Developing a new mindset

At this year’s BITC Responsible Business Awards , Lloyds Banking Group won the building stronger communities award for its work increasing access to financial services for people with dementia. Here , Graham Lindsey, director, Responsible Business tells Ethical Performance how – and why - it set about addressing the needs of customers dealing with this challenging condition.

How did the idea for the dementia programme get on Lloyds’ radar?

Within our Helping Britain Prosper Plan we have committed to be the best bank for customers. That commitment includes those dealing with dementia. One in three people over 65 may develop dementia. With millions of customers, we have a relationship with almost every household within the UK and we are well placed to help develop dementia-friendly communities. Dementia is a growing societal challenge and access to financial services is a fundamental aspect of life that most of us take for granted, but it is one that is fraught with difficulties for those people living with dementia.

What kind of difficulties do dementia sufferers face with financial services?

Studies show that 76% of people with dementia have experienced difficulties when using their bank. Problems include remembering pin numbers through to maintaining a consistent signature that matches a bank card to requesting products that are unsuitable for their particular circumstances. We have tried to make it easy for those people affected by dementia to tell us and discuss their specific customer needs with us and to promote dementia-friendly practices throughout our organisation. 38,000 colleagues became involved in our charity of the year programme, delivering almost 80,000 hours of volunteering and raising £6.5m over the two year period. We also created almost 9,000 dementia friends in our branches.Sustainable change is more than just about money; it’s about engaging communities to take collective action.

Who do you partner with? And how did you select them?

In developing our approach to dementia, we worked with the Alzheimer’s society who, along with Alzheimer’s Scotland were chosen by our colleagues as our Charity of the Year.

When did the programme start?

Launched in January 2013, Alzheimer’s Society and Alzheimer’s Scotland remained our charity of the year for two years until December 2014. At that time we adopted BBC Children in Need as our charity partner.

What does Lloyds’ involvement entail?

The Alzheimer’s programme was a ground-breaking two year initiative that led to the creation of a cross industry working group where Lloyds Banking Group led the sector by developing and co-launching the Dementia-Friendly Financial Services Charter, a landmark guide for banks to help them respond to the needs of customers with dementia and their carers. Around 38,000 colleagues have been involved in everything from baking cakes to trekking the Sahara and climbing Ben Nevis, raising £6.5m (smashing the original target of £2m). We created 713 Dementia Friends in branches and trained 830,000 colleagues. A staggering 79,648 hours of volunteering were undertaken by colleagues and we believe that 9,000 carers have been impacted through training. Over 530 Carers Information and Support programmes were delivered and 205,000 dementia guides distributed.

How does the programme align with the core business? Or is it more about your business values?

The programme reached right into the heart of the organisation where we put customers first in all that we do - including those dealing with dementia.

Our programme has delivered a lasting legacy through the colleagues we have trained, the carers we have helped, through to unlocking financial services for UK households living with dementia. The work to create the Dementia-Friendly Financial Services Charter will help those organisations that sign up to make their entire operations dementia-friendly. This means that managing money does not add to the list of worries that people with dementia and their carers face.

Are there plans to build on the initiative?

Through our Helping Britain Prosper Plan we have committed to be the best bank for customers - this commitment continues.

Business in the Community’s 2016 Responsible Business Awards open for entries in November. The awards are open to businesses of all sizes across any sector and recognise businesses that are creating a fairer society and more sustainable future. Application forms will be live from 2 November 2015 – 12 February 2016 at www.bitc.org.uk/awards.

For more information contact [email protected] or call: +44 (0) 207 566 8668

Cecil the lion and the big data revolution

‘Big data’ has been one of the buzz phrases of the last five years and has already spawned an analytics industry worth $125bn. But is it all hype or does it have the power to revolutionize the worlds of corporate responsibility and responsible investment?, asks Hendrik Bartel, ceo and co-founder of Insight 360

We live in an increasingly interconnected world. Many of us own a smartphone, tablet or laptop - if not all three - and are part of digital processes that generate around 2.5 quintillion bytes of data everyday; enough to fill 57.5 billion i-pads.1 Indeed, we now generate data at such pace it is estimated that over 90% of all the data in the world was generated within the last two years.

Big data has already become critical to the business of sustainability. The growth of corporate responsibility reporting among the world’s largest companies has resulted in vast amounts of sustainability performance data in various formats. For example, CDP requests greenhouse gas emission and other environmental data from over 11,000 companies in 60 countries,2 and over 8,000 organisations have reports published on the Global Reporting Initiative (GRI) database.3

This data provides previously unavailable information which, if analysed well, can help us better understand current trends and make smarter decisions. It seems clear that this revolution is here to stay. We have entered the age of big data.

Finding the signal amid the noise

Big data sets are often too large and too complex for humans or traditional computing methods to meaningfully understand, and much of the information generated is little more than noise.

However, those who successfully extract the value from within this noise are already reaping the rewards. For example, by analysing web searches and social media posts, Google has been able to determine flu outbreaks in 30 countries with a similar accuracy to the Centre for Disease Control - and in real-time.4

In particular, ethical and responsible investors should take inspiration from these industries. Investors are increasingly swamped by a huge volume and variety of environmental, social and governance (ESG) data. ESG data includes diverse sets of variables, such as disclosure on climate change, water management, labour standards, executive remuneration and board diversity. As more and more information on these indicators becomes available it is becoming harder for investors to extract the really useful information and thoroughly understand its material implications.

It is clear that the responsible investment sector needs technology to help it extract the pieces of data that really matter to their investment analysis and decision making processes.

That is why new breeds of computing systems, especially cognitive computing platforms which allow algorithms to adapt, learn and think, are becoming increasingly important in sustainability.

These systems enable vast amounts of data to be analysed, more dots connected and deeper trends understood.

How responsible investors are benefiting from big data

Mainstream investors have also recognised the potential of big data to provide new and additional insights to guide their investment decision-making. Large firms such as Blackrock, J.P. Morgan and UBS have all increased their spends on big data analysis in the past year, and State Street has just opened the “State Street Global Exchange” – a big data division devoted to investment analytics and data management.

Now some tools are emerging to help ethical and responsible investors reap the rewards of this exciting new data era.

For example, my team and I have been working to bring technology experts together with sustainability leaders such as Harvard academic Dr. Robert Eccles and Dr. Jim Hawley to create a cognitive computing platform useful for responsible investment. The result has been the ‘Insight360’ platform, which uses natural language processing (which means it is able to derive meaning from normal or everyday language - just as a human would) to derive quantitative data from a variety of sources. It monitors over 5,000 publicly traded companies – including all those listed on the NYSE and NASDAQ - against over 50,000 sources and extracts the relevant information on issues affecting sustainability performance.

For example, in August 2015, Insight360 was showing a downward sustainability trend at Delta Airways, due to a number of negative events including rejected labour contracts and ongoing litigation regarding the use of Dallas airports. This downward trend was halted when Delta announced a policy banning the transport of big game trophies in the wake of the killing of Cecil the lion.

After this positive action we saw an uptick on sustainability performance at Delta, and investors using the platform were able to immediately feed this information into their portfolio management processes.

What are the downsides to big data?

Like any strategy, big data analytics carries risk. Some might argue that we are developing an over reliance on data sets at the expense of company meetings and on-site visits. To try and take advantage of the insights offered through big data analytics, while recognizing that data alone is insufficient in understanding the bigger picture, Insight360 focuses on making the hands-on work by analysts more focused, productive, and up-to-date by providing them with the relevant information they need and the tools to understand their implications.

We are only just beginning to see the implications and extent of what cognitive computing and big data analytics will be able to accomplish. When used in conjunction with, and to complement, traditional investment processes, the potential benefits that arise from smart machines and big data far outweighs the risks. It is an exciting time for technology and for ethical and responsible investment.

1www.efinancialnews.com/story/2014-01-13/why-big-data-is-big-business-for-asset-managers

2https://www.cdp.net/en-US/WhatWeDo/Pages/cdp-worldwide.aspx

3 http://database.globalreporting.org

4http://medicaleconomics.modernmedicine.com/medical-economics/news/google-flu-trends-collaborates-cdc-more-accurate-predictions?page=full

Sustainalytics buys ESG Analytics reinforcing commitment to leveraging product innovation

The acquisition of ESG Analytics AG, a Zurich-based provider of web-based solutions that assists asset managers and owners to analyse and manage environmental, social and governance (ESG) risk, by Sustainalytics, a provider of ESG and corporate governance research, ratings and analysis, has been characterised as further proof of the Dutch firm’s commitment to new product development and “leveraging technology” to boost value for clients.

ESG Analytics, founded in 2012, is known for its cloud-based software that utilises a comprehensive proprietary methodology to evaluate ESG metrics.

Sven Lidén, ceo of Adveq, a leading asset manager that invests in private equity globally that manages over US$6bn in assets, commenting said: “We helped to launch ESG Analytics three years ago because we wanted to further quantify the progress and impact of our investment activities with regard to ESG aspects.” Other industry participants have “expressed interest in adopting the same approach,” he added.

As well as serving conventional investment managers and pension funds, ESG Analytics has built a reputation in the private equity space, collecting and analysing ESG data on portfolio and target companies and helping managers with reporting to general and limited partners.

Michael Jantzi, ceo of Sustainalytics, reflecting on the deal said: “Sustainalytics is committed to innovation through new products and leveraging technology to enhance the value we provide to clients across a spectrum of risk identification and mitigation solutions.”

He also claimed that the transaction, which was expected to close at the end of September 2015, “enhances Sustainalytics’ position as an ESG market leader” and would help them “accelerate” many of their product innovation initiatives.

ESG Analytics’ products have consistently received high marks for their strong data visualisation and intuitive workflows as well as reliable user experience. Besides an office in Zurich, the firm has representation on Wall Street in New York.

“As the market leader in providing ESG research solutions to institutional investors, Sustainalytics is an ideal fit for us,” stated Rina Kupferschmid-Rojas, ESG Analytics’ ceo and founder. The hope now is that Sustainalytics can leverage ESG Analytics’ “global footprint and resources to extend the reach of our innovative risk analytics solutions” according to Kupferschmid-Rojas.

On the analytics solutions front, Primus, a complimentary data management tool designed to measure the ESG performance of portfolio companies, was released to the market by the Swiss firm back in late May.

Essentially geared towards the private equity sector, it includes a set of 20 core ESG metrics, which were specifically selected for their ability to be “leveraged for cost savings, risk management, and value creation” across diverse industries.

Primus’ interface is touted as being able to guide fund managers as they take the “strategic first steps” in understanding and managing ESG risks and opportunities - without significant resource or time commitments.

The company claimed that Primus will help to “kick-start ESG integration” by providing investors a simplified way to apply meaningful ESG metrics to investments across a range of sectors.

Kupferschmid-Rojas added: “While the focus on ESG integration continues to grow within the private equity space, we are aware of the need for additional instruction and support for investors looking to begin the process.”

In a separate development, Morningstar Inc. announced plans this August to launch the industry’s first ESG scores for global mutual and exchange traded funds (ETFs) later this year. The company, which provides data on over 500,000 investment offerings, will base these scores on Sustainalytics’ ESG ratings.

For further information see here.

Roger Aitken, analyst, interprets the September 2015 data

Among UK Registered Funds, the £544.95m AXA Framlington Health R Inc fund once again top ranked overall out of 255 funds in the sector over the past one year to the end of August 2015 with a cumulative return of +26.06%. However, over the past three and five years it performed even more exceptionally with a robust +91.05% and +160.46%, respectively - ranking first both times.

The fund beat the £1,868.6m Robeco Lux-o-rente DH USD fund into second place by a fair margin with this fund posting +14.04% over the past 12 months versus +12.72%/171st rank over the past three years and +14.78%/149th over five.

Third from top by just a whisker was the £584.35m Pictet-Security P dy GBP fund, which posted +13.86% over the past one year (47.77%/19th over three years; 75.98%/17th rank over last five), followed by the £2,106.89m Pictet-Water HR USD fund in fourth on a past 12-month time horizon with +13.82% - against +63.30% over the past five years.

The bottom ranked fund for this sector was the £24.27m Sparinvest SICAV Ethical High Yield Value Bond EUR R fund with -31.08% over a past one-year horizon (-12.93% over past three years and -7.94% over past five). All of the bottom five funds here posted negative performances over the past year - ranging downwards from SUNARES with +25.65% (ranked 251st and 5th from bottom).

Within the US Mutual funds sector, the US$240.60m Brown Advisory Sustainable Growth I fund came top of 166 funds examined by Morningstar and posted a +10.19% performance over the past one year to date - versus +58.23% (9th rank) over the last three years.

Eventide Gilead N, a US$1,929.72m fund, which ranked top for the past one-year in the previous period under review to the end of this July, was runner up this time around over the past 12 months. Nevertheless, it was top over both the past three and five years on +93.49% and +179.12%, respectively.

In respective third, fourth and fifth from top positions on a past one-year view was Parnassus Endeavor Fund with +6.76% (versus +63.81% over past three years), Calvert Small Cap A fund just behind on +6.38% (+58.54 over three years) and the American Century NT Heritage Institution fund with +5.47% versus +48.06% over the last three years. Sector laggard came in Timothy Plan Emerging Markets A fund on -38.36% over the past year.

Volkswagen Is Not Alone in Emissions, Performance Problems

Volkswagen isn't the only company that is under the microscope for allegedly deceiving consumers about vehicle emission results, says the Europe-based organization Transportation and Environment. According to road tests conducted by the organization, a number of Mercedes, BMW and Peugeot vehicles guzzled, in some cases, as much as 50 percent more fuel than was stated in company-run lab tests.

"The gap between official and real-world performance found in many car models has grown so wide that it cannot be explained through known factors including test manipulations," Transport and Environment concluded in a new report. The organization is a consortium of organizations and companies with environmental interests in the European transportation sectors.

According to its report, Mind the Gap: The Difference Between Official Car CO2 Test Results and Real World Emissions in 2014, Mercedes led the pack with "real-world fuel consumption exceeding test results by nearly half." Similarly, attempts to remedy fuel consumption in Opel/Vauxhall cars (owned by GM Motors) have been ineffective say the report authors, and their fuel economy "is actually getting worse." The organization also notes that while these discoveries don't necessarily suggest that defeat devices were used in these cars, "EU governments must extend probes into defeat devices to CO2 tests and petrol cars too."

The gap between real-world road test results and what is published from lab tests "has become a chasm," the report's authors write. The organization warns that, without action by regulatory agencies, the gap "will likely grow to 50 percent on average by 2020."

Here in North America, the Environmental Protection Agency and its California counterpart, the California Air Resources Board (CARB), are being pressured to explain why action wasn't taken sooner to inform consumers of the assertion that VW had cheated on its emission tests. According to Dan Carter, one of the University of West Virginia researchers that discovered the discrepancy, the EPA and CARB were informed of the problem more than a year earlier, when the research team presented the test results at a symposium in San Diego, in March 2014.

"We said, these are two vehicles — we’re presenting what we can present. And EPA people were in the audience," Carter told LA Weekly.

In fact, Carter said, CARB and the EPA actually sponsored the event and had representatives in the audience. By December of that year, both agencies conducted private investigations, and allegedly secured promises from VW to fix the discrepancies. Yet consumers were not told about the alleged deception, and sales of the vehicles, which had not yet been fixed, were still booming, writes Dennis Romero.

"All this was done in virtual secrecy. People were allowed to continue buying, leasing and driving these cars," writes Romero.

For its part, CARB says it really didn't confirm that there were problems until May of this year when it conducted "confirmatory testing to determine the efficacy of recall for both the Gen1 and Gen2 vehicles." And while CARB chair Mary Nichols admits that the agency was in discussion with VW in 2014 regarding the emission findings, it hasn't explained why consumers were still allowed to purchase the vehicles. Both agencies say that they delayed action due to VW's assertions that the problems were due to "technical difficulties and unexpected in-use conditions," issues that the agencies say were really due to a defeat device that restricted carbon emissions while the car was being tested in lab settings.

VW will no doubt bear the brunt of this scandal. In Germany, the car maker faces a deadline of Wednesday, Oct. 7, to lay out how it will remedy the emissions problem in the 2.8 million vehicles already on German roads. With escalating lawsuits and frozen sales on its upscale diesel models, the company knows it has more than a mechanical problem to resolve.

"We just want to say one thing: We will do everything to win back your trust," VW told German consumers in a full-page ad last week.

But as this scandal widens to include unexplained discrepancies at other automakers' factories, the overarching question seems to be not whether VW will rally to come up with an answer, but how the deception could have been missed by environmental regulators for seven years. What would lead to the conclusion that control tests wouldn't need to be done on the road as well to verify lab results? It's a particularly relevant question as we approach this December's COP21 conference and the ongoing effort to turn back the clock on the environmental impacts of climate change.

Image credit: Flickr/ilovebutter

Bipartisan Carbon Tax Back From the Dead

"This isn't an olive branch; it's an olive limb," explains former congressman Bob Inglis (R-S.C.), describing how pending carbon tax legislation might appeal to Republicans. The limb in question is a 4 percentage point reduction in corporate taxes across the board, one of the key functions of the American Opportunity Carbon Fee Act (PDF), introduced by Sens. Sheldon Whitehouse (D-R.I.), an "undeniable," liberal and Brian Schatz, (D-Hawaii). Inglis and Sheldon are pounding the pavement together to build support for the bill.

It's quite unusual for Democrats to propose a corporate tax break, but these politicians believe this olive limb is the key to gaining bipartisan support for their initiative. They just might be on to something.

The goal of the bill is to starkly lower corporate carbon emissions -- fast. Independent analysis shows that it would reduce these emissions by an impressive 40 percent compared to 2005 levels by 2025.

The bill is structured to be revenue-neutral (meaning money collected from the tax is returned to the people) and border-adjusted (to level the playing field for trade-vulnerable, energy-intensive domestic companies). Here are its key components:

- A $45 per ton tax on carbon emitted beginning in 2016, with an annual increase of 2 percent, "ensuring emitters would be held responsible for the harm they offload on the American people," explains Whitehouse in a summary sheet of the bill.

- Reduce top marginal corporate income tax rate from 35 percent to 29 percent

- Offer Americans an inflation-adjusted $500 tax credit

- Provide a fund for state-directed use to support low-income and rural households and workers transitioning to new industries

The tax would be applied upstream to fossil fuels at the point of mining or extraction (coal and oil companies), large emitters of non-fossil fuel based greenhouse gases (like cement producers), and on producers and importers of industrial gasses (like refrigerants). While this would increase the cost of goods, prices at the pump and electricity costs, it would provide a price signal to incentivize the efficiency and innovation that we need to get off fossils fast.

The bill still has a long ways to go to get mass appeal, but Inglis is working hard to build support for it among Republicans. He has 11 on board so far. "What I’m looking to do is be a leader for my party ... If conservation isn’t conservative, than words have no meaning at all." He believes the carbon tax concept is consistent with Republican ideals, highlighting the hefty reduction in corporate taxes, which, according to Whitehouse, "everyone agrees are too high."

The duo believe that many Republicans want to support carbon mitigation legislation but fear the wrath of the fossil fuel industry, which has gotten too much power since Citizens United allows it -- and every other corporate sector -- to spend unlimited funds to influence elections. Companies with oil and gas interests spent more than $70 million on federal candidates in the 2012 election, almost double what they spent in 2012. Ninety percent of that went to support Republican candidates. This spending represents a massive roadblock for anyone wanting to gain Republican support for carbon legislation.

The carbon tax presents Republicans with "safe passage through the political minefield -- the shelling -- they anticipate from the fossil fuel industry," Whitehouse explains. But they also need support from small business owners in their constituencies.

Finally, the carbon tax provides a gentle way out of an economic predicament faced by fossil fuel companies. Stocks are falling, assets are stranded and Goldman Sachs says peak coal is here. "If you are a coal miner, this is your chance to get your pension funded through the state funds," Sheldon says. Fossils are "a plane is headed for the ground. It's either a soft landing or a crash." He shakes his head, noting, "No one has sympathy for a business that goes under due to changes in the market." This bill provides the signal and opportunity for companies that want to get with the program to do so gracefully. "This is the story of re-enterprise. This is exciting."

Image credit: Flickr/Takver

Scandinavian Corporations Explain Their Business Case for COP21

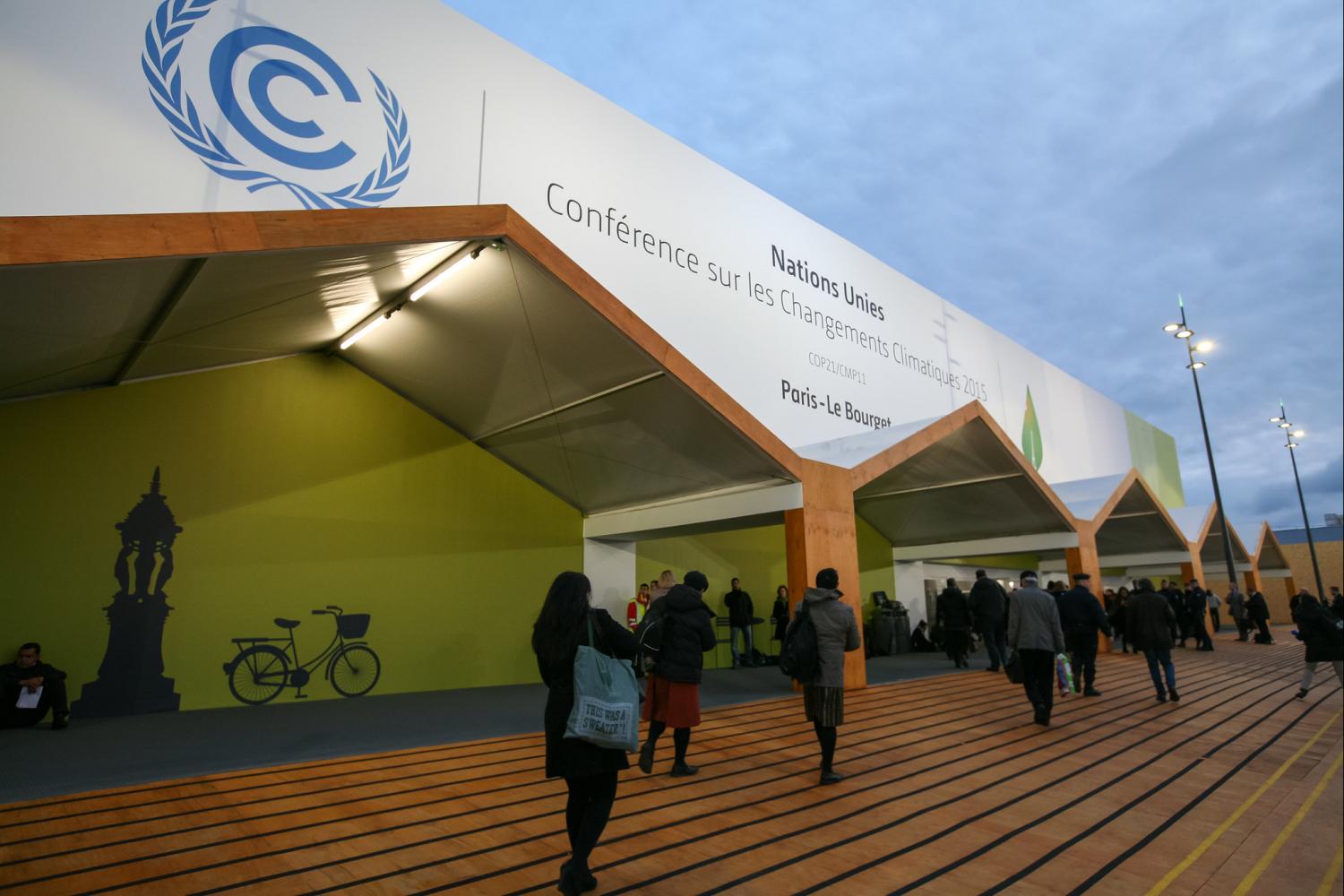

In a few weeks, delegates from governments around the world will convene in Paris at the 21st Conference of Parties (COP21) to try and hammer out an agreement for meaningful action on climate change. Most readers who have come to this page are fully aware of the critical importance of this meeting. We may have signed petitions, contacted our representatives, written op-eds or even articles in publications like this one. But for most of us, all we can do at this point is to wait and hope for the kind of outcome that all of us, whose vision is not clouded by billions of dollars, know that we need.

As a publication with an emphasis on what businesses are doing to bring about a sustainable future, we decided to take a look, as we kick off this new series, at what some leading companies are doing, beyond sitting by and hoping for a good result.

The conversation begins just outside of Copenhagen, where we had the opportunity to sit down with Peder Holk Nielsen, CEO of Novozymes, a biotechnology company that consistently ranks among the top in sustainability rankings (and who happen to be sponsoring our independent COP21 coverage). Their products as well as their operating philosophy are steeped in a vision of a sustainable future. The specialized enzymes they have developed enable biofuels, including cellulosic ethanol, cold water laundry detergents, numerous contributions to the circular economy, including waste-to-fuel, and, most recently, the development of bio-agricultural products which add micro-organisms to seed coatings that allow the plants to take up nutrients more efficiently.

Triple Pundit: Recent events, such as the agreement between the U.S. and China, have hopes running high. Do you share those?

Peder Holk Nielsen: High hopes, yes, but also this feeling that time is running out and that things have to happen and they need to happen fast. Decisions are badly needed. I’ve heard Al Gore use this one punchline several times. He says that “luckily, political will is a renewable resource.” And every time I hear it, I feel like standing up and screaming, “yes, but it’s a scarce resource!”

That’s where I think we are now. We need the political will to make it happen. And I don’t think Novozymes are experts in the process of making that happen. But we are, as a company, seeking impact on this agenda, We are jumping on various soapboxes, to shout out to politicians that 1) time is running out, 2) decisions are badly needed, and 3) which is perhaps most important, many of the technologies that can actually help us are already available.

I think you’re aware of all these consultancy reports, and I think the most well-known is the McKenzie Abatement Curve, where you can look at the necessary CO2 mitigation that needs to happen to stay below 450 ppm. Actually two-thirds of those technologies are available. Of those, one third has been shown to be economically advantageous, while another third is roughly neutral. Then there is one-third where it’s complicated, and expensive, which means, we really don’t understand how to do it yet.

Politically, I think that sometimes that last one-third becomes the excuse for not doing anything. I fail to understand why we don’t do the two-thirds that we already understand how to do. But that requires transformation in our various societies, which, of course, is not a simple thing. And it’s not going to happen unless there is political will.

3p: Do you have a battle plan for adding your voice to this argument?

PHN: As a company, we have a battle plan for how we can actually affect this. As you know, we are suppliers into the renewable energy sector, we have quite a few technologies that go into energy efficiency, and many that go into sustainability in terms of the circular economy in many different ways. So, we have a lot of “tech talk” that we can do, to demonstrate that these technologies really do exist. That’s where we usually start from. Then we work at the United Nations, both at the sustainability conference, and climate conferences. We also work under the Sustainable Energy For All umbrella, which is a partnership between the UN and the World Bank, leading one of the high impact opportunities called Sustainable Bio-energy for All. Then, we are involved in the various COP meetings and have been for the past 6-7 years. We are involved in trying to set the agenda for B20 meetings within the G20. Then we are also involved with local governments, we are trying to get involved with the American administration. We work with other people in the U.S., to try to affect the upcoming primaries and the presidential election. Of course, Novozymes is just a mid-sized European company, so there’s a limit to how much we can put at work here, but if we join forces with a number of other people, we can at least get our voice heard. And of course, Iowa [where the company has a research facility] is not a bad place to try to spin a renewable fuels agenda.

We try to work with the European Union. We are well-connected in China, and are also connected in India and Brazil and of course, here in Denmark where our headquarters are located.

In Paris, we’ll get to sit with the delegates before the actual meetings in a roundtable format, to try to influence them and to try and put words to the technology, both in terms of what it can do now, and what it would be able to do if there was the political will to use it.

3p: So, if you had a minute alone with a critical delegate in an elevator, what would you say to him or her?

PHN: The usual speech would be “don’t let the perfect get in the way of the good.” Let’s try to do what we can now, and then quickly approach some of the key technologies. Then I would talk about our contribution which is to use nature’s own technologies to help us solve some of these problems.

Nielsen closed by talking about how there is “still a lot more money to be made from unsustainable behavior.” We have to counter that, he said, “with facts and political courage.”

Novo Nordisk

While in Copenhagen, we also dropped in on Susanne Stormer, VP of Sustainability at Novo Nordisk, another sustainability leader. When we asked her about the role of business in the upcoming Paris talks, she said, “What we are sensing are tectonic shifts between business, government and civil society. So the logic as we see it, that speaks to the COP and whatever else you want to talk about, is that business has a growing influence and role in society, as an economic factor. That’s what we are. But we are also a social factor and we certainly are an environmental factor.”

She framed the question in terms of “enlightened self-interest,” harking back to the UN Global Compacts put in place by Kofi Annan. We discussed the business case -- self-interest. It comes down to how aware company leaders are about the extent they depend on conditions that they operate in, and the importance of not impacting those conditions adversely. That might mean ensuring a supply of skilled employees, or the need for clean water for their production facilities, or a stable economy in which their customers can afford to buy their products.

Like Novozymes, they too, will attend the talks, and take advantage of opportunities to speak with delegates. “Politicians are just humans too. They want to be informed by people who are in the know. So if they meet people who can speak sensibly and be a business voice, they would be happy to. There are canyons, but they can be bridged.”

Finally, another Scandinavian company, Volvo, with headquarters in Sweden, will hold a series of meetings in Stockholm, just before the Paris summit, convening business leaders, with stakeholders in government and civil society to discuss how business can contribute to sustainable development. The forum, entitled Next Stop Paris” is the theme for this year’s Volvo Group Sustainability Forum, which will be led by Professor Johan Rockström, Executive Director of Stockholm Resilience Centre. Rockström is perhaps best known for his nine planetary boundaries that map out the other areas where human activities could potentially put us in peril.

Image credit: Force Ouvrière/Flickr

Net Zero Lessons From A Wastewater Treatment Plant

If you think that achieving net-zero energy consumption is an impossible ambition for your place of business, take a look at the goal that New York City has embarked upon. Last spring the city updated its sustainability roadmap, OneNYC, including the colossal task of achieving net zero energy at its wastewater treatment plants by 2050. We should say impossible task because within this densely packed city are 14 massive treatment plants that pump, filter, aerate and treat 1.3 billion gallons of wastewater daily, accounting for an enormous amount of energy consumption.

However, take a look at one recently announced upgrade, at the city's Port Richmond wastewater treatment plant on Staten Island, and you can see that net zero energy is not such a faraway dream, even in some very unlikely of places.

Net zero for NYC wastewater treatment

New York is focusing on reducing energy-related emissions from wastewater treatment because, to paraphrase the infamous early 20th century bank robber Willie Sutton, "that's where they keep the emissions." Wastewater treatment is an energy-intensive process that typically accounts for a big chunk of energy use in cities, and New York is no exception.

According to the city (see page 170 of OneNYC), the combined emissions of its water supply and wastewater systems account for almost 20 percent of all emissions attributed to city government, and wastewater treatment alone accounts for 90 percent of that.

To make matters more complicated, the typical New York City treatment plant is wedged into neighborhoods, sometimes literally across the street from homes and other occupied buildings. Building a large ground-mounted solar display or installing a wind turbine is out of the question.

One advantage that Port Richmond does have is a roof over the main part of the facility. That's a big contrast with most treatment plants, which are typically open-air facilities located on the outskirts of a town or city. The latest net-zero announcement for Port Richard actually follows upon an earlier upgrade of the roof, which achieved "cool roof" status back in 2012. The cool roof reduces heat gain in the building by reflecting solar energy upward.

The full fruits of that upgrade were realized in the following years, when a massive new solar array was added to the roof. The new array, one of the largest rooftops solar systems in New York, is a partnership with ConEdison Solutions. It provides for about 10 percent of the treatment plant's overall power requirements. The cool roof helps to make the array more efficient because the solar modules convert light reflected from the cool roof, in addition to converting direct sunlight.

The newest addition to Port Richmond's net-zero upgrade consists of three new boilers and a a new exhaust-capture system. The boilers replace older -- as in, 1970s -- oil-burning models and run on biogas captured from the wastewater treatment process as well as natural gas.

Biogas reclamation is the key element that makes the net-zero goal realistic. In the past, raw wastewater was simply considered a nuisance in need of disposed. With biogas reclamation, wastewater is treated as another source of incoming energy.

Since the new boilers will run on a combination of biogas and fossil natural gas, it appears that New York City does not have net-zero plans for the Port Richmond plant specifically. However, Port Richmond is among the smaller of the city's treatment plants. The city can leverage more energy-harvesting opportunities at its larger treatment plants to keep driving the entire group toward the overall net-zero goal.

A long (or short) road to net zero

While net zero tends to conjure up images of high-tech, ultra energy-efficient buildings, the Port Richmond upgrades illustrate that you can get a lot of mileage by retrofitting older buildings with technology that has already been mainstreamed, including cool roofs and rooftop solar.

The Port Richmond upgrade shows that high energy consumption doesn't necessarily prevent a facility from achieving net zero energy. Before dismissing net zero as an unrealistic goal out of hand, it makes sense to analyze the facility and ensure that all energy-harvesting opportunities have been investigated.

New York's net zero for wastewater goal also provides a path forward for companies that own or operate multiple facilities. While net zero may not be realistic for each facility alone, when treated as a group the opportunities for achieving net zero may become more clear.

The use of biogas capture also shows how facilities can leverage incoming fuel aside from sun and wind energy. That applies to biogas from livestock and from agricultural and food waste as well as municipal wastewater.

Speaking of food waste, New York City's net-zero goal may also provide the local food-service industry with another green branding opportunity. The city has been experimenting with commingling food waste and wastewater, providing local businesses with the opportunity to contribute to biogas capture without having to install a biogas system on their premises.

As for next steps for New York City and other municipalities, this could be a long way down the road, but new advances in wastewater treatment are emerging that enable treatment plants to leave their energy-sucking past behind and even go beyond the net-zero goal, to produce more energy than they consume.

Image credit (cropped): Port Richmond rooftop solar array via NYC DEP.

Divestment's Impact is More Than Just Money

The divestment campaign – a grassroots movement to get public pensions, university endowments and other large funds to remove fossil fuels companies from their portfolios – has garnered some huge victories recently.

Earlier this year, it was Norway's Government Pension Fund announcing it would divest from coal, the dirtiest fossil fuel. Last month, California followed suit, voting to divest its massive state pension fund – one of the largest government funds in the world – from coal. Then, it was the California Academy of Sciences, of the country's most well-endowed museums, accounting it would divest from fossil fuels entirely.

Now, this month, the big news was that America's richest public university system, the University of California system, will pull $200 million out of coal and oil sands investments.

According to Karthik Ganapathy of 350.org, this latest move is much, much bigger than the $200 million price-tag. It is the moral authority that academia divesting gives to the cause, along with the power of association. As he told Huffington Post:

"The whole idea is basically to get the institutions that people trust -- Harvard, the University of California, Stanford -- to get folks to pull their money out of fossil fuels and take a stand against the industry: the way that a lot of them did with tobacco, the way a lot of them did with apartheid-era South Africa. The idea is that it will shift cultural attitudes by getting big institutions that people trust to take a moral stand against."

Of course, this is only a part of the puzzle. The campaign, led by organizations including 350.org, believe that not only is investing in fossil fuels wrong from a moral standpoint, but it is also a bad investment. In order to avoid the worst impacts of climate change, the vast majority of fossil fuels need to remain in the ground. But the valuations of most energy companies includes their proven reserves – and expected future value of exploiting those reserves. Of course, as we know, if all that carbon is leeched into the atmosphere, our global economy will suffer immensely.

Universities are at the forefront of knowledge: They host the scientists who are studying climate change, and are educating future generations about how to take care of the earth. Now, they are, more and more, putting their money where their mouthes are. And that is away from dirty, polluting industries.

The divestment campaign is now aiming for one of the richest institutions on the planet – the Vatican. With the Pope speaking more forcefully about climate, it might just be a matter of time before even they divest from fossil fuels. Expect to hear more and more news from the divestment campaign in the coming weeks leading up the Paris Climate Talks in December.

Image credit: Wikimedia Commons

Report Highlights Plan to Eliminate Ocean Plastic Waste in 20 Years

Plastics: They’re everywhere and in almost everything — from electronics and automobiles to food packaging and chewing gum. In fact, the average American generates between 88 and 122 pounds of plastic waste at home every year. Sadly, 8 million metric tons of plastic finds its way into the world's oceans each year.

The Ocean Conservancy warns that unless drastic measures are taken – in 2025 the ocean could contain 1 ton of plastic for every 3 tons of fish.

Although the scope of the problem may sound overwhelming, combined with the fact that global plastic production is expected to increase significantly, the Ocean Conservancy in partnership with the McKinsey Center for Business and Environment released Stemming the Tide: Land-based strategies for a plastic-free ocean: a solution-oriented report detailing how to reduce plastic waste in oceans by 45 percent by 2025 and eliminate the problem by 2035.

Five countries account for 60 percent of the total leakage of plastic into the ocean: China, Indonesia, the Philippines, Thailand and Vietnam. To achieve this reversal of the status quo, however, all hands are needed on deck in a concerted land-based global response.

"Today's report, for the first time, outlines a specific path forward for the reduction, and ultimate elimination, of plastic waste in the oceans," said Andreas Merkl, CEO of the Ocean Conservancy on Sept. 30. "The report's findings confirm what many have long thought - that ocean plastic solutions actually begin on land. It will take a coordinated effort of industry, NGOs and government to solve this growing economic and environmental problem."

The global cost of this undertaking could be as low as $5 billion annually, but it would also provide economic benefits. The exact impact of ocean plastic pollution is difficult to quantify, but it does impact tourism revenue, human health and property values. Marine life, including seabirds, whales and sea turtles, are dying from ingesting or becoming entangled in marine plastic; livelihoods are threatened; and navigational challenges are created for shipping and transportation industry.

"Considering this is a global environmental challenge impacting sanitation and health, land values, important sources of global protein, and the growth of the consumer goods and packaging industries, an estimated $5 billion scale of intervention makes this one of the most solvable of the environmental challenges we collectively face," said Dr. Martin Stuchtey, director of the McKinsey Center for Business and Environment.

The report calls for both a private and public investment, with solutions for different time horizons. Rapid development of waste-collection systems and mitigating post-collection leakage is the first step. Next, the development and implementation of treatment options. In the long term, the report identifies a critical need for supply-chain cooperation and innovations in recovery and treatment technologies, the development of new materials, and product design that promotes reuse and recycling.

In the short and medium term, the report calls for accelerated development of waste collection and plugging of post-collection leakage, followed by the development and rollout of commercially-viable treatment options.

The report emphasizes the need for fast, effective global solutions with diverse benefits, while also making multidimensional decisions across an integrated lifecycle of plastics. This would require a multi-stakeholder approach for rapid progress, including the important role of industry.

"We're committed to working toward a future of a plastic-free ocean," said Jeff Wooster, global sustainability director for Dow Packaging and Specialty Plastics, a partner on the report. "Companies don't make plastic with the intent of it ending up in the ocean, and we acknowledge the strong role industry must play in order to help eliminate ocean plastic waste by 2035."

Image credit: Flickr/epSos .de