Taking Fewer Car Trips is the Best Thing You Can Do for the Environment

By Paul Mackie

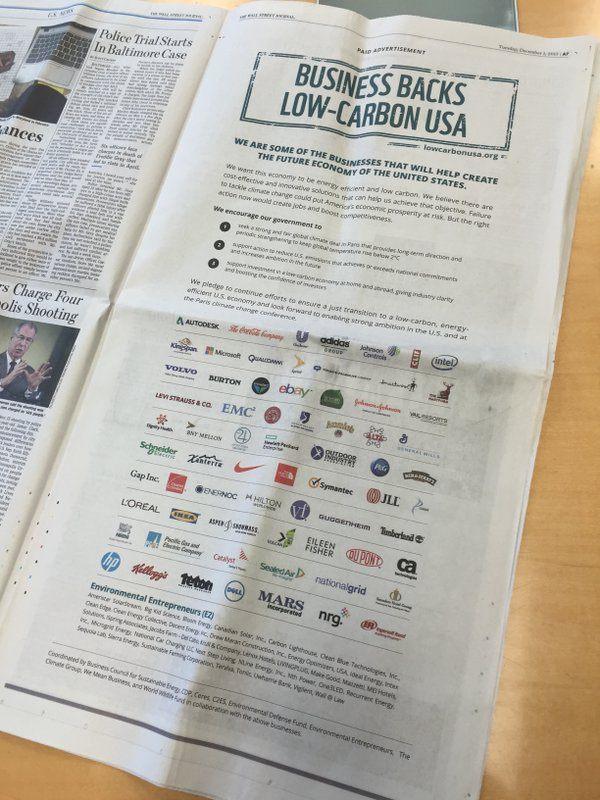

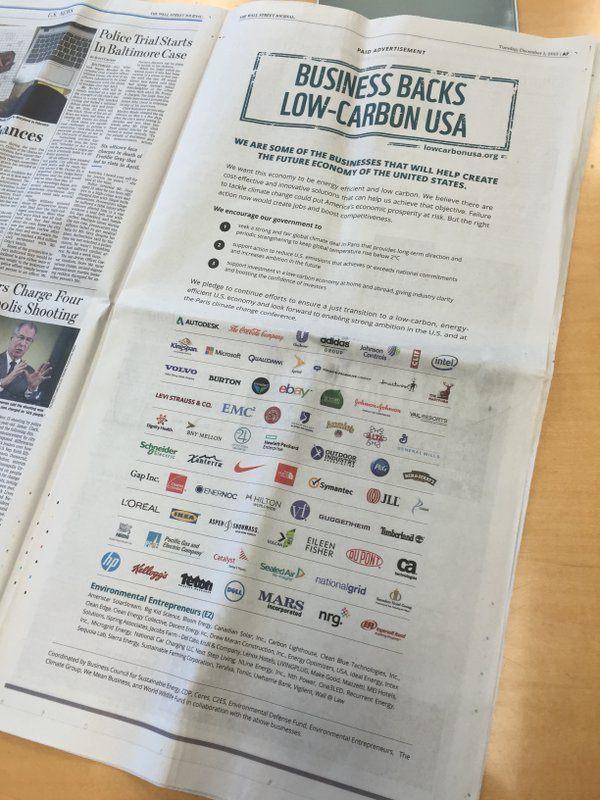

As leaders from around the world are meeting over two weeks in Paris to advance collective action on climate change, it’s heartening to note that transportation continues to gain prominence as an accepted path to cleaning up pollution.

In order to keep global temperatures below levels that are dangerous to humans, transportation offers both the curse of being the fastest growing source of CO2 in the world and the blessing that offers significant hope: If we can reduce the number of cars on the road and, more importantly, the number of total trips, then we can cut the 27 percent of greenhouse gases that originate from transportation vehicles in the U.S.

Perhaps most crucial of all to transportation goals other than the U.N.’s COP21 meeting is the parallel launch in Paris of the Climate Summit for Local Leaders. Anne Hidalgo, the mayor of Paris, and Michael Bloomberg, just named the first-ever U.N. special envoy for cities and climate change, led the group.

City officials in attendance are learning from each other what can be done. For example, Pittsburgh, Pennsylvania, Mayor Bill Peduto is focused on the conversion of his city’s vehicle fleet to fossil-free fuel for a 50 percent reduction in greenhouse emissions. Olympia, Washington, Mayor Stephen Buxbaum stresses the importance of consistent, public reporting of his city’s climate data as a way to show how action affects change. And Oakland, California, Mayor Libby Schaaf has ambitious climate goals, which include engagement with employers to reduce commute and business trips.

Determining which modes to promote from an environmental standpoint

This isn’t about granola-crunching hippies with anti-car axes to grind. Cars are great. They can be beautiful. They can be a life-safer, like when you’re running late and have three kids to drop off at three different play dates. They can even – every great once in a while – truly take you away for a refreshing, exhilarating Sunday drive that’s mostly free from stressful, annoying traffic jams.

But those kinds of uses are becoming less and less commonplace in a landscape that is simply becoming too crowded to continue incentivizing people to use personal vehicles for all of their trips.

The environmental benefits are clear for fewer drive-alone trips. The University of California and the Institute for Transportation and Development Policy recently found that pollution in cities can be cut 40 percent by 2050 by more people switching from cars to taking trains or buses, bicycling, or walking. That, in turn, would put about $100 trillion back into the economy.

How universities (and maybe someday schools) are on the leading edge

It’s no accident that traffic seems considerably more pleasant the moment you enter many university campuses around the U.S. They have been some of the most forward-thinking entities on designing spaces that make it easier to get from place to place. For example:

- As part of its master plan, Lehigh University in Pennsylvania is getting car travel to the periphery to create a more walkable campus.

- Free transit passes, a campus bikeshare program and implementation of a $150 charge for an annual parking pass have helped Westminster College in Salt Lake City reduce its drive-alone rate for students and faculty from 77 percent to 57 percent in just four years.

- Georgetown University in Washington, D.C. added 40 electric golf carts to its fleet to improve the way employees move about campus.

- The University of Kentucky’s Lexington campus offered a $400 voucher for students to use at local bike shops if they agreed not to bring a car to campus for two years.

And, as researcher Todd Litman notes, these programs (which he lists in detail at his website) are often “particularly effective and appropriate in such settings. It is often more cost-effective than other solutions to local traffic and parking problems, and students and employees often value having improved transportation choices.”

One area, however, where much improvement is needed is at elementary, middle and high schools throughout the country. The fact that Mobility Lab published an article with this headline – Arlington County First in Nation with Program to Ease Public-School Staff Commutes – earlier this year indicates a big problem.

“Jurisdictions have typically focused on reducing car trips for students – like under the Safe Routes to School National Partnership, which gets them thinking about walking or biking to school. But the drive-alone rate for Arlington Public Schools staff is a surprisingly high 88 percent, compared to 53 percent for the county overall,” said Elizabeth Denton, business-development manager for Arlington Transportation Partners, which partners with APS in the ATP Schools Champions program.

“Staff at Discovery Elementary School, which is brand new and is also one of three net zero schools in the nation, is forming carpools and establishing walking groups. H-B Woodlawn Secondary Program started a student after-school bicycle club. Other schools are conducting staff commute surveys and working with Safe Routes to Schools to start walking schools buses and to incorporate bicycle and pedestrian education into PE and health classes,” she said.

Denton promotes the Champions program using environmental messaging, which she says is an important motivational factor for school staff. APS is a “green” school system, ranked third nationally in green-energy usage by the U.S. Environmental Protection Agency.

The research presents a compelling path forward

Two studies by Susan Shaheen of the Transportation Sustainability Research Center at the University of California-Berkeley have the data that could prove influential in getting more people to understand the power of reducing car trips as a way to save the economy and the environment.

She studied what the effects of the growing trend in ridesharing would be. Two of the positive factors include potential monthly savings for those who change from driving alone to pooling in some way of $154 to $435 and a decrease in their contribution of greenhouse gases.

And just recently, the Natural Resources Defense Council announced an upcoming study with Shaheen’s group to determine the environmental impact of major ride-hailing services uber and Lyft and whether they are indeed – as these companies have hinted at – removing the total number of car trips from the nation’s roads. The recent launches of UberPool and Lyft Line, which hold great potential for reducing car trips, could help change a long-held societal distaste for riding in cars with strangers.

Sure enough, the Mineta Transportation Institute recently found that Uber and Lyft may be reducing vehicle miles traveled in the San Francisco region by as much as 23 percent.

Whether those numbers add up or pan out over time, at this point, it’s safe to say that we have reached an important period when truly realistic “future of transportation” scenarios like autonomous cars, electric vehicles, ride-sharing, and an on-demand economy present an opportunity – a glimpse in time – when we have a chance to redefine and reinvent the ways we travel and go about our business.

How can leaders in business and policy connect the environment and transportation for people?

Bike advocates have been buzzing about it for a long time now, but truly, one of the best things company leaders and politicians can do is call for better bike infrastructure. Once that happens, it will be much easier for all those Americans with bikes sitting unused in their garages for the past two years to gain the confidence needed to ride sometimes instead of drive.

Some of the most compelling recent evidence for how much bicycling matters to local transportation networks comes from the Institute for Transportation and Development Policy. It found that if cities work harder to get people to bike, carbon emissions from urban transportation could be cut 11 percent.

easy way for business and city leaders to influence the transportation system and increase everyday satisfaction and happiness of employees and constituents. Since 2009, when there were virtually no bikeshare systems in North America, more than 50 cities and towns – from New York City to Birmingham, Alabama – have added them to their transportation networks.

Other low-hanging fruit includes:

- Bike parking and amenities like showers and lockers in office buildings

- Policies and programs that consider increasing carsharing and ride-hailing and the subsequent decreasing need for parking

- Education and outreach efforts to improve public-transportation ridership in low-income areas

Many business executives may fail to focus on how their workforce gets to the office, but any company – big or small – can reap economic and social benefits of promoting the kind of perks provided by LinkedIn and Facebook. LinkedIn has a handful of bikes on site that employees can take to meetings or even to their homes as a way to have healthier, happier workers and a cleaner environment. A similar program at Facebook – still in its early stages – actually helped increase the share of people who bike to work from 1 percent to 6 percent.

Further, streets present a huge opportunity for local transportation departments to do much more than simply patching potholes. With local governments strapped for cash and infrastructure getting worse, an easy sell for politicians ought to be: one mile of protected bike lanes is 100 times cheaper than one mile of roadway, and lots more environmentally friendly.

Transportation thought-leader Chris Hamilton notes, “If we make our streets more people centered, and if we help make it easy for more people to walk, bike, and take transit, our cities will be more prosperous. More physically healthy. More mentally healthy. And more green.”

Here are eight practical ways to help the environment through your personal transportation habits. What are other ways to help?

Photos by Sam Kittner for Mobility Lab

Paul Mackie is communications director at Mobility Lab, which is funded by Arlington County, Virginia and is nationally "the source of research and best practices for advocates to increase awareness and education about more and advanced transportation options for people."