A Metamorphosis in Our Midst

By Giles Hutchins

We are now settling into 2015 -- transformational times, no less, which quite naturally invoke a feeling of trepidation. Tectonic shifts in our socio-economic models, strategic and operational management, and leadership development are metamorphosing our prevalent paradigm into something as different in look and feel as a butterfly is from a caterpillar.

In the early stages of a pupa’s metamorphosis, cells quite different from the caterpillar organize into groups. These ‘imaginal cells’ run up against the opposition of the old caterpillar’s immune system, which perceives them as a threat to the caterpillar’s existence. Over time, as the system of the old caterpillar begins to break down, these new formations spawn forth the structures, processes and logic of the butterfly; ditto for the metamorphosis in our midst.

We know an era is ending and a new one being conceived when the fundamental assumptions and illusions of the old worldview are exhausted by their inability to deal with the challenges of the day. Yesterday’s logic understands nature as purposeless, devoid of meaning and consciousness. This materialism creates an illusion of separation which underpins our cultural tendency towards short-termist profiteering, control-based silo’ed thinking, and divide-and-rule behavior; what Gregory Bateson calls a paradigm for extinction. In short, we have become inured by a corrupting logic that undermines our very evolution.

The good news is that through recent discoveries in quantum science, depth psychology, neuroscience, facilitation ecology and many other fields of research, this outdated logic is now breaking down, giving way to a fresh yet ancient logic inspired by nature. Rather than viewing life as mechanistic with humans separate from and in competition with life, we are opening up to a deeper perspective of life as innately conscious, participatory and sacred. Yet, as economist Joseph Gustave Speth warns us, proposals for transforming our systemic logic will be derided and, when they gain traction, resisted at every turn -- much like the imaginal cells in the early stages of metamorphosis.

Many of today’s organizational pioneers and cultural change agents go unnoticed, catalyzing transformation by applying a deeper wisdom beyond illusion: compassion rather than competition; empathy rather than egotism; synchronicity rather than separateness; service rather than selfishness; reciprocity rather than robbery. And this is not new -- business finds its origins in value-creation through service provision for its community. Likewise, the roots of Western philosophy and science draw from nature’s wisdom. For the ancient Greeks, to embody the inherent grammar running throughout life is the ultimate goal of philosophy (the word originating from philia the Greek for ‘love’ and Sophia ‘wisdom’ – to love and embody the wisdom flowing throughout nature).

And yet many of today’s attempted solutions apply outdated, materialistic and anthropocentric logic without stepping back to question it. If we have any hope of rectifying the error of our ways in 2015, the logic that sets us apart from nature needs to be put right at its root. The word ‘radical’ originates from radix, the Latin for ‘root.' The paradigm shift now upon us has to deal with the root source of our flawed logic and so be radical – philosophically, scientifically, culturally and economically. Deep and complex influences within our own psyche, our collective consciousness and in the structures pervading our culture are being challenged to radically reshape; at its heart this paradigm shift challenges the very way we view the world and ourselves as embodied within it.

In recognizing that we are expressions within nature and that our own rational and intuitive consciousness is immersed within a deeper field -- the ground of our being – we may begin to open our minds to reality beyond the illusion of separation. It is this radical perspective of reality that the great minds of Jung, Einstein, Da Vinci, Confucius and many others understood. As spiritual ecologist Llewellyn Vaughan-Lee explains through his profound work, we are waking up to the awareness of our relationship between our individual soul and the world soul of nature. In his words, "It is only through awakening to an awareness of the sacred within creation, and its relationship to our own sacred nature, that we can begin to redeem the primal imbalance that lies at the root of our present predicament."

It is this recognition, no less, that will we ensure our solutions are both inspired by AND in harmony with nature -- the only viable future for humanity on Earth. Humanity is collectively on the cusp of evolving this deeper awareness, and each of us has the conscious choice in the days and weeks ahead to courageously embrace our destiny as imaginal cells in this metamorphic undertaking.

You can access a podcast series on this shift in our midst here bit.ly/1Gj31TL

A special for TriplePundit readers - a 20 percent discount code AF1014 when ordering The Illusion of Separation by Giles Hutchins in paperback here and the ebook here. Alternatively, the book can be found on Amazon and on Amazon.com

Giles Hutchins blogs at www.thenatureofbusiness.org, facebook community https://www.facebook.com/businessinspiredbynature and tweets @gileshutchins

Telecoms, Data Center Trends Heighten Climate Risks, Vulnerability

Like water, energy and waste management, digital telecommunications and data centers have become utilities essential for modern societies to function sustainably. It is generally accepted that the increasing frequency and intensity of extreme weather events -- and the onset of gradual, long-terms shifts in weather patterns and climate -- pose existential threats to critical information and communications technology (ICT) supply chains, as well as infrastructure.

But a recent report from Riverside Technology and Acclimatise found that the business risks of climate change as they relate to telecommunications and data centers are poorly recognized -- particularly with respect to infrastructure and supply chains. Similarly, climate change resiliency and adaptation plans in this critical segment of the U.S. ICT sector are poorly developed, concluded the report, which was conducted on behalf of the federal government's General Services Administration (GSA).

“Despite the importance of these sectors, the climate risk they face is poorly understood. Even less understood are climate risks to the supply chains both sectors rely upon,” the authors of Climate Risks Study for Telecommunications and Data Center Services highlight. Furthermore, though it boosts operational efficiency and the bottom line, the recent trend that has seen more and more companies sharing ICT resources – platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS), for instance – increases the vulnerability of critical ICT infrastructure and supply chains to the impacts of extreme weather events and more gradual shifts in climate.

Extreme weather, climate change, and ICT infrastructure and supply chains

Bangkok's floods, Superstorm Sandy and Typhoon Haiyan are among the extreme weather events that have caused the loss of many lives, displaced many more families, and resulted in billion-plus-dollar losses to the economies of Thailand, the U.S. and the Philippines in recent years. A total of 258 natural disasters combined to cause $132 billion in economic losses worldwide in 2014, according to reinsurance company Aon Benfield's 2014 Annual Global Climate and Catastrophe Report.

Fifty-three percent of last year's global insured losses from natural disasters occurred in the U.S.

2014 was the second consecutive year of below-normal catastrophe losses. The year before, however, saw a record number of “billion-dollar weather disasters” around the world, according to Aon Benfield's research.

As the GSA report authors point out, “Disruptions in the ability to communicate or access information severely inhibit governments, companies, and citizens, and in periods of disaster or extreme events, this inability to communicate puts national and human security and business value at risk. Climate variability and change may threaten the infrastructural integrity and productivity of these critical sectors, increasing the number and severity of disruptions. Extreme or unusual weather can lead to cascading impacts felt across sectors and borders.”

Climate adaptation and resilience across telecoms, data centers

Climate risk and vulnerability in the ICT sector are poorly understood, particularly when it comes to recognizing risks and planning to adapt to gradual, long-term shifts, the report's authors continue. Even less well-understood are the risks climate change poses to ICT supply chains, as well as how resilience can be enhanced. "Extreme weather events, like Hurricane Sandy in 2012 and the Thai floods in 2011, dramatically show the potential economic cost of climate change in the near term,” the authors state.

“However, cumulative or gradual climate impacts are less likely to be studied due to failure to spot the signals if operating performance gradually deteriorates, uncertainty of the timing and magnitude of impacts, the absence of stakeholder consensus in the wake of an extreme event, and the short- term decision-making time frames of many businesses.”

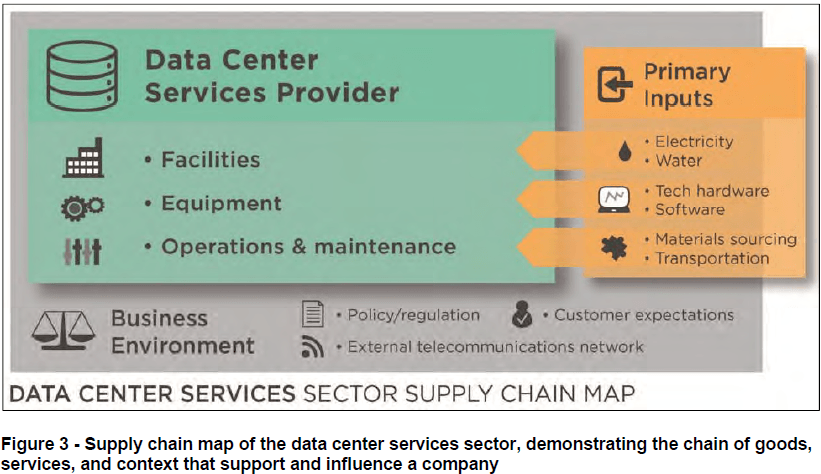

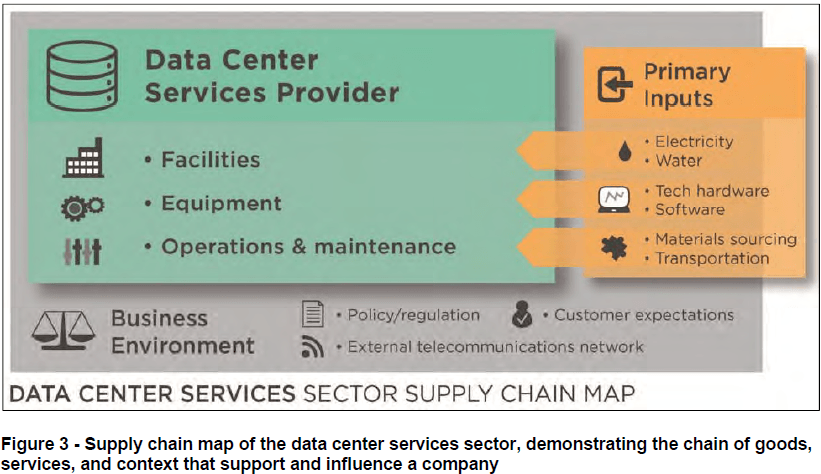

Riverside Technology and Acclimatise's report for the GSA “presents an initial step toward understanding how climate change may disrupt these sectors, how resilience can be fostered, and recommends next steps.” In doing so, Riverside and Acclimatise produced maps of telecoms and data center infrastructure and supply chains and used them as a basis for elaboration.

The report's authors also note that ICT equipment used in telecoms and data centers “were designed to function within within specific climate and environmental conditions." Climate change (which can include both incremental changes as well as extreme events) can impact the operating parameters and enterprise supply chains, causing impacts to telecoms and data center companies and their customers.

“Impacts may result in changes to functionality, quality of service, return on investment, business continuity, and cost, in addition to cascading impacts on the diverse customers that rely upon them. Value protection strategies are required to address these risks.”

Operational efficiency, climate risks and vulnerability

Compounding climate risks is the trend toward outsourcing of telecoms and data center functions to third-party hosting companies and managed services providers, according to the report. Such initiatives increase operational efficiency and can result in reduced IT costs and new revenue-generating opportunities. But they also reduce redundancy across the network and generate single points of failure, the report's authors highlight.

Drawing on case studies from around the world, the GSA report authors offer examples of adaptation options and early instances of initiatives being undertaken by telecoms companies to enhance climate resilience. They also provide a summary list of key recommendations:

- Frame climate risks as business risks using the language of business, not science. And contextualize climate risk from the perspective of private sector companies, their customers, investors and regulators.

- Plan for both a changing climate baseline and for climate extremes. Successfully addressing climate risk requires careful attention to subtle impacts (e.g., the cumulative impact of increasing sequences of warmer than average days on wired telecommunications) as well as to the effects of extreme storms.

- Build awareness of climate risks before disasters strike. Working with stakeholders to build consensus and collect the information each offers is to effectively build resilience.

- Conduct direct consultations with the private sector to understand their needs, strengths and weaknesses, as these stakeholders know the business, sites and technologies best and can help build understanding of what would happen under likely climate scenarios.

- Thoroughly assess climate risk of both telecoms and data center sectors, informed by consultations with experts and stakeholders. This will allow for the prioritization of risks to both sectors according to their relative consequence and likelihood;

- Require federal service providers to demonstrate climate resilience in all procurement processes, with suppliers required to undertake a climate risk assessment and demonstrate how their products and services will continue to meet required contractual and serviceability performance standards;

- Elucidate, test and document adaptation options as value protection strategies in both sectors, as many of these strategies and fixes remain prescriptive, not detailed and/or untested;

- Assess operating headrooms for key assets in both sectors to understand the functional thresholds for critical assets in a changing climate, which will assist in identifying and prioritizing risks, planning operational maintenance and informing future capital expenditures;

- Assess both sectors within the context of their asset lifetimes, with climate risk assessments scaled to the life cycles of assets and equipment. Though lifetimes are short, assets must be robust during their useful lives;

- Include telecoms and data centers in the fourth National Climate Assessment, alongside other key sectors already represented.

Provide guidance on SEC material risk disclosure.

Pitfalls in Measuring Corporate Sustainability

By Amy Kalafa

Are you one of those people who gets excited when the price of a Tesla becomes almost affordable, or when you can buy a toothbrush made from recycled plastic, or a lipstick certified cruelty-free? If so, then you may be glad to know that there are a whole host of tools in the business world that give companies a way to report on their corporate sustainability practices.

Business directors are fond of the phrase, "What gets measured gets managed." According to a 2013 report by KPMG, 86 percent of large American companies use some form of sustainability reporting, up from 74 percent in 2008.

To date, all sustainability reporting in the U.S is voluntary self-reporting, but a growing number of indexed stock portfolios are based on corporate environmental and social governance (ESG) metrics. Firms like MSCI and ENSOGO scrutinize report contents and provide detailed evaluations to stock analysts, and companies that don’t file a corporate sustainability report are now perceived as laggards in corporate citizenship.

The Dow Jones Stock Exchange even has its own index — the Dow Jones Sustainability Index (DJSI) -- for publicly-traded companies.

The field of sustainability reporting is still a bit of a minefield, however, stewing in an alphabet soup of acronyms. Analysts struggle to standardize metrics and measurements. Reports may not be comparable from year to year, as the frameworks for measurement continue to evolve. Worse yet, companies are free to define their boundaries in whatever terms they choose. Some will interpret boundaries in the broadest sense, reporting on the environmental impact of all of their suppliers (Walmart, for example, asks each of its suppliers to file a sustainability report), as well as the impact of their products once they've been purchased and used by consumers. Others ignore these factors and only report on their corporate offices or factory floor.

A close examination of a number of reports reveals that some are difficult to distinguish from a company's regular annual report to stockholders. Accomplishments in energy conservation and public relations are highlighted while indirect costs such as water pollution, carbon emissions, and other health and social impacts are glossed over. Some reports seem to be based on a loose definition of sustainability that refers only to the financial sustainability of the company.

Globally, Brazil, Denmark, France and South Africa now require companies to file sustainability reports. Shareholders, analysts and investors are also putting on the pressure by requesting disclosure on matters of corporate sustainability. This phenomenon is certainly having an impact on business performance, with those companies that do file reports performing significantly better in the markets than their non-reporting peers.

Even for smaller companies that can't afford to hire consultants and purchase software, self-reporting raises issues and awareness about which sustainability aspects are most relevant to the business. The process obliges managers and directors to acknowledge the cost of depleting natural capital and damaging the environment whether directly through pollution or indirectly through energy consumption, waste and employment practices. According to a report by Ernst and Young, sustainability reporting gives companies a better reputation, meets the expectations of employees, improves access to capital and increases efficiency and waste reduction.

Most companies that make the commitment to report use some version of the Global Reporting Initiative (GRI) standards. These standards guide a company through a comprehensive sustainability audit, with sections on human rights and resources, environmental impact, and consumption of natural resources, as well as fossil fuel. In addition to a numerical rating system, GRI requires a narrative approach. As a result the reports can run over 100 pages. Datamaran, Governance and Accountability Institute and RobecoSAM are among the new businesses that are crunching data and developing software to simplify the process of sustainability reporting.

Another framework in development, the Sustainability Accounting Standards Board (SASB) may ultimately displace GRI. SASB aims to disclose the risks that sustainability issues have on a company's financial bottom line. Its goal is to integrate sustainability measurements into the annual 10-K reports required by the Securities and Exchange Commission (SEC) for all public companies in the U.S. If SASB can succeed in demonstrating that sustainability issues would materially affect a ‘reasonable’ investor’s assessment of a company, it could come to be required by the Securities and Exchange Commission. For the first time in the U.S., sustainability reporting would be mandatory.

Though all the acronyms are still baffling, with an environmental crisis looming --and consumers, investors and other stakeholders demanding corporate accountability -- we can bet that sustainability reporting will soon become a big business in its own right. As that happens, the demands of the marketplace will vie with regulatory frameworks to determine which metrics and standards will become the norm.

Image credit: Flickr/teegardin

Amy Kalafa is a TV producer, filmmaker, author and current student at Bard MBA in Sustainability. Her work in the fields of sustainable food, clean energy and mental health has earned international recognition and awards.

Recruiter looks to reward emerging sustainability superstars

Acre, the sustainability recruitment consultancy, has launched a recognition programme to find superstars in the sustainability field.

Applicants for Acre365 need to have made a significant social or environmental impact within their first 12 months within a new role at an organisation.

Andy Cartland, founder and director of Acre, said: “Placing talented professionals in roles where they can effect change is core to Acre’s mission and we want to recognise and celebrate these achievements via the recognition programme. We believe that people who do remarkable things in their first 12 months of employment have the ability to create a foundation of change that can help achieve the seemingly impossible."

The judging panel comprises Ronan Dunne, ceo of Telefonica; Jean Oelwang, ceo of Virgin Unite; Liz Goodwin, ceo of WRAP; Jim Woods, ceo of The Crowd; Steven Lang, partner at Ernst & Young LLP and Acre's Andrew Cartland

The three winners will receive an Acre365 trophy, invitation to the celebratory awards dinner at a prestigious London restaurant and £1,000 to invest via the Kiva micro-financing platform.

The deadline for submissions is 18 February 2015 and successful applicants will be selected and announced in March 2015 by the panel.

To enter, click here.

Picture credit: © Dagadu| Dreamstime.com- Eco Bulb Set Photo

Davos 2015: World needs new business model

The global economic system isn't working for six billion people, labour leaders at the World Economic Forum in Davos, have warned.

Mass unemployment, mistrust in institutions, rising inequality and extremism are global risks for working people, employers and leaders, maintained the International Trade Union Confederation (ITUC).

“The very nature of corporate incentives to invest in any equal distribution is being undermined by their own business model. It’s a two way street: business needs workers, and workers need fair-minded employers. At the moment, business is letting down its side of the deal,” said Sharan Burrow, general secretary of the ITUC.

John Evans, general secretary of the OECD Trade Union Advisory Committee (TUAC), who is also ITUC Chief Economist, commented: “A central aspect of ‘inclusive growth’ must be reducing income inequality and reversing the decline in the share of wages in output and income.”

Since the 1980s, real wages have failed to grow at the same rate as productivity, and as a result the wage share has drastically fallen. The global wage share has declined from 62% to 54% according to the UN.

“Raising wages and reducing inequality together with public investment are key elements of a recovery plan. Government and business leaders have in their hands the tools to make a measurable difference to the lives of working people. Thirty-three million jobs could be created in G20 countries alone, with co-ordinated increases and investments in infrastructure.

“A minimum wage on which people can live, strengthening collective bargaining, curbing the excesses of CEO pay and respecting ILO standards in global supply chains are actions that leaders can put in place," Evans added.

Picture credit: © Ylivdesign | Dreamstime.com - Business Structure Photo

Path of First Round-the-World Solar Flight Now Public

Bertrand Piccard and André Borschberg of Switzerland, who founded Solar Impulse, announced the flight path of Solar Impulse 2 during a press conference today in Abu Dhabi. The project’s latest plane will depart the capital of the United Arab Emirates in late February or early March and will return from this groundbreaking solar flight after flying around the world in late July or early August. The plane’s journey, which could take anywhere from 22,000 to 25,000 miles (35,000 to 40,000 kilometers), intends to fly day and night, 20 hours per flight, using only solar power--while sending a global message about the promise of clean energy and the need to confront the growing risks of climate change.

Solar Impulse has already made impressive history with the organization’s first prototype, which has flown across the United States, Morocco and Europe. The trips’ stops were opportunities for Piccard and Borschberg to evangelize Solar Impulse’s mission. But at a higher level, the two men, who are both engineers and pilots, have long emphasized the need to push the boundaries of renewable energy research and development. Next month’s round-the-world flight will promote their mission even further as they aim to reach out to governments, schools and local media during their upcoming journey—planned to both meet the challenges of geography while carrying out a very geopolitical strategy.

The first impression the plane makes is a reminder of what many have told Piccard and Borschberg since they conceptualized their vision over a decade ago: Their dream looks impossible. The plane has the wing span comparable to a 747 (236 feet, or 72 meters) yet weighs about as much as a family-sized car. Over 17,000 solar cells power four electric motors, which will rely on lithium batteries weighing 2,077 pounds (633 kg). The cockpit only has room for one pilot, which in part explains why the Solar Impulse 2 will take 25 or so flight days to travel around the world.

After takeoff from Abu Dhabi, the plane will stop in Muscat, Oman in order to position itself for the flight across the Arabian Sea where it will visit two cities in India. Piccard and Borschberg chose to stop in Ahmedabad in recognition of the city’s burgeoning clean technology sector; Varanasi, one of India’s oldest cities, serves as a symbol of how solar energy can transform lives and create economic opportunity in developing countries. From India the plane will continue to Myanmar, which the pilots said was important to recognize the country’s recent opening to the world. Solar Impulse’s final two stops in Asia are in China: Chongqing, which is industrializing rapidly as the country seeks to develop the nation’s interior, and then Nanjing. The duo will spend about a month in China as Piccard and Borschberg hope to use the media to spread clean technology’s potential to 80 million school-aged children.

The next leg, a five-day trip to Hawaii, presents not only technical challenges, but Solar Impulse’s biggest human challenges. High density thermal insulation is all what the pilots have to protect themselves from extreme cold and heat. The five or six days’ flights will be spent in a 41 square foot (3.8 m3) space that has only enough space for some physical exercise, oxygen, food and drink and survival equipment. After another long journey from Hawaii, Solar Impulse 2 will land in Phoenix to recognize Arizona’s rapid adoption of solar power. After a yet to be determined stop in the Midwest and New York’s JFK Airport, another long journey is planned across the Atlantic. Stops in southern Europe or Northern Africa will follow before the plane returns to its Middle East launch in Abu Dhabi.

Like past ventures in space travel, Solar Impulse’s attempt to circumvent the globe serves to demonstrate the future potential of new forms of energy technologies. The many partners who are vested in this project could also reap new opportunities in the future. For example, the chemical company Solvey has developed a composite of carbon fiber and paper to create a lightweight, honeycombed skin that allows the plane to shed weight. ABB has provided support with three engineers who are well versed in solar inverter and battery storage technologies. Google, Omega and Bayer Material Science are among the other companies that have supported Solar Impulse.

So of course we will not be gallivanting around the globe in solar powered planes, or cars, anytime soon. But pushing engineers and scientists to advance renewable energy technologies, while inspiring youth to consider a career in this sector, are more than a worthy enough outcome if Solar Impulse 2 completes its journey.

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Disclosure: Masdar covered Leon Kaye’s travel costs to Abu Dhabi Sustainability Week.

Image credits: Leon Kaye

Abu Dhabi Sustainability Week Launches with Award for Al Gore

Abu Dhabi Sustainability Week, the annual conference that brings together over 30,000 professionals to meet on issues including energy, water and waste, kicked off yesterday. As always it started with a grandiose opening ceremony and a reminder of the United Arab Emirates’ achievements over the 40+ years since independence.

In addition to the panels, press conferences and massive exhibition halls, the winners of the annual Zayed Future Energy Prize (ZFEP, or the “Oscars” or “Nobel Prize” for clean energy), which included former U.S. Vice President Al Gore, were announced for 2015.

Founded in 2008, ZFEP awards US$4 million in prizes for both achievements and future potential in clean energy development. The committee who decides the final winners recognized Gore for his “unwavering personal and political commitment” to climate change, while constantly expressing optimism that the world community can take on the challenge. Gore said he would divert the US$500,000 cash award to The Climate Change Reality Project, an initiative he founded in 2006 to train activists to speak publicly about climate change’s risks and find more effective ways to communicate them.

While Gore may have been the marquee name, the other awards announced during the brief ceremony give an idea of how renewable energy and clean technology have become more mainstream across the globe. The other achievement award, which ZFEP gives to a large corporation, went to Panasonic. The iconic electronics manufacturer was lauded for its research and development work dedicated to solar energy, its advancements in battery technology and leadership in the development of Fujisawa Sustainable Smart Town.

Where ZFEP’s long-term impact could stand out globally is with the awards given to smaller organizations and schools. M-Kopa Solar, the awardee in the small and medium enterprise category, is an example of how renewables are no longer an expensive alternative for the wealthy -- but now are a key towards economic empowerment for the world’s poorest citizens. The Nairobi, Kenya-based company provides pay-as-you-go solar electricity systems that include a rechargeable radio, cell phone charging port and three lights — in turn allowing citizens in East Africa to forego buying expensive and dirty kerosene to power their homes.

On the nonprofit side, Liter of Light, a social enterprise launched in the Philippines, won the category for its work in expanding passive solar lighting to some of the world’s poorest communities.

Finally, five high schools across the world won awards for their projects seeking to phase out conventional electricity systems with renewable alternatives. Awardees included a high school in the Maldives that wants to install a 45-kilowatt solar system to deliver all of its power needs, along with another in Canada that will launch biomass heating and solar air connectors.

The prize competition, the cycle of which starts in the spring of each year, received almost 1,000 entries. For the first time this year, ZFEP gave an honorary award to Egyptian president Abdul Fattah al Sisi for his government’s commitment to sustainability. The most populated nation in the Arab world has committed to sourcing 20 percent of its energy from renewables by 2020 and is on track to install 4,300 megawatts of solar and wind power in the next three years.

More information on ZFEP, finalists, and past awardees can be found here.

Image credit: Leon Kaye

Based in California, Leon Kaye has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. He shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Disclosure: Masdar covered Leon Kaye’s travel costs to Abu Dhabi.

Wind Power, Polar Vortexes and Price Gouging

The appearance of the polar vortex in late 2013-early 2014 put much of the U.S. and eastern Canada in a record-setting deep freeze around this time last year, adding another new term to lay-people's weather-related vocabulary. The polar vortex also stressed power utility grids and generation assets, sending consumer demand and power prices soaring in markets from Texas to New England.

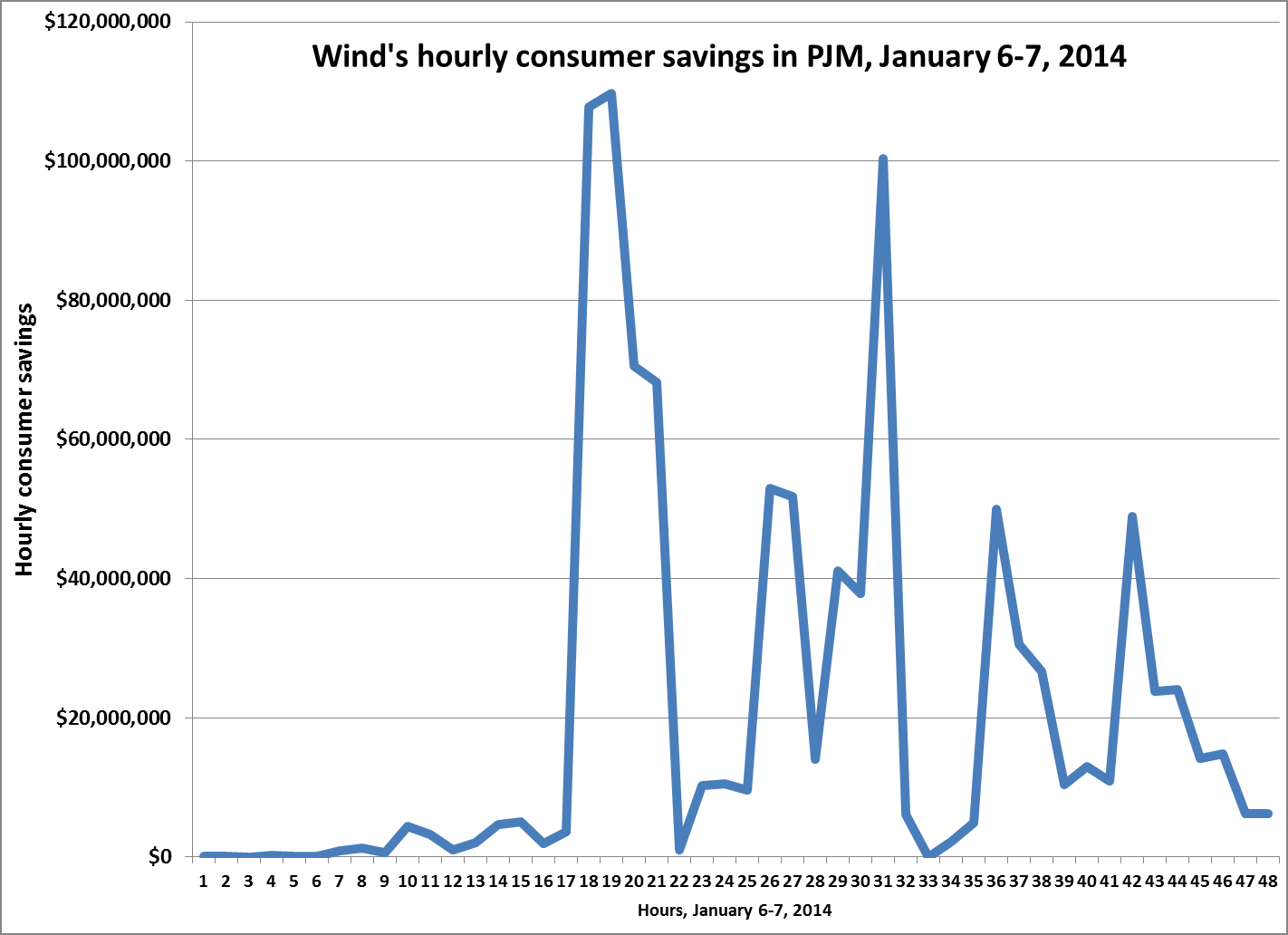

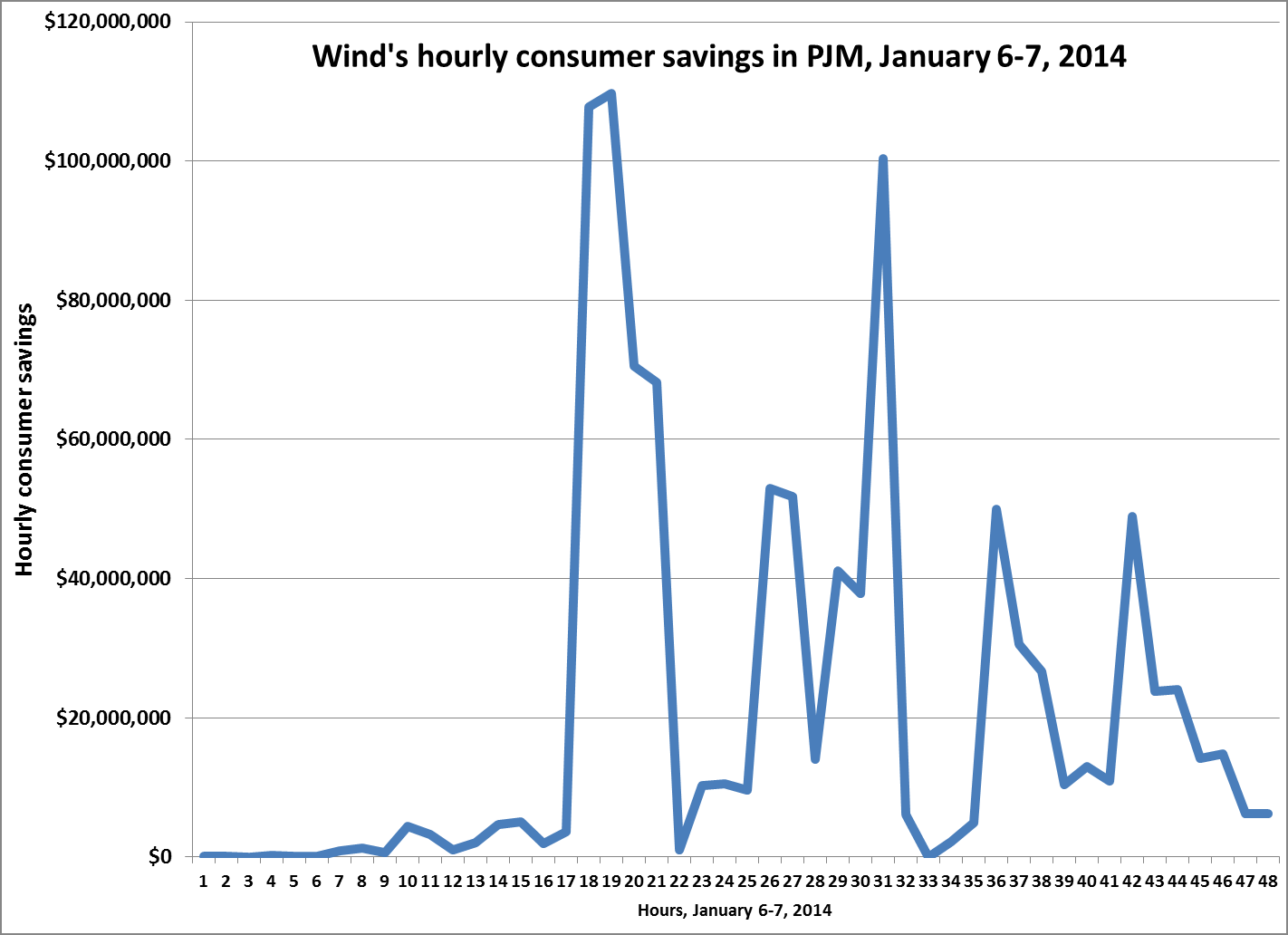

Wind power was a stand-out performer, however. According to study from American Wind Energy Association (AWEA), wind energy saved end-users in the Great Lakes and Mid-Atlantic states at least $1 billion during just two polar-vortex days last January.

In these and other regions, AWEA's Greg Hresko and Michael Goggin highlight: “[W]ind energy provided large quantities of critical electricity supply when it was needed most, keeping the lights on and reducing the impact of these price spikes.” According to their analysis, “[W]ind energy protected Mid-Atlantic and Great Lakes consumers from extreme price spikes during the polar vortex event” over just two days in early January 2014, “saving consumers over $1 billion on their electric bills.”

Two days, $1 billion in savings

The record-setting cold the polar vortex brought in two events from December 2013 to April 2014 prompted unusually high demand for electricity and natural gas, “both for heating and power generation,” Hresko and Goggin recount. The low temperatures led to outages at power plants as equipment breaking down and fuel shortages.

Electricity prices, meanwhile, “rose to dozens of times their normal levels in many regions. The Mid-Atlantic and Great Lakes states were particularly hard hit by these abnormally cold temperatures and the resulting energy price spikes.”

In their analysis, Hresko and Goggin calculate “how much more electricity prices would have increased had the region's wind generation not been online” Jan. 6 and 7, 2014. They do this by taking hourly grid operator data, data on fuel prices “and a detailed representation of the characteristics of every power plant in the region.”

In sum, they found that electricity consumers in the Mid-Atlantic and Great Lakes regional markets saved at least $1 billion as a result of wind power generation on just those two polar-vortex days. As they elaborate in their report:

"By diversifying America’s energy mix, wind energy improves electric reliability and protects consumers from energy price spikes. While wind energy always provides these benefits, they can become particularly pronounced when the electric grid is stressed."

New opportunities for power market manipulation, price gouging

Though wind power was a stand-out performer and power grids overall held up well to the strains the polar vortex put on generation and distribution assets last winter, the events revealed several troubling issues. Besides exposing the vulnerability of regional U.S. power grids to increasingly common and historically intense extreme weather events, it also revealed faults in the structure of power markets. That includes the potential for those who both own and speculate in U.S. power markets to “game” the system and reap windfall profits at the expense of consumers.

California residents and power market regulators should be very familiar with such conflicts of interest. Going down in notoriety, Enron traders shamefully – and shamelessly – manipulated power supplies and market prices when California first deregulated its power markets. While Enron traders instructed operators at power plants Enron owned to hold back electricity supply, the company was going long in the market, reaping extraordinary profits while California customers went without power and paid exorbitant prices.

Price gouging may be once again rearing its ugly head, according to a report from Al Jazeera U.S. “The test case is playing out in New England,” Al Jazeera's David Cay Johnston reported back in May 2014.

“Energy Capital Partners, an investment group that uses tax-avoiding offshore investing techniques and has deep ties to Goldman Sachs, paid $650 million last year to acquire three generating plant complexes, including the second largest electric power plant in New England, Brayton Point in Massachusetts.

“If regulators side with Wall Street — and indications are that they will — expect the cost of electricity to rise from Maine to California as others duplicate this scheme to manipulate the markets, as Enron did on the West Coast 14 years ago, before the electricity-trading company collapsed under allegations of accounting fraud and corruption.*Image credits: AWEA; "Wind energy saves consumers money during the polar vortex," Greg Hresko and Michael Goggin

Highlights From the World Future Energy Summit in Abu Dhabi

Poking around the exhibit hall at the 2015 World Future Energy Summit, one of the key elements of Abu Dhabi Sustainability Week (ADSW), there was much to see.

A substantial number of exhibits were still focused on oil and gas. Though I skipped most of those, I did stop to thumb through some of the energy projections for the future. ExxonMobil showed residential and commercial demand for oil remaining flat through 2040 and natural gas increasingly slightly, with both coal and biomass declining. Most of the growth in demand will be met by electricity, which is shown to nearly double between 2000 and 2040, according to the company's projections.

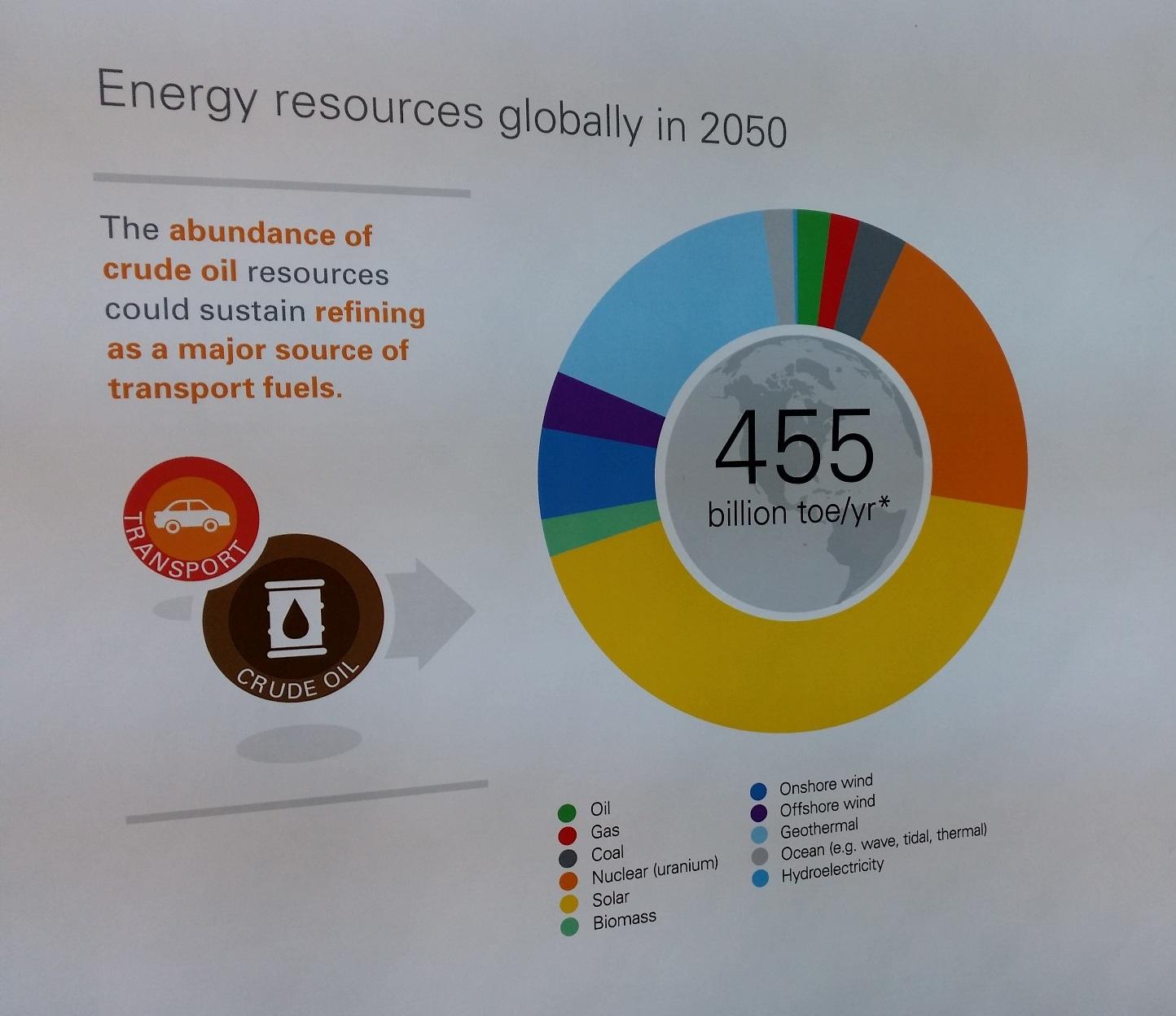

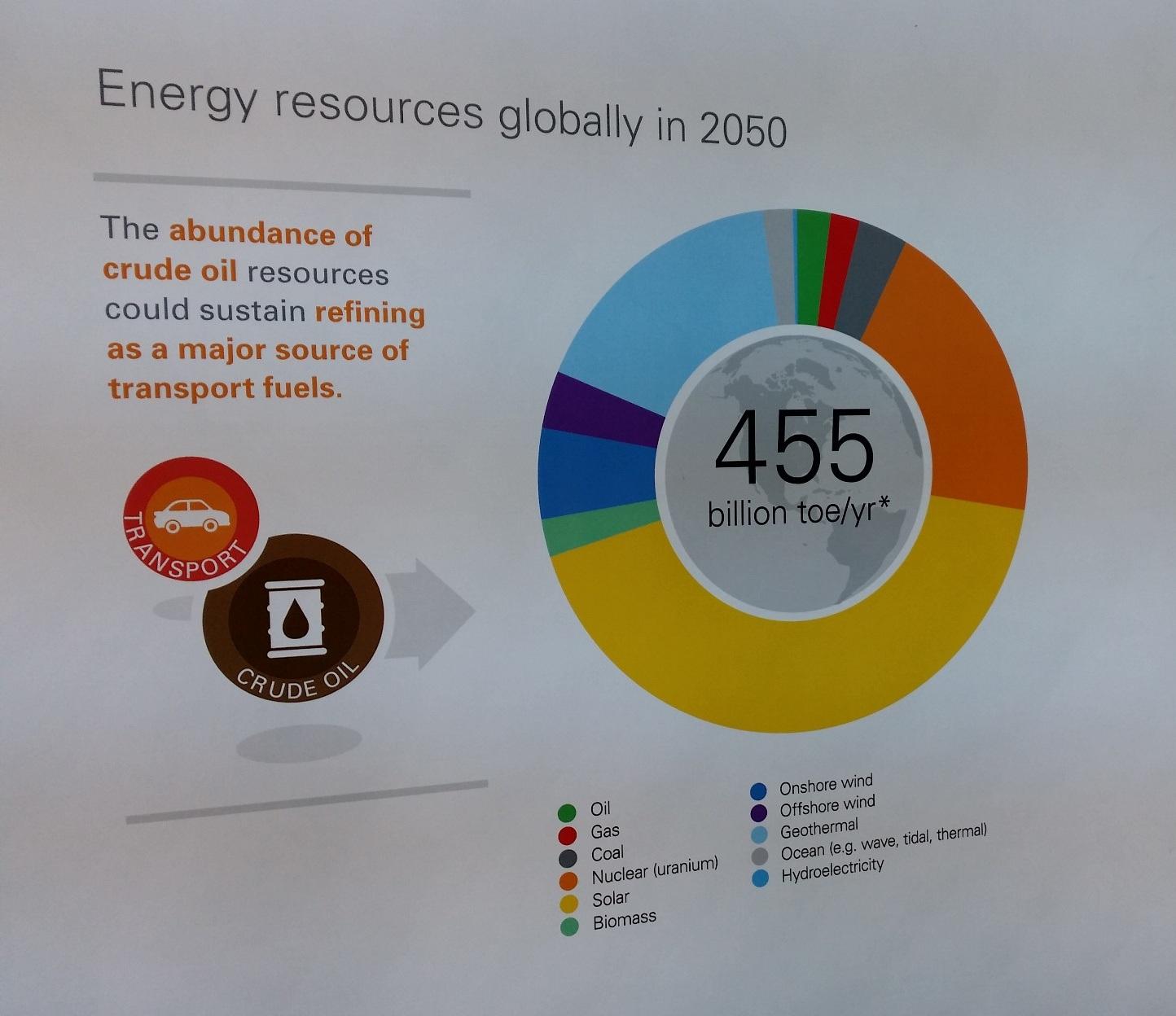

BP, on the other hand, offered projections for 2050, (on a pie chart without numbers) which shows solar comprising more than 40 percent of the total "technically-accessible energy resource." Second was nuclear at about 20 percent. Geothermal will provide about 15 percent, followed by wind (onshore and offshore) at close to 10 percent, according to BP's projetions. Oil and gas were little more than slivers on the chart, with the two combining for about the same portion as onshore wind.

Speaking of wind, conference sponsor Masdar had an operational 3-D mockup of their London Array offshore wind farm. Sitting off the coast of England, the wind farm produces 630 megawatts from 175 turbines -- that's 3.6 MW each. Of course, those are tiny compared to the 8MW monsters introduced by Vestas last year. This industry doesn't stand still for anyone.

Nuclear power was also well represented with a number of vendors on hand. Right here in Abu Dhabi, there is a major project in the works, which I will write more about later in the week.

One interesting exhibitor was Gulf Power & Marine which was presenting a new 'solar hydrogen' capability. This is a type of solar photovoltaic (PV) plant with integrated hydrogen storage. Advertised as the "greenest power plant on the world market," the system uses solar PV to directly produce electricity while producing hydrogen at the same time.

The hydrogen system, developed by Linde, uses electrolysis to make hydrogen from sunlight, which is stored in tanks to be burned at night or during cloudy periods using a conventional gas turbine. The hydrogen portion requires three times as much solar as the direct generation, which says a lot about the cost of storage. Despite this, at the gigawatt scale, Gulf Power claims it can achieve an unmatched 5 cents per kilowatt-hour.

That's based on an estimated $9 billion cost, amortized over a 25-year period. The technology is being offered with power generation capacities ranging from 100 MW to 1 GW.

Up to 75 percent of the water used to make the hydrogen can be reclaimed when the hydrogen is burned, resulting in a water consumption rate of only 145 cubic meters per hour for a 1GW plant. No plants have been built as of yet, but the company is at the show, ready to take orders.

On the more unusual side was the Green Float, a concept developed by the Japanese construction firm SHMZ. This is essentially a manmade island, floating in the ocean near the equator, where the temperature remains fairly constant.

At the center of the island will stand a 1-kilometer tall tower, atop of which will be a 1 km diameter dish, which will receive energy beamed in from solar satellites. People will also live in the tower, hence the nickname City in the Sky. The island will also contain farms to grow food, fertilized by waste products from above. With the benefit of ocean sequestration, these manmade islands will potentially be carbon negative.

That only scratches the surface of all there was to see at the World Future Energy Summit, which itself was only a third of the exhibit space at ADSW -- not to mention the lectures, talks and ceremonies. But at least it will give you a taste.

Image credit RP Siegel

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand. RP recently won the Masdar Blogging Competition and willing be attending Abu Dhabi Sustainability Week

Follow RP Siegel on Twitter.

Why B Corps Should Cap Executive Pay

This is a recurring series of excerpts from the book “The B Corp Handbook: How to Use Business as a Force for Good“ (Berrett-Koehler Publishers, October 2014). Click here to read the rest of the excerpts.

By Ryan Honeyman

Certified B Corporations are leading a global movement to redefine success in business.

As a community of thought-leading businesses, one of the best ways that the B Corp movement can continue to drive positive change is to address the controversial issue of executive pay.

For example, in 2013 the average pay ratio of a Fortune 500 CEO compared to the average salary of their employees was 331:1. Some employers have started to implement a cap on the ratio between the highest and lowest earners in their company.

Namaste Solar, a B Corp based in Boulder, Colorado, caps the ratio of its highest salary to its lowest salary at 3:1. Whole Foods Market, a publicly-traded member of the Fortune 500, caps its highest salary at 19 times the average employee pay. Certified B Corps that implement this practice typically cap their pay ratio between 5:1 and 10:1.

"Restructuring the payment and perks offered to our employees, so that production workers could reap the same benefits as upper management, was an important step toward equality for every team member," said Merlin Clarke, owner of the B Corp Dogeared Jewels & Gifts.

For many companies, the cost of adjusting base compensation to meet a specific highest-to-lowest-wage ratio will be marginal, as the changes would affect only a small number of entry-level employees. Matching benefits for both executive and non-executive employees, on the other hand, is probably a larger financial commitment and could instead be a long-term goal.

"At Whole Foods Market, everyone from the CEO to entry-level team members has the same benefits. The only differences are based on tenure with the company—the longer someone has been with the company, the greater his or her paid time off and the larger the company contribution toward health-care premiums and company-funded health-care reimbursement accounts."A cashier who has worked for the company for several years enjoys the same benefits enjoyed by the two co-CEOs of the company. It’s very powerful to be able to tell people about this practice. It creates a sense of solidarity throughout the organization," said John Mackey, co-CEO of Whole Foods Market.

Another reasons to consider capping executive pay is that more money doesn't necessarily make you any happier. For example, recent research suggests that a salary between $75,000 and $100,000 (depending on your location and cost of living) is the magic number. The study found that as people earn money from zero to $75,000, their happiness rises. Any more money after that, however, and it's just more stuff -- with no gain in happiness.

Image credit: B Lab

Ryan Honeyman is a sustainability consultant and author of The B Corp Handbook: How to Use Business as a Force for Good (Berrett-Koehler Publishers, October 2014). Ryan helps organizations like Ben & Jerry’s, Klean Kanteen, and McEvoy Ranch become B Corporations and maximize the value of their B Corp certification. To learn more, visit www.honeymanconsulting.com or follow Ryan on Twitter @honeymanconsult