For the first time ever, clean energy investment by China and other emerging economies has surpassed the mark for wealthier nations. This significant flip in global clean-energy trends spells more bad news for fossil fuel companies like ExxonMobil, which have been counting on emerging economies both to grow their business and to leverage a positive image for their brands.

ExxonMobil in particular has been leaning on the "energy poverty" argument to portray its products as a net benefit to humanity, but the new report pulls the rug out from under the company's public relations strategy.

Flipping a global clean-energy trend

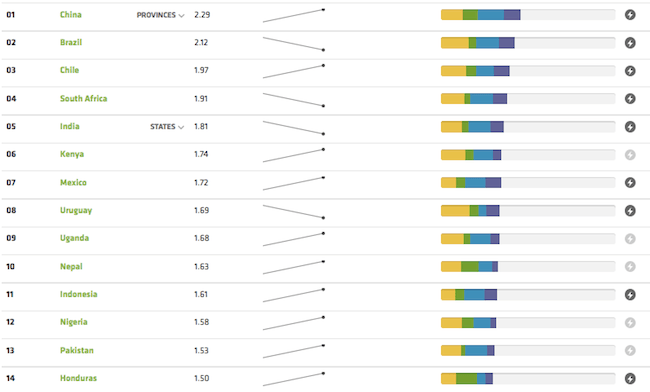

The new report is from a global clean-energy competitive index called Climatescope, a global public-private project supported in part by Bloomberg New Energy Finance, where you can find an interactive map as well as free downloads for the full 200-page report and the supporting data.

The report covers clean-energy investment for the calendar year 2014 among 55 developing nations in Latin America, the Caribbean, Africa and Asia. That includes a number of major markets including China, India, Pakistan, Brazil, Chile, Mexico, Kenya, Tanzania and South Africa.

The comparison group includes the United States and other members of the Organization for Economic Co-operation and Development (OECD).

For those of you on the go, Bloomberg New Energy Finance has summarized the major points, the main one being this:

"On a percentage basis, clean energy capacity is growing twice as quickly in Climatescope nations compared to OECD ones."

Climatescope totals up 50.4 gigawatts of new clean-energy capacity built in 2014 among the group of 55, a 21 percent increase from 2013. The 50.4 mark also surpasses OECD deployment.

That trend is reflected in the dollar figures for clean-energy investment. Among the 55 emerging economies assessed by Climatescope, new investment in renewables topped out at a record high of $126 billion. That's the highest mark ever for emerging economies -- a good 39 percent higher than the 2013 -- and it puts that group of 55 ahead of wealthier nations.

TriplePundit readers will not be surprised that China made a key difference in pushing the group of 55 past OECD countries. According to the report:

"China alone added 35 gigawatts of new renewable power generating capacity all on its own – more than the 2014 clean energy build in the U.S., U.K. and France combined."

Financial institutions also played a major role. Investments by banks and other institutions within the group of 55 totaled $79 billion in 2014, a significant increase from the 2013 figure of $53 billion.

Clean-energy technology gains parity

"Continuing declines in clean energy costs appear to be driving growth. Costs associated with solar photovoltaic power have ticked down 15% year-on-year globally. Solar is particularly competitive in emerging markets which often suffer from very high power prices from fossil generation while also enjoying very sunny conditions."

"Progress in 2014 was achieved despite a number of countries in the survey seeing economic growth rates slow. Average gross domestic product growth across Climatescope nations slipped to 5.7 percent in 2014 from 6.4 percent in 2013 with the slow-down most apparent in major nations, Brazil, South Africa, and China. Despite the pullback, these three countries attracted a total of $103 billion in new clean energy investment in 2014."

It's also worth noting that one of the drivers behind global clean-energy investment is President Barack Obama's Power Africa campaign, which launched in 2013 as an "all of the above" energy strategy for electrifying sub-Saharan Africa.

That doesn't necessarily mean good news for fossil fuels. As Bloomberg points out, though Power Africa may lean partly on natural gas as a "cleaner" fuel, its focus includes utility scale geothermal as well as solar off-grid solutions.

That dovetails with another new clean-energy report by IRENA, the International Renewable Energy Agency, which concludes that the region's clean energy resources could be tapped relatively quickly. Renewable energy now fills 5 percent of the region's need, and the report anticipates that could surge to 22 percent by 2030.

Image credit (screenshot): via Climatescope.org.

Tina writes frequently for TriplePundit and other websites, with a focus on military, government and corporate sustainability, clean tech research and emerging energy technologies. She is a former Deputy Director of Public Affairs of the New York City Department of Environmental Protection, and author of books and articles on recycling and other conservation themes.