lines.

1. Zappos

Zappos has a reputation for providing one of the best customer experiences out there. Its attention to customer service -- and its efforts to put customers at the heart of its business model -- is an inspiration to businesses the world over.To better understand how important customer service is to the online retailer, check out CEO Tony Hsieh's speech from SXSW 2009. You have to see it to believe it, but here's a teaser to wet your palette: "Our whole philosophy is: Take most of the money that we would have spent on paid marketing and instead put that into the customer experience," Hsieh said. Watch the whole thing below.

2. Amazon

Amazon has taken a lot of flack from environmental groups for its use of "dirty" energy and failing to file climate risk disclosures with the SEC. But when it comes to customer service, the online retailer is one of the best there is.

In fact, it topped MSN Money's Customer Service Hall of Fame list for four years in a row and also made the top five in customer service rankings from Temkin, JD Power and Forrester Research. Its user-friendly website, one-click shopping, no-hassle returns and free-shipping options have attracted some 180 million happy buyers. (Their foray into frustration-free packaging doesn't hurt either.) Combined, Amazon customers buy an average of 9.6 million items a day, according to MSN Money.

3. USAA

When you think of a banking and insurance company, a joyful customer experience may not be the first thing that comes to mind, but USAA has proven to be an exception. Its banking business took the top spot in the 2014 Temkin Customer Service Ratings, which rates 233 companies across 19 industries, and its insurance arm tied Amazon for No. 2. It also received high marks from MSN Money and JD Power.

So what makes USAA's customer experience so great? For starters, it has inarguably the best insurance program for military families and veterans -- offered at rates affordable on a military salary or pension. Additionally, one out of every four employees USAA hires has direct military experience or is the spouse of someone who serves or has served, according to the company.

Beyond its outstanding commitment to soldiers and their families, USAA also boasts a whopping 13,000 customer-service agents -- meaning customers are guaranteed to connect with a real, live human on the phone rather than waging an endless battle with an automated system.

4. Marriott

Marriott, along with its Courtyard by Marriott label that caters primarily to business travelers, is the best of the best when it comes to hotel customer service. It received the highest score out of all hotels in the 2014 Customer Experience Index from Forrester Research and also scored high marks from MSN Money -- which used a small budget hotel in Tampa, Florida as an example of the company's commitment to its customers."It's right there on the hotel's website: Marriott, a multibillion-dollar worldwide chain, credits the success of one Florida property to the lady who puts the muffins out in the morning," wrote Karen Aho of MSN Money. She's speaking of Jinney Byrne, who not only bakes tasty morning treats, but also regularly checks on guests in their rooms at the Fairfield Inn & Suites in Tampa, where many stay while receiving cancer treatment. This is only one small example, but the high ranks prove it's one of many.

5. Costco

Costco proves a long-forgotten edict true: Happy employees equal happy customers. The bulk retailer is one of a select few American companies that pay a living wage to all workers, starting its employees at $11.50 per hour with an average wage of $21 per hour, not including overtime. Coincidentally, it also scored top ranks from Temkin and Forrester Research for exemplary customer service.Did we miss your favorite company? Tell us about it in the comments section!

Image credit: Flickr/gazeronly and USAA

Based in Philadelphia, Mary Mazzoni is a senior editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared in the Philadelphia Daily News, the Huffington Post, Sustainable Brands, Earth911 and the Daily Meal. You can follow her on Twitter @mary_mazzoni.

Why World Population is a Human Rights Issue

By Jennie Wetter

Today was World Population Day, and the planet celebrated by registering 165 new births every minute. Global population is currently 7.2 billion and counting, and projected to grow to 10.9 billion by 2100.

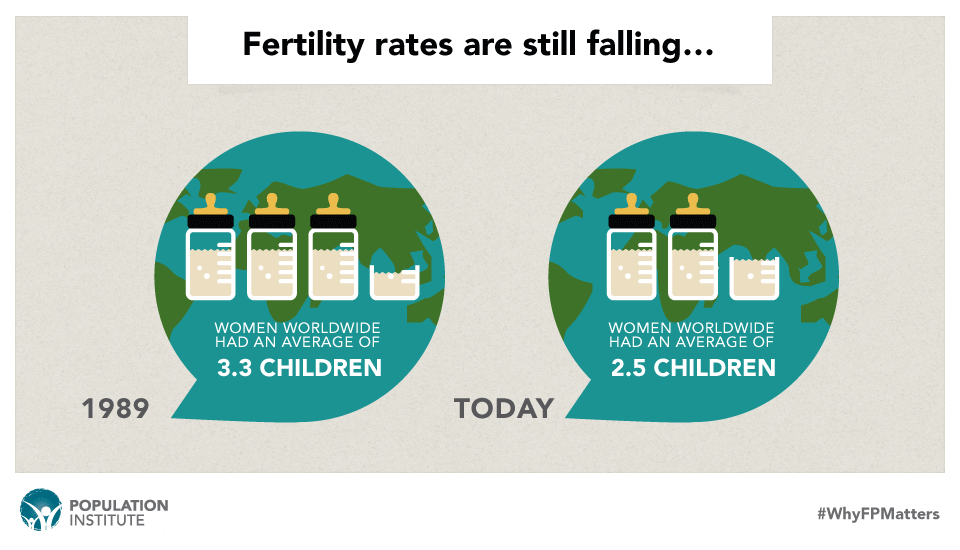

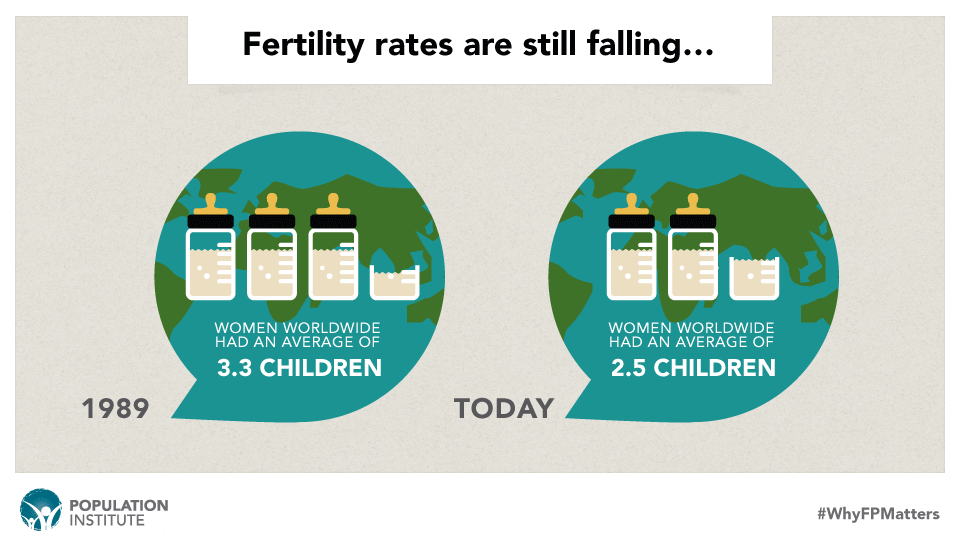

If that sounds like a lot, consider this: Those estimates are only valid if fertility rates, which have declined in recent decades, continue to drop. That’s a big “if.” If fertility rates fail to decline further, the world population could soar to 27 billion! Here is a new set of shareable infographics and short information that explains this.

The infographics make it clear that there’s a vital link between keeping birth rates falling and fighting hunger, poverty and environmental damage. Rapid population growth has already complicated efforts to reduce poverty and eliminate hunger in Africa, whose population of 1.1 billion is expected to more than double by 2050.

Over the next year the United Nations will be crafting its post 2015 development agenda. This plan will decide where the world commits its resources. Part of that process is happening next week at the United Nations where the Open Working Group will meet for the 13th and final time to craft the Sustainable Development Goals before official negotiations begin. We don’t yet know whether they will include universal access to reproductive health care and contraception, but they absolutely should, because that’s key to keeping fertility rates declining. If they don’t, the consequences of letting the population triple or quadruple are unthinkable.

As it is, with 7.2 billion of us on the planet, one out of eight of us experiences hunger. We’ve made great strides in reducing the number of people living in extreme poverty, but there are still 1.2 billion people who live on less than a dollar a day, and 2.4 billion people living on less than $2.00 a day. This means over a billion people are hovering on the edge of extreme poverty.

We already we use more resources than nature can renew each year. Every year that continues, we apply more pressure to the planet. The atmosphere gets more saturated with greenhouse gasses, forests and rivers shrink, water levels fall, and fisheries collapse. The Global Footprint Network estimates that by 2030 we will need two Earths to meet our demand for renewable resources, and if everyone in the world lived like the average American, we would need at least five planets to support us.

These trends are already unsustainable now. Imagine how they’ll track if global population growth accelerates.

Thankfully, for the time being, fertility rates are falling.. In 1989, when the first World Population Day was declared, women worldwide were having an average of 3.3 children. Today that average is down to 2.5. More and more women are using contraceptives and that is a great thing for women, their families, communities and the planet.

But many women around the world who need them still can’t get access to them. Some 287,000 women die from preventable causes related to pregnancy and childbirth every year. We could cut that to 105,000 women a year just by meeting the unmet need for contraceptives. The United Nations estimates that there are 222 million women in the developing world who want to avoid a pregnancy, but who are not using a modern method of birth control. Getting them contraceptives would only $3.5 billion a year – less than FIFA will make this year on the World Cup!

We also need to empower girls and women, make sure they’re allowed to stay in school and not forced to become child brides. They need to be able to make informed choices about using family planning services and have children by choice, not by chance.

In moving forward on the post-2015 development agenda we need to recommit ourselves to a healthier and more sustainable world, and that begins by promoting gender equality and providing universal access to family planning and reproductive health services. It’s a rights and health issue, but it’s also a matter of survival for us all. If fertility rates stop declining and the population quadruples, there won’t be any sustainable development.

Jennie Wetter is the Population Institute's director of public policy.

Walmart Sees Gold in Small Neighborhood Grocery Stores

Go small or go home. That's my motto. Or it would be if I had a motto. And it seems that's something Walmart is embracing -- to the benefit of walkable communities and of those in food deserts where lower-income people suffer limited access to fresh fruits and vegetables.

Walmart has announced it will nearly double its number of "small format" stores in unconventional locations, adding up to 300 more units around the U.S. focused on "perishables" such as fresh fruits and vegetables and meats. One of the major factors in the format's success is how it uses pharmacies -- another benefit to communities with walkability issues -- as traffic builders.

This is not to say that the stores are specifically intended to address food desert issues. Back in 2011, Walmart committed to building stores in rural and urban food deserts, but that didn't include the smaller format stores. However, the company did say stores like Walmart Express "will likely" serve food deserts. Ultimately, though, the intent of the smaller stores is to get a foothold in dense urban centers that aren't cut out for the huge, sprawling format. Heck, some cities like Chicago have been downright politically hostile to Walmarts within the city limits.

The new format seems to be a huge hit, already. Walmart expects to see up to $20 billion in growth each year from these wee little outlets by 2018.

I have mixed feelings about Walmart, of course. On one hand, there are the low wages and questionable labor conditions of their sources, and frankly, on the occasions I go there, I get the distinct impression they don't give their employees the freedom to do their jobs well; they have to call a manager for every teeny weeny thing while I, the customer, wait and wait and wait and the employee apologizes and apologizes. On the other hand, Walmart is the largest private producer of solar energy in the U.S., and they do come up with ways to serve the low-wage community. In my city, the Super Walmart with a grocery section has a bus that goes out to underprivileged areas, and that's a really important service.

When you live in a city with scant mass transit and you neither have the resources to have a car nor even know anybody with the resources to have a car, any food assistance you might get loses serious practical applications when all you have access to is food from the gas station or convenience store: overpriced bread and canned goods, potato chips, Honey Buns, and soda pop. It's a very serious matter when the neighborhood liquor store is the only thing within walking distance and has a sign that says "We Accept Food Stamps." There's not going to be anything to buy there but crap.

Walmart's foray into small urban stores with fresh foods and pharmacy access may turn out to be a huge deal for underprivileged communities, especially as it shows other retailers there's money to be made serving them. Other stores such as Target and Whole Foods are following suit, with Whole Foods experimenting with lower-cost options for staple items.

Image credit: Walmart: Source

Are We Really Ready to Divest from Fossil Fuels (and Plastics)?

Former Secretary of the California Environmental Protection Agency Terry Tamminen came up with an interesting question the other day. In a post on Fast Company, the author and founder of the NGO 7th Generation Advisors asked a simple question regarding the carbon-producing fuels that we are now bent on relegating to the environmental trash heap: Can we really afford to divest from fossil fuels?

What a great question. It’s the kind that only one who has sat in the proverbial hot seat and lobbied for consensus and compromise would be asking right now.

Divestment strategies have gained a lot of media steam these days, despite their debatable success at times. As Tamminen points out, they worked in slowing down the tobacco industry – until investors realized there were now a whole lot of cheap stocks out there to buy up. And of course, they’ve worked in some humanitarian issues, like the South Africa Apartheid in the 1990s.

But they haven’t always worked as well in either the political or corporate arena. A research team at the Catholic University of Leuven in Belgium found that companies under pressure for political or environmental reasons to divest an operation from a given international region were less likely to do so if they only had one investment than companies that operated a broad spectrum of operations in different countries in the same region. In other words, those that had all their eggs in the same basket felt less able to divest than those who had other “flexibility options.”

Tamminen points out that while it’s great to see increasing dialogue about fossil fuel divestment, we haven’t really grappled with the full impact or requirements of such a sweeping measure.

“We’ll need alternatives in more than the transportation sector,” points out Tamminen. “What about making plastics, pharmaceuticals and cosmetics? Or making artificial rubber, something that other environmental advocates applaud as they try to end the deforestation caused by rubber tree plantations?”

But the question that I’ve found myself wondering recently is: Why isn’t more attention given to incentivizing investment changes by the companies that have all or most of their money tied up in fossil fuel industries?

We use tax credits and retraining stipends like crazy to bolster the U.S. economy. We offer tax credits and other incentives to small businesses, to farmers we want to encourage to grow new crops, and families who have dependants. We offer systems to train unemployed workers, to train soldiers returning from war, to aid disabled veterans who aren’t able to work and other individuals in need of new careers. Recently, we encouraged millions of uninsured citizens to get health insurance by offering tax credits to defray the cost of monthly premiums. It’s a step that, however controversial, is expected to improve the economic wellbeing of not just those now insured, but also the country as a whole.

While it’s debatable whether oil and gas companies need tax credits to diversify to other industries, it seems to me that the real question is what we ultimately want to see from any successful divestment process. If we want companies to change their mindset, maybe we need to make it a bit easier to find a new path, rather than expecting them to simply absorb the losses that come from decreasing demand and increasingly hostile pressure of those who want change.

Perhaps establishing industry-specific federal tax breaks that encourage companies to diversify into new research areas is an answer. Or perhaps it’s graduated tax credits for new forms of renewable energy that benefit regional power companies still relying on coal power. Or perhaps it’s establishing retraining incentives that take some of the financial sting out of transitioning from fossil fuel industries.

And yes, most of these incentives would come with legislative considerations that help to ensure that political and legal quagmires such as what Minnesota recently experienced wouldn’t occur.

As we learned with the tobacco industry, simply divesting from the fossil fuel industry isn’t going to make gasoline investments go away, any more than it will transform kitchens that have relied on plastic dishes and microwave-safe bowls and manufacturing companies that have built empires from plastic fittings. The cost of restarting such industries will just become cheaper as companies loose money and struggle to dump their losses. But creating incentives that make it worthwhile for those companies to diversify into renewable energies and use the decades of expertise to retool our energy sector does more than start businesses. It helps to change mindsets about where we’re really trying to go.

Image credit: Cjp24

Redwood: The Natural Solution to a Man-Made Problem

By Charlie Jourdain

Mankind is ingenious if nothing else; and such inventiveness has allowed us to make incredible advances in science, technology and other pursuits that have made life easier. At the same time, some of our leaps and breakthroughs have resulted in unintended consequences that haven’t been kind to the environment.

At the California Redwood Association, we embrace science and technology, but we also believe that in many cases using products grown by nature can be the best decision for the environment and for the end-user. Sometimes, man does not need to add to what is already wonderfully designed.

We’ve discovered this as we’ve analyzed building products – most notably lumber used in decking. Though likely with the best of intentions, there are companies that try to use recycled plastic to create lumber (a composite, synthetic mix), but in doing so, contribute to carbon emissions through the use of fossil fuels. And just as unfortunate, composite lumber often gets dumped in landfills, where it doesn’t go away.

In the end, through what we’ve experienced and through an extensive Life Cycle Assessment and Environmental Product Declaration, we’re convinced that whenever possible we should responsibly use what the Earth has already provided. If so, we are much closer to being truly sustainable than cooking up products in the lab.

Over the last several decades, redwood lumber producers have turned the legendary wood species into what may be the most environmentally friendly building product in the world.

How? By truly embracing the attributes of redwood, which grows naturally only in a small region of the world, protecting redwood that is ancient, and then growing redwood on highly-regulated, private commercial lands zoned specifically for timber production. Redwood is so unique that it seems to have been made for building – fire resistant, insect resistant, durable, resists warping, strong and beautiful.

And how does it compare to man-made products?:

- Renewable vs. Non-renewable: Redwood is grown using the soil, sun and water, and for every tree that is harvested in a privately-owned commercial forest, seven trees are planted. Developing man-made products requires using chemicals, fossil fuels, colorants, binding agents and fillers before being molded or extruded.

- Carbon footprint: Redwood decks store carbon throughout their lives, and use significantly less energy and fresh water to be processed into lumber. A composite deck consumes 15 times more energy – 87 percent of that energy comes from non-renewable fossil fuels, a major source of carbon emissions.

- Biodegradability: Redwood is biodegradable; when it’s lived out its usefulness it goes back to the earth to help make more trees. Composite decks, however, often go to a landfill.

We also believe that it’s important to remember that the huge redwood trees that come to mind for many – the towering and legendary trees – are protected in perpetuity on 100,000 acres of parks and protected lands.

All the members of the California Redwood Association (CRA) are committed to sound forest management practices to ensure that our forests will remain healthy, beautiful and productive for generations to come. We take pride that 100 percent of CRA member owned timberlands are certified as well-managed by the Forest Stewardship Council (FSC). This means responsible harvesting at sustainable levels and protection of the natural habit.

At the California Redwood Association, we’ve seen the market come full-circle in terms of understanding the natural solution vs. man-made solutions. More and more homeowners and remodelers are realizing that to be truly green, it’s hard to improve on Mother Nature.

Charlie Jourdain is president of the California Redwood Association.

Harnessing Young Talent for the Impact Sector

By Shannon Houde

In many ways, millennials are the hope of the 21st Century -- and they've got a lot to teach us about social innovation. But to get them on board, business has to speak their language

"The youth of today" -- it's a typically derisory comment that anyone under the age of 30 will have undoubtedly heard from older people in their circle. Addicted to social media, valuing job satisfaction over job security, prizing individuality above conformity ... "The youth of today" wouldn't know real work if it jumped out of their tablet screen. But there's another way of looking at the millennial generation, and business leaders run the risk of losing out by not paying attention to them.

A fascinating report from my previous-employer, Deloitte, surveyed 7,800 members of the millennial generation across 26 countries, and the results were summed up as 'big demands and high expectations.' Millennials will comprise 75 percent of the global workforce by 2025, and the findings show that they want to work for organizations that make a positive contribution to society by addressing global challenges of resource scarcity, climate change and income equality. They also want to work for companies that support innovation, and identified the biggest barriers to innovation as management attitude, operational structures and procedures, and employee skills, attitudes and diversity. What's more, the report states that they are "ready to work independently if their needs are not being met by a traditional organization," implying an entrepreneurial spirit and attraction to alternative working structures.

This means big things for the impact and sustainability sectors. A young global generation -- connected culturally and spatially through technology, motivated by social good and seeking careers that facilitate innovation -- is exactly the kind of leadership business must harness if it is to adapt to the triple bottom line of economic, social and natural capital in coming decades.

So how do they do it? Well, if current findings are anything to go by, the answer is: badly. Another Deloitte survey -- this time looking at global human capital trends -- found that 66 percent of CEOs surveyed believe they are “weak” in their ability to develop millennial leaders, while only 5 percent rate themselves as “excellent." As Katie Fehrenbacher points out in a recent blog post: "Companies that are good at recruiting young talent talk about creating a 'mission-driven' culture. Google has known this for years and it’s only one reason why it tackles projects like putting $1 billion into clean power farms across the U.S. ... Social good is cool." More companies need to follow in Google’s mission-driven footsteps if they're to meet the challenge of attracting, retaining and developing young talent. In an interview with Inc.com, Deloitte's Josh Bersin sets out three useful strategies to help millennials see the opportunities in a company:

- They want face time, so devising leadership programs that let them spend time with senior leadership can help convince millennials that they could eventually rise to that level too.

- They want to jump around and explore new opportunities far more quickly than past generations, so map out vertical and horizontal career paths within your company clearly if you want to hold on to them.

- They need a different type of manager, one that focuses on graduating employees into better positions rather than hoarding talent, and giving them the opportunity to grow.

One of the most interesting observations around millennial talent acquisition came from a Stanford Graduate School of Business study that found that 90 percent of MBAs were willing to eschew financial gain in order to work for a company with a strong commitment to social good. This reinforces the idea that, with sufficient innovation, effective management and leadership development, impact organizations don't need the big bucks to attract the cream of today's talent - they need sustainability credentials.

According to an article on Forbes, corporations are seeing potential employees from top universities asking specifically about volunteering and community service, indicating that it is one of the criteria for an “employer of choice." As the authors put it, "companies that don’t consider magnifying their community footprint will be held accountable by future potential employees."

For today's business world, the key message is that Generation Innovation will lead the way on aligning social and environmental impact with financial performance. The key response is to put strategies in place now to ensure that they're doing it for your company, not the competitor’s.

If you’d like some practical advice and tools for incentivizing innovation and finding top young talent, contact me.

Image credit: itupictures, via Flickr/ CC BY

Shannon Houde is founder of Walk of Life Consulting, the first international career coaching business focused solely on the environmental, sustainability and corporate responsibility fields.