New website to help build market for sustainable finance

National Ethical Investment Week has rebranded as Good Money Week in an effort to make the week more relevant to a mainstream audience.

As part of this strategy it has launched a new website - Goodmoneyweek.com - which will act as a hub for news and events as well as raise awareness of and build the market for sustainable and ethical investment and finance.

Good Money Week’s mission is to support the growth of the UK sustainable finance market and ensure everyone who utilises a financial product or service – from current accounts to investment portfolios - understands the influence of their financial decisions and the importance of engaging with their money and how it is being used.

Helen Wildsmith, Head of Ethical and Responsible Investment, CCLA, said: “Whether you want to understand the risks that climate change could cause to your investment returns, investigate how your money could better reflect your charity or church mission, or learn how to link your personal finances with your own views, Good Money Week shows how everyone can benefit from good investments’.”

Neville White, Head of SRI Policy and Research, Ecclesiastical Investment Management, commented: “We continue to see this area of the investment market grow and Good Money Week is a key initiative that provides information and clarity to both advisers and private investors alike.”

Good Money Week takes place 19-25 October 2014 and includes a varied programme of events around the country. UKSIF will be co-ordinating a range of activities including a call to Government to produce a Sustainable Spending Scorecard, social media campaigns, a ‘write to your MP’ action and a hustings and reception on the Terrace Pavilion of the Houses of Parliament.

Picture credit: © Terry Brooks | Dreamstime.com

Walmart and Target talk sustainability

In a highly unusual alliance, rival retailers Walmart and Target have agreed to co-host an industry summit to address sustainability issues in the personal care products market.

The Beauty and Personal Care Products Sustainability Summit took place earlier this month in Chicago and was organized by Forum for the Future, the global sustainability non-profit.

The meeting evolved through conversations over a period of time with both companies. “We see each other at many events,” explained Helen Clarkson, Forum’s U.S. director.

Both Walmart and Target took to Twitter to remark on their momentous partnership.

“Do you think people will be surprised? Great way to spur sustainability convos … MT,” tweeted Target. It followed up with: “This is one uncommon collab you want to watch.”

Meanwhile, Walmart tweeted: “Walmart + Target + sustainability leaders = opportunity to make a difference. See you in September!”

A Target spokeswoman said the event will bring together product manufacturers, other retailers, NGOs, and industry influencers for a conversation about a collaborative approach to beauty product sustainability.

“The summit is a result of both companies wanting to create more sustainable products for our guests, team members and the environment. Consumers want and expect leadership from their retailers when it comes to the quality and sustainability of the products they buy,” said Target spokeswoman Kristy Welker. “To that end, both companies recognize that this is an issue where we have common interests and can collaborate to create change within the beauty and personal care industry.”

Surveys have been sent to participants about their areas of most concern. The feedback will be used to whittle the agenda into three specific topics. Attendance will be held to about 80 and the one day event will take on a workshop format.

Procter & Gamble, the maker of Cover Girl and Olay, L’Oréal and other large consumer packaged goods companies are expected to attend. Burt’s Bee, a leader in the natural beauty product sector, is among those already committed.

The US beauty industry has been criticized for its lack of cohesion on ingredient use and labeling topics. For the most part it still falls under the dated Federal Food, Drug and Cosmetic Act of 1938, that provides for much self-regulation. A bill introduced in Congress last year to strengthen cosmetics oversight has not gotten serious consideration.

Separately, the Personal Care Products Council, an industry scientific group, had been in talks with the Food & Drug Administration, to jointly author legislation addressing product standards. But the two parties hit an impasse earlier this year and talks have stalled.

New Technology Helps Companies Choose Products, Ingredients Based on Sustainability

How can a manufacturer reformulate a cleaning product to contain fewer harmful chemicals, and how can a retailer stock its shelves with more eco-friendly merchandise? UL (Underwriters Laboratories), a product safety testing and certification company, thinks it may have a solution: a set of data tools that helps businesses search and choose ingredients and products based on their environmental and social responsibility profiles.

Managed by UL’s recently launched Information & Insights division, the collection of tools build upon several databases with information on product ingredients and the consumer product index GoodGuide – all of which UL acquired – to allow manufacturers and retailers to essentially track products and materials across the supply chain.

UL’s search engine Prospector allows engineers and designers to look up materials they might want to use to create new products or reformulate existing ones – like developing a shampoo that rinses faster or a toothpaste that also whitens teeth. But, in addition to searching for ingredients that change the abilities or characteristics of a product, engineers can also identify materials that are more sustainable – ingredients that are free of certain chemicals, have received an environmental certification or comply with environmental regulations.

“Our grand vision [with Prospector] is to help people make healthier, safer products,” said Mathieu Guerville, director of strategy and business development at UL Information & Insights.

The Prospector database is especially suited for chemical-containing products at this time, he said, including personal care products, household and industrial cleaners, lubricants, and sealing and binding agents. But in the future, Guerville said that the company will be adding a platform for conflict materials and a search engine for materials used to make electronics and appliances.

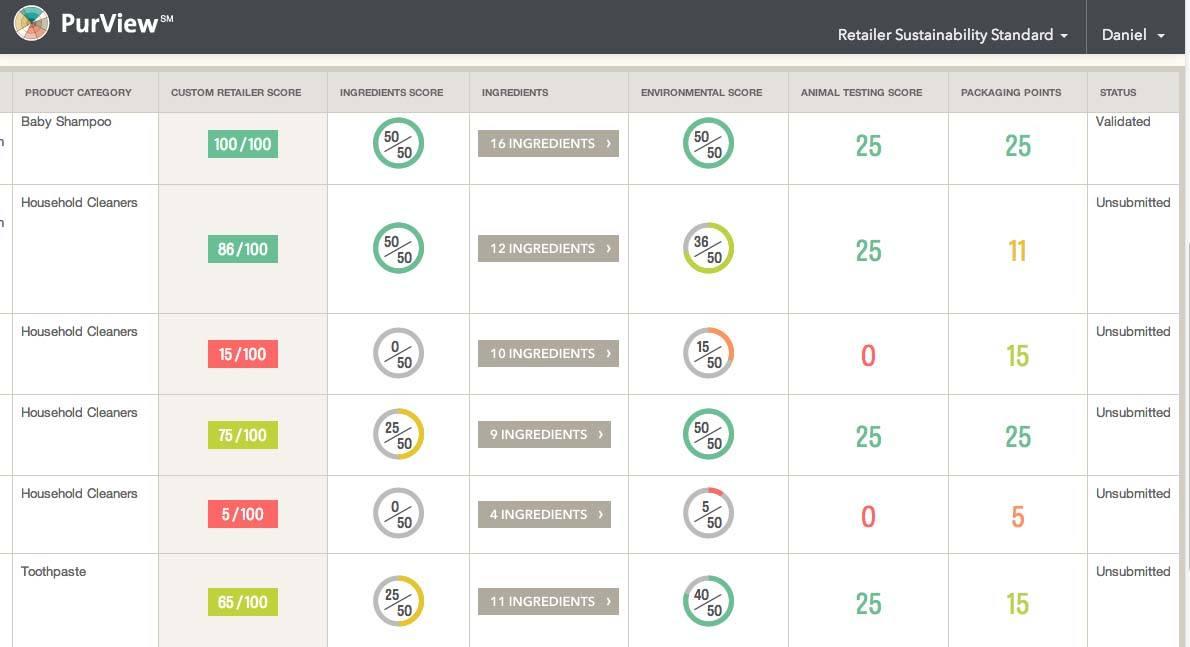

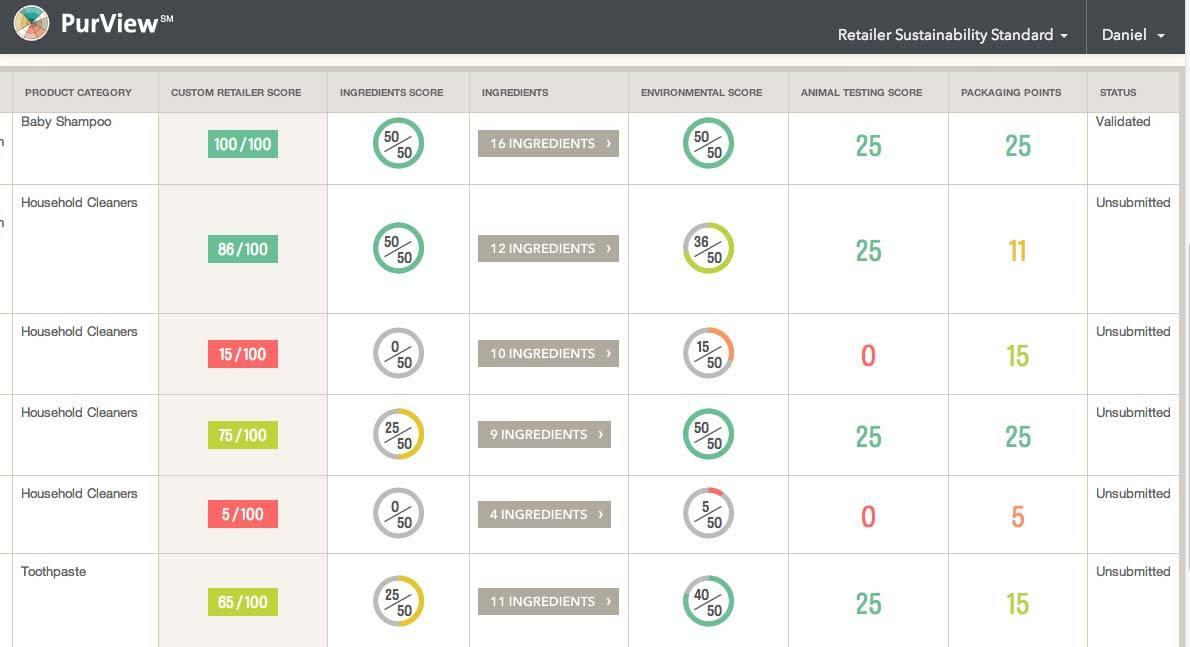

The second component of UL’s tool set is PurView, a new cloud-based software that allows manufacturers and retailers to choose products based on sustainability criteria that is important to their company – if the product was tested on animals, if it contains a certain chemical or if it was made with fair labor practices, for example. PurView works for businesses much in the way the GoodGuide works for consumers – and that’s because the data platform is powered by the guide.

“[This] allows purchasers to decide what products to put on their shelves, which ones not to put on the shelf, and which ones to put on a green shelf and give preferential treatment,” Guerville said.

The software-as-a-service data technology can also help businesses respond to customer demand, according to Guerville. UL can review consumer searches on GoodGuide, inform retailers and manufacturers of search trends and they can change their purchasing behavior accordingly. For example, Guerville said, if UL sees an increase in searches for personal care products without microbeads – those nano-sized plastic particles that end up polluting oceans and waterways – the company could let its clients know, and they could avoid buying microbead-containing products to sell to their customers.

Overall, UL’s data tools can be viewed as technology that both pushes and pulls the market towards sustainability, Guerville said. Prospector is the push mechanism, assisting manufacturers in designing more eco-friendly products and propelling more sustainable goods into the marketplace. PurView works as a pulling mechanism, Guerville said, enabling retailers to choose environmentally responsible products to sell in their stores and therefore, creating an increased demand for sustainable merchandise.

But will companies be willing to invest in this new suite of data tools to help them manufacture and purchase more eco-minded goods?

Guerville thinks UL’s tools will be important to businesses looking to respond quickly to their clientele, especially as interest for sustainable products grows.

“We’ve started to see manufacturers and retailers realizing the importance of the consumer perspective and that consumers are expecting more transparency, as they become more educated about the health and sustainability aspects of the products they buy,” Guerville said.

Guerville also noted that for many companies, sustainability is not about cost anymore; it’s becoming a standard practice.

“We’re seeing an interesting trend: Companies are not trying to compete on cost as much as before, but they want to be sure that at least some degree of sustainability is the minimum expectation for everybody,” he said.

Image credit: UL Information & Insights

Passionate about both writing and sustainability, Alexis Petru is freelance journalist based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

Public-Private Collaboration Yields Potential Solar Silicon Game-Changer

Developing a cheaper, more efficient means of fabricating solar photovoltaic (PV) cells could revitalize U.S. solar PV manufacturing, a technology invented here in the U.S. That's in addition to helping realize the Department of Energy's (DOE) SunShot Initiative goals of driving the cost of installed solar power capacity under $1 per watt -- a level competitive with fossil fuel-fired electricity generation.

U.S. solar silicon manufacturing startup Crystal Solar -- with the help of the U.S. DOE's National Renewable Energy Laboratory (NREL) -- has developed a new method for fabricating high-quality, high-efficiency monocrystalline solar silicon wafers at 100 times the throughput and half the cost of traditional methods.

Crystal Solar's innovative approach to fabricating silicon solar wafers garnered it an “R&D 100” award as one of the top technology innovations of 2013. If Crystal Solar can scale-up production, the new method “could be a game-changer, creating American jobs and stemming the flow of solar cell manufacturing overseas,” CEO T.S. Ravi of the Santa Clara, California-based company stated in an NREL news release.

Cooking with gas

Rather than fabricating solar silicon wafers by sawing thin slices from an ingot of silicon – the standard industry approach – Crystal Solar has developed a much more efficient and less costly direct gas-to-wafer method that entails growing layers of semiconducting silicon directly on reusable silicon substrates.

As NREL explains, Crystal Solar's new gaseous-deposition method offers “several advantages, including eliminating the waste incurred in the traditional approach, which involves sawing thin slices from a large ingot or block of silicon. In the new approach, wafers can be made thinner without compromising their quality or efficiency.”

Overcoming a hurdle to similar R&D efforts, Crystal Solar's gaseous deposition process also speeds up solar silicon fabrication. That also lowers manufacturing costs. Crystal Solar can produce as many as 500 wafers per hour and sells for less than $5 million. That translates to a cost per wafer of around 13 cents per watt -- “less than half the typical cost of 30 cents per watt for high-end wafers,” Ravi highlighted.

Critical government support

Government support has always been critical to guiding market forces toward new technologies that could prove socially, environmentally and economically beneficial. Just three years into the decade-long SunShot Initiative, the U.S. solar industry is more than 60 percent of the way towards realizing the SunShot goal to reduce the cost of utility-scale solar to a cost-competitive 6 cents per kilowatt-hour, as well as drive the cost of installed solar power systems down to under $1 per watt by 2020.

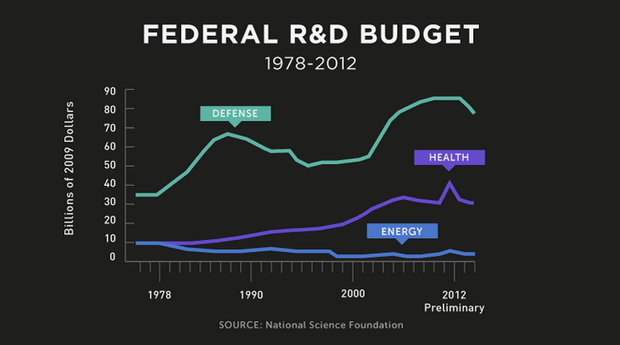

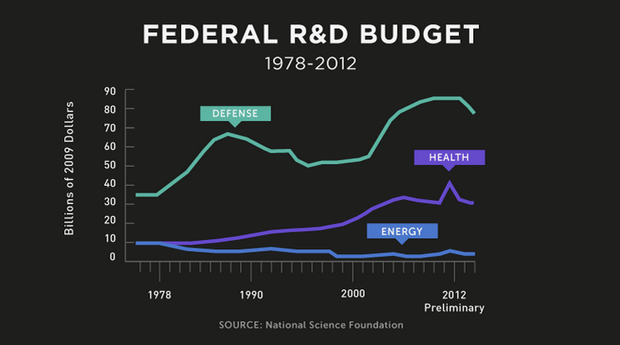

The rapid decline in costs and technological advances in U.S. solar and renewable energy technology have come despite the comparative paucity of private-sector, as well as government, investment in energy research and development (R&D), much less the investments in clean energy. As Bill Gates noted in a blog post on the need for “energy miracles”:

- Sixty percent of the federal government's R&D spending is on defense; about 25 percent is on health. Energy spending? 2 percent.

- The U.S. ranks 11th in overall percentage of gross domestic product that goes to energy research. (Finland and China are the top two, respectively.)

- R&D spending on energy isn't just a government problem. It's also a serious problem in the private sector. The energy industry invests less than half of one percent (0.42 percent) of its revenue in research. In contrast, the pharmaceutical industry puts 20.5 percent of sales into R&D, and aerospace and defense spends 11.5 percent.

Currently at the pilot-manufacturing stage, Crystal Solar is planning to build a factory here in the U.S. The company is “struggling to keep up with the people who want our wafers,” Ravi stated. "We believe this technology will probably thrive in the United States, that it will be cheaper to do it here than anywhere else in the world."

That would be a boon in terms of reviving the U.S. manufacturing base, which currently accounts for around 13 percent of economic activity. The success of Crystal Solar and NREL's collaboration is also a testament of the effectiveness and triple bottom line benefits that can result from public-private partnerships.

*Image credits: 1), 2) Crystal Solar/NREL; 3) NREL; 4) National Science Foundation

Study: Diversity Still Jeopardized by Workplace Attitudes

Americans have been under the impression for years that equal employment legislation and similar programs in companies have helped to conquer discrimination in the workplace. We’ve been pretty much secure in the impression that women and minorities have almost as fair a chance at advancement as men, and that the glass ceiling can be overcome.

A recent study by a University of Colorado research team, however, has challenged those statements by providing data that shows that women and minorities actually suffer professionally when they help promote other women or individuals of color. White men, however, are perceived and rewarded positively for promoting individuals from those same sectors.

The authors’ findings are a lot more detailed than that, but what struck me in the month-and-a-half that news about the study has bounced across the Internet is the broad variety of ways that the findings have been interpreted. Most articles mentioning the findings summarize this hot-button study by saying that “dedication to diversity can be a liability in the workplace,” as the Wall Street Journal noted it; or that “valuing diversity is apparently frowned upon by Corporate America,” as the Huffington Post writer framed the issue.

An article in the U.K.’s Daily Mail made the interesting leap that the U.S.-based study meant that “being the token female or minority boss was better for YOUR career” and explained that, “the authors wondered whether it might be better for diversity offices to be run by white males.”

But however you sum up this particular survey, the Hekman et al study challenges our views of diversity in the workplace. It contradicts our comfortable belief that equal employment opportunity legislation and corporate initiatives have been improving job advancement opportunities for years. And it leaves us with the unsettling question of whether equal employment opportunities are really a fallacy for some.

But is the problem our ability to shatter that glass ceiling, or our perception of what it means to us? Hekman touches on this when he suggests that labels can often determine our success in shattering that glass ceiling. If what we really want is to encourage “diversity-valuating behavior,” he says, call it by what you want to inspire: “demographic-unselfishness.” That may seem like a mouthful for some who simply want job advancement, but his suggestion hits at the core of the problem: perception. How we view the problem will often define whether we think we can fix it.

Canada faced a similar problem in the late 1900s regarding another issue of perception: national identity. The steps that it took – which were just as controversial at the time – had an interesting trickle-down effect when it came to issues like diversity in the workplace.

Faced with an increasing amount of television and movie programming from other countries (the U.S. and Britain to be specific), the Canadian Radio-television and Telecommunications Commission implemented requirements that specified the amount of Canadian-produced content that had to be aired on television. Among other things, it presented Canadian producers with the challenge of coming up with stories and settings that correctly reflected Canadian society and demographics. Not surprisingly, the outcome was more programs that featured First Nations (Canadian indigenous) communities and new immigrants. But it also cast the spotlight on gender issues in the workplace. As assimilation and cultural issues rose in the national agenda, so did the television’s portrayal of those demographics – and so did the viewers’ perception of its importance. Looking back, the Canadian Content concept may have had less to do with defining an image for Canada and more about reflecting and accepting its growing diversity.

Here in the U.S., what we see and experience in the workplace is also reflected by what we see in the media – or in better terms, is often governed by we read and are told. Hekman’s summary of the challenges ahead maybe a wakeup call, but is that because EEO policies don’t work or because, seen through the summary we’re offered by the media, we believe they won’t work?

Hekman’s conclusions were largely limited to what companies might implement of their own volition. But in a country and a time when consumers have managed to revolutionize large corporations’ perceptions of sustainable production and workers’ rights in foreign countries, assuring workplace diversity is just another step toward realizing a sustainable and fair marketplace.

Image credits: 1) Thetaxhaven 2) USDA staff participating in 2014 Women's Equality Day: USDA

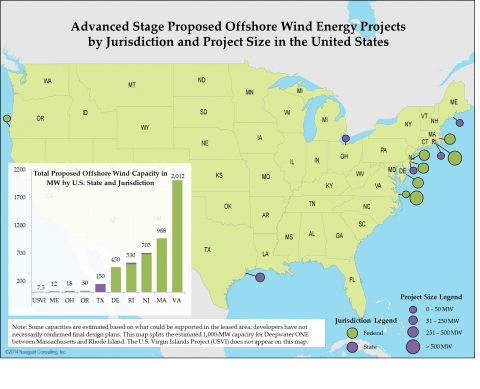

Report: 14 U.S. Offshore Wind Projects in 'Advanced Stages' of Development

Momentum is finally building up in the U.S. offshore wind energy industry, the result of concerted clean energy policy and action plans enacted by the Obama administration. With 14 projects in advanced stages of development, the latest Department of Energy offshore wind report highlights progress across multiple fronts.

Taken together, pioneering projects hold out the potential to deliver some 4,900 megawatts of clean, renewable electricity to U.S. businesses and communities, according to the Offshore Wind Market and Economic Analysis: 2014 Annual Market Assessment report, produced by Navigant Research.

Building offshore wind energy farms also means a lot more in the way of green jobs and economic stimulus. It also drives innovation that will help keep U.S. industry competitive in cutting-edge wind and clean energy technologies. Furthermore, realizing U.S. offshore wind energy potential will be a big step forward in terms of reducing U.S. greenhouse gas emissions and dependence on fossil fuels. And that will be a big plus in terms of improving human and environmental health and safety, as well as reducing the potential for overseas conflicts.

Catching up on offshore wind energy

When it comes to offshore wind energy, the U.S. is getting a late start as compared to European countries and China. While the U.S. has zero in the way of installed wind power capacity, 2,304 offshore wind turbines with a total capacity of 7,343 MW were fully grid-connected in Europe as of mid-year 2014, according to the European Wind Energy Association's (EWEA) latest report.

The situation has been changing for the better during President Barack Obama's tenure, however. As lead agent, the federal government has brought together multiple stakeholders and employed the latest in public-private partnerships and ecosystems-based planning to bear on the problem of how best to accelerate development of America's vast offshore wind energy potential.

That includes involving local coastal and fishing communities, the shipping industry, and environmental organizations in the offshore wind energy planning process, along with state and local government representatives. It has also entailed making use of leading-edge marine spatial planning and coastal zone resource management methods and technology.

As a result, the Navigant report authors state in the executive summary: “The U.S. offshore wind industry is transitioning from early development to commercial viability.”

Growing offshore wind power capacity

Worldwide, offshore wind power capacity now totals around 7 gigawatts, according to Navigant's DOE report, the third annual assessment of the U.S. offshore wind market.

More than 1,700 MW of offshore wind power capacity was brought online globally in 2013, a 50 percent year-over-year increase. More than 812 MW (47 percent) of new generation capacity was brought online in the U.K. alone.

Growth in global offshore wind capacity is set to continue over the near-term, the report authors believe. Over 6,600 MW of offshore wind power capacity spanning 29 projects is under construction worldwide. Offshore wind farms with a capacity of 1,000 MW are under construction in China.

Here at home in U.S. waters, “The U.S. offshore wind market has made incremental but notable progress toward the completion of its first commercial-scale projects,” Navigant highlights.

Advanced-stage U.S. offshore wind projects

Having progressed to their initial stages of construction, Cape Wind and Deepwater's Block Island are the two most advanced offshore wind energy projects in the U.S. In addition, the DOE Bureau of Ocean Energy Management (BOEM) has been carrying out commercial lease auctions for federal Wind Energy Areas (WEAs). As a result, 14 U.S. offshore wind energy projects with total planned capacity of 4.9 GW have moved into advanced stages of development.

Continuing to fund demonstrations for the Offshore Wind Advanced Technology (ATD) program, Fisherman's Energy, Dominion and Principle Power were awarded up to $46.7 million in federal funding for the design and construction of pilot projects off the coasts of New Jersey, Virginia and Oregon, respectively.

Two other projects – by the University of Maine and the Lake Erie Economic Development Company of Ohio – will receive funds to continue engineering designs for their proposed projects, according to Navigant's DOE report.

Offshore wind: Innovations and costs

The costs of building out initial offshore wind energy projects is substantial, as are the technological and engineering challenges. Navigant found that the average reported capital cost of installed offshore wind power capacity declined in 2013 to $5,187 per kW. That compares to $5,385 per kW for projects completed in 2012.

On a precautionary note, “A lack of data for projects anticipated to reach completion in 2015 and 2016 makes it difficult to assess whether the trend will continue. Note that all such capital cost data are self-reported by project developers and are not available for all projects globally,” the report authors note.

Technologically, the trend is toward installing larger wind turbines farther offshore. According to Navigant's assessment:

“The average nameplate capacity of offshore wind turbines jumped substantially from 2010 to 2011 as projects increasingly deployed 3.6 MW and 5 MW turbines. Since then, however, average turbine size has plateaued around 4 MW.”

Looking forward, Navigant anticipates that the upward trend in average offshore wind turbine size will resume around 2018 as developers install more 5 MW and larger turbines. In the U.S., average offshore wind turbine size for advanced-stage projects is expected to range between 5 MW and 5.3 MW.

The offshore wind energy development drive has also spurred innovations in wind energy turbine, drivetrain and platform substructures. Direct-drive and medium-speed drivetrains account for just three percent of installed capacity. Navigant expects alternative drivetrain configurations will increase significantly over the next few years, however, as new 5 MW to 8 MW turbine models from Siemens, Vestas, Alstom, Areva and Mitsubishi are installed.

Under the surface, Navigant found that the advent of extra-large monopile substructures has lessened the impetus for alternative designs. The authors point out that offshore wind energy substructure design is very much dependent on site-specific factors. Hence, they see “plenty of opportunity ... for new designs that can address developers' unique combinations of needs.”

*Image credits: 1) Vattenfall; 2) EWEA; 3) US DOE

Disruptive Business Models Shake Up Existing Markets

By Duncan Jefferies

Electric vehicles, 3-D printers, nanomaterials and the Internet of Things are all poised to reshape the world, just as the steam engine, telephone and car did before them. Although it’s hard to predict exactly what kind of impact these potentially disruptive technologies could have on today’s products and services, they are likely to be driven forward by small, innovative companies that have spotted a window of opportunity in an existing market and pried it open – a quality that marks out several of this year’s Ashden Award winners.

Meeting off-grid demand with solar energy

Thanks to the rapidly-falling cost of solar panels and improvements in energy storage, the energy sector, for example, is primed for an upheaval that could shift power away from the energy giants and spark a revolution in the way energy is produced, distributed and consumed, while giving millions of people in the developing world access to a reliable source of electricity. It’s a revolution that Off Grid Electric is spearheading in Tanzania. The company is supplying solar-as-a-service in a country where 85 percent of households have no access to the grid, and it’s doing it with the help of another disruptive technology: the mobile phone.

For Jonathon Porritt, Founder-Director of Forum for the Future, this encapsulates “what’s really exciting about today’s sustainable energy innovations: The degree to which they are simultaneously giving rise to new business models, seriously weakening the stranglehold that today’s incumbent players in the world of energy have had around our throats for decades."

Whereas it could cost a household around $700 to connect to the national grid, a basic Off Grid Electric plan costs $6 to install and $1.25 a week for two lights and a mobile phone charger, with customers able to top-up their system through their phone. The service has already helped more than 15,000 homes do away with inefficient, dangerous and environmentally damaging kerosene lamps, and the company hopes to raise this figure to 10 million within a decade. “Our value proposition is simple: Switch to solar and get far better service for less than you are already spending to light your home," says Raphael Robert, head of expansion at Off Grid Electric.

An all-day customer care telephone line and ongoing support from local agents has helped to allay the fears of customers who have previously had reliability issues with their own solar energy system or who are reluctant to switch from kerosene. “People can use our product without the risk," says Robert. “They can just call our customer care number and say ‘our light is broken,' and an agent will go and change it for a new one. And those are the customers who go out and spread the word.”

Cleaning up cookstoves (and indoor air)

Word of mouth has also played a vital part in the success of Greenway Grameen’s biomass cookstove, which has been designed to replace the traditional mud stoves used by 87 percent of rural Indian households. The World Health Organization recently reported that 4.3 million people die from the results of indoor air pollution each year, the majority of which comes from cooking smoke. As well as reducing this smoke by 70 percent, Greenway Grameen’s Smart Stove cuts cooking times by around 30 minutes and household wood use by around 1.1 tons per year.

According to David Bent, director of Sustainable Business at Forum for the Future, “seeking feedback and quickly improving” plays a key part in the success of many disruptive technologies – something Neha Juneja, co-founder and CEO of Greenway Grameen, knows only too well. “We did about 10 different designs with feedback for each," she explains, “and for every different design we would do about 15 to 20 prototypes."

Having trialled some of them in stores to see which designs customers were most happy to pay for, the company established an aspirational marketing campaign for the final design. “It makes your kitchen look modern; you’re a modern woman, hence this is the product for you” is the message that Greenway Grameen aims to communicate to potential customers. It seems to be working: More than 120,000 stoves, which retail for $23, have now been sold. Over two-thirds of these sales have been through partnerships, particularly with microfinance institutions – another recent disruptive innovation.

Greenway Grameem’s approach illustrates that sustainability-focused technologies with disruptive potential are most likely to gain mass appeal by offering something new, desirable or cost-effective. As Bent says: “There is potential for examples like ZipCar to shake up existing markets, but not because they are sustainability focused. They’ll be successful because they deliver better value for customers. In ZipCar’s case, that’s providing flexible urban travel without the hassle and heartache of owning a car. The sustainability outcomes will be a result of uptake, rather than a reason.”

Turning food waste into a clean-burning resource

Sustainable Green Fuel Enterprise (SGFE) 'charbriquettes' also illustrate this point. This pioneering Cambodian business turns coconut shells and other waste organic matter into clean-burning briquettes, which are used as cooking fuel in Phnom Penh’s homes and restaurants. Around 80 percent of Cambodians cook on wood charcoal, despite the fact that the country has one of the worst rates of deforestation in the world. SGFE charbriquettes are produced in low-emission kilns, and have saved an estimated 6,500 mature trees to date.However, the success of the business relies on the fact that charbriquettes retail at a similar price to charcoal, yet burn for longer, are sturdier (allowing street food vendors to transfer them between stoves), and produce fewer sparks and less mess. As Carlo Figà Talamanca, CEO of SGFE, says, for a new market entrant to win over skeptical consumers and retailers, “You have to have a better product than the conventional one. People won’t bother to change their habits otherwise."

Like Greenway Grameen, SGFE has modified its product in response to customer demands, tweaking the amount of binder in its charbriquettes to get the perfect mix of hardness and heat. During the process through which biomass is turned into char, the greenhouse gases that are produced are burned off using technology devised from clean cookstove designs, rather than vented into the atmosphere, and the heat used to dry the charbriquettes – an innovation that helped the company to win an Ashden Award. “I would say the biggest design element in our case was not just the end product … but also the production process," says Talamanca.

Inspiring sustainable agriculture with a simple water pump

Technologies that are well established in Western countries, or have even been surpassed, can still prove disruptive in developing economies. Proximity Designs, for example, is working to introduce treadle pumps and other sustainable agriculture technologies to Myanmar (Burma), one of the hardest places in the world to start a business, according to the World Bank. There is very little access to electricity in the country, and until now farmers have irrigated their crops by lifting water in buckets from wells and carrying it in watering cans to their fields.

Proximity’s foot-operated treadle pumps, drip irrigation systems and water-storage tanks, refined through extensive farmer feedback, are now helping to dramatically increase crop yields and incomes across the country, which has suffered from decades of technological isolation. Using one of the social enterprise’s pumps, people can achieve the same water outputs in half or even a third of the time. They’re designed to be affordable to someone earning $2 a day, costing between $25 and $38 each. Around 90,000 people in 5,000 villages now use the pumps, and farm incomes are increasing by an average of $250 per season.

“Farmers were already looking for alternatives to backbreaking, time-consuming work," says Jim Taylor, co-founder of Proximity Designs. “One of the priorities was affordability, since farmers knew they could use diesel pumps, but these were totally of reach financially. It was then our mission to design something that truly presented a better way to lift water from wells that was also affordable.”

Proximity is always trying to improve on existing solutions, hence its next project: a low-cost solar water-pumping system. Looking even further ahead, advanced 3-D printing could also have a huge impact on global industry, allowing anyone to quickly ‘print’ replacement parts for existing products or assemble new ones from designs available online. Although 3-D printers are dropping in price (you can pick one up in the UK for £700), they are still largely the preserve of hobbyists, rather like the microcomputer was in the late 1970s and early 1980s. But once the range of ‘printable’ materials increases and 3-D printers move into the mainstream, innovative organizations the world over will be able to harness yet another disruptive technology for sustainable ends.

Image credit: Martin Wright

Duncan Jefferies is a freelance writer and Assistant Editor for Green Futures.

Ashden is a Forum for the Future Partner. www.ashden.org

Reviewing Fiat's 2013 Sustainability Report with GRI G4 in Mind

Editor's Note: This post compares Fiat Group's 2011, 2012 and 2013 sustainability reports. The automaker's 2011 and 2012 reports complied with the Global Reporting Initiative's G3.1 standard and both received an A+ ranking. Its 2013 report is GRI G4 Comprehensive. A version of this post originally appeared on the CSR Reporting blog as part of the site's ongoing G4 Game-Changer series.

The first thing you might notice about the 2013 Fiat report is that it is around 100 pages shorter than the two prior reports. Bad news for graphic designers but great news for those who predicted that the Global Reporting Initiative's G4 Guidelines would lead to compactness. However, despite the fewer pages, Fiat identified more material issues in 2013 (23) than in 2012 (18) (material issues were not specified in 2011).

Not only that, Fiat actually fully reported more general disclosures and more performance indicators in 2013 than in both prior reports. (2011 and 2012: 42 general disclosures; 2013: 55 general disclosures; 2011 and 2012: 83 performance indicators; 2013: 88 performance indicators.) Fiat reports on everything in the framework, material or otherwise.

Let's take a closer look at the 2013 report and how the G4 Guidelines fit in.

Material issues: Are they driving the report -- or is it just for show?

In this report by Fiat Group, there does seem to be a shift towards more considered reporting of material issues. The materiality matrix has substantially changed from 2012 to 2013.

In 2012, there were fewer issues, and the issues were rather broad-based: corporate governance, climate change, public policy engagement, etc. The issues were not sector-specific, and could apply to any industry anywhere. In 2013, while there are more issues, they are more sector-specific, more closely related to Fiat's core business and more narrowly defined, in a way that enables more detailed focus and defined management approach. Vehicle safety and vehicle quality, for example, are two issues that feature in 2013 that were not present in 2012.

Additionally, the prioritization of issues has changed significantly in 2013. Of the top five issues, only two were restated in 2013 -- customer satisfaction and research and innovation -- but both have changed position. Customer satisfaction was number one in 2012 ... it has dropped a couple of notches in 2013. Research and innovation has been bumped up a little.

This change in materiality seems positive. The new matrix seems more relevant and focused on the issues that affect Fiat and Fiat's stakeholders. The structure of the Fiat report has changed to reflect the new material focus. In the two prior reports, Fiat reported in three sections: economic, environmental and social. In the G4 report, there is a series of chapters that break the report into smaller, more specific sections, for instance, there is a section on employee health and safety, and sub-sections on vehicle safety and vehicle quality. There appears to be evidence of an attempt to align the report structure with the stated material issues, although, with 23 issues, this makes for a rather crowded, and slightly fragmented, report.

Focus: Focused and relevant or ticking the boxes?

At comprehensive level, all performance indicators should be reported for each material aspect in this report. With 23 material issues ... that's quite a lot.

Also, one issue, for example, human rights across the value chain, can cover 12 different human rights indicators across 10 different material aspects. In this report, Fiat identifies six other issues that came up in stakeholder engagement that are covered in the online report, but not in the main print report.

So, although some of the material issues are broad enough to encompass a broad span of indicators, it seems that Fiat has been a little selective and not just ticked all the boxes indiscriminately, even though everything is reported in one way or another.

Engagement: Process or lip-service?

It's very easy to fudge stakeholder engagement to give the impression that a great deal of interaction has taken place when in fact, not much actually has. In the Fiat report, there is evidence of several targeted stakeholder intervention opportunities that have shaped Fiat's thinking.

In addition, Fiat has published a set of Stakeholder Engagement Guidelines. This is good practice, and I suspect that stakeholder engagement policies are now becoming quite trendy.

Therefore, in this report, the game on stakeholder engagement does appear to have changed. In the prior report, engagement initiatives reported were primarily incident-based, with less emphasis on ongoing dialogue and process. In 2013, more detail is provided.

Integrity: Shapes up or misleads?

To be in accordance as a G4 comprehensive report, Fiat should identify the material aspects that have governed the selection of specific standard disclosures (including performance indicators). This achieved in a sort of indirect way in the Fiat report. The material issues are listed in the materiality matrix. At this point, these issues are not directly correlated to the GRI table of material aspects, as is required by G4. They are reported as a set of company-defined issues. General disclosure G4-19 requires the reporting company to "List all the material Aspects identified in the process for defining report content." However, Fiat Group does not do this in a direct way and in my view, does not therefore respond precisely to G4-19.

On the other hand, each page of the Fiat report includes a disclosure-label reference to the relevant GRI G4 performance indicator which is part of a material aspect.

So, for example, in the narrative that discusses vehicle safety, the indicator labeled is G4-PR1 (report the percentage of significant product and service categories for which health and safety impacts are assessed for improvement). This is part of the material aspect: Customer Health and Safety. (I managed to work this out all by myself!) So while this does not totally strictly meet the requirements of G4, there is a sort of audit trail from material issue to aspect to indicator. But.

The but is that, more importantly, perhaps, using the same example, the PR1 indicator label is referenced on 10 separate pages in the report. I looked at all 10 and was not able to find any specific response to the indicator, although there are several pages of narrative about vehicle safety and a whole load of technical stuff about the Euro NCAP 5-star rating, structural crashworthiness, Anthropomorphic Test Dummies, traction and chassis control systems, side-thorax airbags, hood deformation, and more things I prefer not to think about. So, not only is the aspect missing, but also a clear response to the performance indicator.

I find this quite puzzling as this report received GRI's Materiality Matters Check icon, which means that the GRI was charged with checking that the information required by materiality disclosures is present in the report. The Materiality Matters check does not assess the quality of the disclosures, it assesses their presence in the report.

G4-19 is not disclosed. Material aspects are not stated. So how did this report pass the Materiality Matters check?

Even more puzzling, or perhaps we should be accustomed to this by now, this report was externally assured, and the assurers confirmed that this report meets the G4 comprehensive in accordance requirements.

How can this be confirmed if material disclosures are not reported as declared?

While I fully respect reporters that choose not to report GRI, G3, G4 or any G, I do find it disappointing when reporters declare they have reported in accordance with something and then they do not. And if two sets of checkers cannot identify this discrepancy, then there is something structurally wrong with the skills and expertise that are deployed throughout the entire reporting process. Whether it is a matter of skill, intention, understanding or born-on-Mars, the report's declaration that it meets the requirements of G4 comprehensive level is misleading in this specific example. I didn't look for more examples.

Impact: What did we do or what difference did we make?

When it all boils down to what's most important, we could probably argue that the real game-changer of G4 is that is should be about impacts (material impacts) and not (only) about actions. A report that drones on about we did this and we did that is (a) boring (b) boring and (c) irrelevant. A report that relates the activity to the impact the company is having in society is (a) relevant (b) more credible and (c) more meaningful for stakeholders.

Unfortunately, one of the things that was not entirely fixed in G4 was the dissonance between a report that should be about impacts and a set of indicators which are about performance. Unfortunately, too many G4 indicators require counting up what we did (hours we trained or communicated, assessments we made, initiatives we undertook). This doesn't really help us know if all these actions actually delivered a desired outcome for society, or the beginnings of one.

Fiat, in this report, has followed this direction and reports extensively about its activities but far less about its overall impact. I'd like to have seen more impact-based disclosures, maybe even a few representative case studies. For example, in the vehicle safety section, the most material issue, there is a ton of detail about how Fiat is making cars safer. But there is no information about the outcome of this activity.

The report's authors write: "The Group is strongly committed to its efforts to ensure safety for all road users. This commitment is grounded in the respect for human life which is reflected in all of the Group’s activities."

But, actually, there is nothing in the narrative about whether road users are actually safer as a result of Fiat's efforts. I would have found a case study or some reference to numbers or severity of accidents in Fiat cars to be far more convincing than line after line of safety awards for different car models and safety ratings achieved.

Game-changer: Does or doesn't?

I think the Fiat report is driving (safely) in the right direction. There are signs that the company has made an attempt to move in the direction of G4. The rather techno-babbly and over-wordy language make for tough reading, and the immense detail tends to detract from the core material focus. There is an opportunity to change the game more decisively with Fiat's next report.

I give this report a 58 percent game-changer rating.

- Material issues: 65 percent

- Focus: 70 percent

- Stakeholder Engagement: 60 percent

- Integrity: 50 percent

- Impacts: 45 percent

Stay tuned for more game-changer analyses.

Image credits: Fiat Group's 2011, 2012 and 2013 sustainability reports

The Top 10 U.S. States for Solar Power -- And What They Can Teach Us

By Julia Young

The United States is witnessing a solar energy revolution with a massive, 120-fold increase in solar capacity over the last decade.

The solar market in the U.S. had its second largest quarter in 2014. A huge 1,330 megawatts of solar photovoltaic (PV) capacity was installed in the first quarter, enough to power 3 million homes. This is the result of increasing awareness among Americans, as each year tens of thousands of them opt to install solar panels in order to reap the benefits of clean, natural and renewable energy from the sun.

Why is solar energy on the rise?

Solar energy is not only good for consumers, but it is also extremely beneficial for the environment and the economy in the long run. Following are a few reasons which highlight the rise in the demand for solar energy in the U.S.:

- The installation cost of solar energy systems has decreased considerably -- by as much as 60 percent since 2011.

- Solar energy is helpful in downsizing expensive investments in long-distance transmission lines.

- Solar photovoltaic cells produce much less (91 to 96 percent) global warming pollution than coal-fired and natural gas-fired power plants.

- Solar power plants have played an important role in providing clean energy jobs to local Americans. Approximately 140,000 people are currently employed in this industry, and around half of these jobs, such as installation, are in close proximity to their hometowns.

Local governments, businesses and everyday homeowners in a growing number of U.S. states are taking note of these benefits and adding solar to their energy mixes. Here's a look at the top 10 states for solar energy in the U.S. and what we can learn from their example.

Top Ten Solar States

The top 10 solar states, based on their ranking of solar capacity, are depicted in the following table:

| State | Population | Cumulative Solar Electric Capacity per Capita (Watts/person) | Rank | Total Solar Electric Capacity Installed during 2013(MW) | Rank |

| Arizona | 6,553,225 | 275 | 1 | 724 | 2 |

| Hawaii | 1,392,313 | 243 | 2 | 150 | 6 |

| Nevada | 2,758,931 | 161 | 3 | 47 | 12 |

| California | 38,041,430 | 148 | 4 | 2,760 | 1 |

| New Jersey | 8,864,590 | 136 | 5 | 240 | 5 |

| New Mexico | 2,085,538 | 113 | 6 | 46 | 13 |

| Delaware | 917,092 | 82 | 7 | 9 | 23 |

| Massachusetts | 6,646,144 | 66 | 8 | 244 | 4 |

| Colorado | 5,187,582 | 63 | 9 | 61 | 10 |

| North Carolina | 9,535,483 | 57 | 10 | 328 | 3 |

What makes these states leaders in solar energy?

The adoption of strong policies by these states has differentiated them from others in the drive to go solar. By employing these policies, they have encouraged businesses and homeowners to opt for a much cleaner, cheaper and renewable source of energy. A few of those policies are:

- All of these states have set renewable electricity standards, which help in keeping the minimum requirements that must come from renewable sources of energy like solar energy. Apart from this, eight states even have solar carve-outs that help in setting specific targets for each of the clean forms of electricity.

- Among these states: Nine of them offer flexible financing options like third-party power purchase agreements, while eight of them have allowed PACE (Property Assessed Clean Energy) financing.

- Some of the states have quite powerful net metering policies. Through these policies, consumers are compensated at full rate for all the extra electricity they help in supplying to the grid.

- These states have good interconnection policies, which reduce the hassle and time required for companies and individuals to connect to the grid.

The ranking of policy leaders of solar energy as per the new solar power per capita is as follows:

| State as per Policy Ranking | Corresponding Ranking as per Total Solar Capacity per Capita |

| Arizona | 1 |

| New Jersey | 3 |

| Delaware | 7 |

| Massachusetts | 8 |

| Maryland | 10 |

| New Mexico | 11 |

| Colorado | 12 |

| New York | 16 |

| DC | 19 |

| Illinois | 20 |

U.S. solar market key statistics

The Solar Energy Industries Association and GTM Research forecast another strong year for the U.S. solar market with an estimated 26 percent growth in 2014. Some of the important findings of their 2013 report are:

- A total of 918 MW of CSP and 12.1 GW of PV was operating in the states in 2013.

- More than 4,700 MW of solar photovoltaic capacity was installed in 2013 -- a nearly 41 percent rise since 2012 and about 15 times 2008 figures.

- Around 140,000 individual solar panel installations were done in 2013 and, as a result, about 440,000 systems operate today.

- The total concentrating solar power (CSP) capacity of the states has increased by 80 percent with 410 MW of CSP installed only in 2013.

- Solar power has become the second largest source of renewable energy behind natural gas because of a 19 percent rise in new electricity generation capacity in 2013.

- Average PV system prices have fallen by 15 percent, reaching a new low of $2.59 per watt.

Despite the recent threat by fossil fuel interests in the success of solar power, these states have reaffirmed and shown keen interest in expanding their commitment to solar energy by increasing their goals and implementing new policies to access cleaner solar power. If the scenario in the states continues to follow this path, the country would surely reach their goal of getting at least 10 percent of their energy from the sun by 2030.

Julia Young is a green movement activist and believes in advancing sustainability. She was taught to value and conserve natural resources by her parents and has grown up with a mindset which reflects the same. Currently, she is working as an online marketing manager for Vista Solar, a bay area based commercial solar power installation firm. She is also an avid blogger on topics related to environmental sustainability and solar energy.

Green Lighting Can Save the Federal Government Cash ... and Cut Our Taxes

By Seth Leitman

While the green lighting wave comes across the U.S., let's not forget that the main motive for our federal government to install these energy-efficient bulbs is to save cash, cut costs and -- bottom line -- help us to cut taxes.

A company I know, MSi Lighting (now partnering with 3M), has already installed LED lights at the Liberty Bell, Air and Space Museums, and even cruise ships (which save more per watt than on land due to fuel costs). This is equal to a lot of cash.

Yes, tax dollars are our cash, so I want to save our tax policy wonks a lot of time on Sunday talk shows: Install green lighting aka clean technology.

So let us dig a bit into some numbers here and realize we need to be asking our elected officials to 'Show us the money!' Tax money, that is.

Since we do not have figures yet from the federal government on energy savings due to green lighting, let's look at a study a lighting company did for some businesses. Then we can start to equate that to budgets and inevitably our taxes. Fair? Ok. Here we go.

1. Just one building equals big savings

A Las Vegas furniture company saved over $182,000 in energy costs per year on one 50,000-square-foot-building. Now imagine a 50,000-square-foot-building that's a warehouse for storage of government documents or even a U.S. Post Office. That's $182,000 per federal building.

2. That savings really adds up

MSi Lighting has officially announced that its customers will save $2 billion during the life of their energy-efficient bulbs. However, when you include fuel costs too, it can go up to $10 billion. As stated: "This economic savings will provide a reduction of costs that expand across the corporate bottom line of a home, business, fleet of ships or government operating expenses." Now realize MSi Lighting LED bulbs are at Federal Air and Space Museums, the Liberty Bell and other government locations. These bulbs are also installed at private-sector buildings ... Image if the federal government purchased efficient bulbs at the same rate.

Everyone should realize that we have plenty of U.S. government buildings across the country. Every major city has federal or local government buildings. If they all started switching out lamps at the same rate as the private sector, we would save a lot.

3. Savings could be even greater at sea

One customer of MSi Lighting, Carnival Cruises, spent $2.19 billion on fuel annually. According to industry standards, 27 percent of the fuel budget is for lighting. That is about $591.3 million dollars in cash savings per year across the entire fleet after switching to more efficient alternatives.

Imagine if lighting on ships and submarines can be cut to over $3 billion a year over 30 years -- that's getting into trillions folks. Part in parcel, let's think of the U.S. Naval fleet. There are plenty of ships in the sea. If we started switching them to LED, we could realize an amazing amount of savings. It is also safe to recognize that the federal government has more ships than Carnival Cruises.

4. Efficient bulbs cut energy use in more ways than one

Levitz Furniture saved $80,000 in cooling costs per year when their story was reported. That building was only about 50,000 square feet. Again, as mentioned in No. 1 here, there are plenty of 50,000-plus square feet of U.S. government property out there just waiting to be converted. That's at least another $80,000 per year in cooling cost reductions in addition to the electrical energy savings listed above.

--

Now imagine all the government buildings went LED: How much can we save a year in energy and other related costs then? Trillions. So bye bye, deficits folks. Buh bye.

Seth Leitman, a renowned Best Selling Author, Editor and expert on Green-Eco Friendly lifestyles, is an industry leader, referred to as “The Green Living Guy.” In addition to authoring and/or editing a series of nine books with McGraw-Hill Professional entitled the “Green Guru Guide,” he hosts a radio talk show on Blog Talk Radio and a featured expert on WPIX 11 in New York City.