Momentum is finally building up in the U.S. offshore wind energy industry, the result of concerted clean energy policy and action plans enacted by the Obama administration. With 14 projects in advanced stages of development, the latest Department of Energy offshore wind report highlights progress across multiple fronts.

Taken together, pioneering projects hold out the potential to deliver some 4,900 megawatts of clean, renewable electricity to U.S. businesses and communities, according to the Offshore Wind Market and Economic Analysis: 2014 Annual Market Assessment report, produced by Navigant Research.

Building offshore wind energy farms also means a lot more in the way of green jobs and economic stimulus. It also drives innovation that will help keep U.S. industry competitive in cutting-edge wind and clean energy technologies. Furthermore, realizing U.S. offshore wind energy potential will be a big step forward in terms of reducing U.S. greenhouse gas emissions and dependence on fossil fuels. And that will be a big plus in terms of improving human and environmental health and safety, as well as reducing the potential for overseas conflicts.

Catching up on offshore wind energy

When it comes to offshore wind energy, the U.S. is getting a late start as compared to European countries and China. While the U.S. has zero in the way of installed wind power capacity, 2,304 offshore wind turbines with a total capacity of 7,343 MW were fully grid-connected in Europe as of mid-year 2014, according to the European Wind Energy Association's (EWEA) latest report.

The situation has been changing for the better during President Barack Obama's tenure, however. As lead agent, the federal government has brought together multiple stakeholders and employed the latest in public-private partnerships and ecosystems-based planning to bear on the problem of how best to accelerate development of America's vast offshore wind energy potential.

That includes involving local coastal and fishing communities, the shipping industry, and environmental organizations in the offshore wind energy planning process, along with state and local government representatives. It has also entailed making use of leading-edge marine spatial planning and coastal zone resource management methods and technology.

As a result, the Navigant report authors state in the executive summary: “The U.S. offshore wind industry is transitioning from early development to commercial viability.”

Growing offshore wind power capacity

Worldwide, offshore wind power capacity now totals around 7 gigawatts, according to Navigant's DOE report, the third annual assessment of the U.S. offshore wind market.

More than 1,700 MW of offshore wind power capacity was brought online globally in 2013, a 50 percent year-over-year increase. More than 812 MW (47 percent) of new generation capacity was brought online in the U.K. alone.

Growth in global offshore wind capacity is set to continue over the near-term, the report authors believe. Over 6,600 MW of offshore wind power capacity spanning 29 projects is under construction worldwide. Offshore wind farms with a capacity of 1,000 MW are under construction in China.

Here at home in U.S. waters, “The U.S. offshore wind market has made incremental but notable progress toward the completion of its first commercial-scale projects,” Navigant highlights.

Advanced-stage U.S. offshore wind projects

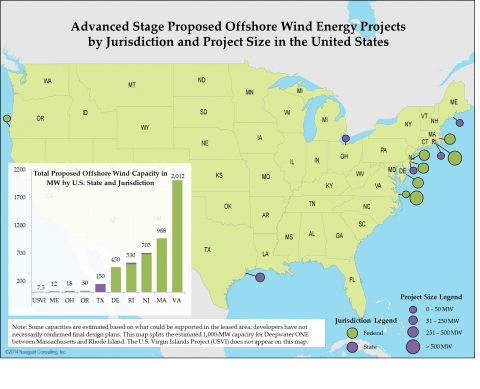

Having progressed to their initial stages of construction, Cape Wind and Deepwater's Block Island are the two most advanced offshore wind energy projects in the U.S. In addition, the DOE Bureau of Ocean Energy Management (BOEM) has been carrying out commercial lease auctions for federal Wind Energy Areas (WEAs). As a result, 14 U.S. offshore wind energy projects with total planned capacity of 4.9 GW have moved into advanced stages of development.

Continuing to fund demonstrations for the Offshore Wind Advanced Technology (ATD) program, Fisherman's Energy, Dominion and Principle Power were awarded up to $46.7 million in federal funding for the design and construction of pilot projects off the coasts of New Jersey, Virginia and Oregon, respectively.

Two other projects – by the University of Maine and the Lake Erie Economic Development Company of Ohio – will receive funds to continue engineering designs for their proposed projects, according to Navigant's DOE report.

Offshore wind: Innovations and costs

The costs of building out initial offshore wind energy projects is substantial, as are the technological and engineering challenges. Navigant found that the average reported capital cost of installed offshore wind power capacity declined in 2013 to $5,187 per kW. That compares to $5,385 per kW for projects completed in 2012.

On a precautionary note, “A lack of data for projects anticipated to reach completion in 2015 and 2016 makes it difficult to assess whether the trend will continue. Note that all such capital cost data are self-reported by project developers and are not available for all projects globally,” the report authors note.

Technologically, the trend is toward installing larger wind turbines farther offshore. According to Navigant's assessment:

“The average nameplate capacity of offshore wind turbines jumped substantially from 2010 to 2011 as projects increasingly deployed 3.6 MW and 5 MW turbines. Since then, however, average turbine size has plateaued around 4 MW.”

Looking forward, Navigant anticipates that the upward trend in average offshore wind turbine size will resume around 2018 as developers install more 5 MW and larger turbines. In the U.S., average offshore wind turbine size for advanced-stage projects is expected to range between 5 MW and 5.3 MW.

The offshore wind energy development drive has also spurred innovations in wind energy turbine, drivetrain and platform substructures. Direct-drive and medium-speed drivetrains account for just three percent of installed capacity. Navigant expects alternative drivetrain configurations will increase significantly over the next few years, however, as new 5 MW to 8 MW turbine models from Siemens, Vestas, Alstom, Areva and Mitsubishi are installed.

Under the surface, Navigant found that the advent of extra-large monopile substructures has lessened the impetus for alternative designs. The authors point out that offshore wind energy substructure design is very much dependent on site-specific factors. Hence, they see “plenty of opportunity ... for new designs that can address developers' unique combinations of needs.”

*Image credits: 1) Vattenfall; 2) EWEA; 3) US DOE

An experienced, independent journalist, editor and researcher, Andrew has crisscrossed the globe while reporting on sustainability, corporate social responsibility, social and environmental entrepreneurship, renewable energy, energy efficiency and clean technology. He studied geology at CU, Boulder, has an MBA in finance from Pace University, and completed a certificate program in international governance for biodiversity at UN University in Japan.