Carbon markets are expanding quickly around the world, with China, California and Quebec now jumping on the bandwagon, but the results have been mixed. A new partnership led by former U.S. Vice President Al Gore and Ecofys seeks to investigate how effective carbon pricing can better lead to their ultimate goals: sustainable global growth and reduced greenhouse gas emissions.

There are many challenges facing carbon markets, mostly due to the lack of a strong international framework. It is tough to exchange credits across both national, and sometimes regional or state, borders, as regulations and liquidity can vary greatly from market to market. The Paris Agreement, while historic, did not help as it leaves each country to determine on its own how it will meet its climate goals. That means there won't be a global carbon market for some time, at least.

It gets even more complicated here in the United States, where the backwards, climate-denying caucus in Congress has prevented the creation of a national carbon market. Here, states have taken the lead. California now exchanges carbon credits with Quebec, while a coalition of Northeastern states has set up a regional exchange. However, with differing pricing systems, exclusions and exchange mechanisms, these systems often have challenges working in tandem even though they are trying to solve the same problem -- climate change.

That's where this new partnership comes in. “The proposed research aims to deliver actionable results and solutions for these challenges," said Kornelis Blok, director of science at Ecofys, in a press statement. "With our innovative approach, we will take a comprehensive look at the issues, encompassing the policy, industry, investor and civil society perspective.”

Another challenge the partnership aims to tackle is allowing for better understanding of climate risk -- one of the reasons that coal bonds and companies' stock prices are collapsing. As companies are becoming increasingly aware, climate change can have adverse impacts on their bottom lines, due to its wide-ranging impacts on water, weather and agriculture, as well as its propensity to increase natural disasters. This has to be factored into carbon pricing, making effective pricing a crucial component of helping companies, and investors, determine climate risk.

“Carbon remains a largely unpriced externality in today’s financial markets," said David Blood, senior partner of Generation Investment Management, in a statement. "Although it is impossible to know the exact timing of the prospective tipping point when financial markets will fully internalize carbon risk, it is critical for investors to prepare for its inevitable impact.”

The project will run for three years and will focus on practical, actionable policy solutions to better connect carbon prices, climate risk and actions toward the global 1.5-degree limit in global temperature rise we agreed to in Paris this past December. Hopefully it will come alongside moves to develop a truly national carbon market here in the United States.

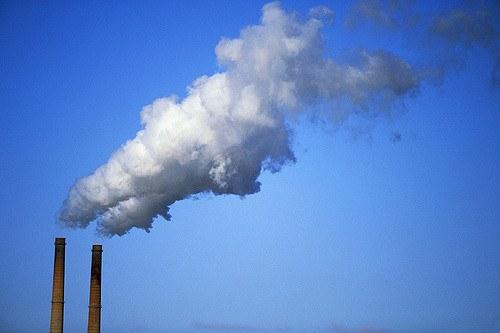

Photo Credit: Gerald Simmons via Flickr

Nithin Coca is a freelance journalist who focuses on environmental, social, and economic issues around the world, with specific expertise in Southeast Asia.