Companies Have Cash — They Should Keep It Where It Counts

The path to financial advancement is being blocked for 22 percent of Americans. Unbanked or underbanked, many are in financial services deserts and left behind by a system that makes wealth largely unattainable for so many.

Corporate leaders often talk about their commitments to creating an equitable society, and when things like racial inequity and disparate COVID recovery are on the front pages, donations are pledged and resources committed. But too few take advantage of this simple approach to long-term significant impact — depositing cash where it can work for the communities that need it most.

Community Development Credit Unions (CDCUs) and Certified Community Development Financial Institutions (CDFIs) provide underserved communities with safe, accessible tools to manage and improve their finances. In the last five years, CDFI members have grown 16 percent to 14.5 million, many of whom would’ve otherwise likely been unbanked or underbanked, with limited, if any, access to credit. But branches are closing, and this is where corporate deposits can help.

Companies with money to deposit can compound the societal benefits of these credit unions while taking advantage of competitive rates, asset preservation and quick ratio management.

In communities where CDCUs are at work, fewer consumers turn to predatory lenders, more underrepresented minorities are able to start businesses and families who would otherwise be locked out of traditional mortgages are able to purchase homes. These credit unions specialize in providing fair loans, bank accounts, and financial education and credit counseling for low income and underserved populations. They offer a level of financial choice and potential upward mobility where it didn’t exist before.

But CDCUs and CDFIs aren’t generally flush with cash. In fact, they’re often driven to join forces in order to scale operations and offer full services to their member base. These mergers and consolidations mean those that remain have better tech and more holistic services, but some communities lose their branches. There were 571 minority deposit institutions in 2017, for example, and 518 in 2021.

To continue and grow their impactful work, CDCUs need a steady source of below rate capital, like deposits. Those deposits pay off, many times over.

For each dollar invested, CDFIs are able to leverage as much as $12 of additional private capital. For example, Self-Help, a CDFI headquartered in North Carolina with 72 branches and over 180,000 members, can raise an additional $7 of deposits for every dollar. So a recent NerdWallet deposit of $2 million has a $16 million impact that can be delivered directly to credit union members in the community. The Financial Equality Project asks other companies to make similar investments. The alternative, depositing business liquidity in big banks, simply doesn’t have this impact — not even close.

An estimated 22 percent of Americans are either unbanked or underbanked, according to The Federal Reserve, and the CFPB estimates some 26 million are credit invisible. People of color are disproportionately represented in these groups. They are caught in a financial services desert, without access to credit like traditional loans or even a bank account to protect their earnings from some of the effects of inflation. They’re more likely to turn to high interest loans with exorbitant fees when an unexpected expense comes up or prices rise beyond the scope of their paycheck, and they’re less likely to ever own a home or be able to afford retirement.

The work that has been done to combat financial inequity is notable, but shouldn’t conceal the work that remains. Those of us with the power to decide where a company keeps its money have an obligation to put it where it can do the most good. This doesn’t come at a cost. No one loses in this scenario.

Interested in having your voice heard on 3p? Contact us at editorial@3BLMedia.com and pitch your idea for a guest article to us.

Image credit: Unsplash

To Fix Climate Change, Big Cities Must Embrace Circularity

Circularity is the powerful climate solution that big cities are ignoring.

There’s no getting around the fact that urban hubs are major contributors to climate change, and the problem is getting worse: In 2020, cities were responsible for about 72 percent of global greenhouse gas emissions, up from 62 percent in 2015.

It’s also equally clear that the current approaches alone can’t reverse the damage we’re doing to the planet.

We should all be encouraged that London has introduced fees on high-polluting vehicles in its city center, Paris has outlawed diesel cars and New York has enacted Local Law 97 to regulate emissions from buildings. But these steps only address direct greenhouse gas emissions from buildings and transportation.

There’s more to creating and maintaining a more sustainable and resilient city than reducing emissions from direct emissions sources like heating, cooling and vehicles. In an interconnected global economy, it’s (over)consumption that’s driving emissions higher and higher worldwide. Research shows that we need to reduce indirect emissions from consumption in cities by as much as 50 percent by 2030 to have any hope of staying below the limit of 1.5 degrees Celsius established in the Paris Agreement.

This means city leaders must embrace circularity.

So what is circularity, and how can it help? Very simply, a “circular city” is one that eliminates waste and keeps materials in use for long periods of time through smart design, reuse and repair.

Circularity is an antidote to waste and planned obsolescence. Cheap, disposable goods and wasted food cycle through our cities and quickly end up in landfills. New York City, for example, produces over 14 millions tons of trash every year, and about 75 percent of it is sent to landfills in central New York State, Pennsylvania, Virginia and South Carolina. Landfills, which are also major drivers of climate change, are disproportionately located near low-income communities.

In addition to reducing waste and emissions, a truly circular city also brings social and economic benefits by increasing access to high quality goods, building community resilience, benefiting local businesses and creating local jobs.

And as we’ve seen with the Circular Campus initiative I’ve spearheaded at Barnard College, taking action to fix overconsumption is possible.

Here’s how we can pull policy levers to scale up this approach to the city level:

Accurately measure and report on indirect emissions from consumption. Too many cities focus solely on direct emissions, which isn’t enough.

Make repair and reuse services tax exempt. Every thrift store, repair shop, dry cleaner that provides alterations, and hardware store that repairs lamps is part of the circular economy. These businesses should be incentivized to continue offering and expanding upon their sustainable practices.

Restructure waste collection. Pay-as-you-throw waste collection – when combined with incentives for reuse in construction – will help individuals and businesses send fewer large items to landfills and reduce waste overall.

Make composting mandatory. Providing tax breaks for buildings and organizations that recycle and compost will reduce the amount of waste that is sent to landfills.

Support circular businesses. Funding innovative circularity start-ups will help them build the reverse logistics systems needed to refine circularity initiatives that will benefit everyone. Once all the kinks have been worked out, city governments can put these systems into effect all across the country.

Circularity is a powerful tool in the fight against climate change, waste and inequity, but we’re not using it to the extent we should be: Data released in 2021, for example, show that only about 8.6 percent of the global economy is “circular.” The World Resources Institute calculates that by “doubling global circularity in the next 10 years, global greenhouse gas emissions could be reduced by 39 percent by 2032.”

Big cities, though, are the perfect place to develop and scale circular systems, and when it comes down to it, circularity is a refreshingly simple ideology: It requires us to produce and buy only what we need, take good care of our things and repurpose them when they’re no longer of use. This ancient practice is already a familiar, but too often informal, part of our daily lives. From neighborhood swaps to compost sites to public libraries to building retrofits and preservation, circularity is all around us. Our job is to recognize, resource and scale this powerful, common sense approach to living.

Embracing this basic idea will allow our big cities to thrive in harmony with the planet.

Interested in having your voice heard on 3p? Contact us at editorial@3BLMedia.com and pitch your idea for a guest article to us.

Image credit: Pixabay

High Pump Prices: Oil Lobby Says Blame Russia and Biden, But Economists Say It Ain’t So

Can you remember a more expensive time to fill up at the pump? Me neither. Gasoline and diesel prices are hitting record highs in countries around the world. Why is it so expensive? It’s the war in Ukraine. It’s the sanctions on Russia. It’s Joe Biden’s environmental regulations.

Well, hold on a minute. A recent report from InfluenceMap shows how the oil and gas sector in the U.S. is using the war in Ukraine and high energy prices to promote this messaging and push for expansion of fossil fuel production.

There are a multitude of factors that go into the price of oil and placing the blame for soaring prices on Russia and Biden is missing more than half the story, but that’s the narrative that the fossil fuel industry is running with.

What does the report claim?

On February 24, 2022, Russia officially invaded Ukraine. In the tension build-up prior to the invasion, and in the succeeding months since the invasion, InfluenceMap has recorded a massive spike in the lobbying efforts of the oil and gas sector in the United States.

Between January 26 and April 1, the American Petroleum Institute (API) — one of the most prominent oil and gas lobby groups — ran 761 ads under its ‘Energy Citizens’ banner. Designed to appear like a grassroots organization representing ordinary citizens, the group is controlled by the API and promotes the interests of the American oil and gas sector.

By comparison, in the final three months of 2021, prior to the Russia-Ukraine conflict, the Energy Citizens group published just 67 ads.

The three central messages being pushed by the lobby group are that: 1) Biden’s climate policies have caused a decrease in the supply of oil and gas, causing high prices; 2) the way to stabilize gas prices and increase energy security is to increase the supply of American oil and gas; and 3) liquefied natural gas (LNG) is a clean, low-carbon source of energy that will help achieve emissions reduction goals.

The fossil fuel sector scored a major win with its campaign in March when federal energy regulator, FERC, pulled back its policy that would require an environmental assessment of existing natural gas pipelines.

InfluenceMap and AFP Fact Check have found the group’s messaging campaign to be “misleading.”

How are the lobbyists’ messages on Russia, Biden misleading?

The case for the oil and gas lobby rests on the fact that the high energy prices are caused by a combination of the Russia-Ukraine conflict (including resulting sanctions) and environmental regulations imposed by the Biden Administration. Biden’s policies are being touted as an obstacle to increasing production of oil and gas because it has increased the cost of drilling – costs that are being passed on to the consumer at the pump.

But this isn’t the whole story. WTRG Economics President James Williams provides some insight into the current price hike.

In early 2020, “we had COVID, which depressed oil prices because it depressed demand. The rule of thumb is that oil needs to be at $40 a barrel to break even, so you don't get much drilling until you get to $60," said Williams, speaking to AFP Fact Check.

The COVID-19 pandemic drove down demand for fossil fuels; travel was halted, businesses were forced to close, and more employees were working from home than ever before. The lessened demand sent the price of oil down. Oil prices even went negative in April 2020.

The shockingly low prices meant it wasn’t profitable for companies to drill for more oil. The halt in drilling led to a shortage in supply. Now, demand for oil has largely returned to normal levels. High demand and short supply have contributed to a spike in oil prices.

Economists add that Biden’s climate policies will likely have an impact on future oil prices, but they are not short-term price drivers.

Yes, the Ukraine crisis, the sanctions on oil and gas from Russia, and climate regulations have an impact on the price of oil, but they are not as immediately impactful as the lobbyists would lead you to believe.

New crisis, same tricks

This isn’t the first time that the fossil fuel industry has taken advantage of a crisis to push for more favorable policies.

Not long ago, it was the COVID-19 pandemic that provided leverage for the industry. An InfluenceMap report from April 2020 tracks how the fossil fuel lobby took advantage of the pandemic to lobby for deregulation of their industry.

Profiting from a crisis is nothing new, nor is it isolated to the fossil fuel industry. Acclaimed author and Climate Justice Professor, Naomi Klein, has written extensively about this phenomenon called “disaster capitalism.” It’s corporate nature to make profits wherever possible, even amidst a crisis. The oil lobbyists just happen to be really, really good at it.

Image credit: Mathias Reding via Pexels

Business Leaders Recalibrate to Protect Election Integrity

United in their belief that a strong economy requires a strong democracy, a coalition of business leaders and organizations recently announced the Business & Democracy Initiative (B&DI), a partnership with the goal to protect election integrity in the United States and rebuild trust in democratic institutions.

The Business & Democracy Initiative’s founding partners include the Leadership Now Project, the Black Economic Alliance and Public Private Strategies.

“Business leaders across the country are concerned about the health of our democracy. They understand that our economic dynamism depends on a capable and accountable government,” Daniella Ballou-Aares, CEO of the Leadership Now Project, said in a public statement. “The Business & Democracy Initiative will provide business leaders with the knowledge and platform to lead on the issues—from preventing election crises to expanding civic engagement—and secure a strong economy for the next generation.”

Polling by Morning Consult on behalf of the B&DI indicates the business community wants to be active in protecting democracy in the U.S. and that consumers will support them. The overwhelming majority of business leaders (96 percent) say the existence of a well-functioning democracy is important to a strong economy. Eighty percent of business leaders think businesses should act to protect democracy and to ensure safe and fair elections.

Just over half of business leaders (51 percent) say their businesses are more likely than they were five years ago to encourage employees to take a stance or speak out in support of democracy, or to take a public stance as a business. Sixty-four percent of consumers say that businesses with a public commitment to democracy shows those businesses care about their customers, employees, and has the “right values.”

The business community is well positioned with the public to defend democracy and election integrity, said Ballou-Aares, because businesses are trusted more than government and media. Edelman’s Trust Barometer for 2022 reveals the global level of trust in government and media dropped during the past year, she said, whereas businesses are the most trusted institutions (61 percent), for a second consecutive year.

Respondents to the Edelman survey believe the corporate community can and should do more to address societal issues, said Ballou-Aares. Business leaders, she said, need clear guidance on how to address complex, often controversial, issues to ensure they are aligned with their corporate values and are acting in their stakeholders’ best interests.

Businesses and business leaders are accountable to their customers and their employees to represent principles, not political parties, Ballou-Aares told 3p. Those principles, she said, must align with the “most basic values in our country—the rule of law and a participatory democracy,” and the B&DI coalition stands firmly behind those principles.

The coalition encourages business leaders to use their platforms to make public statements supportive of U.S. election integrity by providing employees, customers and other stakeholders with the facts and figures to mitigate misinformation, she said.

Citing research by Freedom House, Ballou-Aares noted that 45 of the top 50 global companies operate in a democracy.

“China may have a strong economy, but at what price? There are multiple contemporary examples of populist and authoritarian governments undermining business in countries like Brazil, Hungary, Turkey and China,” said Ballou-Aares. “In the U.S., corporations are increasingly threatened with targeted, punitive regulations when they publicly disagree with political leaders in states like Florida, Georgia and Texas.”

The business community needs to stand together against such retaliatory measures, she said, because “now is not the time to remain silent.”

Ballou-Aares told 3p the Business & Democracy Initiative will not endorse any candidates for office and instead will focus on mobilizing business leaders “committed to protecting elections and rebuilding trust in democratic institutions.”

“We seek to engage stakeholders across all levels of business to advocate for reforms that address the threat to our democracy,” said Ballou-Aares. “As the health and stability of American democracy continue to be under serious threat, the business community is a critical voice in the fight to preserve our free, open and democratic system.”

Image credit: Leon Kaye

Fear of 'Getting it Wrong' With Diverse Ads Can be Mitigated Through Inclusive Talent and Leadership

While advertisers are increasingly aware of the need for campaigns that represent the diversity of the human experience, a poll by the Unstereotype Alliance highlights the fears that many senior marketers in the U.K. have about getting representation right. Recognizing that advertisers have a responsibility to accurately portray all people without perpetuating stereotypes is a step in the right direction. In order to do so, people from the communities that are being represented must be included in the creative process. However, in order for inclusive marketing — especially diverse ads — to really mean anything, it is imperative that the companies behind the advertisements diversify their staffing as well: and at the c-suite level in particular.

The Unstereotype Alliance was organized by UN Women, an arm of the United Nations devoted to gender equality, in order to collaborate with the advertising industry and promote and empower positive change through marketing. Its poll of more than 100 top marketers in the U.K., as reported in AdWeek, shows overwhelming support for diversity in advertising. In fact, 70 percent of respondents planned to increase the level of inclusion and placement of diverse ads in their promotional material over the next year. The problem? Sixty-four percent name “getting it wrong” as their biggest concern.

There is good reason for that concern considering that 36 percent of those surveyed admitted a lack of diversity among creative talent in their organizations and among brands, according to a recent report breakdown in The Drum. Furthermore, 47 percent agreed that they didn’t know enough about diverse communities while 44 percent stated that they did not have enough experience portraying them.

Simone Pennant, founder and director of the TV Collective, spoke about the importance of this self-awareness on “How to Achieve Authentic Representation," a part of the Unstereotype Alliance’s “Conversations for Change” series, which aims to help guide advertisers as they promote diversity and inclusion in their work. “There is an arrogance to assume that you know everything and that your team can all look the same and be the same and assume that they know about different communities.”

How brands choose to proceed in such conditions will determine how their marketing strategies come across and whether or not they are successfully inclusive. Homogenous marketing teams risk creating something through diverse ads that is at best inauthentic and at worst tokenistic. Pennant continued: “If you don’t think there’s enough Black women directors and you’re in a position to hire them, then hire them. If you’re casting and you think there’s not enough people of disabilities, hire them or cast them. So take full responsibility in creating the kind of change that you want to see.”

The experts featured on the Unstereotype Alliance’s series agree that inclusive marketing can be a force for real change in the world. Melda Simon, the U.K. Lead for the organization, explained that just as advertising can be harmful and promote negative stereotypes, it also has the power to break those stereotypes down and replace them with understanding and positive representation instead.

In order to do so, representation by means of diverse ads is just as important behind the scenes as it is in the final copy. “Diversity is pretty meaningless if it’s only the screen,” Colette Philip, founder of Brand by Me, said on “The Power of Cultural Nuance," another video in the “Conversations for Change” series. “We’re still seeing the same closed groups of people holding power and making all the decisions.”

So, while advertisers have a responsibility to accurately portray the full diversity of humanity on screen, brands also have the responsibility to diversify their talent and executive leadership. Insensitive marketing, on the other hand, risks pushing people away — not just from the brand’s products, but as an employer as well — further exacerbating a brand’s lack of diversity.

Image credit: Chris Murray via Unsplash

Environmental Due Diligence is a Major Play for M&A Risk Mitigation

Merger and acquisition (M&A) dealings in 2021 reached a staggering $2.4 trillion - something not seen since 2015. While 2022 may not experience that level of activity, M&As are nonetheless expected to be substantial. As these transactions increase, the organizations involved will face new risk mitigation challenges as investors are increasingly growing more concerned about the potential impacts of climate-related risks to businesses.

Taking a closer look at sector drivers for the second half of 2022, commercial space acquisitions are going to continue at a relatively strong pace, especially as many organizations adhere to a hybrid working model and no longer need, or want, to carry the cost of large offices. In addition, as global economic unrest and significant supply chain constraints continue, many businesses are suffering. For many, profitability is dropping beyond the point of survival, and building owners could be looking to cash out while they still have equity left in their organization. As construction costs surge and housing prices remain at near-record highs, there is an opportunity to refurbish or retrofit a company’s existing property to meet the shift from large commercial or industrial space to smaller, more flexible commercial space or residential space designed for the hybrid worker.

As organizations navigate a landscape where potential deals can be affected by global economic headwinds and a rising interest rate environment, they must also consider the need to update and prepare their risk models and mitigation procedures to include greater risk profiling in environmental due diligence. However, meeting these new risk demands is going to be a heavy lift for many companies but, at the same time, is not something to be ignored in this new deal environment.

Hidden environmental risks can bruise your organization’s reputation and the bottom line

The last thing any organization wants is to acquire another business or property that has a tarnished compliance history or is handcuffed with unnecessary or overly restricted permits. From an environmental compliance perspective, organizations must now include risk factors for current and future operating conditions of the potential acquisition. This is imperative to ensure that all parties involved are adhering to required regulations and permitted with the capacity to allow for expansion of production.

A prime example of this can be seen in construction and development. Changes from commercial or industrial use to residential development can trigger more stringent environmental cleanup standards. If any redevelopment work is going to be done to an acquired building or piece of land, it is important to understand if contamination may be present in any of the areas that might be disturbed by the work. In many instances, these areas may not have been previously investigated because they were under existing infrastructure and inaccessible in the past but may be exposed when demolition or new construction begins. A key part of environmental due diligence is a better understanding of any sort of contamination and how it can be remediated correctly and efficiently with the future use of the property top of mind.

Improper environmental due diligence could put a black eye on the acquiring organization, and the lack of operational flexibility due to permit limits could reduce profit margins on the investment. However, as organizations re-evaluate their due diligence processes, they need to take a closer look at their risk models to ensure they meet any new risk mitigation challenges.

Updating environmental risk models for the new deal environment

Given our collective experience of the past couple of years and an overall increased focus on sustainability initiatives, the risk models and strategies from pre-2020, which focused primarily on adverse impacts to property or operational compliance, may no longer be sufficient for future transaction evaluations. As organizations ramp up their M&A activity, it is important to make sure risk models are updated and ready to be deployed.

Issues like environmental impacts, supply chain instability, community acceptance, permit transference or termination and surprises related to operational health and safety liabilities could all have an impact and become expensive to manage down the road if not incorporated into models from the start. Depending upon the parameters of the transaction and how liabilities may or may not transfer with the assets, organizations will often find that the business costs associated with these risks may far outweigh the cost of initial due diligence.

However, many businesses limit their due diligence to simple Phase I Environmental Site Assessments (ESAs), which do not provide the full picture needed to do a thorough evaluation. The importance of considerations not covered by the Phase I ESA process is becoming even more critical with the recent changes in how sustainability initiatives must be documented and reported and the shifting focus of most global brands. By shifting focus and risk models beyond Phase I ESA, organizations can aim to further protect the interests of both parties involved in the transaction

Ultimately, wading through historical data in the due diligence process requires a large commitment upfront. There are a wide range of documents and data to analyze, and organizations should partner with a third-party that understands a buyer’s strategic goals, then manages, organizes, and interprets the data to best meet a buyer’s objectives – and fully realizes and articulate the risks associated with the investment.

Interested in having your voice heard on 3p? Contact us at editorial@3BLMedia.com and pitch your idea for a guest article to us.

Image credit: Pavel Danilyuk via Unsplash

Memo to Businesses: Don't Go Back to Normal After Mass Shootings

It’s hard to know what to say after mass shootings rock a nation. But just a day after the school shooting in Uvalde, Texas, diversity, equity and inclusion consultant Kim Crowder put in words exactly what businesses need to hear.

“This week, many of our team members are hurting. They are also in fear of what could happen to them, those they love, and their fellow coworkers,” Crowder’s newsletter began. “Today, we wake up and go to work as if nothing happened, or at least we try to,” she wrote after recounting the horrific events that transpired at a Tops supermarket in Buffalo, New York, and Robb Elementary School in Uvalde — leading to a combined total of 31 people killed and many others injured.

The world may be trying to get on with its scheduled programming, but Crowder said businesses should take more than a moment of silence in the coming weeks to evaluate how they are handling the safety and wellbeing of their employees, especially those belonging to protected classes.

Instead of going back to normal, can’t we continue to a new normal?

Depending on how you count, as Al Jazeera reports, the United States experienced between six and 818 mass shootings in 2021. The number rockets to 818 incidents when you include any shooting where four or more people were injured, including the shooter. The counts of both the Gun Violence Archive and Mass Shooting Tracker reach to the hundreds.

We can’t continue with business as usual, Crowder said in a recent conversation with TriplePundit. “I think at this point, we can all agree enough is enough,” she said. Crowder herself, when walking around her local grocery store these days said she wonders whether someone could barge in and decide that she, a Black woman, doesn’t belong. The shooting at Tops isn’t the only incident of targeted racial violence the U.S. has seen in recent years.

What businesses can do right now to protect employees

Clearly, the U.S. has some large-scale changes it needs to make to safeguard its residents. Among the first steps businesses can take, Crowder said, is to speak up about government policies toward mass shootings, collaborate with other business leaders, redirect political spending and lobbying, and even create a think tank to more closely study the issue, if needed.

“We saw this happen in 2020, where New York City business owners wrote a letter to Mayor Bill de Blasio about those experiencing homelessness in New York City, particularly during COVID,” Crowder said. “And they came together and wrote a letter. And so this can happen; it has happened.”

Business leaders can activate “their collective access to power,” she added.

Mass shootings and additional tragedies don’t have to feel personal for a company to act, Crowder insisted. "[If] your team members are in some way impacted, then it should be a priority for you,” she said. And while political movement can take some time, office safety policies can be enacted immediately. “You’d be surprised how many companies do not have these policies already in place,” Crowder said.

Protecting employees by putting safety measures in place

In her newsletter, Crowder wrote: “Workplace diversity, equity, and inclusion are more than focusing on internal practices. It is about identifying and supporting what is dire and essential to team members and the communities we serve.”

So many of the mass shootings we hear about occur in workplaces. Employees have gotten ready in the morning to travel to work and do their job, whether it’s stocking shelves or teaching a class. Some workplaces may not yet have the safety measures needed for threatening situations. In those cases, Crowder recommends the services of a workplace safety consultant. After all, a business can’t simply implement one safety policy to cover all cases and all employees. Some employees may work in an office and others in a warehouse. Certain employees may be targeted for one reason or another. A consultant can create nuanced plans that respond specifically to employee needs. “The more our workplaces can start thinking about that, the better,” Crowder said.

One example of a safety-related skill a consultant may teach employees relates to intercepting subtle threats, Crowder noted. Employees may be taught to create a distraction away from the commotion, like dropping a jar. That distraction can diffuse a situation that may have otherwise escalated.

Be sensitive to your employees after mass shootings and any tragedy

Crowder said she was happy to hear that her young niece had the day off from school after the Uvalde shooting. She added that employees need that same sort of sensitivity, too. Maybe an office will cancel all meetings for the rest of the week so team members can breathe or provide employees the option of taking a day off, Crowder said.

Yes, ensuring your employees feel cared for does pay off. According to the Harvard Business Review, employee attrition attributed to mental health factors was already high in the U.S. in 2019, but has since risen. Taking actions for the safety and wellbeing of employees can also help a nation heal and truly build back stronger after tragedy.

Image credit: Nelly Antoniadou via Unsplash

The State of Corporate Social Responsibility? It’s Quite a White One, Actually

The Association of Corporate Citizenship Professionals (ACCP) recently produced a first-of-its-kind research study by race and seniority of corporate social responsibility (CSR) professionals. And the results of the study, titled, “Advancing Equity in the Corporate Social Impact Profession,” paint a dismal picture of some CSR teams representing the opposite of the diversity, equity and inclusion (DEI) they advocate for in the workplace and the community.

Of approximately 1200 surveys distributed, 208 were returned. Survey data also came from three focus groups facilitated by Leverage Philanthropic Partners (LPP) and Building Movement Project (BMP). Both companies are in the business of CSR through capacity building and research.

The results: just a little more than 60 percent of respondents indicated they work on teams with less than 25 percent Black, Indigenous and people of color (BIPOC) staff. Fifty-eight percent of respondents stated that “none/few” of their team members came from the communities served by their company’s CSR programs, and less than 20 percent of CSR professionals feel prepared to effectively advance equity in their work.

Additionally, the survey found that most department and division heads (CSR professionals) were white women, and that corporate DEI strategies are seen as lacking, especially by BIPOC professionals. And there is concern that corporate racial equity commitments may be fleeting, particularly among BIPOC professionals.

Lack of diversity within the team itself, inequity in terms of opportunity to participate, exclusivity in favor of white workers, and absent stakeholder representation: It adds up to a failing grade in CSR 101.

Along with the disappointing news from the ACCP report came a five-part action plan to advance racial equity and maximize the return on community initiatives. As the ACCP sums up, such works needs to be about “building a diverse talent pipeline by capturing the interest of and preparing young people of color to enter the profession, providing pathways for growth and upward mobility, advocating for a sustained commitment to DEI, educating and resourcing corporate social impact teams, and building partnerships across the broader social impact field that support racial equity.”

Some of those suggestions might translate into the development of internal programs that sharpen the profile and effectiveness of the CSR team.

But “fixing” the problem of an all- or mostly white CSR leadership group is half the challenge. One purpose of corporate social responsibility is to favorably communicate an organization’s brand and impact to its stakeholders and consumers. The challenge becomes an external one, as well, of understanding the culture of the organization and the community.

“Preparing young people of color to enter the profession,” might happen in the form of an internal company advancement program. But a commitment of support to an early learning program of an impoverished school district within the sphere of the corporation would go far in demonstrating cultural awareness and simultaneously build future human wealth for the corporation.

Just to capture the definition of the word “culture” is made challenging by the fact that the meaning of the term in America is being rewritten by political parties almost on a daily basis. We are now trending toward unprecedented duality.

From a political point of view, easily translated to the corporate perspective, Michelle Goldberg wrote a headline in the New York Times for her article on May 24 which said, “Cultural Power Won’t Save Progressives.” The culture that progressives would lean toward is being redefined into nonexistence when calls to pay your “fair share” in taxes suddenly become socialism. And laws are becoming more morally prohibitive in nature than crime preventive. Picking a side can mean entrenchment and isolationism.

Rick Spanier of Tucson, Arizona, was a commenter on Goldberg’s column and had this to say: “Let’s abandon the sloppy conjoining of politics and culture. Let’s accept that the U.S. is awash in politics and devoid of common culture.”

I’m not as cynical as Spanier. A good CSR team and plan take into consideration the climate of the times. And admitting we’ve lost our sense of common culture can be a good thing on the path to recovering it. The question becomes whether CSR programs can survive their own politics.

Of course, those within the CSR profession should continue to advocate for DEI within their ranks and beyond but advocate from an informed position that acknowledges the discipline required to solve internal and external systemic problems and the ultimate satisfaction of having done so.

Image credit: Emma Dau via Unsplash

How America’s Second Largest Cancer Charity Changes (and Saves) Lives

Each June as part of the Subaru Loves to Care initiative, employees from Subaru retailers across the country and local LLS staff come together to visit cancer patients, offering words of encouragement and handing out blankets.

“Cancer is a frightening diagnosis,” said Louis J. DeGennaro, Ph.D., who worked for decades in cancer drug discovery and now serves as president and CEO of the Leukemia & Lymphoma Society (LLS). “It can rob an individual of their identity. It can rob them of their livelihood, their freedom, their family and their life. Our goal is to be there for patients all along the way, so they know that they're not alone and that they can access through us the very best treatment possible.”

LLS has invested more than $1.5 billion since 1949 to fund research into treatments for cancers of the blood and bone marrow, a broad categorization that includes 140 distinct diagnoses. It also provides support services to cancer patients and their families across all 50 states and serves as the “voice of cancer patients” in Washington and state legislatures through policy advocacy. TriplePundit sat down with DeGennaro, who most affectionately refer to as “Dr. Lou,” to find out more about how the second largest cancer-focused nonprofit in the U.S. works to meet patient needs — and learn what brands can do to help.

Funding cutting-edge research on the road to a cure

The U.S. Food and Drug Administration (FDA) approved a stunning 25 new treatments for blood cancers in 2021 alone. The FDA has approved almost 100 new blood cancer treatments since 2017, more than 70 of which came out of research funded by LLS, an indication of the nonprofit’s knack for identifying innovation as well as the rapid pace of development in cancer research over recent years.

“This is a remarkable outcome in the last five years alone,” DeGennaro told us. “It's the long-term significant funding in this space, including what LLS has been able to put into the system, that is now paying out for patients.”

Each of these new treatments will save countless lives — and every breakthrough potentially opens the door to the next generation of therapies.

Take for example CAR T-cell immunotherapy, a revolutionary form of treatment DeGennaro describes as akin to “Star Wars medicine.” Approved in 2017 to treat leukemia and lymphoma, CAR T-cell immunotherapy reprograms a patient's T-cells — a type of white blood cells known as the soldiers of the immune system — to find, attack and eliminate cancer. It doesn’t work for every patient, but when it does, the results are nothing short of miraculous.

“I have witnessed this — patients have gone literally from their deathbeds to, in days or weeks, being cancer free,” DeGennaro said. The first group of patients who received the treatment in clinical trials recently celebrated a decade without cancer. “For this group, it has kept them cancer free for 10 years,” he continued. “Some people would call that a cure.”

This type of targeted therapy was ushered in by another major innovation from more than a decade earlier: Imatinib, brand name Gleevec, which was approved in 2001 for the treatment of chronic myeloid leukemia — turning a once fatal diagnosis into a manageable condition for most patients.

Rather than a prognosis of three years to live, patients with chronic myeloid leukemia can now treat their cancer at home with two pills a day — allowing them to live healthy and productive lives without ever receiving chemotherapy or radiation treatment in a hospital.

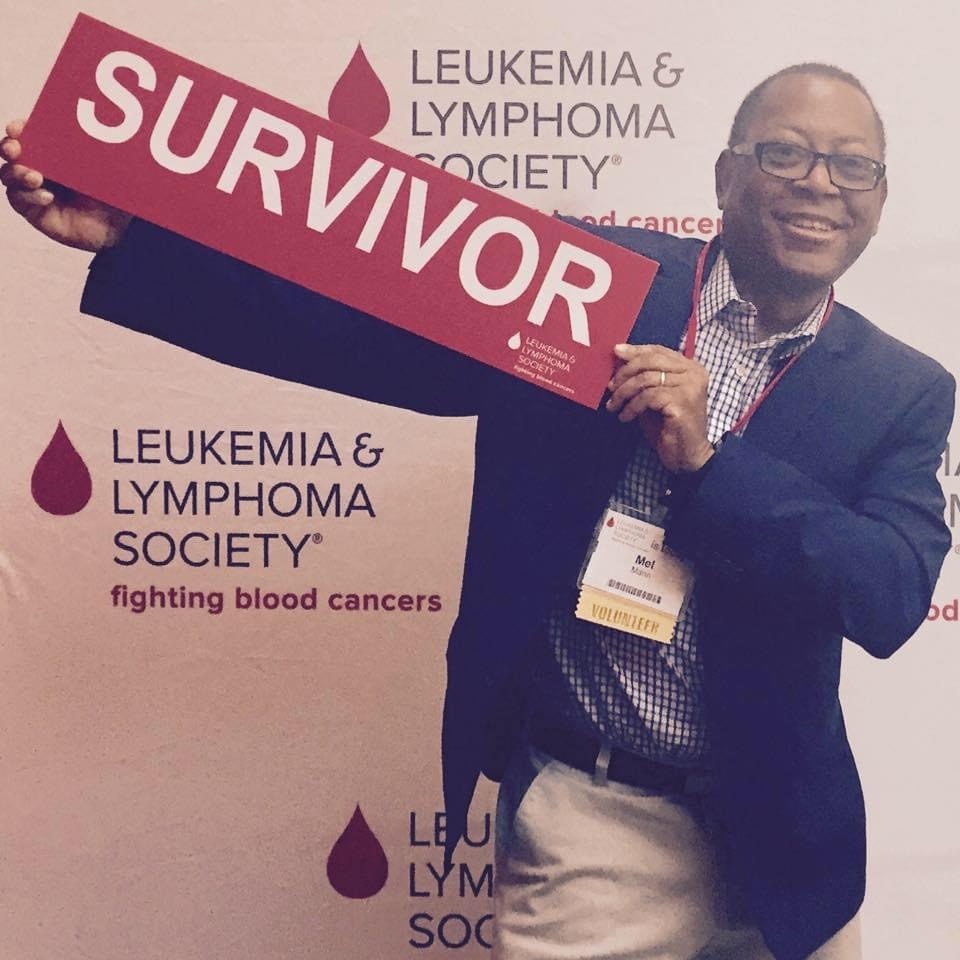

One of those patients is Mel Mann, who beat chronic myeloid leukemia in the late 1990s after receiving Gleevec as part of a clinical trial. Mann recently appeared on an LLS podcast alongside Dr. Brian Druker, a physician researcher at Oregon Health Sciences University whose work in the development of Gleevec saved his life. “I’m glad that Mr. Druker spent so much time in the lab, because if he hadn’t been burning that midnight oil and really studying this issue, I wouldn’t be here. It’s just plain and simple,” Mann said on the Bloodline With LLS podcast in September. “I was able to see my daughter grow up and become a physician herself. I mean, it’s like a miracle.”

The treatment has saved an estimated 350,000 lives globally since its approval.

Supporting cancer patients and their families when it’s needed most

While research into future treatments is critically important, two-thirds of the money LLS spends is devoted to providing free services for patients who are fighting cancer today — and those services are extensive.

The organization’s Information Resource Center, staffed by oncology nurses and social workers, is available to answer patients’ questions in more than 150 languages and help guide them to the right treatment and the right physicians. For cancers that are more difficult to treat with approved therapies, oncology professionals in the LLS Clinical Trial Support Center help patients secure a spot in trials that their physicians think could work for them.

Through the financial assistance division, which distributed $240 million in 2021 alone, patients can get help with paying for their prescriptions, traveling to their treatments or even paying their household bills. LLS also recently launched its first series of scholarships awarded to blood cancer survivors so they can finish their education that may have been disrupted by their cancer treatment.

“I love and cherish LLS for the connections I made through their community,” said Kyle, an LLS scholarship winner from Georgia. “I met and connected with so many wonderful people who I still talk to today, even though I’m in remission.”

Part of the organization’s patient support work also centers on expanding access to life-saving treatments in underserved communities. “Your outcome as a cancer patient should not be dependent on your ZIP code or the number of zeros on your paycheck,” DeGennaro said emphatically. “We have to provide equity in access to every patient.”

For example, the Influential Medicine Providing Access to Clinical Trials (IMPACT) program spearheaded by LLS looks to ”partner with major medical centers and bring clinical trials into the community-based cancer treatment centers where, frankly, most patients are actually treated,” DeGennaro explained.

IMPACT provides funding to major medical centers to create a network of clinical trial sites at community-based hospitals and clinics.. The program kicked off at the Mayo Clinic Cancer Center in Minnesota, Vanderbilt University Medical Center in Tennessee and Weill Cornell Medicine in New York City. This funding will allow for the creation of clinical trial sites at community-based treatment centers across the upper Midwest and rural South, as well as in underserved urban communities in and around New York.

LLS also delivers education programs tailored for underserved communities — for example, Myeloma Link, a 5-year-old outreach initiative, seeks to raise awareness about the signs and symptoms of myeloma in underserved Black communities and increase access to optimal care and resources among Black myeloma patients and their families. Black Americans have at least double the risk of myeloma as any other race or ethnicity, and they often face additional barriers and lower access to care.

Policy advocacy

State and federal policy is another key lever to enable equal access to treatment for every patient. On Capitol Hill and in state houses across the country, LLS looks to be the “voice of cancer patients” and “help lawmakers understand where they can make a difference in the lives and the outcomes of their constituents,” DeGennaro said.

Among other efforts, the organization’s Cost of Cancer Care initiative aims to develop what it calls “aggressive but feasible cost-cutting ideas” that would bring down costs for patients without sacrificing quality of care. And when bills related to cancer care — such as those impacting medical insurance or drug prices — come up for debate, more than 30,000 LLS-affiliated advocates volunteer to contact their representatives with more information about how the proposed legislation impacts patients.

How brands can help

I was 7 years old when my father was diagnosed with Hodgkin's lymphoma, and I later learned through stories how bad it really got — how close we came to losing my dad, and how my mom managed to provide for the family while navigating the tangled labyrinth of insurance companies, billing departments, and healthcare providers that made up his treatment. My parents sure could have used the services that LLS provides, and they’re not alone. “I hear this far too often,” DeGennaro said, “and brands can certainly help us in raising awareness in the patient population. If patients don't know about us, we can't help them.”

Further, LLS looks to leverage the unique strengths of its corporate partners to better serve patients. For example, since “the pharmacist is becoming the frontline of blood cancer care,” LLS works with Walgreens to create training programs for pharmacists so they understand patient needs — and the latest treatments — better, DeGennaro said.

LLS has also worked with Subaru of America since 2016 through a partnership that makes use of the automaker’s penchant for community-based philanthropy as well as its network of auto retailers from coast to coast. Subaru is the largest automotive donor to LLS. Each June as part of the Subaru Loves to Care initiative, employees from Subaru retailers across the country and local LLS staff come together to visit cancer patients, offering words of encouragement and handing out blankets.

Chemotherapy treatment rooms are notoriously cold, but “it's not just about a blanket,” DeGennaro told us. “In the moment that blanket means a lot, but it’s the support, the personal connection that defines this partnership.” Subaru and LLS have distributed more than 230,000 blankets, along with more than 31,000 arts and crafts kits for young patients, and thousands of messages of hope, since 2016.

“We're always leading with what we can do for patients,” DeGennaro said. “We're trying to cure these diseases — and in the meantime, while we're at that, making sure patients have the best outcomes and the best quality of life.”

This article series is sponsored by Subaru and produced by the TriplePundit editorial team.

Images courtesy of Subaru and LLS

No Way, Plant-Based Whey? Yes Whey!

With a growing interest in plant-based alternatives for everyday foods and drinks, Strive Nutrition’s latest release of a new milk alternative comes at an opportune time. Many of the leading brands of plant-based milks and other nondairy products contain little or no protein. While limiting consumption of animals and animal products has a positive impact on the environment, there is the argument that a plant-based diet has some risk of sacrificing nutritional value. Oftentimes, the tradeoff is for the ethical treatment of animals in exchange to meeting personal health requirements. To that end, Strive Nutrition is incorporating a whey protein, which Perfect Day produces, resulting in a completely animal product-free line of food and beverage products. This inclusion, says the company, provides the creamy texture and decadent flavor of dairy, without the cows. Perfect Day’s plant-based whey protein, says Strive, also enhances the nutritional value of the beverage.

Strive, through this partnership with Perfect Day, aims to create a tasty, sustainable and nutritious alternative to conventional whole milk with its product Freemilk, launching this summer. Among the biggest concerns when switching to plant-based milks and beverages is whether or not they will be able to directly replace dairy milk’s nutritional profile. Many plant milks don’t have the same frothing, whipping, foaming and cooking abilities as dairy milk. Not to mention, they often taste completely different. According to Strive, Perfect Day’s plant-based whey protein can give Strive’s Freemilk the taste, texture, and nutrition of dairy, without the lactose, hormones, antibiotics or connection to factory farms.

According to Dennis Cohlmia, Co-Founder and CEO of Strive, “Perfect Day’s animal-free whey protein isolate is bio-identical to whey protein from conventional dairy production and processing.” It’s a lactose-free complete protein, and includes all nine essential amino acids along with other nutritional components of whey protein. The primary protein in the whey found in cow’s milk is beta lactoglobulin (BLG) protein, which Strive says comprises 95 percent of Perfect Day’s whey alternative. Using animal-free whey protein results in a beverage that contributes less to climate change, and is also free of hormones, antibiotics, and potential microbiological problems. The company claims Freemilk has 25 percent more complete whey protein per serving and 75 percent less sugar than conventional milk, as well as no cholesterol and no lactose.

Perfect Day’s plant-based whey protein is vegan, but vegan products do not escape the issue of allergens. In the case of whey proteins, the molecular structure of BLG can trigger allergies, as previous research on the subject has verified. To that end, Strive includes a milk allergen warning on the package, the same way there are allergen claims on soy, nuts, gluten and pea protein. With this information in mind, Freemilk is vegan, because no animals are involved in the process, yet people with milk allergies should be aware of any potential risks.

Among Strive’s drivers for contributing new products in the animal-free dairy category is climate change. Back in 1979, the company pioneered aseptic food processing to create high quality foods with natural ingredients and without preservatives. The motivation is to make products that taste delicious and are also good for the planet. As Cohlmia explained to TriplePundit, "Perfect Day animal-free whey protein isolate is the first animal-free dairy component that is commercial and meets FDA GRAS [i.e., generally recognized as safe].”

Plant-based dairy alternatives are often low in protein and skeptics point out that they often don’t provide significant nutritional value. On that point, Strive says it seeks to enrich plant-based beverages with a complete protein profile and has future plans for this food and beverage segment. The company has said that it will soon add more flavors, as well as single-serve packaging for school, work and travel. On the horizon later this year is also a Strive+ line of sports protein shakes and protein hydration waters using Perfect Day’s plant-based whey protein.

Image credit: Strive