Dong Energy is the latest canary in the coal mine for the global coal industry. The Danish energy giant, which last fiscal year generated almost $9 billion in revenues, recently announced that it would phase out coal from all of its power stations by 2023.

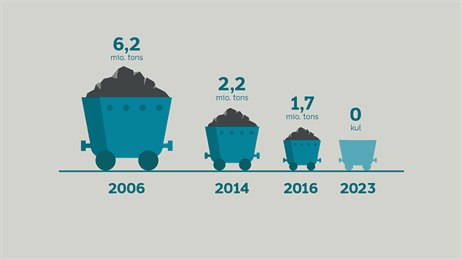

The company’s pledge comes after it consumed 1.7 million metric tons of coal in 2016, a steep decline from a decade earlier, when the company used 6.2 million metric tons to fuel its power stations.

“The decision is in line with our vision to lead the way in the transformation to a sustainable energy system and create a leading green energy company," Dong Energy CEO Henrik Poulsen said in a statement.

The company said its last few coal fire-powered plants will transition to use biomass as feedstock.

Just last month, Dong followed through on its 2016 promise to divest from the oil and gas exploration business, which last year only comprised 4 percent of the company’s capital outlays. Those operations will be sold off by the end of this year as Dong continues to invest aggressively in wind power.

Dong has become a renewable power leader across Europe and increasingly more of the world, with its 5.8 terawatt hours (TWh) of wind and hydropower capacity. Meanwhile the company continues to be bullish on offshore wind power as it seeks to more than double its current capacity from 3 gigawatts to 6.5 GW by 2020. Should all the offshore projects in which Dong is involved launch at the end of this decade, that installed capacity would be enough to meet the electricity needs of approximately 16 million Europeans.

For those who are still not convinced of clean energy’s staying power, take a look at Dong’s most recent financial performance and business decisions. After losing $25 million in 2015, the company reported profits of $250 million last fiscal year. Dong said its overall sales declined by 6 percent, but 2016 revenues from wind power soared by 36 percent from the previous year. That continued growth in renewables in part emboldened the company to issue an IPO last summer (with the caveat that the government of Denmark is its largest shareholder, with just over a 50 percent stake).

In addition to holdings in offshore wind farms such as the 630-megawatt London Array located in the Thames Estuary, Dong is investing in similar projects worldwide. Last month the company agreed to purchase a 35 percent stake in Formosa I, Taiwan’s first offshore wind farm. Dong is also taking the emerging U.S. offshore wind market seriously, as last year it announced it would take over a proposed 1 gigawatt wind farm off the coast of Massachusetts.

The company claims it has a 26 percent market share of the world’s offshore wind power capacity, and it seeks to double that capacity by 2020.

Despite the slump in fossil fuel prices, divestment from coal and other hydrocarbons has picked up momentum across Europe as more companies and investment funds worry that deposits of these fuels could end up becoming stranded assets.

After considering a divestment strategy for two years, Norway’s sovereign wealth fund decided to relinquish its coal-related assets last April. A few months later, the municipality of Stockholm, Sweden, announced that it would divest from its holdings in coal, oil and natural gas. And last month, Ireland’s parliament voted to strip fossil fuel investments from its $8.6 billion strategic investment fund.

Image credit: Dong Energy

Leon Kaye has written for 3p since 2010 and become executive editor in 2018. His previous work includes writing for the Guardian as well as other online and print publications. In addition, he's worked in sales executive roles within technology and financial research companies, as well as for a public relations firm, for which he consulted with one of the globe’s leading sustainability initiatives. Currently living in Central California, he’s traveled to 70-plus countries and has lived and worked in South Korea, the United Arab Emirates and Uruguay.

Leon’s an alum of Fresno State, the University of Maryland, Baltimore County and the University of Southern California's Marshall Business School. He enjoys traveling abroad as well as exploring California’s Central Coast and the Sierra Nevadas.