Denmark Sets New Wind Power World Record

Denmark has long been one of the world's leaders in wind power. The country of 5.6 million has set a goal of generating 50 percent of its power from clean energy sources by 2020 and aims to be entirely fossil fuel-free by 2050. Those goals, especially the one for 2020, are well achievable: Denmark has announced it scored 39.1 percent of its energy from wind in 2014.

That statistic is quite a jump from 2013, when Denmark generated 33.2 percent of its electricity from wind, and it has more than doubled its wind power capacity from a decade ago (18.8 percent). The result is a country that has understandably dubbed itself the world’s “Wind Power Hub.” Considering the Danish wind industry’s claim that it has built over 90 percent of the world’s offshore wind turbines, Denmark’s continued surge in wind power development, while stunning, has its origins in long-term planning.

Denmark’s wind energy policy dates back to the 1970s, when the oil shocks resulting from the Middle East crises sent the energy import-dependent nation scrambling for new sources of power. At first nuclear energy was the preferred choice, with up to 16 locations across the country identified for future power plants. But an anti-nuclear energy campaign launched, eventually nudging the Danish parliament to abandon that option by the mid-1980s — even before the Chernobyl disaster spooked many countries into abandoning their more ambitious nuclear power plans. Meanwhile a nascent wind power sector began to take shape, eventually leading to today’s giants such as Vestas and DONG Energy. Long before feed-in tariffs became commonplace in Europe, the Danish government launched such programs in 1990 to help scale wind power throughout the country.

Now Denmark has over 5,200 wind turbines in operation, with about 25 percent of those offshore. The Danish government is offering strong support for its wind power sector, with approximately €135 million ($200 million) earmarked for wind power research and development and other energy technologies annually. Meanwhile coal, long the backbone of Denmark’s energy infrastructure, is slowly being phased out. Denmark estimates less than 30 percent of its energy needs will come from coal by 2020.

Denmark’s ambitious plans for a future free of oil and gas are not entirely guaranteed. Some experts argue that the rapidly increasing output of wind power could cause the price of wind energy to collapse to the point where energy companies would have to scramble to sell off that energy, leaving customers with higher utility bills. And while Denmark’s achievements are impressive, it’s going to take more than this little Nordic country going carbon-free to stop global warming. What Denmark does prove, however, is that long-term energy planning can pay off with not only a more secure energy policy, but added economic growth as well. Oil may be cheap now, but it will spike again at any moment: So, while many countries will yet struggle again because of their lack of an energy plan, Denmark will be relatively unscathed.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com.

Published earlier today on Triple Pundit.

Renewable Energy Rising Across All Spheres of U.S. Society

Organizations across the U.S. are coming to grips with our fossil-fuel addiction and the escalating, often hidden, true costs of fossil-fuel production, distribution and combustion.

Registering another record-setting year in 2014, the U.S. solar energy industry is looking forward to another banner year in 2015, while the recent extension of the federal wind energy production tax credit is expected to boost growth across the wind sector.

A mix of supportive government policies and R&D investments, along with energy market reforms, ongoing technological advances and new financing vehicles, is proving to be a potent and self-reinforcing combination for allocating public- and private-sector resources for public good. As a result, the costs of renewable energy generation and energy efficiency upgrades are expected to continue on their downward trend -- and installations continue to grow -- despite the recent sharp drop in oil prices.

Manufacturers such as Boeing, for example, are helping refute the notion that “green” renewable energy technologies can't meet heavy industry and grid power needs. Smart grid demand response and management systems are being refined, while a new generation of advanced energy storage systems hold out the promise of a more efficient, effective and clean energy-fueled power grid.

U.S. universities, such as Cornell University, are at the leading edge of change as well, both in terms of installing and tapping into renewable energy sources for electricity and carrying out renewable energy and clean tech R&D. Community-based renewable energy is also on the rise, with municipalities such as aptly-named Greenfield, Mass. The town gives residents the opportunity to go 100 percent green energy by investing in and buying electricity from local utility distributors, solar power installations and wind farms.

Renewable energy and 737s

A growing list of leading U.S. companies are busting myths by proving that renewable energy resources can reliably and affordably meet all of their electrical power needs. Manufacturing airliners requires a lot of energy, but Boeing is demonstrating its commitment to corporate social, as well as environmental, responsibility in a variety of ways, including making increasing use of renewable power.

Producing 737s at a record pace, Boeing in December announced that renewable energy sources are meeting 100 percent of electricity needs at its production facility in Renton, Wash. Sealing an agreement with Puget Sound Energy, the 737 manufacturing facility's electricity needs are being fully met by a combination of hydroelectric power and wind energy from the local utility, purchased via renewable energy credits (RECs).

Commemorating the green energy milestone at an on-site ceremony,Beverly Wyse, vice president and general manager of Boeing's 737 program, said:

“Boeing is proud to expand our investment in clean, renewable energy. Investing in local wind energy through Puget Sound Energy demonstrates our commitment to our local community and the environment, and mirrors the environmental performance of our new fuel efficient 737MAX aircraft.”

Community-based renewable energy on the rise

In addition to manufacturers, entire communities are choosing to meet their electricity needs via renewable as opposed to fossil fuel-fired resources. Ringing in 2015, residents and businesses in Greenfield, Mass., for instance, will be getting their electricity from a new utility provider. Replacing incumbent Western Massachusetts Electric Co., the Greenfield town board chose ConEdison Solutions as its electricity supplier.

What makes this particularly notable is the fact that the electricity ConEdison Solutions distributes to Greenfield residents and businesses is sourced wholly from “green” renewable energy resources. Adding to the social and environmental benefits, Greenfield negotiated “an electricity price that is lower than WMECo's at the time of program launch.

“The town's goal,” as stated on the Greenfield Light & Power Program website, “is for the program price on average to beat WMECo's price.”

Solar and wind-powered schools and universities

The Solar Foundation recently released the first nationwide assessment of solar energy use across U.S. schools and communities. The study revealed that installed solar photovoltaic (PV) capacity at U.S. schools soared over the past decade, doubling every year for the past six years. That's resulted in big reductions in greenhouse gas emissions – the equivalent of not burning 50 million gallons of gasoline, as well as avoiding the social and environmental threats associated with fossil fuel-fired electricity generation.

Adding to this total, the Ivy League's Cornell University last month announced it “has agreed to purchase all electricity generated by the proposed Black Oak Wind Farm in Enfield, New York,” the Cornell Chronicle's Blaine Friedlander reported.

Awaiting municipal approval, purchasing all the renewable power from the Black Oak Wind Farm would meet 20 percent of Cornell's annual electricity needs – the equivalent of powering some 5,000 homes. Having accepted a final environmental impact statement (EIS) on Nov. 12, the Town of Enfield Board “is preparing a findings statement to complete the mandated State Environmental Quality Review,” according to the Cornell Chronicle. That's expected to be finalized early this year.

Cornell faculty, students and staff in 2009 developed a plan to cut carbon emissions to net zero by 2035. From 2008 to date Cornell has realized a 32 percent reduction.

“Wind is a very reliable source of renewable energy and contributes zero carbon into the atmosphere while generating electricity. As we use more wind, we reduce our dependence on carbon-produced electricity. This is a major step toward Cornell becoming a carbon neutral campus,” KyuJung Whang, Cornell vice president for facilities services, was quoted in the Chronicle's report.

Adding to its social and environmental cred, the Black Oak Wind Farm would be New York's first community-owned wind farm, a growing number of which are cropping up across the U.S. In December, community-owned solar project development specialist Clean Energy Collective announced a strategic partnership with solar PV manufacturer and project developer First Solar, the largest solar PV manufacturer in the U.S. In addition to working together to develop community-owned solar PV projects across the country, First Solar took an equity interest in CEC, indicative of a strong interest in community solar power on the part of market-leading solar PV providers.

*Image credits: 1) EPA Green Power Partnership; 2) Boeing; 3) Greenfield Light & Power; 4) Black Oak Wind Farm

Beef Industry Having a Cow over Potential USDA Recommendations

Americans’ consumption of beef has been declining at a steady rate since the 1970s, but the beef industry is still a powerful lobbying force in this country. So watch for an onslaught of propaganda if a U.S. Department of Agriculture panel makes new recommendations for dietary guidelines in the near future. In a move that will bring screams of nanny state-ism, socialism and “Blame Obama,” the Associated Press has reported this advisory panel is close to recommending a diet that is both higher in plant foods and reduces its overall environmental impact.

Clearly that suggestion is a shot at the beef industry, which at a global scale has a massive effect on land use and carbon emissions. True, the industry is making a nudge towards becoming more sustainable, but big beef’s impact on water, land and air is hard to ignore. Plus considering Americans’ generation-long struggle with obesity, a diet heavy on produce, whole grains, nuts and other plant-based products is not a bad idea. So that “My Plate” icon, which replaced that disastrous “food pyramid” suggesting we heap on the carbohydrates at meal times, could soon have less room for meat.

Naturally, the beef industry is not having it.

Take this statement from a doctor’s statement issued from the National Cattlemen’s Beef Association:

"Despite a large body of strong and consistent evidence supporting lean beef’s role in healthy diets, the Dietary Guidelines Advisory Committee appears to be out of touch with today’s lean meat supply in the retail counter and the 30+ years of nutrition advice showcasing benefits of lean beef. I am deeply disappointed that the Committee missed this opportunity to positively influence the American diet by blatantly disregarding sound science and removing lean beef from a healthful dietary pattern.”

Of course, the U.S. beef industry has long been a beneficiary of government largess with its long history of receiving federal subsidies. Most of that largess is going to four large conglomerates while smaller independent ranchers are going bankrupt. So while the beef industry cries foul (which by the way, Americans have turned to more fowl in recent years, one reason why red meat consumption is falling), it has long been a fan of “big government” . . . unless that same government suggests eating a little less of that subsidized meat, which would be a good idea for most of us in the long run.

So watch for the political fireworks to continue later this year when the USDA makes its quinquennial dietary recommendations. This same National Cattlemen’s Beef Association, which only exists because of the federal funds received that keeps it afloat, still carries plenty of clout on Capitol Hill. A USDA recommendation to suggest “Meatless Mondays” was torpedoed a few years back, with the suggestion that the government agency only exists to protect the meat industry, not make suggestions for the health of U.S. citizens. One cannot blame any industry for making public relations campaigns and political chess moves to protect its business. But when this is done on the public dime, the bellyaching at the very least is certainly head scratching.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com.

Image credit: FoodSafety.gov

White Castle Bets on Veggie Sliders

News has been spreading of White Castle's new veggie sliders. Why should we care? Because we care about broader acknowledgement of health and sustainability. Not that a company particularly cares about either, but it acknowledges that customers want those things ... even if the actual product isn't healthier.

White Castle is diving into a market other fast food chains have tried out but with limited customer buy-in. When McDonald's gave it a go back in 2000, they reportedly sold about four veggie burgers a day. Burger King sells them, but I've yet to hear or read a great review. And yet, White Castle is forging ahead.

I wish I could vouch for the quality of the new veggie sliders, but there really isn't a White Castle within 50 miles of here. It's a real bummer, too, because I love White Castle. Mmmm .... sliders.

Veggie sliders were among the top three most requested items in a 2013 White Castle survey. Jamie Richardson, the company's vice president, believes the limited-time menu offering is going to bring new customers in the door. I mean ... that's why they do these sorts of things, right? In order to reach a broader customer base?

The draw may not necessarily be that veggie sliders are healthier. Of course there may be that perception among many. But the veggie version has about the same fat and calorie content as meat-based White Castle sliders, so "healthier" may not be the exact word.

Apparently the draw for White Castle is that the veggie slider reduces what I found to be a delightful fast food industry term: "the veto vote." As in, there are a bunch of people at the office saying, "Where should we get food?" And when somebody suggests White Castle, another person vetoes it -- possibly on the grounds that there aren't vegetarian options. The goal, apparently, is to reduce your fast food chain's likelihood of being vetoed in a group decision process.

Honestly, I'd never thought about it in detail. But that's exactly how it goes in the real world.

Ultimately, this is a good move for everybody. Not because it's healthier or because there's a change of heart among fast food board members. But because it reflects a move among the public to demand or seek out products that may be healthier or more sustainable. We can leave conversations about greenwashing or health-washing for another article.

But ultimately I see less meat in the fast food offering as a more sustainable option, with regards to the amount of food that can be produced in a smaller space if it's a vegetable versus if it's beef. Also, lower beef production has a reduced impact on climate change due to lower methane (from cow farts and excrement).

These changes, whenever fast food companies or major corporations take them on, can be subjected to a cynical eye: the company is just trying to sell more product and it's not necessarily healthier. And that's fine. I tend to see it as the actual market making fundamental changes, and that's a much better, much more powerful force than one fast food chain.

Cultivating the Next Generation of Leaders Through Social Entrepreneurship

By Bruce A. Vlk

Within public policy schools, social entrepreneurship is a relatively new addition to curriculum. Traditionally, society has considered solving social problems the domain of governments and philanthropy. The emerging field of social entrepreneurship has introduced business tools and unlocked global capital markets to solve major social problems, with the promise of building enterprises that are both financially sustainable and solve the great social challenges of our time.

“It seems difficult in the short or medium term to see major changes through public policy alone. Our students look at government and they see it’s broken,” says Christine Mahoney, associate professor at the Frank Batten School of Leadership and Public Policy and faculty director of the Social Entrepreneurship Initiative at the University of Virginia.

Professor Mahoney further states, “The problems are massive, and even government and philanthropy together is not going to be able to meet the demand. These massive institutions cannot be changed easily. And so if they cannot be changed, you either give up or, in an entrepreneurial spirit, you go around it and come up with a different solution.”

In 2011, Professor Mahoney, along with undergraduate students Lily Bowles and Kevin Pujanauski, secured a grant from the Jefferson Trust to seed classes, prize competitions, field work and faculty in social entrepreneurship. Since then, Mahoney and her colleagues have explored how social entrepreneurship can drive policy change. Their initiative, Social Entrepreneurship at the University of Virginia (or SE@UVA) has enabled thousands of students to build leadership skills at the intersection of business, government and society.

“We are a school of public policy but we are also a school of leadership. We teach some of the basics of social psychology behind leadership, but we need to create opportunities for students to practice becoming leaders. That's how you get good at it,” says Mahoney.

The initiative seeks to generate exciting public policy outcomes through the proliferation of innovative ideas. Professor Mahoney, who has conducted extensive research on lobbying and advocacy in the U.S. and the European Union, sees how social innovation by groups can be adopted and scaled-up by governments to bring about large-scale change. Social entrepreneurs are fixated on solving a problem, and they’ll explore and adopt whatever strategies do that most effectively. She cites the example of social entrepreneur John Kluge Jr. (a fellow at SE@UVA), who co-founded impact investing firm Eirene and then co-founded the nonprofit Toilet Hackers, in order to address the sanitation crisis around the world. Through both organizations he and his team have experimented with different investing, direct action and advocacy tactics – moving forward with what works and pivoting away from less effective strategies.

“Most social entrepreneurs see a problem and they are passionate about solving the problem. They go and do the important up-front legwork, experimentation and pivoting to perfect their model. Then they can go to government to see it scaled up. But often, the government comes to them after they have proven it works,” Mahoney says. SE@UVA is interested in understanding what makes for the most successful social innovators and how their ideas can be scaled-up not only through the support of government, but also through public-private partnerships, social impact bonds and impact investing.

Traditionally universities can have silos, but SE@UVA aggressively pursues an interdisciplinary approach. Understanding how to start and operate a business is not enough; the next generation of young leaders must also understand finance, policymaking, nonprofits and international development, among many other things. This is what experts in the field refer to as “multilingual leadership,” and it lies at the heart of the SE@UVA’s curricular approach. So far, the results are encouraging:

- Field Experience: students have had the opportunity to gain hands-on experience with social ventures in Brazil, Tanzania, Rwanda, Zambia and the Philippines.

- The Batten School has sponsored a Social Entrepreneurship Track within the University’s E-Cup.

Today, SE@UVA offers six classes, some cross-listed under the Batten School, the U.Va. Curry School for Education and the U.Va. College of Arts and Sciences. The initiative also works closely with the U.Va. School of Engineering and Applied Science, the Darden School of Business and the McIntire School of Commerce.

According to Mahoney, SE@UVA is built upon a simple, yet powerful mission: To cultivate the next generation of innovative social leaders. Its four pillar strategy advances that mission:

- Cross-Disciplinary Curriculum

- Experiential Education

- Research and Scholarship

- Leadership Development

The excitement and interest from the student population is palpable: Public policy students work with engineering students on projects; business students discuss problems with education students; and faculty interact with community and business leaders. Although still in its early stages, Mahoney hopes SE@UVA will be a model for bridging the gap between seemingly intractable policy problems and innovative solutions.

Bruce A. Vlk is the Director of Communications and Marketing for the Frank Batten School of Leadership and Public Policy at the University of Virginia.

GRI kicks off project to explore future of reporting

The Global Reporting Initiative (GRI), architect of the world’s most widely used sustainability reporting framework, has kicked off a new project - Reporting 2025 - aimed at promoting discussion about the future of sustainability reporting.

Over the course of the next year GRI is to interview thought leaders to identify the main issues that will be – or should be – at the centre of companies’ agendas and their public reports. Throughout 2015, GRI aims to generate articles, videos, analysis papers and publish them on the GRI website.

GRI’s chief advisor on innovation in reporting, Nelmara Arbex, is leading the Reporting 2025 project. Arbex has worked in corporate sustainability for 14 years and in her previous role as GRI’s deputy chief executive, she supervised the development of the G4 Guidelines, which involved thousands of stakeholders in more than 30 countries.

“As the practice of reporting continues to mature, it’s crucial that we make sure our activities are leading to a sustainable global economy,” commented GRI’s chief executive Michael Meehan. “This means that organizations must do more than merely produce a sustainability report. The data collected needs to empower informed decision-making, not just for management but also for other stakeholders. Reporting 2025 will examine how best to bring this about.”

The project is being sponsored by Boston College – Center for Corporate Citizenship, Enel and SAP.

Venture Capitalists Inject $27 Million Into Stem's Distributed Energy Storage Tech

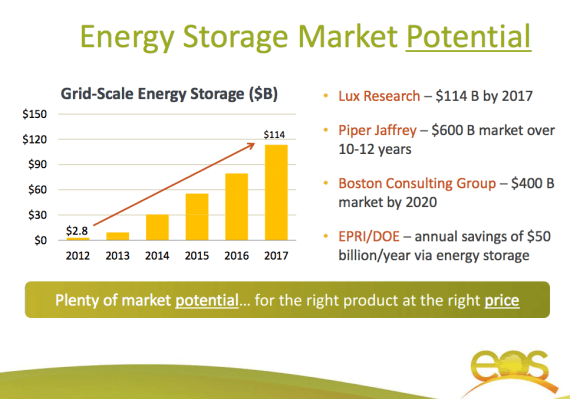

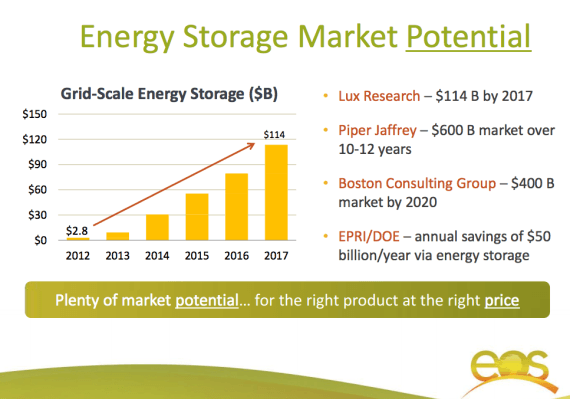

Fueled by power market reform and technological advances, investor enthusiasm regarding the commercial prospects of advanced energy storage technology is on the rise. A study by the Electric Power Research Institute and the U.S. Department of Energy determined annual savings of $50 billion could be realized by deploying energy storage systems across the U.S. power grid.

Savings of this magnitude, along with market researchers predicting rapid growth in revenues, is stoking investors' appetite for pioneering young companies that have proven their advanced energy storage solutions commercially. Among this small but growing set is Millbrae, California-based Stem, whose technology is capable of managing fleets of distributed energy storage systems so as to meet or exceed grid operators' needs and yield attractive financial returns and environmental benefits.

On Jan. 7 Stem announced it had closed a $27 million equity financing round. Constellation Technology Ventures and Total Energy Ventures joined earlier investors, including GE Ventures, that see energy storage playing a growing role in the U.S. power grid, both in front of and behind the meter, and Stem's technology helping drive that growth.

Integrating energy storage into the grid

Integrating energy storage systems distributed across multiple customer sites, Stem's predictive analytics software platform optimizes charging and discharging of battery storage capacity. This is a defining attribute that can enhance grid power reliability and resiliency -- and do so even more more efficiently than conventional fossil fuel-fired reserve generation capacity, proponents contend. Conducting their own research, power industry and market regulators in states such as California, Hawaii, New York and Texas have instituted market reforms that open the door for energy storage providers to gain a foothold in local and regional markets.

Back in November, Stem was one of three pioneering power technology companies awarded contracts by Southern California Edison (SCE) to deploy advanced energy storage systems “behind the meter” at utility customer sites. SCE's solicitation to include distributed energy storage solutions as a means of meeting forecast local capacity requirements marked a milestone in U.S. power industry history.

Kicking off California investor-owned utilities' drive to acquire 1.325 gigawatts of energy storage capacity by 2020, SCE awarded Stem a multi-year contract to deploy 85 megawatts of power storage capacity. Commenting on SCE's distributed energy storage contract awards, California Energy Storage Alliance Executive Director Janice Lin stated: “This is a major win for behind-the-meter storage, demonstrating that this technology is a valuable tool for both utilities and their commercial and industrial customers ... SCE is a pioneer in leveraging customer-sited storage for local capacity requirements and should be commended for its efforts to make storage an integral part of its operations.”

Growing investor enthusiasm

With their equity investments, Constellation Technology Ventures and Total Energy Ventures join Angeleno Group, Iberdrola (Inversiones Financieras Perseo) and GE Ventures in funding Stem's ongoing technology R&D and its geographic expansion. Michael Smith, vice president and leader of Constellation Technology Ventures (the venture capital arm of Exelon Corp.) commented:

“Energy storage is becoming an increasingly important energy and demand management solution for customers and utilities. We view Stem among the leaders in this market and look forward to taking an active role in facilitating Stem's nationwide expansion.”

Similarly, in addition to injecting equity capital, Total Energy Ventures, the venture capital arm of France's Total energy group, affords Stem the opportunity to expand by working through its extensive renewable energy and energy storage project development channels. As Bernard Clément, senior vice president of business operations for Total Energy Ventures, elaborated:

“Total is always looking for ways to optimize its operations, and smart energy solutions like Stem's play an important role in strengthening the service we offer our customers. We believe Stem's combined storage and software system adds considerable value to our offering and that of our affiliates.”

*Images credit: 1) Stem; 2) Eos Energy Storage

Larry Summers Calls For a Carbon Tax Now

In a recent op-ed in the Washington Post, former Treasury Secretary Lawrence "Larry" Summers makes the point that, with gasoline taxes at levels not seen in years, this would be an excellent time to implement a carbon tax.

It's not likely that a 25-cent-per-gallon surcharge to help offset the impacts of resulting carbon emissions will draw outrage at a time when gas prices have fallen by over a dollar. Yet, this is the amount that a proposed $25-per-ton carbon tax would cost. The $1 trillion collected from this could be used to fund aggressive development of cleaner technology and to help prepare cities and towns for the many changes that have been predicted.

Summers points out that, "The core of the case for a carbon tax is the recognition that those who use carbon fuels or products do not bear all the costs of their actions."

Indeed, the only realistic possibility for a successful market-based approach to combating climate change is some mechanism that reflects the full impact of each transaction. "Free" market forces that pro-business advocates often cite are not sufficient because the impact of today's actions may not show up until years from now and in some locale thousands of miles away. Indeed, buying and burning carbon fuels like gasoline, diesel and natural gas today is a bit like driving without a speedometer -- in that we have no feedback on how quickly we are adding carbon into the atmosphere.

Filling up your SUV today could contribute to coastal flooding in Florida 10 years from now, but neither you nor the people who sold you the gas have any connection to this outcome without a mechanism in place to effect this.

Of course, no one likes to pay taxes, and this fact has for years been a rallying cry for conservatives who feel that the government is already too large. They claim that added taxes would only increase the size of the government. First of all, these folks tend to consistently undervalue the role that government plays in facilitating the interactions between businesses, the public and the environment. I've already pointed out that free market forces alone are not sufficient in cases like this. Secondly, a number of proposals that have been put forth for a carbon tax would have all of the money refunded to taxpayers at tax time, with the possible exception of the wealthiest individuals. Some of the proposals could potentially allow for significant reductions in income tax.

Perhaps more importantly, as Summers adds, "That which is not paid for is overused."

These low gas prices are making it harder to justify efficiency measures and renewable supply on an economic basis. The payback period just got a little longer. Hence, another benefit: The implementation of a carbon tax could also stem the tide, which is already underway, of people rushing out to buy large SUVs and pickups, as if these super-low gas prices not were not just a temporary blip on the economic timeline.

There are several reasons why the return to higher gas prices is inevitable. First, although increased U.S. production has put supply ahead of demand, the rapidly growing economies in places like India and China are quickly increasing demand which will soon catch up to supply once again. But even before that happens, the economics of oil production will take over. Oil companies will not sell gasoline at a loss. And these low prices are already close to what it costs to produce the oil, especially when using exotic, deep-earth drilling techniques like tar sands extraction or hydraulic fracturing (aka "fracking") of shale deposits. Geologist David Hughes has pointed out the fact that fracking wells do not last long and when they give out, new wells must be drilled at even greater depths which translates into higher costs.

A carbon tax will shift that break-even point as well.

The mentality that says, "let's buy a gas-guzzler because prices are down," is the kind of thinking we really need to get away from if we are to get to a sustainable existence.

Summers is absolutely right. This is the perfect time for a carbon tax. Now, let's see what the Republican-controlled Congress has to say about that.

Image credit: Flickr/teegardin

Top 3 Sustainable Supply Chain Trends for 2015

By Elisabeth Comere

Sustainable business strategies seem to be the focus of customer companies today, and companies will continue to move forward with full integration across their supply chains in response to the resource crunch. Here are the top three trends for 2015.

1. Better resource management

Currently companies are facing major barriers to adopting responsible alternatives, like bio-based plastics and FSC-certified fibers, because demand simply isn’t strong enough to put them on a level playing field with conventionally-produced materials. So, how do we raise the bar?

- Establish a Business Code of Conduct for Suppliers (BSfS)

A social and environmental code of conduct will drive responsibility throughout the supply chain by holding each supplier to a higher standard with respect to environmental protection in sourcing, manufacturing, distribution, and the treatment of workers and communities. To be effective, a code of conduct cannot rely on a signature alone as it requires active and regular engagement through data reporting, third-party inspections and audits

- Build upstream partnerships

Engage your base material suppliers by working collaboratively to meet your responsible procurement goals. Working directly with your suppliers is a big opportunity to close identified gaps with a continued focus on driving responsible sourcing.

- Establish a chain of custody

A chain of custody provides transparency from resource extraction to the point of sale. Third-party management and chain of custody certification is more credible than a self-declaration from suppliers as proof that raw materials came from well-managed areas.

- Reporting and evaluating your supply chain

2. Innovative bio-based materials

Multinationals will continue to explore how their operations can contribute to a circular material flow by taking a hard look at the resources entering their supply chains. The premise is to reduce the consumption of primary materials by extending the lifecycle of those in use by reusing, recycling and transitioning to naturally renewable components. More and more businesses will look to responsibly-managed, plant-based sources -- such as timber, sugar cane and dent corn, wheat, biomass wastes, and algae -- to do just that. Renewable material integration moves operations closer to a circular business model; secures a continuous flow of feedstock; and demonstrates a commitment to environmental and social sustainability.

3. Eco-efficient operations

Constantly at play, and often times competing, are two forces: economics and the environment. For Tetra Pak's customers, economic performance is affected by production efficiency, operational cost and total cost of ownership, while action on the sustainability front is largely driven by brand reputation, retailer demands and legal requirements. As we know, these forces can have adverse effects on one another if under-managed or mismanaged, and they need to work in harmony for customers to remain competitive, profitable and sustainable.

We anticipate a growing trend in 2015 of companies using a gate-to-gate approach for reducing the environmental impact of production processes – a holistic methodology that is used to optimize each stage of a product’s lifecycle. At Tetra Pak, we recognize this can seem like a daunting but necessary task for operations, especially for those companies that already have fully established systems in place.

To better help our customers, Tetra Pak has launched a new Environmental Benchmarking Service, a comprehensive audit that is used to measure generated waste, energy and water consumption of the entire processing plant. Based on this audit, the Tetra Pak Technical Service team will then provide specific recommendations on opportunities for improvement, helping customers not only to reduce their environmental impact, but also to lower cost.

Pilot projects have been carried out in the U.S. and in Europe, delivering average costs savings of around 20 percent. For example, at Pacific Foods, a U.S.-based producer of organic foods and beverages, opportunities were found to reduce the company's carbon footprint by approximately 3,500 tons of CO2e and to cut its water consumption by some 31 million liters every year.

Elisabeth Comere is responsible for environment at Tetra Pak – the world leader in packaging and food processing solutions. She joined the company in 2006 as Environment Manager for Europe where she helped define and drive Tetra Pak’s environmental strategy and contributed shaping recycling for cartons in Europe. Since 2010, she is based in the U.S., focusing on advancing the Tetra Pak’s commitment to sustainability in the U.S. and Canada and is involved in various industry and customer packaging and sustainability initiatives.

Paranoia or Flight Risk? United Fires 13 Flight Attendants over “BYE-BYE” Images

Earlier this week 13 flight attendants filed a whistleblower complaint with the Department of Labor’s Occupational Safety and Health Administration (OSHA) against United Airlines. The 26-page document claims that United fired them illegally in retaliation for refusing to fly on a 747 from San Francisco to Hong Kong last summer because of suspicious images and a message scrawled on the tail of the airplane. According to the Chicago Tribune, the flight attendants had a total of almost 300 combined years of experience—not that it mattered to the airline.

According to the complaint, the combination of “BYE BYE” and one face that looked “devilish” worried the crew enough to request that United complete a thorough inspection of the 747 to make sure no explosives were planted within the aircraft. The airline refused, the flight attendants refused to board the plane . . . and then all of them were fired for insubordination.

Are we talking about cautious professionals during an uncertain time, or was this a total overreach?

According to the attorney representing the flight attendants, his clients “did exactly what the flying public would expect from a group of highly experienced airline professionals.” David J. Marshall claims the mass firing violated the Wendell H. Ford Aviation Investment and Reform Act for the 21st Century (AIR21), legislation signed into law in 2000 to protect whisleblowers from retaliation if they report any problems with airline security. According to Bloomberg, United followed the company’s, and the Federal Aviation Administration (FAA)’s guidelines, found nothing alarming, and even described the incident as a “joke.”

So was this a just a prank? Let’s take a step back and look at airport security in general. Plenty of experts will tell you air travel security in the U.S. is a joke. Pat-downs, checking every piece of luggage, high-tech scanners—they all give the appearance of security, but they do not confront the stubborn fact that all these procedures combined are more “security theater” than a guarantee of our safety. At the same time, one would think the airlines learned the error of their ways after the 9/11 attacks—their penny pinching ways (poorly paid security staff, and few of them at that before 2001) were among the reasons a bunch of guys were able to use four airplanes as WMD’s. No company wants to go endure a disaster that would cripple a company’s reputation just when the airlines are finally performing well financially, so chances are the silly faces scrawled on that 747’s tail merited little more than a quick screening and not a fully loaded investigation.

Nevertheless, dismissing the concerns of a group of flight attendants, all of whom had at least 18 years of experience, is a bit much. Firing them goes too far--a suspension would have been more reasonable. At first glance it seems easy to mock the flight attendants for being overly cautious, but this also appears to be a one-off incident. Many of us bemoan the skies for no longer being friendly, but in fairness to pilots and flight attendants, flying is far from glamourous and the benefits are not what they were a generation ago. This July incident should serve as a case study, not another chapter in the long running tensions between airlines’ workers and management.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com.

Image credit: Katz, Marshall & Banks