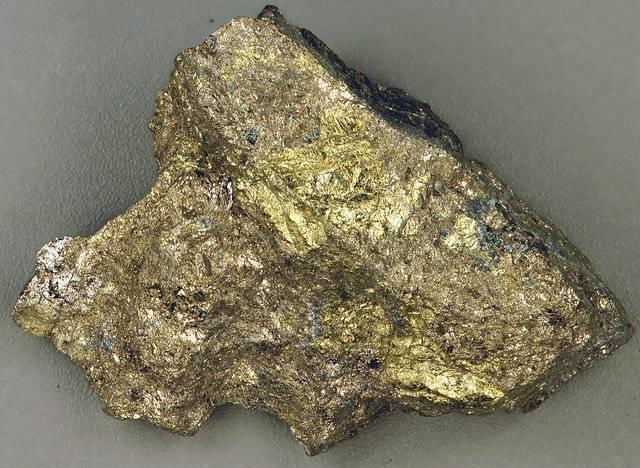

According to Bloomberg, the price of palladium briefly surged to $1,005 an ounce earlier this week, marking the first time the rare, silvery white metal hit the $1,000 mark since 2001. The metal’s price has since settled at $987 an ounce as of press time, but as the Financial Times noted, the price of palladium has tripled over the past six months, and has surpassed the price of another rare metal, platinum.

The main reason for this price surge, explain many industry analysts, is that demand for palladium is being driven by the automotive industry, which covets palladium for its effectiveness in catalytic converters – the exhaust emission control devices in cars that turn toxic gases into less harmful pollutants.

In recent years, there has been a huge interest in elements that are either rare or difficult to source, such as lithium, cobalt, neodymium and dysprosium – but that interest has been because of the rise of the electric car and innovations in battery technology, which currently requires rare earth metals. Investors’ mania over the assumption all-electric cars will become the transportation of the future has led to the surge in prices for these materials. Such speculation has been behind the resurgent interest in California’s Mountain Pass mine, the only major deposits of rare earch metals in the U.S.

Of course, as is the case with any commodity, these metals' prices often appear as a roller coaster on a linear chart. Earlier this decade, as China restricted their exports, their prices spiked (which was a subplot of Netflix’s series, House of Cards, a few seasons ago). But within a few years, those prices declined as manufacturers either found ways to use less of these elements or found substitutes.

“The road to a promised land of zero-emission vehicles is littered with speed bumps and red lights that threaten to seriously slow the progress of the electric car,” said Karl West of the Guardian as he outlined the challenges manufacturers face as they seek materials that often pose logistical, ethical and political challenges.

Meanwhile, future projections of how many electric vehicles (EVs) will be on the globe’s roads are all over the map. Bloomberg New Energy Finance (BNEF), for example, has estimated that EVs will comprise a majority of all new car sales before 2040, and also concluded that they could become cheaper than internal combustion engine (ICE) cars in most countries by 2029.

As Stephen Lacey of GreenTech Media pointed out earlier this summer, just about every international organization or transportation association has been revising their EV projections to higher numbers – well, everyone except the automakers. Meanwhile, auto manufacturers such as Volvo say they are accelerating the rollout of EVs; some governments, such as those of the United Kingdom and France, say they will phase out ICE cars altogether in the long run.

Nevertheless, there has been a twist within the wider automobile sector along the way. As EVs still comprise a minuscule amount of automobile sales worldwide, ICE cars are still being sold at a steady pace. Yet automakers feel the pressure to ensure their cars are less polluting as governments pass stricter regulations and consumers seek cleaner-burning cars. “So before electric cars sweep across the world’s roads, [palladium] is in high demand as car manufacturers look for other ways to cut the emissions from their fleets,” wrote Eshe Nelson for Quartz earlier this week.

Meanwhile, after being discouraged by the high price of platinum for years, automakers and their suppliers may start turning to that metal for use in catalytic converters, as its pricing forecasts suggest they will remain lower than that of palladium in the near future.

Image credit: James St. John/Flickr

Leon Kaye has written for 3p since 2010 and become executive editor in 2018. His previous work includes writing for the Guardian as well as other online and print publications. In addition, he's worked in sales executive roles within technology and financial research companies, as well as for a public relations firm, for which he consulted with one of the globe’s leading sustainability initiatives. Currently living in Central California, he’s traveled to 70-plus countries and has lived and worked in South Korea, the United Arab Emirates and Uruguay.

Leon’s an alum of Fresno State, the University of Maryland, Baltimore County and the University of Southern California's Marshall Business School. He enjoys traveling abroad as well as exploring California’s Central Coast and the Sierra Nevadas.