A Millennial's Letter to Financial Services Industry

Editor’s Note: This article originally appeared in “The Millennials Perspective” issue of Green Money Journal.Click here to view more posts in this series.

By Liesel Pritzker Simmons

As a millennial, I have recently noticed a flurry of studies, articles, and reports about my generation, authored by a diverse range of interested parties. Quite a bit of the pure sociological data suggests that the 80 million of us born between 1980 and 2000 are narcissistic, lazy, and optimistic to the point of being delusional – it’s enough to make me want to delete that selfie!

Interestingly, the selfish characteristics so rampant in the sociological studies seem to dissipate when researchers start looking at how we millennials spend our time and money. We want our work to have meaning for ourselves and the world, and we place a higher value on consumer goods that have some sort of beneficial social or environmental impact. Climate change is not a debate for us, and we probably still nag our parents about separating the trash from the recycling. Although we are generally more conservative in our investment decisions than previous generations (can you blame us?), we are willing to take on more financial risk if it increases exposure to ESG impact. Impact Assets recently authored this excellent Issue Brief outlining many of the attitudes of millennial investors.

There is little doubt in my mind that the plethora of studies on millennials, and particularly the way they intend to invest their money, will continue to multiply, for underpinning nearly every report is one essential, ubiquitous fact: Millennials will inherit over $30 trillion from the baby boomers in North America alone. This is the largest transfer of wealth the world has seen to date, and it could present an enormous opportunity for the financial services industry. If only advisors knew what these selfish, self-less millennials wanted to do with their assets…?

To add anecdotes to data, my own motivations as a millennial investor stem from a few formative experiences that fundamentally shaped my worldview. I grew up in a very wealthy family, but one that valued hard work and giving back. I was brought up with a firm understanding that I had an obligation to help leave the world a little better than I found it – with great fortune comes great responsibility, to misquote FDR and Uncle Ben from Spiderman. When I inherited control over my assets at age 21, I wrestled with what to do. Like many who inherit wealth they did not create, I view my role as a steward – though I may be making decisions regarding its management, this wealth is not “mine”.

Rich white girl goes to Africa

Confused and curious, I decided to start reading and traveling. I read Amartya Sen while volunteering in India, Jeffrey Sachs and Muhammad Yunus while working at a microfinance institution in Tanzania. It was the first time I really witnessed that level of extreme poverty, and it made me feel even more unworthy of all the wealth I was born into.

More than anything else, though, I was moved by the people I met and the complexity of their lives. Examining daily cash flows, asking women how they thought about savings or paying school fees, how they made decisions when emergencies arose – I was humbled by how complicated it all was. And markets were everywhere – even in the most impoverished places, I saw clear evidence of financial problem solving and ingenuity. I know how cliché this sounds: Rich White Girl Goes to Africa, Has Life-Changing Experience. But alas! There it is.

I returned from these experiences, energized and eager to help. So I took a portion of my assets and started a foundation, because that’s what rich people do when they are energized and eager to help. Under my mother’s leadership, the IDP (Innovation, Development, Progress) Foundation has become a leader in the low cost private school movement, focusing on expanding educational opportunities in Ghana and other parts of the world. And while I am very, very proud of the work the foundation has done, over time I found myself feeling constrained by the limits of philanthropy and aid. Many of my experiences and frustrations have been corroborated by the work of economists like Dambisa Moyo, who cites compelling data about the ineffectiveness of some aid-based development. Programs start and stop, funding agendas change, and many well-intentioned “interventions” are designed halfway around the world from the very communities they aim to help. Oftentimes, aid reduces systemic issues into technical problems that can be “solved” with two-year interventions. There didn’t seem to be much space for dignity – or the indigenous problem solving I had witnessed.

What I found to be particularly bizarre, however, was the disconnection between the talk and the action. At many philanthropy conferences, I would hear the buzzwords: We should be engaging in “strategic”, “catalytic”, “venture” philanthropy that seeks “measurable”, “scalable”, “operationally sustainable”, “market-based” solutions to the world’s problems. It seemed odd to me… If there was a growing consensus that aid should be administered like business, well, why don’t we just simply do business?? Let’s stop talking like first year MBAs and just do it.

This was the real light bulb for me. But let me be clear – I don’t think all philanthropy is bad or ineffectual. Indeed, philanthropy can take risks and prove concepts. It can fund research and pick up the pieces when disaster strikes. And philanthropy can “buy down” risk in order to attract market-rate capital to help address chronic social problems. Some very important parts of society, such as the arts, will always need at least some philanthropy to recognize meaning and value where the market does not.

What I realized, however, is that philanthropy simply isn’t enough. I needed to use all the resources I had at my disposal to help scale solutions for a broad set of stakeholders. So I set out to learn as much as I could about how to leverage business and finance as a means for social impact.

Profit with purpose

Luckily for me, there were already many, many examples of how good business practices can generate real value for communities all over the world. People were experimenting with creative ways to share that value, through innovative ownership structures like the Employee Stock Ownership Plan (ESOP) and new corporate structures like Benefit Corporations. There were financial products that cater to these types of businesses through funds or debt facilities. I can barely keep up with all the new reports and conferences about impact investing. Even the large banking institutions seem to be in an arms race over new Social Impact Bond issuances.

Read the rest of Liesel's article here.

Article by Liesel Pritzker Simmons, Co-Founder and Principal of Blue Haven Initiative, a family office dedicated to investing for-profit and non-profit capital to solve social problems. BHI looks across asset classes and capital types to find solutions-oriented opportunities both in the US and in developing markets.

She is the Co-Founder of the IDP Foundation, Inc. (www.idpfoundation.org ) a private foundation with a mission to mobilize resources and strategic support to increase educational opportunities. Established in 2008, the IDP Foundation has supported and developed a wide range of programs in the education sectors most notably the innovative IDP Rising Schools Program in Ghana, which leverages microfinance networks to empower nearly 200 low cost private schools with trainings and financial services.

Keeping the Pulse of the Planet: Using Big Data to Monitor Our Environment

By Neno Duplan

Big data has become a major buzzword in tech these days; the ability to gather, store and aggregate information about individuals has exploded in the last few years. Businesses are harnessing that data to understand consumer behavior at unprecedented levels. Meanwhile, consumer advocates worry about big data’s power to aggregate our information, and that the access to our information, movements, purchases, availability, even your Wednesday-night route home from work, can be tracked, stored very cheaply and sold to other companies. Yet with all of this tracking and gathering of data about our activities, and the subsequent concerns over privacy, most of us do little to resist the tide of monitoring.

Modern humans have become major data junkies. We are complicit in this cycle with our online activity and mobile use and have been for years. We create meticulously cultivated personal radio stations in music apps; we enter our food intake and exercise in weight-loss apps; and we record late-night feedings of infants in breastfeeding apps. We wear monitoring devices — voluntarily — to gather data about ourselves even when we sleep. We even have them for our dogs!

These activity trackers or digital monitors typically combine a wearable device with a website or smartphone app to view data collected about your movements and habits. The goal is to measure not only your steps from the parking lot to your desk, but also your sedentary downtime at work or in front of a television, bursts of intense exercise and even your sleep habits — all to create a complete picture of your most and least healthful behaviors. Some models also offer tips and set goals based on your data. The devices send all the data about your movements back to a Web-based tracking program, which displays your every move and calories burned on the sort of precise charts and graphs that economists use to monitor recessions. The idea behind having this complete picture of your activity is to spur you into action to change unhealthy habits and make better choices for your body.

How fit is the planet?

There is an opportunity for us to use this same insatiable desire to collect data for another good: environmental monitoring. Similar devices, equipped with environmental monitoring sensors such as temperature, carbon, or chemicals in the air or water can give us unprecedented information about a location’s, region’s or the planet’s overall health. In the event of an environmental disaster like a major spill, nuclear accident or volcanic eruption, we could have an instant characterization of short- and long-term impacts of that disaster on its surroundings. What could be more important than keeping the pulse of the planet as a whole? We may be able to derive more health benefits from such data than from personal monitoring. If you live in downtown Beijing, knowing about the quality of the air you breathe and the water you drink may help more with making health choices than any amount of monitored exercise.

Why we should care

Stepping up monitoring of the environment actually feeds into our desire to understand the data we monitor about ourselves. If we are monitoring ourselves to improve our health then we cannot ignore another factor that may have equally, if not even more of an effect on our wellbeing: environmental exposure to toxins. Studies as far back as July 2000[1] indicate that environmental factors may be playing a much more prominent role in the incidence of cancer than was previously believed. The conclusions of these studies over the past decade indicate that inherited genetic factors make a minor contribution to susceptibility to most types of cancers, and that the environment has an important role in causing cancer. Dr. Robert N. Hoover, of National Cancer Institute in Rockville, Maryland, said:

"Several things seem clear with respect to the importance of genetic and environmental factors in the causation and control of cancer. First, knowledge of one should expand our knowledge of the other. Information about types of environmental exposure that affect the risk of cancer should point to genes that might modify this risk, and the identification of genes associated with risk could help to indict previously unrecognized environmental risk factors. Second, when genes and environment interact to produce a risk greater than the sum of their independent effects, this interactive component can be eliminated by removing either the genetic or the environmental factor. Finally, for cancer at many sites there are limited effective options for prevention. For this reason, unique opportunities to expand our knowledge of risk factors should be exploited regardless of their source. Perhaps it is time to drop the competition implied by talking about a debate over nature versus nurture in favor of efforts to exploit every opportunity to identify and manipulate both environmental and genetic risk factors to improve the control of cancer.”

Much like with a FitBit, if we have access to more complete environmental information we can act on it faster and demand changes from polluters that will improve our health. And these changes don’t have to be very big — for instance, detecting persistent low-level emissions from a source that otherwise may go undetected for years can improve air quality in a given neighborhood, which may in turn have more of an effect on human health than any healthy level of exercise. The movies “Civil Action” (1998) and “Erin Brokovich” (2000) gave us an introduction to how environmental incidents and human exposure can impact people living in neighborhoods affected by nearby contamination. Earlier and easier access to information could prevent more of these clusters of disease from happening in the future.

Room for improvement

Unfortunately, businesses are currently not so keen on sharing the data they collect about their emissions, wastewater and energy use as they are with sharing consumer information. But they are gathering data, aggregating and analyzing it, and even acting on their activities as part of their risk-management protocols and environmental stewardship.

What’s missing is the commitment to work across an industry, region or country to measure all of these activities in a meaningful way on a global scale. What is also appalling is that some Fortune 100 companies environmental managers are reluctant to host their company’s environmental data in the cloud for fear of someone accessing it without authorization — the very same data their company is obliged to report to regulators and for which it is against the law to not disclose data if found to exceed regulatory limits. Ironically, some of the very same companies see no problem with accessing our private information from consumer cloud companies to target us in selling their products and services. Despite this resistance from business leaders, over the longer term it is idealistic to envision a world in which we can use shared environmental data to take a more concerted approach in our collective environmental stewardship.

The work that we do at Locus is aimed at addressing a monumental global problem. There is a growing need for companies to harness their huge disconnected databases and spreadsheets and mine the information. In a decade or so, planet Earth may be a meshed grid of static sensors coupled with movable ones installed on people, transportation devices, and other moving objects to collect data in real time. The conversation about the environmental landscape has evolved drastically over the last 50 years as we continue to comprehend the extent to which human activity has affected the planet. Companies and society need a collective and holistic understanding of the problems we face.

The only way to understand the full picture, and in turn to act meaningfully on a global level, is for all individuals and companies to understand the impact of their activities. It’s impossible to mitigate the risks and effects of those activities to the planet when we don’t have the data to characterize the problem and see the full picture. Perhaps someday we will have environmental data sharing among all public and private organizations, the regulatory bodies that govern them, and the scientific community at large- but any coordinated effort is years in the making. One of the impediments to institute a change like this lies with the government. So far, there have been no imposed data exchange standards; a prerequisite for a broad data exchange. In the meantime, Locus is ensuring we are ready to help tackle the problem one site, one facility, and one enterprise at a time.

Image credit: Flickr/alper

Neno Duplan is the president & CEO of Locus Technologies, an environmental data management software company that’s been providing businesses with the power to be green-on-demand since its founding in 1997. Locus’ cloud software enables companies to organize and validate all key environmental information in a single system, which includes analytical data for water, air, soil, greenhouse gases, sustainability, compliance, and environmental content. For more information on Locus Technologies, visit: www.locustec.com.

Kimberly-Clark Releases Sustainability Report

Kimberly-Clark is a big company with well-known brands like Scott, Depends and Huggies. It has also made some real strides in sustainability, as its latest annual sustainability report shows.

The company achieved a 26.4 percent reduction in water use in manufacturing in 2013, beating its 2015 goal of 25 percent. The report attributes the reduction to a more efficient manufacturing footprint, water conservation programs, and upgraded water and wastewater systems.

All totaled, Kimberly-Clark completed six major water reduction projects last year. For example, it made upgrades to the wastewater system at its Northfleet Mill that allows more than half of the wastewater to be recycled and reused.

When it comes to sourcing, Kimberly-Clark has also set lofty goals. The target is to source 100 percent of its wood fiber from suppliers who have achieved third-party certification of their forestry activities by 2015. Clearly, the company can meet those lofty goals as it met its target in 2012. A 2016 target is to achieve 100 percent chain of custody certification. All of the Kimberly-Clark tissue mills in North America and Europe are already chain of custody certified, along with about 50 percent of its mills in other regions. By 2025, the company plans to source 90 percent of the fiber in its tissue products from environmentally-preferred sources, including Forest Stewardship Council (FSC)-certified wood fiber, recycled fiber and sustainable alternative fibers. It has already sourced 71.7 percent from environmentally preferred sources.

Reducing waste sent to landfill

Generating waste is a natural part of the manufacturing process, but Kimberly-Clark wants to reduce the manufacturing waste it sends to landfill.

The target for 2013 was to have 85 percent of its manufacturing waste diverted from landfill. Unfortunately, it only achieved of 81.6, but it was an increase from 78 percent in 2012. It is on track to “be near 90 percent landfill free by the end of 2014,” according to the report. The goal for 2015 is to be 100 percent landfill free.

One way the company is striving to meet its goal is by reducing the amount of waste it makes in production. Another way is by developing relationships with recyclers. Its internal scrap sales team (KimCycle) generated $28 million sales in the U.S. and the company's health care operations in Mexico in 2013. Its Epping, South Africa operations sold 572 tons of diaper trim to a recycler that produces plastic materials such as park benches. Recycling saves money, as the monetary savings for selling the waste was over $200,000.

Reducing greenhouse gas (GHG) emissions

Kimberly-Clark has developed a corporate-wide GHG inventory of the six major GHGs and reports progress annually based on detailed Environmental Protection Agency (EPA) protocols. The target is to reduce GHG absolute emissions from manufacturing by 5 percent from a 2010 baseline by 2015. It achieved a 3 percent reduction in 2013 in absolute GHG emissions at its manufacturing facilities from 2012 and a 6.4 percent reduction from 2010.

Employing renewable energy and reducing energy use

Kimberly-Clark employs renewable energy in a number of locations, including biofuels from wood waste and landfill gas in the U.S., Switzerland, Brazil and Thailand. It has solar installations in the U.S. and Italy, and cogeneration at four manufacturing facilities. Its newest cogeneration project is at its facility in Millicent, Australia which produces over 90 percent of the energy needed for the facility. In addition to renewable energy, the company has energy reduction initiatives. From 2012 to 2013, its manufacturing facilities reduced energy over consumption by 50 percent.

Image courtesy of Kimberly-Clark

Dr Pepper prescribes healthy lifestyle with Let's Play initiative

Video games and TV may take a backseat for many kids this summer if US soft drinks giant Dr Pepper Snapple (DPS) Let's Play initiative takes off. The programme aims to address the decline of active play in communities across the US by providing the tools, spaces and inspiration to make play a daily priority.

The launch was kicked off with a special citywide event, #LetsPlayChicago, where DPS together with its partner organizations KaBOOM! and Good Sports, announced the building of a new school playground and presented more than $68,000 in new sports equipment to community organizations across Chicago.

“Through our Let’s Play initiative, we are committed to promoting healthy lifestyles built on balance – balancing calories consumed with calories burned,” said Joe Rowland, Sr. VP-Central Business Unit General Manager for Dr Pepper Snapple.

“As an employer of more than 1,000 Chicago-area residents with thousands of retail customers serving millions of local consumers, we have a stake in the future of this community. That’s why we are committed to working with our partners at KaBOOM! and Good Sports through Let’s Play to provide opportunities for active play for kids and families in Chicago.”

China becomes world's biggest solar market

The global solar market is shifting from Europe to Asia, finds a new report from Hanergy and China's New Energy Chamber of Commerce.

According to the Global Renewable Energy Report 2014, China became the world's biggest market for solar power in 2013, with the country's newly installed photovoltaic generating capacity jumping 232% on-year to 12 gigawatts (GW).

Financing activity also reflects the shift. China accounted for the largest proportion of global solar industry financing at$23.56bn, equivalent to the entire amount raised in Europe.

The report also notes the continued move from fossil fuel to renewable energy. Total global power generation grew 4.3% from the previous year, to 22513.8 terawatt-hours (TWh), while renewable energy power generation grew at 13% per annum, accounting for 5.2% of the world's total output.

"Governments are turning to greater use of renewable energy to tackle pollution and deliver energy security, underpinning growth momentum in the global renewable energy industry," commented Li Hejun, chairman and ceo of Hanergy & president of the China New Energy Chamber of Commerce.

The report can be downloaded free of charge here.

3p Weekend: 10 Companies That Stand for LGBT Equality

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

As marriage equality legislation makes its way through courtrooms across the country, it's clear that equality will soon be the norm rather than the exception. While some companies still hang on walls of shame across the blogosphere for their persistent opposition to LGBT equality, an ever-growing list of forward-thinking firms are turning up the volume in their support for diversity.

1. Nike

Nike is three years into its #BeTrue apparel and footwear line that promotes LGBT equality. Last year, the company donated $200,000 in proceeds from that line to the LBGT Sports Coalition, a nonprofit formalized in June 2013 at Nike's annual LGBT Sports Summit in Portland, Oregon.The company also started the Nike Equality PAC to support same-sex marriage in Oregon last fall, which included $100,000 in up-front capital from the company and an additional $180,000 from its executives.

2. Levi Strauss & Co.

Levi Strauss & Co. has a long history of supporting equal rights. It partnered with White Knot for Equality in 2009 and 2010 to feature white ribbons on its iconic blue jeans in support of same-sex marriage. In 2012, the company linked up with the Human Rights Campaign to produce men's and women's T-shirts in support of marriage equality."Levi’s has always been a tremendous voice for equality," HRC President Joe Solmonese said in a 2012 press release. "From ensuring fairness in California by rallying business opposition to Proposition 8, publicly supporting marriage equality in New York with specialty-designed storefront windows and scoring a 100 percent on HRC’s Corporate Equality Index, Levi’s has been a long-standing and ardent supporter of marriage equality."

3. IBM

The fourth largest company in the world, IBM makes diversity a core part of its business model. The company has 43 LGBT diversity network groups around the world -- 19 in the United States, 16 in Europe, four in Latin America and four in Asia Pacific -- and featured a section on employee inclusion in its most recent corporate responsibility report. It has also rated a perfect 100 on the Human Rights Campaign's Corporate Equality Index since 2003 and is named one of the organization's "Best Places to Work" for LGBT equality.

4. Honey Maid

In early March, Honey Maid launched its “This Is Wholesome” ad campaign featuring several “unconventional” families, including a family with two dads. After the ad drew criticism from religious and anti-gay circles, the company released a follow-up video on social media addressing both the negative and positive comments it received. The ad itself is enough to bring a tear to your eye, and the company's willingness to double-down on its position about what makes an "all-American" family proves it stands on the side of equality.

5. Caesars Entertainment

Earlier this year, Caesars Entertainment celebrated New Jersey's legalization of gay marriage by offering one lucky couple an extravagant $50,000 wedding package at one of the company’s Caesars, Harrah’s, Bally’s and Showboat resorts and casinos in Atlantic City. The company has also maintained a perfect 100 in HRC's Corporate Equality Index for seven years in a row and is named as one of the organization's "Best Places to Work."

6. American Airlines

American Airlines launched its Rainbow campaign, a dedicated sales staff and website to serve the LGBT community, way back in 1994. The company has also scored consistently high marks in the HRC's Buyers Guide and Corporate Equality Index and appears on the organization's "Best Places to Work" list.7. Google

Google strives to make its workplace more inclusive on every level. Joining the ranks of employee resources groups for veterans, women and multiple nationalities, Google's Gayglers group is made up of LGBT 'Googlers' and their allies. "The Gayglers not only lead the way in celebrating Pride around the world, but also inform programs and policies, so that Google remains a workplace that works for everyone," the search giant writes on its website.The company also isn't afraid to go public with its support for the LGBT community. In 2012, it launched its Legalize Love campaign to support LGBT rights around the world. It has also changed its iconic search bar to rainbow colors on many occasions -- perhaps most famously during the 2014 Sochi Olympic Winter Games, in protest of Russia’s anti-gay legislation.

8. Gap, Inc.

Gap, Inc. established its Gap Gay Employees, Allies & Resources (GEAR) program back in 2006 to create an inclusive and supportive environment for LBGT employees. More recently, the company took to social media in support of the Supreme Court's decision to kill the Defense of Marriage Act and California's Proposition 8. It also scored a perfect 100 on HRC's Corporate Equality Index and was named one of its "Best Places to Work."9. Starbucks

Earlier this year, former BP CEO John Browne released a book, “The Glass Closet: Why Coming Out Is Good Business,” about his double life as an executive and a closeted gay man. When speaking to the press about the business case for equality, Browne, who was forced to resign from his position at BP after being outed by a British tabloid, pointed to Starbucks as a diversity success story.

The coffee giant's corporate leadership discussed its support for same-sex marriage at a 2012 shareholder meeting, resulting in a boycott by the National Organization for Marriage. A year later, an angry shareholder addressed the company’s annual meeting, blaming the company’s political position for its less-than-stellar earnings in the quarter after the campaign. In response, Starbucks Chairman and Chief Executive Howard Schultz said, “Not every decision is an economic decision … We employ over 200,000 people in this company, and we want to embrace diversity. Of all kinds.”

10. Apple

Apple donated $100,000 to defeat California's Proposition 8 way back in 2008. When Prop 8 and DOMA were defeated in the Supreme Court last year, the company had this to say: "Apple strongly supports marriage equality and we consider it a civil rights issue. We applaud the Supreme Court for its decisions today."Apple is also well known for its workplace diversity and boasts a perfect score in the HRC's Buyers Guide and Corporate Equality Index.

For even more companies that stand for equality, check out the HRC's Buyers Guide and Corporate Equality Index online.

Image credits: 1) Flickr/heatherclot 2) Human Rights Campaign 3) Screenshot of Google homepage (taken by Mary Mazzoni on Feb. 7, 2014)

Based in Philadelphia, Mary Mazzoni is a senior editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared in the Philadelphia Daily News, the Huffington Post, Sustainable Brands, Earth911 and the Daily Meal. You can follow her on Twitter @mary_mazzoni.

S&P Acknowledges Role of Income Inequality in Downturn

There has been a well-documented trend over the past 50 years to tweak the rules of the economic game to favor those at the top. The movement has been called “trickle-down economics,” among other things. Though it was mostly perpetuated by greed, it was consistently justified as being good medicine for the economy, even if it tasted bitter to those at the bottom, or even to those in the middle who found themselves drifting in that direction.

Now, a new report, issued by mainstream economic authority Standard & Poor’s (S&P), acknowledges, perhaps for the first time, that the extreme level of income inequality in this country is actually hurting the economy. In fact, the revered oracle has actually cut its forecast for economic growth (from 2.8 percent to 2.5 percent) based on these conditions.

The rationale behind this is simple. Consumer spending is responsible for 70 percent of GDP. Poor people don’t have much to spend, but they tend to spend every bit of it. Wealthy people tend to spend a smaller proportion of their incomes. So, as more and more wealth is concentrated in the hands of the very rich, less of it is circulated through the economy. That’s exactly what has been happening. Between 2009-2010, for example, income growth of the top 1 percent was 15 times higher than everyone else. Setting policy that gives those at the bottom more, by adjusting tax rates or increasing wages, will provide more direct benefit to the overall economy than piling ever more into the bulging bank accounts of those at the top.

This has been the subject of some controversy, with those in the investment community claiming that investment, not consumer spending, is the major driver. That idea is now being debunked by S&P, which acknowledges that “changes in federal tax policy over the years has exacerbated inequality, as tax rates for top earners have fallen faster than rates for average Americans.”

Henry Ford understood this logic back in 1914, when he more than doubled the wages of his workers, while shortening the work day from nine to eight hours. Conservatives, even today, would be aghast at such a move, though it proved to be successful. Ford understood that if his workers could afford to buy cars they would, and they did, by the thousands.

This is all very interesting, you say, but what does it have to do with building a more sustainable economy? Actually, it has quite a bit of relevance. For one thing, people who are totally strapped for cash tend to shop for price first. They tend to look at greener or healthier items as a luxury. This phenomenon is a major driver behind the obesity epidemic in this country. Fast food, which is high in fat and sugar, is cheaper than healthy food and it’s all many families can afford. Likewise, low-income people hold on to old cars, even if they are gas-guzzlers, and buy the cheaper incandescent light bulbs even if they use a lot more energy. As long as there is a market for these unhealthy and inefficient items, companies will continue to produce them.

Then there is the Walmart phenomenon. Walmart came into being and then became the largest company in the world by taking advantage of this dynamic. People on dwindling incomes have no choice but to shop where prices are lowest, even if that means buying goods that are almost exclusively made overseas by peasants who are paid pennies on the dollar compared to the American worker. This has decimated the American workforce, closing U.S. factories and driving a positive feedback loop for the continuing downward spiral of the middle class, while boosting profits and stock options for those at the top. Millions of tons of goods are now being shipped from thousands of miles away, produced in countries with little in the way of social or environmental protections.

This all goes to say that if working class people earn a little more, they could make different choices, better choices that would support healthier families, a healthier economy and a healthier society.

Then there is the political dimension. Sadly, our political process has become corrupted by the influence of campaign contributions which candidates need to get their message heard on mainstream media. Today, a small handful of ultra-wealthy individuals are driving an extreme self-serving agenda that they are powering with millions in contributions. Their agenda tends to support the status quo, which was built in a day when profit was the primary factor, and businesses were not asked to take responsibility for the impacts of their actions. Recent laws and Supreme Court decisions have allowed this to continue despite its corrosive impact on our society. These large donations could be countered by small contributions by a large number of people representing the broader society, but many people can’t afford to give even a dollar.

Finally, there is education. The S&P report says that the economy could grow by additional 0.5 percent annually if the average student stayed in school even one more year. But with so many families at or near the poverty line, many young people drop out of school to go to work, in order to help their families meet expenses. This too impacts sustainability, as people who are educated are more likely to appreciate the longer-term perspective entailed by the sustainability journey.

The S&P report is encouraging news that even mainstream economic organizations are beginning to see how things fit together.

Image credit: Michael Coglan: Flickr Creative Commons

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

Tax-Advantaged U.S. Oil and Gas Companies Reap Huge Gains

Akin to health care, U.S. tax policy is one of those perennial, politically divisive issues that everyone seems to agree needs reform, but change is never forthcoming. President Barack Obama's efforts to get U.S. corporations to repatriate the huge sums of money they hold in offshore banks and tax havens by invoking economic patriotism has been met by the by-now traditional blowback from self-professed “free market” neoconservatives and “pro-business” interests.

Avoiding U.S. taxes, American multinationals have stashed some $1.95 trillion in offshore banks, a year-over-year increase of 11.8 percent from 2013, according to a Bloomberg News study. Despite claims to the contrary, data from the U.S. Federal Reserve show that the effective U.S. corporate tax rate has been declining almost continuously since the early 1950s. Furthermore, while the share of federal revenue paid in by individual U.S. citizens in taxes is now approaching 50 percent, that for U.S. corporations has dropped to around 12 percent.

U.S. corporate tax policy, moreover, is at odds with broadly beneficial goals being pursued by the Obama administration, state governments, businesses, communities and individuals across the U.S., such as the drive to reduce greenhouse gas emissions and foster the transition to cleaner, sustainable energy resources. Besides continuing to be heavily subsidized, the U.S. oil and gas industry reaps huge gains from tax advantages unavailable to other types of businesses, according to a study from Taxpayers for Common Sense (TCS).

Gaming the U.S. tax code

Internationally, overall U.S. taxes in 2008 amounted to 27.3 percent of GDP, at the bottom-end of the scale according to a comparative study of tax rates across 33 OECD (Organization for Economic Cooperation and Development) countries. The OECD average was 36.2 percent.

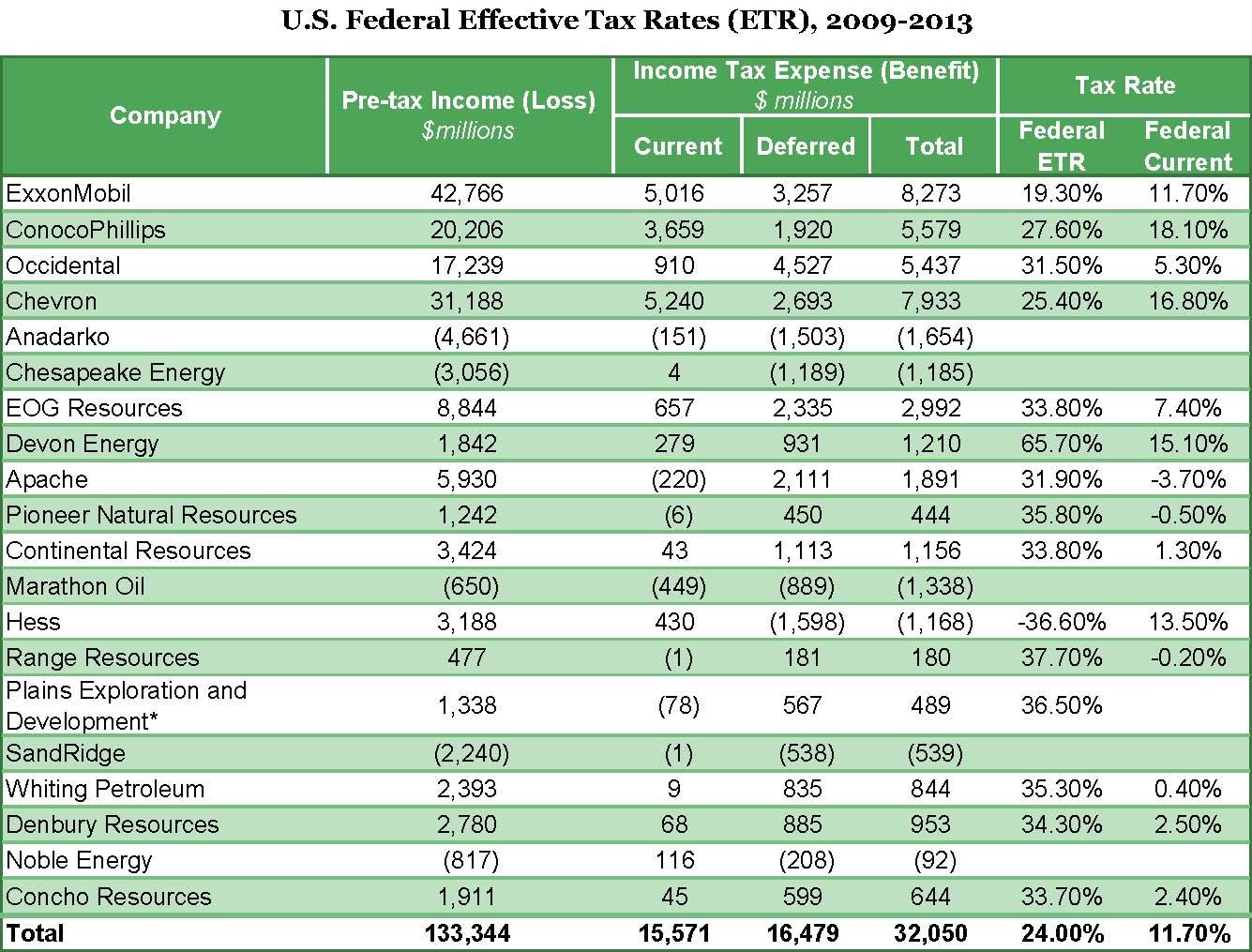

Zooming in on large, U.S.-based oil and gas companies, they “paid far less in federal income taxes than the statutory rate of 35 percent” from 2009-2013, according to TCS's “Effective Tax Rates of Oil and Gas Companies: Cashing in on Special Treatment.” Furthermore, as the TCS report authors explain, “Thanks to a variety of special tax provisions, these companies were also able to defer payment of a significant portion of the federal taxes they accrued during this period.”

Twenty of the largest oil and gas companies reported a total $133.3 billion in U.S. pre-tax income over the five-year study period. The total of federal income taxes they paid: $32.1 billion, an effective federal tax rate of 24 percent – 11 percent below the statutory rate. In addition, special provisions in the U.S. tax code allowed them to defer payment of more than half this tax bill.

Actually, these oil and gas companies paid only $15.6 billion in federal income taxes over the past five years. That translates into a current tax rate – the amount of U.S. federal income tax paid regularly every tax period – of 11.7 percent, the report authors highlight.

Paying more taxes abroad than at home

Four of the biggest U.S.-based oil and gas companies – ExxonMobil, ConocoPhillips, Occidental and Chevron – accounted for 84 percent of the group's total income and 85 percent of its tax liability. Collectively, the four's effective rate from 2009-2013 came in at 13.3 percent.

Smaller U.S.-based oil and gas companies paid in an even smaller share of their tax liability on a current basis, TCS found. Excluding the big four, the remainder of the companies studied deferred over 87 percent of their tax liability. They had an effective U.S. income tax rate of 28.9 percent, but a current tax rate of just 3.7 percent.

Just how egregious this can get is illustrated by the following: “Many of the companies deferred more of their federal income taxes than they actually paid during the last five years.”

Occidental Petroleum's tax bill from 2009-2013 totaled $5.4 billion, TCS' researchers found. It deferred payment of $4.5 billion, or 83 percent. Of a total federal tax bill for the period of $1.2 billion, Continental Resources deferred $1.1 billion.

Over the five-year period, the amount of taxes Devon Energy deferred more than doubled from $1.9 billion to $4.8 billion. Apache's rose from $2.6 billion to $7.9 billion.

Amazingly, the total amount of net deferred tax liability for some of these U.S.-based oil and gas companies has grown to represent a significant share of their net worth. ConocoPhillip's total deferred tax liability amounted to $22 billion as of year-end 2013, about 42 percent of its shareholder equity. Denbury Resources' deferred tax liability grew to represent about half its reported shareholder equity of $5.3 billion.

What's more, these companies paid “dramatically less” in U.S. income taxes than they paid to foreign governments over the same period, which totaled some 46.2 percent of their total foreign pre-tax income, TCS highlights. Generally speaking, these foreign governments don't permit taxes to be deferred, so the companies paid out 99 percent of some $254.2 billion in accrued tax liabilities to foreign governments.

*Image credits: 1), 3) Taxpayers for Common Sense; 2) U.S. Federal Reserve via Wikipedia

Beijing to Phase Out Coal

Local authorities in Beijing announced that the city will ban coal sales and use by 2020 to reduce air pollution, Xinhua News Agency reports.

Six Beijing districts will stop using coal and will close coal-fired power plants by 2020. Coal use is expected to drop to less than 10 percent by 2017. Other fossil fuels, including fuel oil, will also be banned.

Coal burning accounts for 22.4 percent of Beijing’s PM 2.5, small airborne particles that contribute to smog. Coal use also accounted for 25.4 percent of Beijing’s energy use in 2012.

The main driver for coal reduction is air pollution, which is notoriously bad in Beijing. Back in February the Guardian reported that Beijing spent a week “blanketed in a dense pea-soup smog.” Beijing’s concentration of PM 2.5 particles rose to 505 micrograms, far above the 25 micrograms the World Health Organization recommends as a safe level.

In 2013, 92 percent of Chinese cities didn’t meet national ambient air quality standards, and coal burning is responsible for almost half of China’s overall PM 2.5 pollution.

China is the world’s biggest energy consumer and leading greenhouse gas (GHG) emitter, according to a Greenpeace report. In 2013, coal accounted for 65 percent of the country’s overall energy use, which makes it the most coal-dependent country among top energy users.

China accounts for almost half of the world’s coal use, and its dependence on the dirty fuel increased steadily in recent years: Its coal use and emissions grew an average of 9 percent a year from 2000 to 2010. In 2010, China’s increase in coal-fired power generation capacity equaled Germany’s existing generating capacity.

Last September, China’s State Council released an “Airborne Pollution Prevention and Control Action Plan,” which acknowledged that tackling air pollution will require significant reductions in coal use. Specific coal use targets in provincial action plans accompanied the report and included coal consumption caps for several provinces. Many provinces have already committed to reducing coal use by 2017.

“No other major coal consuming country has ever implemented such rapid changes in their coal policies,” the Greenpeace report states.

While coal use is decreasing, China is undergoing a rapid renewable energy expansions. In 2012 China’s wind power production increased more than coal-fired power production. China installed more power solar panels last year than any other country, and the amount installed was more than China added in all the years before 2013 combined. By the end of 2013, China made the list of countries leading the world in total installed renewable power capacity, a Renewables 2014 Global Status Report revealed. China topped the list for non-hydropower capacity, surpassing the U.S.

Image credit: Bobak

Coca-Cola to Invest $5B in Sustainable Development Across Africa

Africa is the last frontier for global investment, and beverage companies in particular are moving in quickly. One of them is Coca-Cola, which has long used its distribution network to help deliver medical supplies in countries such as Ghana and Tanzania. Now the company promises to invest an additional US$5 billion in sustainable development projects through the end of this decade.

By several estimates Africa has six or seven of the world’s 10 fastest growing economics, so Coca-Cola’s focus on the continent should not be surprising. Its largest competitor, PepsiCo, has also ramped up investment in Africa, and brewing companies also have their sights on Africa due to its growing middle class and untapped marketing potential. Before these purveyors of fizzy drinks and beer can entrench themselves in these markets, however, much work needs to be done.

To that end, Coca-Cola’s new round of investment will tackle a bevy of challenges prevalent throughout Africa. In addition to new bottling plants, updated equipment and training, Coca-Cola has promised programs to tackle some of Africa’s social and environmental problems. The company says it will develop initiatives that will improve safe water access, women’s economic empowerment and “sustainable sourcing” programs.

It behoves Coca-Cola and its peer companies to take on such an agenda for two main reasons: economic security and social responsibility. One of the biggest challenges to investing in Africa is the country’s infrastructure, which can stand in the way of reliable manufacturing and distribution. Plus the local population needs to be trained to ensure the company has a market that makes it possible to buy and sell their products — not too different from what technology firms face in Africa. And then there are the local sensitivities. A company that wishes to use water in a region where far too many people struggle to gain access to it has got to ensure all can tap into this resource. Boosting local agriculture can also ensure local populations have more stable sources of food while companies also have a reliable supply chain. With advocates increasingly louder and more consumers aware of the “global land grab” occurring across the world, especially in Africa, multinationals must ensure they are partners in this region, not exploiters.

Coca-Cola insists its development efforts in Africa, which in total will reach US$ 17 billion by 2020, will address all of these problems. The launch of one program, Source Africa, intends to partner with small farmers to ensure food security while guaranteeing local ingredient sourcing. The company also says it will expand its commitment to its Replenish Africa Initiative (RAIN) with the goal to triple the number of citizens who gain from safe water access and sanitation — and says the programs’ reach will extend into 37 of Africa’s 55 nations. In sum, like many of these programs we hear about, the list of Coca-Cola’s promises is long. What will really matter is how the results will bear fruit in a region with much potential that has suffered far too much disappointment.

Image credit: Coca-Cola

Leon Kaye has lived in Abu Dhabi for the past year and is on his way back to California. Follow him on Instagram and Twitter.