Last spring, I visited my brother, Mark Cowell, owner of Blue Stone Farm in Otsego, Michigan. He was busy harvesting kale, onions and asparagus for the first farmers market of the season. His vegetables are pesticide-free and his chickens are free range.

All of his annual CSA shares were spoken for, and my son was excited about stocking up on dandelion jelly since we were out and he will not eat store-bought jam. My kids are also fans of the Concord grape jelly, the zucchini bread and the fresh green beans, although they don’t really understand all that goes into growing and harvesting fresh food. But, I know we are lucky to have access to healthy, locally-grown produce.

Often people feel that farmers market produce is more expensive and outside their food budget, but some organizations, like Fair Food Network and the Michigan Farmers Market Association, are working hard to make locally-grown produce more accessible to low-income families.

In 2009, Fair Food Network launched an innovative program called Double Up Food Bucks that allows SNAP (Supplemental Nutrition Assistance Program) benefit recipients to redeem them at farmers markets to double their money up to $20 (for a total of $40) per market, per day so they can take home more locally grown fresh fruits and vegetables. This expands their food budget for healthy food, increases the number of customers at farmers markets, increases farmers’ income and keeps more dollars in the local economy. The USDA estimates that “every $1 in new SNAP benefits spent can result in up to $1.80 in total economic activity.”

“One of the biggest benefits of the program is that by spending locally, instead of at Walmart, that money stays within the community,“ Mark said.

Until 2015, Double Up Food Bucks was funded entirely by private donors. Double Up’s strong track record in Michigan informed and inspired bi-partisan support for a new $100 million healthy food incentive grants program established in the 2014 Farm Bill. In March, Fair Food Network received a $5.1 million award, the largest award to a nonprofit in the first round of funding to further expand the program in Michigan.

I talked to the Texas Township Farmers Market Manager (in Kalamazoo, Michigan), Emily Beutel. She has seen the program gain popularity by leaps and bounds each year.

In 2009, five farmers markets in Detroit participated in Double Up, and now over 150 sites across the state do, including 20 grocery stores in one of the first pilots in the nation, an important next frontier in healthy food incentives to reach more low-income families and expand the program benefits to mid-size farmers who can serve these larger markets.

The program has impacted more than 300,000 low-income families and 1,000 farmers each year The number of customers at the Texas Township market, and the use of SNAP funds, has grown, and more than that, Beutel and Mark have seen how enthusiastic and loyal many customers have become.

Beutel has watched customers develop close, long-term relationships with individual farmers, and learn about different types of fruits and vegetables and how to prepare them. Even after some customers got to a place where they no longer needed SNAP benefits, they continued to come to the market and buy from their preferred farmers.

“Local food is not a luxury item,” Beutel says. “Everyone should have access to it. It’s about everyone having a basic right to eat healthy, local food. We are really proud to be a part of that.”

The summer, as usual, was a busy one for Mark, harvesting and preparing his goods for CSA customers and markets in southwest Michigan. Business was good.

As the West Michigan farmers market season was winding down, I asked how the Double Up Bucks program was going. He said that he, Emily and some of the other farmers didn’t see the bigger SNAP numbers they thought they might see this summer. However, he said, this fall they felt like the numbers went back up.

I contacted Fair Food Network to see if they had any current numbers on how the program was doing and spoke to Emilie Engelhard, Communications Director.

Engelhard told me that each year, demand for Double Up has grown and the value of SNAP benefits spent with farmers has increased, including this year. Fair Food Network is now working with local partners in dozens of other states to bring this proven model to their communities. While Michigan isn’t widely known for pioneering sustainability efforts, it is far and away the leader in the Midwest states for SNAP use at farmers markets and number three in the nation, even though eight states distributed more SNAP benefits.

Engelhard shared some USDA data on SNAP use at farmers markets. According to Alan Shannon, Public Affairs Director of USDA-FNS/Midwest, SNAP redemptions in the six Midwest Region states (IL, IN, MI, MN, OH, and WI) grew from $2.3 million in 2012 to $2.8 million in 2014, with Michigan leading the way.

The USDA also reported that overall, farmers markets (FMs) nationwide are working hard to reach more people in their communities and provide fresh local food for a wider customer base. According to a 2014 Farmers Market Managers Survey (45% of farmers markets in USDA directory), 64% of FM managers reported increased numbers of customers and 63% reported higher sales. “A majority of FMs (52%) are involved in increasing access to fresh foods through supplemental coupons, CSAs, and direct marketing to restaurants and food service providers. The states with most FMs are: California, New York, Michigan, Ohio, and Illinois. Taken together, FM economic viability is improving and increasing healthy food access to vulnerable populations.”

In addition, Engelhard says, “the $5.1 million grant from the USDA’s Food Insecurity Nutrition Incentive (FINI) grants program awarded in March 2015 (plus matching funds) will allow us to expand the program in Michigan to more farmers markets and up to 50 grocery and small food stores, and help markets adopt mobile technology and be open year-round.”

She also did a bit of research on the numbers at the Texas Township Farmers Market, and although the final numbers are still being tallied for the season, she says that they are consistently strong.

“Double Up and SNAP distributed to customers are nearly identical at Texas Township farmers market this year compared to the same time period last year (June – August). The only noticeable difference is that the market is reporting less Double Up and SNAP transactions and less new customers compared to the same time period last year. This could indicate that there are more returning customers coming to the market and maximizing the match compared to last year.”

Engelhard suggested that a vendor (like Mark) might feel like they are seeing less Double Up transactions because there are fewer new faces compared to last year even though the dollars in the marketplace are very comparable. Also, she says, some experienced Double Up users could also be holding onto their tokens to redeem in peak season, which could explain that bump Mark noticed this fall.

One positive reason that the numbers may have dipped is that fewer people are receiving SNAP benefits each year as we move away from the recession. The USDA reported that the “average monthly SNAP participation in 2014 was 46.5 million, down from 47.6 million in 2013..” So this seemingly slower sales period during the summer might also underline the transition that Mark and Beutel talked about, namely that when customers no longer need SNAP benefits, they continue to shop at the farmers market with their own funds, which would keep sales numbers steady while Double Up transactions seemed more infrequent.

Of course, the Texas Township Farmers Market is just one small market in Michigan, but overall, the news for rural markets in Michigan is also very good. According to a Fair Food Network report:

“In 2014, more than one-third of the farmers’ markets that participated in the program were in communities of fewer than 50,000 people, and 50 of these markets were in rural communities with populations of less than 20,000. Almost 20 percent of the SNAP and Double Up dollars were spent in these markets last year, and 34 new rural markets and farmstands joined the program in 2015. Rural residents also used Double Up incentives at higher rates than urban shoppers, which may dispel myths that farmers’ markets are an affluent urban phenomenon.”

Blue Stone Farm doesn't have any more farmers markets this year, but we still get jars of jelly whenever we can. We’ll keep buying it as long as they can make it, and then we’ll live off of our frozen green beans and wait for next spring.

It will be interesting to see what other changes the Double Up Bucks program brings to farmers markets in Michigan and other states in the future.

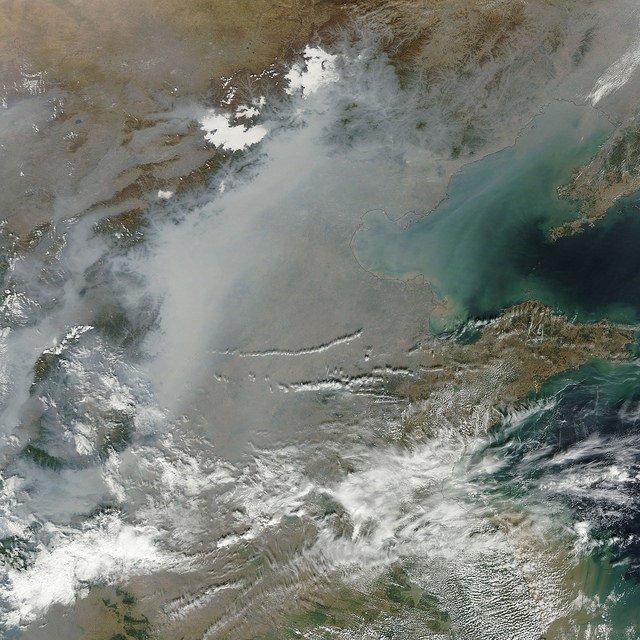

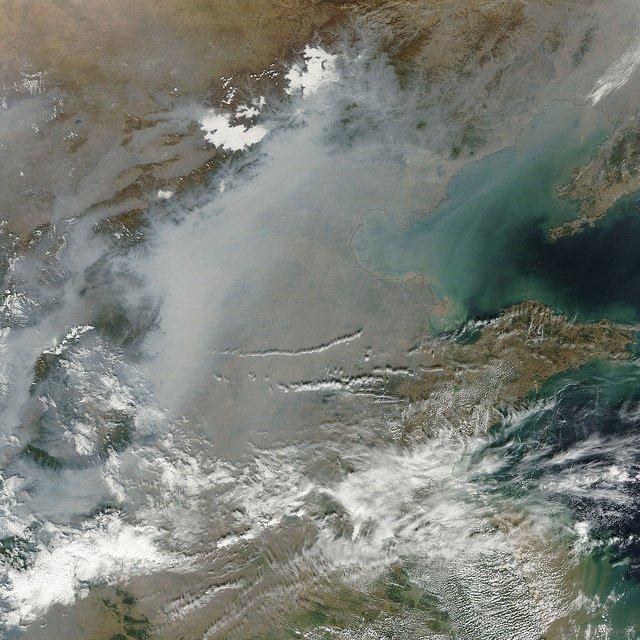

images courtesy of Blue Stone Farm