A coalition of nearly 350 global institutional investors are calling on world leaders to institute “stable, reliable and economically meaningful carbon pricing." They elaborate by calling for carbon pricing "that helps redirect investment commensurate with the scale of climate change challenge, as well as develop plans to phase out subsidies for fossil fuels.”

The Institutional Investors Group on Climate Change (IIGCC) includes some of the world's largest and most prominent institutional investors, including Australian CFSGAM, BlackRock, Calpers, Cathay Financial Holdings, Deutsche, PensionDanmark and South African GEPF. Collectively, the 347 institutional investors manage over $24 trillion in assets.

IIGCC's call for meaningful carbon pricing and the elimination of fossil fuel subsidies comes as world leaders meet for the U.N. Climate Summit this week to hammer out details of a global climate treaty and successor to the Kyoto Protocol.

Making sure their presence is felt and their voices heard, over 300,000 people [ed. note: the crowd count has been raised to 400k] took part in the People's Climate March in Manhattan on Sunday. Organized by a group of environmental, social justice and public interest organizations, the march kicked off Climate Week NYC. A week-long series of events and demonstrations, Climate Week NYC organizers are likewise calling on government leaders to institute strong climate change action plans that are seen as a means of realizing other key U.N. goals, including alleviating poverty and growing socioeconomic inequality.

The need for stronger climate change action

The International Energy Agency (IEA) has estimated that at least $1 trillion or more per year needs to invested in clean energy by 2050 if the rise in global mean temperature is to be kept within the 2 degrees Celsius limit determined as a climate change tipping point by the U.N. Intergovernmental Panel on Climate Change (IPCC). Though it's been growing rapidly over the past decade, global investment in clean energy totaled just $254 billion in 2013.

In a statement the group of 347 institutional investors said:

"Gaps, weaknesses and delays in climate change and clean energy policies will increase the risks to our investments as a result of the physical impacts of climate change, and will increase the likelihood that more radical policy measures will be required to reduce greenhouse gas emissions," said the statement – the largest of its kind by global investors on climate change. Stronger political leadership and more ambitious policies are needed in order for us to scale up our investments."

Wielding financial clout for stronger climate change action

Managing more than $24 trillion in assets, it's clear that the group of 347 institutional investors wields a lot of financial clout. They themselves can take meaningful action, systematically boost clean energy investment, and decrease investments in fossil fuel companies and markets.

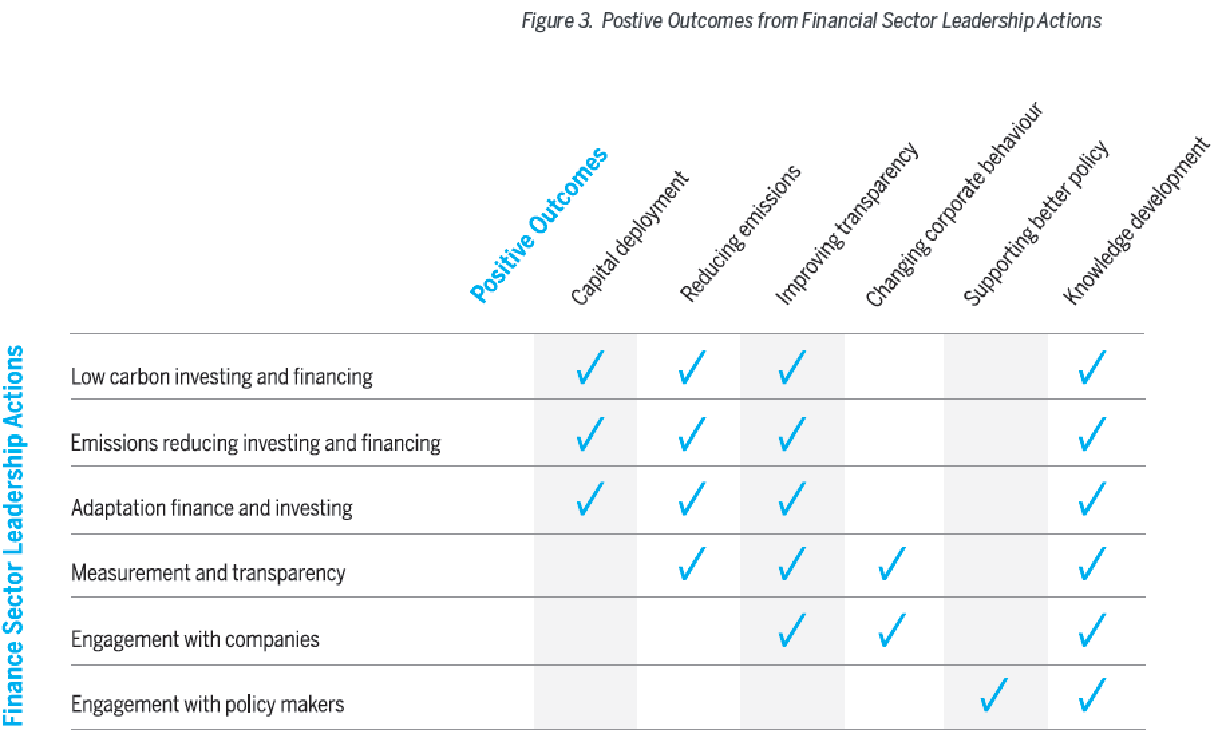

The institutional investors group also published a report illustrating the actions they are taking to “support a low-carbon, climate-resilient economy.” These include making direct investments in a wide range of low-carbon companies and projects, the creation of low-carbon investment funds, company engagement, and reducing exposure to fossil fuel and carbon-intensive companies.

The group's statement and report was coordinated by Ceres' Investor Network on Climate Risk (INCR) in the U.S.; the Institutional Investors Group on Climate Change in Australia and New Zealand (IIGCC); and the Asia Investor Group on Climate Change (AIGCC), along with the U.N. Environment Programme Finance Initiative (UNEP FI) and Principles for Responsible Investment (PRI).

Echoing and reinforcing calls by environmental, social justice and public interest groups, PRI Managing Director Fiona Reynolds stated:

"Stronger carbon and climate frameworks are needed to catalyze institutional investment. The time is now for national governments to overcome the political obstacles that prevent global carbon pricing and hinder long term capital flows into climate mitigation and adaption."

U.N. Under-Secretary-General and UNEP Executive Director Achim Steiner asserted that the dichotomy between taking strong climate change action and promoting economic growth and social development is a false one.

“The perception prevails that we need to choose between economic well-being or climate stability,” Steiner was quoted in a press release. “The truth is that we need both.

"What is needed is an unprecedented re-channeling of investment from today's economy into the low-carbon economy of tomorrow. Investors are owners of large segments of the global economy as well as custodians of citizens’ savings around the world. Having such a critical mass of them demand a transition to the low-carbon and green economy is exactly the signal governments need in order to move to ambitious action quickly.”

“It is significant that the largest institutional investors from around the world are in agreement that unmitigated climate change puts their investments at risk,” said Mindy Lubber, director of INCR and president of the U.S.-based nonprofit sustainability advocacy group, Ceres. “The financial community has a message for heads of state gathering at the United Nations next week: we can’t afford to wait any longer for a climate deal.”

*Image credits: Institutional Investors Group on Climate Change

An experienced, independent journalist, editor and researcher, Andrew has crisscrossed the globe while reporting on sustainability, corporate social responsibility, social and environmental entrepreneurship, renewable energy, energy efficiency and clean technology. He studied geology at CU, Boulder, has an MBA in finance from Pace University, and completed a certificate program in international governance for biodiversity at UN University in Japan.