By Shivani Siroya

With over 16 billion dollars flowing through mobile money platforms in Kenya alone, mobile money is continuing to expand rapidly, even into the deepest rural communities around the world. With it comes a valuable distribution platform providing newfound access to technology and information. In the financial sector in particular, various organizations and agencies are partnering up with telecommunications companies (telcos) to use mobile phones as an innovative means for providing an array of financial services to those previously unreachable and unbanked.

Currently, there are over 200 mobile money ventures, with high success potential in Africa, Southeast Asia, and Latin America. In Kenya, the mobile money service M-Pesa has proven significant success with 18 million mobile phone users subscribed and 43 percent of Kenya’s GDP flowing through the service.

By allowing users to send, receive, spend, and even save money all through their mobile phones, mobile money provides a low-cost platform and a level of accessibility never before seen in formal banking. The simplicity of mobile money and its ability to provide affordable and accessible banking services has transformed the financial possibilities and opportunities available for the unbanked and underserved.

With close to half of the Kenya’s population participating in the country’s popular M-Pesa mobile money service, countries such as Pakistan, Bangladesh, Cambodia, Somaliland, Tanzania, and Uganda have been quick to adopt the technology. In 2013, financial giants Visa, Mastercard, PayPal, and Google, along with a multitude of banks have partnered with government organizations and non-governmental social service departments to jump on the mobile money bandwagon and launch these services worldwide.

The question remains: Is mobile money enough to solve this problem of financial access and inclusion? While mobile money services certainly provide a crucial first step to financial inclusion, the industry is now looking beyond basic remittances. Providing mobile users with a full array of mobile financial products and services is the next step towards an inclusive financial system.

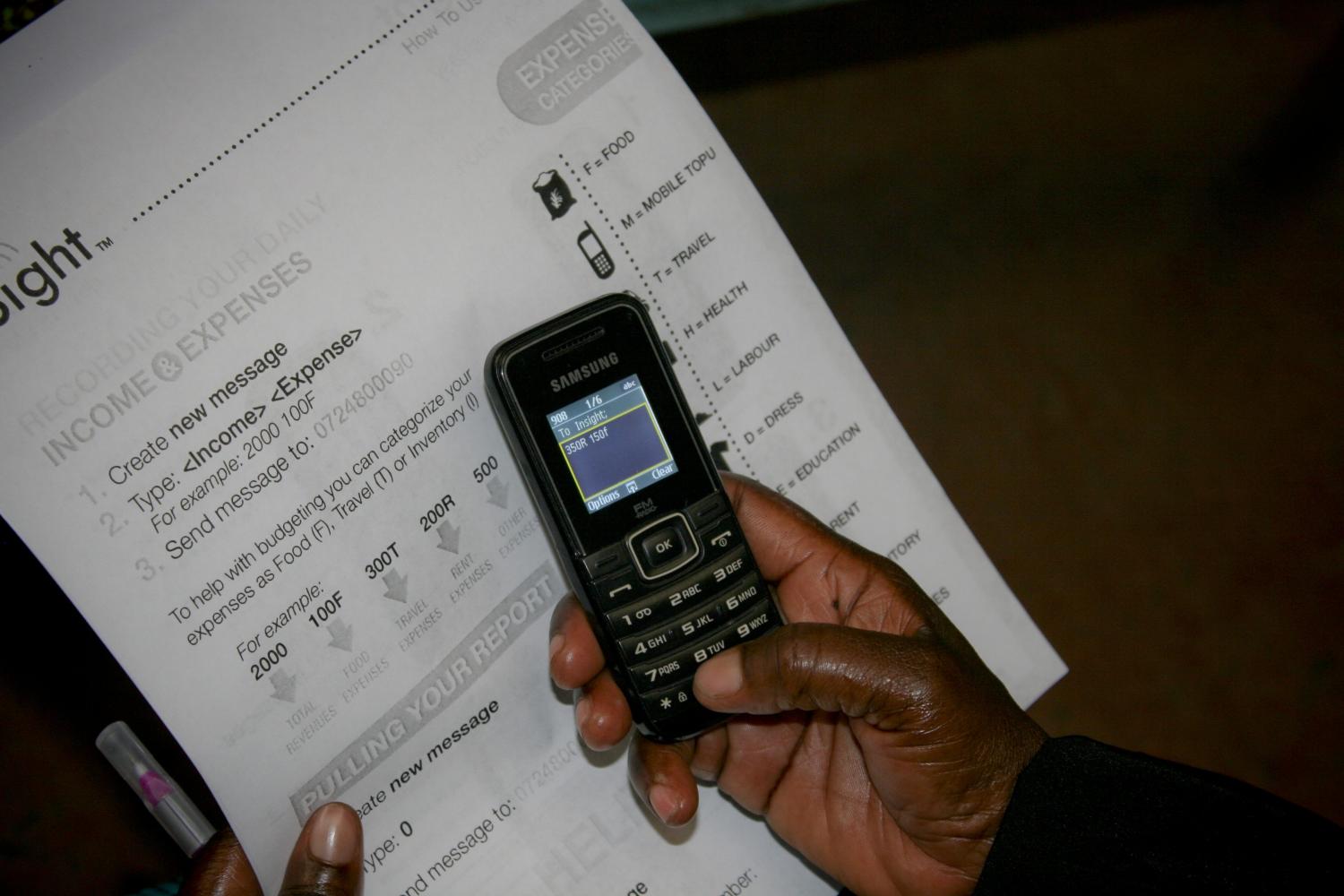

Fortunately, the expansion of mobile money has paved the way for new financial products for the unbanked, such as our solution at InVenture our product - InSight – is a simple SMS, Voice, Web and Android – tool that allows individuals in the informal economy to perform daily money management and receive a formal financial identity. Our dynamic algorithm uses cash flow data collected by the system to synthesize an individualized credit score for each user. This information is then shared with product and service companies as well as financial institutions to help individuals qualify for affordable access to business loans, housing, insurance, education services and everyday essentials.

InVenture is now focusing on partnering with mobile money providers, NGOs, and other mobile applications to integrate InSight into their service offerings and allow users to seamlessly extend their mobile subscription into a formal financial identity.

The industry as a whole is now focusing not only on providing access to a wider array of consumer and banking products, but also on increasing education about the importance of savings and credit and on improving the efficiency and financial reach of current providers and retailers. We believe that in order to open up the global marketplace, it is critical to ensure that a proper financial foundation is established. Our goal is that through InSight, we will provide millions (perhaps billions) of individuals with the awareness and formal identity they need to create their own futures and build economies where more people can thrive.

In 2013, companies began to push the envelope of mobile money, moving beyond product introductions to financial literacy and access initiatives. In 2014, we hope to accelerate this movement through innovative collaborations with organizations like the Vodafone Americas Foundation and others that bring together telcos, financial institutions, mobile money providers, and other key industry players. Together, we can make the dream of full global financial inclusion a reality.

Ed note: Vodafone Americas Foundation’s annual Wireless Innovation Project is now accepting grant applications from top innovators in the mobile technology field that have the potential to make a decisive change in the world. Applications for 2014 are due February 3rd!

Shivani is currently the CEO and Founder of InVenture. InVenture is a mobile technology company providing simple credit scoring and accounting tools to the >4 billion people across the globe currently lacking a formal financial identity. InVenture's work has been recognized by USAID, TED, Economist Vodafone, Bloomberg, and Forbes.

She is a 2013 Ashoka Fellow, 2013 TED Fellow, 2011 Echoing Green Fellow and 2011 Unreasonable Institute Fellow. Shivani holds a M.P.H from Columbia University and a B.A. from Wesleyan University.

Twitter: @inventure @shivsiroya

TriplePundit has published articles from over 1000 contributors. If you'd like to be a guest author, please get in touch!