By 2030, the coal industry will effectively be operating in the red. That's the latest analysis from the CarbonTracker Initiative, an independent think tank that looks at the economic implications of today's coal energy and other markets.

But what analysts were really looking at in its study Lignite of the Walking Dead, which was released this week, was what the scenario would look like economically if the 28 countries that comprise the European Union were to actually limit global warming to below 2℃ by 2050.

And while the prospects of a world that doesn't include carbon-intensive coal energy is appealing to many, an incomplete transition presents formidable economic challenges for the global community, say the writers.

The report is a follow-up to its earlier study on the U.S. markets, No Country for Coal Gen, which was released in September. In that report, the analysts looked at the regulatory risks for the U.S. coal market if the world were to maintain an under 2℃ strategy. The prospects looked grim for the U.S. coal industry.

"The economics of U.S. coal power could not be starker: new coal capacity is not remotely competitive," said the writers, who projected that in the coming years it would be "the exception rather than the rule for the operating cost of existing coal to be lower than the levelized cost of new gas and renewables."

That's good news for a world that chugs along fine on renewable energy, right?

Not so fast, say the authors.

EU's misguided optimism

Transitioning to clean energy on a global or continental basis doesn't happen overnight. And as the EU is learning, it doesn't happen simply out of resolve. It's hard work replacing an industry that was once believed to be irreplaceable -- one that for years, had fueled much of the world's production of electricity.

"Confidence in coal-heavy utilities [in the EU] is returning as business restructurings, court rulings and power prices have revived balance sheets after years of huge impairments." Despite the current global discussion about the need to transition to renewable energy, share prices in German utilities like RWE and Uniper have surged in recent years (67 and 74 percent respectively).

Yet that renewed emphasis on coal energy hasn't accounted for the challenges the market continues to face. "[Air] pollution regulations and rising carbon prices will continue to undermine the economics of coal power in the EU, potentially making generation assets unusable by 2030."

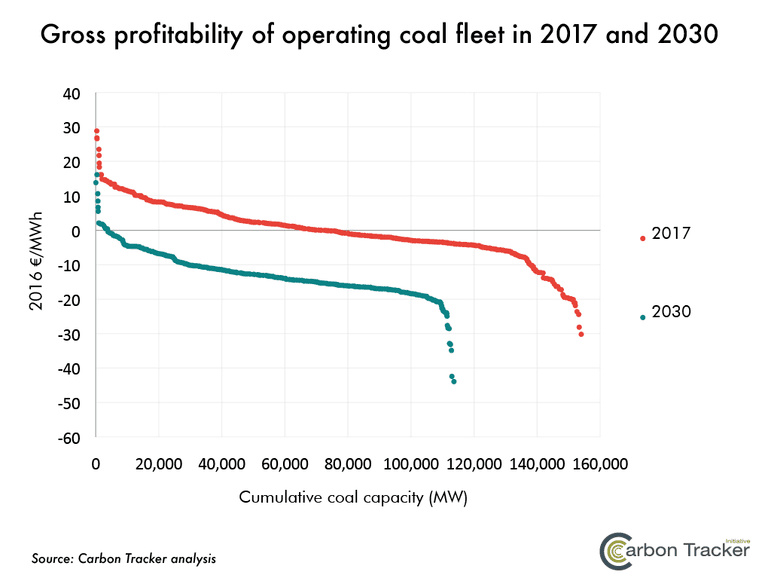

At the present time, therefore, 54 percent of coal in the EU is currently cashflow negative. By 2030, that loss is estimated to rise to 97 percent. The EU will be burdened by a $25.9 billion economic loss if it continues to support coal-heavy industries, analysts report.

Coal energy investors are at a crossroads

"Utilities with exposure to coal power in the EU are at a strategic crossroads: continue to invest in coal and hope governments will allow rent-seeking in the form of capacity and retirement payments, or divest and prepare for a low carbon future."

European energy companies like Swedish government-owned Vattenfall have already taken a decisive step to divest from coal. The company, which has markets throughout the continent, initiated its switch last year when the company announced that to avoid further losses, it planned to transition to sustainable sources, including solar and wind, within five years.

But its move highlights a dilemma, notes CarbonTracker: While some companies are successfully making the switch, others like EPH have found economic value in operations that were slated to be phased out, "including the purchase of Vattenfall’s German lignite units."

The issue raises an interesting question: How to ensure solvency of companies that transition from decades-long dependence on coal technology and infrastructure as they reinvest in sustainable sources and infrastructure?

With a "pro-coal strategy [that] largely depends on lobbying strategies to avoid regulation and secure support payments," it isn't easy, the analysts observe.

First, "[investors] should adjust the valuation ascribed to coal generation assets held by utilities. This will involve using asset-level model which provides a 2030 retirement schedule by dynamically determining which units close when."

They also suggest that utilities need to realize the imperative of that 2030 benchmark to avoid further market losses. Recognizing the need for "a combination of policy commitments,technological progress and business model changes" that shift the energy industry as a whole can facilitate a smoother and more successful change to renewable energy for the affected companies and the market as a whole.

And as the EU has seen in the past, positive leadership doesn't just help reform the industries within its own borders, it can set a pathway for innovative change in other parts of the globe, as well.

Images: Morning vista at RWE's Grevenbroich, Germany plant (2008)- Flickr/Patrick; Graphs - CarbonTracker

Jan Lee is a former news editor and award-winning editorial writer whose non-fiction and fiction have been published in the U.S., Canada, Mexico, the U.K. and Australia. Her articles and posts can be found on TriplePundit, JustMeans, and her blog, The Multicultural Jew, as well as other publications. She currently splits her residence between the city of Vancouver, British Columbia and the rural farmlands of Idaho.