By Joseph Plummer

Since its inception in 1997, the Bill and Melinda Gates Foundation has made grant payments totaling more than $33.5 billion. These grants have gone to things like polio eradication, the Malaria Vaccine Initiative and targeted education efforts in low-income communities. The Gates Foundation’s endowment is currently around $43 billion.

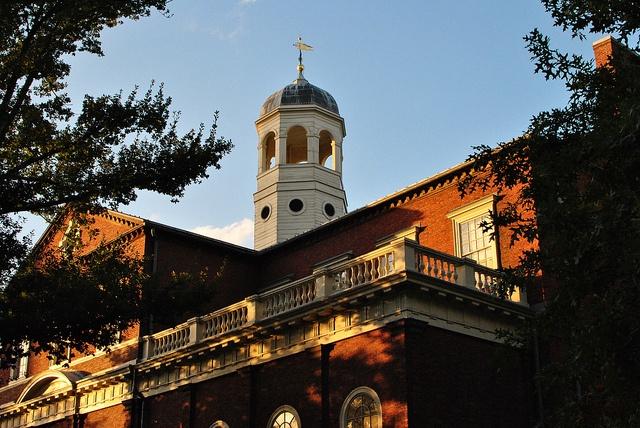

Harvard’s endowment is of a similar magnitude: around $32.7 billion, compared to the average university endowment of about $350 million. Harvard has used its massive endowment to fund professorships, financial aid and research. These endowments seem to be positive forces for good. Furthermore, they seem to provide perpetual funding for their chosen causes. So, why don’t we have more massive endowments?

Most endowments are the result of wealthy individuals setting aside money for a particular cause or set of causes. Or, in the case of universities, it is the result of an accumulation of donations and grants. So, it makes sense that we don’t have thousands of massive endowments of magnitudes similar to that of Gates and Harvard. On the other hand, we have witnessed numerous injections of capital into the economy by the federal government in the form of stimulus packages and quantitative easing.

The American Recovery and Reinvestment Act of 2009, which was introduced to the House on Jan. 26, 2009, and signed into law by the president three weeks later, injected roughly $800 billion into the American economy over 10 years. The legislation funded things like infrastructure, energy efficiency, education, healthcare and scientific research. The Federal Reserve has also been very active in recent years. The latest round of quantitative easing (QE3) started in September 2012 at a rate of $40 billion per month and peaked in 2014 at a rate of $85 billion per month. This money is injected into the economy when the Federal Reserve buys securities from banks thus giving banks more capital to lend. Quantitative easing and federal stimulus packages are shortsighted solutions to our economic problems. We need an effective long-term solution. We need more massive endowments.

Consider the money associated with the American Recovery and Reinvestment Act of 2009 -- $800 billion. That amount of money is the equivalent to about 18 Gates endowments or 25 Harvard endowments. Similarly, at the starting QE3 rate of $40 billion a month over two years, we could create 24 Gates endowments. At the QE3 rate of $85 billion a month over two years, we could create 62 Harvard endowments. That’s a $33 billion endowment for every state and territory in the Union. Again, endowments provide perpetual funding streams. These wouldn’t simply fund a road maintenance project and create jobs for a year. Endowments are designed to give ongoing support.

Advocates for smaller government should like this idea. While this wouldn’t necessarily shrink government, it would inherently shrink the market share of the government sector (perhaps a more accurate term for this would be 'sector share').

As a percentage of the economy (GDP), the government sector (government expenditures), which includes local, state, and federal government agencies, represents a significantly larger percentage (~40 percent) than the nonprofit sector (~5.5 percent), which includes charities, foundations, universities and hospitals.

Therefore, if newly injected money were funneled to the nonprofit sector, then the nonprofit sector would grow while the government remained close to the same size. It is also reasonable to assume that as the nonprofit sector grows, the government sector would not only shrink in sector share, but also in actual size. A lot of the work done by government agencies can be done by the nonprofit sector (think: education, healthcare and other social services).

It is clear that our societal challenges aren’t getting easier. Issues relating to food, energy, water, poverty, infrastructure, education and justice are becoming more and more complex. A more robust nonprofit sector is necessary to address these challenges. Increasing the size and number of philanthropic and university endowments can very effectively address the social and environmental challenges of today and tomorrow.

As governments consider future rounds of economic stimulus and quantitative easing, they should consider the effectiveness and longevity of endowments.

Image credit: Flickr/Angela N.

Joseph Plummer is a degree candidate in the Executive Master of Natural Resources (XMNR) program at Virginia Tech, expecting to graduate in May 2016.

TriplePundit has published articles from over 1000 contributors. If you'd like to be a guest author, please get in touch!