Employing as many as 10 million Americans and generating an estimated $500 billion in annual revenue, the U.S. “impact economy” is already sizable, and still developing. Growth could be accelerated substantially were the federal government to make a concerted effort to support the social enterprise sector's ongoing development, according to a policy paper from Deloitte Consulting's GovLab.

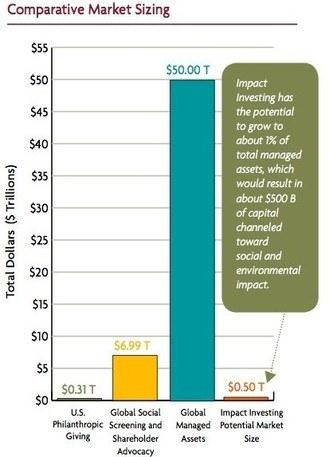

Emerging over the course of the past decade, the so-called “impact economy” has grown rapidly as entrepreneurs, investors and nonprofit sector leaders across the U.S. began developing more socially and environmentally conscious and responsible business models, legal structures and investment vehicles. Yielding triple bottom line returns, 2020 growth prospects for “impact investing” have been estimated to range between $400 billion and $1 trillion.

Part and parcel of a broad-based effort to spur further growth in the impact economy, federal government action to develop a market for “Payment for Success” (PFS) financial instruments, such as social impact bonds, would help make up shortfalls in government budgets and deliver substantial social and environmental, as well as economic, benefits across society, Deloitte GovLab asserts in, Government and the impact economy.

The Impact Economy's triple bottom line returns

In its report, Deloitte Consulting's GovLab zooms in on the social impact bond as an example of the “win-win-win” manner in which innovative “impact investing” can deliver triple bottom line benefits across society.

As GovLab recounts, the first social impact bond was launched in the U.K. in 2010 with the objective of reducing recidivism at Peterborough Prison. Since then, 16 social bonds have been issued in the U.K. and nine in the U.S. According to the report authors:

“These activities as well as other innovative financing mechanisms have contributed to an ecosystem in which a range of support organizations are eager to participate in the impact economy...With the rise of the impact economy, all have an opportunity to challenge conventional thinking and reinvent their models.”

The federal government's pivotal role

As is true for any new economic sector or market, the federal government can play a vital role in shaping and supporting the impact economy's growth and development.

In the report, Deloitte GovLab authors outline steps the U.S. government could take to help the social enterprise sector realize its full potential, broken out across three main lines:

- As a convener or “market facilitator,” by providing resources and infrastructure and building relationships among those engaged in building the impact economy;

- As a buyer of goods and services, by focusing more public resources on achieving social outcomes; and

- As a regulator, by crafting regulations, policies and incentives that drive more investment capital into the impact economy.

More specifically, in its prospective role as a market facilitator, Deloitte GovLab encourages the Obama administration and Congress to:

- Build a repository of leading practices;

- Develop platforms to facilitate investment;

- Standardize and track metrics; and

- Create dedicated impact funds.

As a buyer of goods and services, GovLab continues, the federal government could:

- Fund Pay for Success and other performance-based programs; and

- Reform procurement processes.

Finally, as a regulator, the federal government could catalyze development and growth of the impact economy by:

- Creating legal defnitions for social enterprises;

- Encouraging impact investment through the tax code;

- Reforming the Community Reinvestment Act; and

- Clarifying definitions under the Employee Retirement Income Security Act

An L3C – low profit, limited liability company – whose business is firmly rooted in triple bottom line principles, 3p is a growing part of the impact economy landscape. As such, it plays an active role, as well as having a growing stake, in its ongoing growth and development. As Deloitte GovLab highlights in the conclusion to its report:

“With promising new vehicles such as social enterprises, social impact bonds, impact investments, and benefit corporations, we have a chance to use public and private investment in ways that generate real, measurable social impact.

“If the impact economy is to reach – or top – $1 trillion by 2020, the federal government will need to encourage its growth and activity, set the rules of the road, and help bring together a diverse community of players.”

*Image credits: 1) IR Matters; 2) WhyDev; 3) SOCAP

An experienced, independent journalist, editor and researcher, Andrew has crisscrossed the globe while reporting on sustainability, corporate social responsibility, social and environmental entrepreneurship, renewable energy, energy efficiency and clean technology. He studied geology at CU, Boulder, has an MBA in finance from Pace University, and completed a certificate program in international governance for biodiversity at UN University in Japan.